Weekly Economic Digest for 8-25-23: Housing; Durable Goods; and Consumer Sentiment

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

The major economic theme this week was housing with the National Association of Realtors releasing existing home sales on Tuesday, and the Census Bureau releasing new home sales on Wednesday. In addition, data on July durable goods orders was released on Thursday, and the University of Michigan Consumer Sentiment Index was released this morning.

Housing Market

Existing home sales dropped significantly to just above 4 million units on an annualized basis (graph below). This isn't surprising given that mortgage rates continue to rise and existing mortgage holders are reluctant to give up their existing mortgage for one that with a rate more than double what they have now. What is surprising is that prices for exiting homes continue to rise after bottoming out in December 2022. The current median price of an existing home is just under $400K. Clearly, the principle of supply and demand is driving these prices...inventory for existing homes is low so prices are bid up even though interest rates are at a 22-year high. As of this morning, the 30-year mortgage rate hit 7.23%

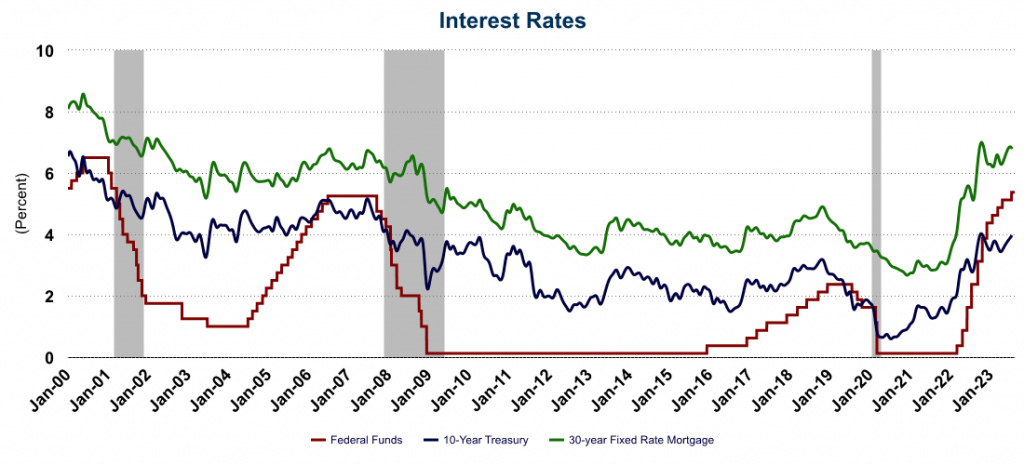

This gap between existing mortgage rates and the rate most home owners currently have has not been this large since the early 1980s. Real estate professionals refer to this situation as a "golden handcuff" - homeowners are "handcuffed" to their homes with very low mortgage rates.

So, then, it also isn't surprising that home builders are building even more units to meet the demand. Even with the rise in mortgage rates, new home sales rose to an annual rate of 714K units (graph below) moving in the opposite direction from existing home sales.

Even so, buyers appear to be very weary of entering into a mortgage at these rates. According to the Mortgage Banker Association the activity for mortgage applications this week dropped to their lowest level since 1995. In response, lenders like Zillow are now offering mortgages at 1% down to attract home buyers.

As interest rates continue to rise, there will continue to be some disequilibrium in the housing market. If the Fed continues on their quest to raise the federal funds rate, the 10-year will respond in-kind, and the 30-year mortgage rate will continue to rise.

For the better part of 24 years, interest rates were near zero which precipitated a steady decline in the 10-year treasury (which allowed explosive government spending - see graph below) and home owners got used to extraordinarily low interest rates. An entire generation has come to expect virtually free money. Those days are over and as people adjust to the new normal of higher interest rates they will also have to come to grips with living in less home than they anticipated. First-time home-buyers will be the most impacted as their expectations will take time to adjust. In the 1980s, entry-level homes were around 1,300 square feet. Now, they are between 2,800 and 3,200 square feet. But as interest rates rise and housing costs grow faster than wages home sizes will change course. Further, it wouldn't be surprising to see a 40-year mortgage rolled out to make monthly payments more affordable.

