Weekly Economic Digest for 10-6-23: ISM Manufacturing and Services Index; Factory Orders; Employment; Consumer Credit; and the Yield Curve

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

The Weekly Economic Digest is coming out a day late this week as I was spending some personal time camping with family and friends. But what a week it was! The big economic release this week was the September jobs report, but frankly, all the economic news was dwarfed by the news made in the U.S. House of Representatives, which on Tuesday, for the first time in the history of our republic, voted 216-210 to remove a sitting Speaker of the House. Because this article is a summary digest of the week's economic news, I will refrain from adding my own political thoughts. But since the federal budget does impact the overall economy, I will agree with something Rep. Gaetz said when he was accused of "throwing the House into chaos." Chaos? A $33 TRILLION federal debt is chaos. Facing a $2.2 trillion annual deficit is chaos. Spending $32,000 every SECOND on interest (more than $1 trillion per year) is chaos. Governing through continuing resolutions (CR) and omnibus spending bills rather than annual budgets and single-subject appropriation bills is chaos. And lastly, passing yet another CR to keep the status quo and the federal government open is chaos.

But I digress....back to the economic data of the week......

Employment

On Wednesday, ADP reported that the U.S. economy added only 89,000 new jobs in September. Only 89,000. Economists expected the number to be closer to 160,000. Despite the low reading, the number is consistent with the recent trends in the labor market.

Which is why, when the September employment report was released on Friday, it was a complete shock. According to the Bureau of Labor Statistics, the U.S. added 336,000 jobs in September...nearly double what economists were expecting. When the number came out, as is so often the case, most of the media picked up on the headline number and instantly declared that "this shows the economy is strong" and that "the labor market is in good shape." But as we have pointed out in the past, the devil is in the details, and you have to read through the entire 39-page report to really understand what is going on in the labor market.

These 336K are "payroll" jobs and are based on the “establishment” or “payroll” survey. It measures employment, hours, and earnings in the nonfarm sector and is based on jobs on industry payrolls. The other measure of employment in the release is the “household” survey. It is designed to measure the labor force status of the civilian non-institutional population and data from this survey is used to calculate the labor force and the unemployment rate. According to the household survey, only 86K more people reported being employed.

So how can only 86K additional households report being employed and the entire economy have added 336K jobs? Simply, it is because people are taking on additional part-time jobs! When a person takes a second job, a new job shows up on payrolls, but the number of households reporting being employed doesn’t change. This month, the U.S. added 151K part-time jobs. That represents nearly half of the months job growth right there! At the same time, the economy posted a LOSS of 22K full-time jobs! In fact, for three consecutive months, the U.S. has added part-time jobs (for a total of 1.2 million part-time jobs) and for those same three months, has lost full-time jobs (for a total of -692,000 full-time jobs.) Trading full-time jobs for part-time jobs is not a sign of a healthy labor market.

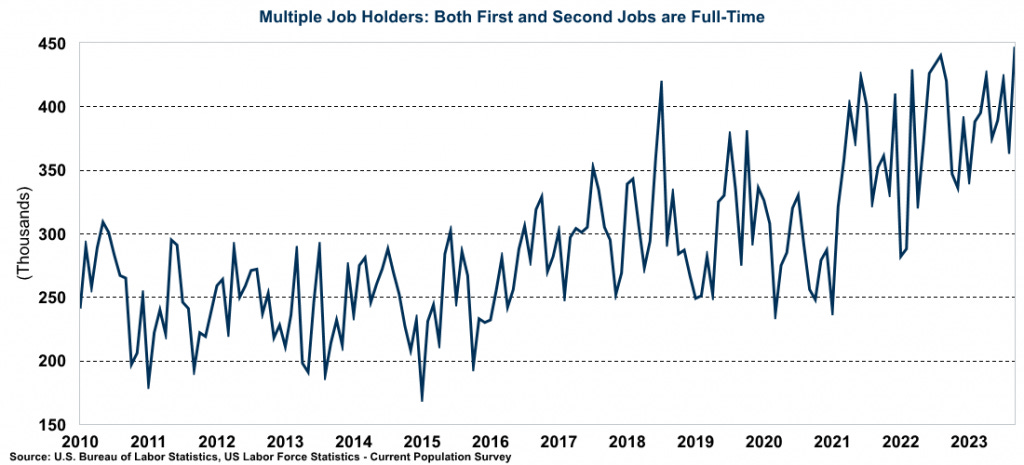

Simply put, people are having to work multiple jobs to make ends meet. Many of these may have one full-time job, and a part-time job to help close the gap between their income and the ever increasing costs they face every day. However, an astonishing number of people are now reporting to have multiple FULL-TIME jobs! In fact, in September, 80,000 additional people reported having two full-time jobs. The number of people with two full-time jobs now sits at an all-time high of 447,000.

Finally, if you look further into the details, you find that nearly 1/3 of the new jobs were created in the low-wage leisure and hospitality sector, and another 22% were in government. Bars, restaurants, hotels and government...not exactly the high-wage sectors you want to see creating jobs. Add to that the fact that more than a third of the jobs gains are the result of double-counting multiple job holders, and the labor market doesn't look nearly as strong as the big headline number suggests.

The unemployment rate was unchanged at 3.8% but labor force participation remains well below pre-COVID levels. In fact, the number of those not in the labor force is roughly 5 million more than pre-pandemic. If these people were back in the labor force, the unemployment rate would be closer to 6.8%.

Consumer Credit

Total consumer credit actually DECLINED by $15.6 billion in August, the biggest decline since the early days of the pandemic. The decline was in non-revolving credit including auto loans and student loans. Interest on student-loan payments had been suspended during the pandemic, but began accumulating again in September. It appears some student borrowers started making payments early to avoid extra interest when their payments must resume in October. However, revolving debt (e.g., credit cards) actually rose $14.7 billion...a trend that has been going for some time as people are using credit cards to fill the gap between income and living expenses.

ISM Manufacturing and Services Index

The Institute for Supply Management (ISM) Purchasing Managers Index (PMI) for manufacturing was released on Monday. The PMI is generally considered to be one of the most reliable economic indicators available providing insight into what is happening at the factory level. A reading below 50 means that the sector is contracting. As you can see, the index did move up in September, but is still below 50 and has been below 50 since October of 2021.

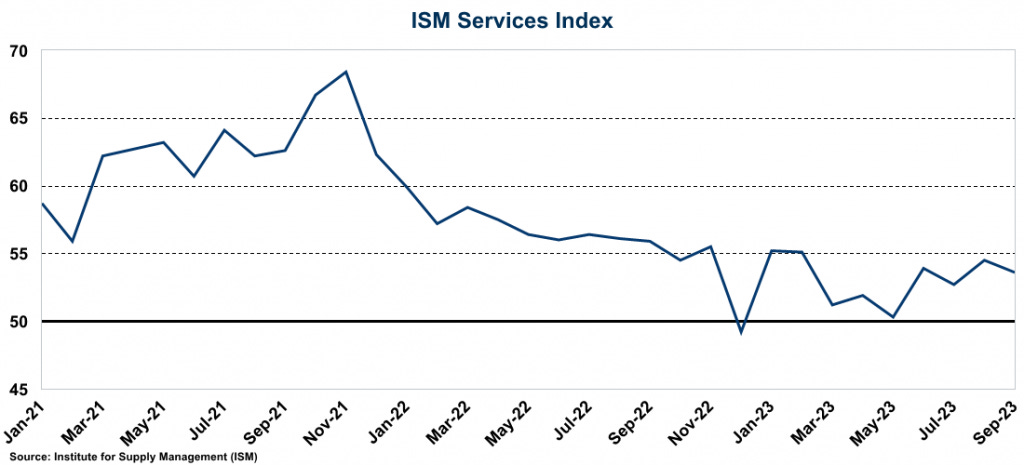

The ISM services index was released on Wednesday and showed a slight pullback in sector growth but it remains above 50. The majority of the respondents remain positive about business conditions, but did express some concern about the future of the economy.

Factory Orders

Last month we discussed the continuing decline in U.S. factory orders which have been steadily declining since April 2021. As the ISM Manufacturing Index above showed, manufacturing continues to be in decline. This month's data on factory orders confirms the trend. New orders grew 0.5% year-over-year which represents the 6th consecutive month of virtually flat or declining growth.

Interest Rates

In total, the combined result of both the political and economic news this week sent interest rates soaring. The 10-year treasury was pushed to its highest level in 16 years and the 30-year fixed rate mortgage rose above 7.7%....the highest level since 2000.

The yield curve is still inverted and has been for well over a year, although, this week, it moved in a direction of being significantly less inverted than it has been. As you can see below, an inverted yield curve nearly always precedes a recession, but turns back positive before the recession actually begins. (On the graph below, when the line drops below zero, the yield curve is inverted.)

From a low of -108 basis points, it is now in the -35 point range, and continued movement in this direction will send a strong recession signal. Further, mortgage rates near 8% are surely to dampen the already weak housing market, which is yet another force moving the economy toward recession.

General Thoughts...

A final comment on the economy in the United States. In 1954, Darrell Huff wrote a small book entitled How to Lie with Statistics, and people who work with data on a regular basis know all too well how numbers can be manipulated to tell the story you want to tell. You can do the same thing with graphs. This week I came across a situation were this was made clear. Economist Noah Smith authored a recent post entitled Working-class wealth is improving where he states "the fact that working-class wealth has been recovering as a share of America's total wealth for a decade, even as every group has increased its wealth, says that something is going right in the U.S. economy."

Really? Something is going right in the U.S. economy? Is working class wealth really recovering as a share of total wealth? That statement surprised me as that is not what I perceived to be the case. So, I looked at the data. The graph below shows the net worth of the bottom 50% of Americans compared to the top 1%. Since 2009, the net worth of the top 1% have gone from $15T to $45T...a 3x increase. The bottom 50% have gone from $0.5T to $3.6T...at 7x increase. So, yes, from that perspective, net worth has risen faster for the bottom 50% and you see that in the graph below.

However, let's look at that exact same data, but instead of using a double Y-axis, we will use just one. In that case, the story looks much different. In this perspective you notice that since 2009 the net worth of the top 1% has risen by $30T while the net worth of the bottom 50% has risen only $3.1T. The wealth of the top 1% has grown 10x that of the bottom 50%!

Further, if you look at the share of total assets, since 2009 the share of the top 1% has risen from 22% to more than 28%. At the same time, the share of total assets since 2009 for the bottom 50% has declined from 8% to less than 6%.

Another interesting story this week surrounded the release of the ATTOM third-quarter 2023 U.S. Home Affordability Report. It showed that median-priced single-family homes are less affordable now (compared to historical averages) in 99 percent of counties around the nation. 99 percent! Considering all this, I'm not sure that those in the bottom 50% would agree with Mr. Smith's conclusion that "something is going right in the U.S. economy." Actually, between high inflation, rising mortgage rates, mounting consumer credit card debt, people needing two or more jobs, falling real wages, and declining relative wealth, it feels like something is going very, very wrong.