Durable Goods

Durable goods orders saw their biggest drop since COVID as orders for transportation equipment plummeted. As can been below, orders for transportation goods have been quite volatile of late, causing huge swings in the data. Adjusted for transportation goods, durable goods rose for the third consecutive month.

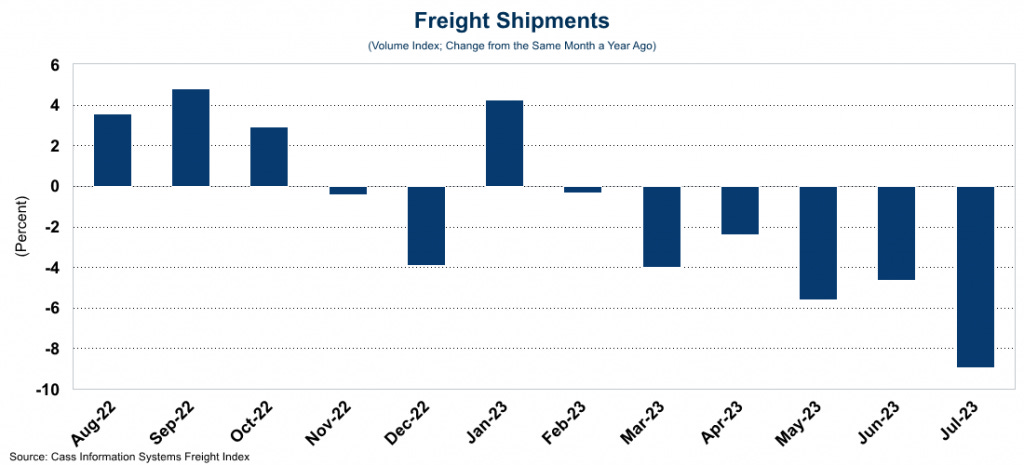

However, overall industrial production has been negative on a year-over-year basis for those same three months, and the overall trend has been going down for the past year, indicating a significant slowdown in the goods-producing sector of the economy.

Further evidence of this is significant decline in freight shipments. With the exception of COVID, you have to go back to the "Great Recession" in 2008-09 to find this level of decline in freight shipments. In short, the industrial economy is slowing down and is very likely already in a recession.

Consumer Sentiment

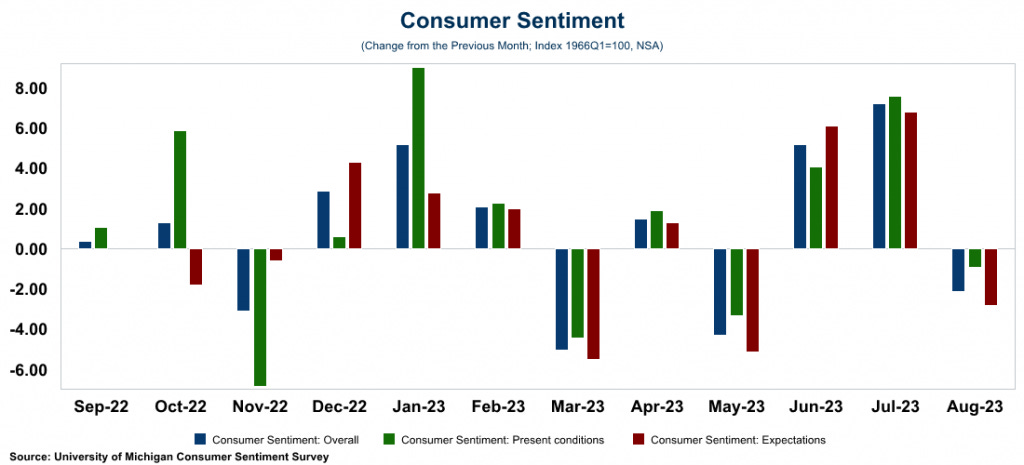

Finally, despite consensus expectations of no change, consumer sentiment dropped in August as consumers' opinion of both the current economy, and their expectations of the future economy dropped from previous months. While consumer sentiment is still higher than it was a year ago, the housing market as well as the overall slowing of the production economy may be starting to have an influence on how consumers feel about the overall economy.