Weekly Economic Update 04-12-24: Consumer Prices; Producer Prices; Tax Day; and a Summer Read

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Let's go ahead and get the obvious out of the way. A rate cut in June is OFF the table. Not going to happen. In fact, at this point, any rate cut this year will be seen for exactly what it would be...a blatantly partisan political move. If the government is to be believed, the economy is growing at better than 3%; employment is "strong"; and inflation is trending up. What is the possible rationale or justification for a rate cut in this environment? There isn't one.

A colleague asked me why inflation is going up when the Fed is tightening? One point that I have been making since late 2022 is that the Fed didn't tighten nearly enough! When they were saying that the terminal rate would be in the 5% range, I argued that it needed to be in the 7%-8% range at a minimum to have the desired effect on inflation. A quick look back at previous periods of high inflation in 1970, 1974, 1980, and 1990 show that the Federal Funds rate needs to be HIGHER than the rate of inflation. In the third quarter of 2022, inflation was running higher than 8%...and the funds rate was hovering at 2%. The Fed was late to act and didn't go nearly high enough.

Why didn't they go high enough? The federal debt. The gold bar in the above graph shows that in those previous periods, the debt-to-GDP ratio was much lower and the interest burden of higher rates wasn't as significant. Now, it is. Why can't they go higher? Because when your debt is $35 trillion, every basis point higher in the interest rate is a lot of money.

But if they lower the rate, inflation takes off even more. What are they to do? My guess...they will have to stop their "quantitative tightening" and open up the balance sheet once again and start taking on the debt. They have done an excellent job of rolling $1.5 trillion off their balance sheet. But at some point, if congress won't stop spending, they are going to be forced to monetize the debt.

And let's be honest....is the Fed really "tightening"? Do we have "tight" financial conditions right now? The Fed's own National Financial Conditions Index (NFCI) suggests not. The NFCI provides information on U.S. financial conditions in money markets, debt and equity markets as well as the traditional and "shadow" banking systems. Positive values of the NFCI indicate financial conditions that are tighter than average, while negative values indicate financial conditions that are looser than average.

With the exception of one month at the beginning of COVID, financial conditions haven't been "tight" since September of 2009! In fact, while the index moved in that direction early on in this "tightening" cycle, they have been trending down (i.e., looser financial conditions) since before the rate peaked at 5.25%!

So the Fed is between a rock and hard place. Now, let's get to the data that has them in that position.

Consumer Price Index

The Consumer Price Index (CPI) for March came in much hotter than expected at 3.5% year-over-year. For the month, it was up 0.4%, which translates to 4.6% annualized. Core CPI (CPI less food and energy prices) also came in much hotter than expected at 3.8% year-over-year. This is the third straight month where core inflation came in "hotter than expected." In January we were told it was due to a "seasonal anomaly" (as if January isn't always cold.) February also had some "seasonal adjustments" going on that supposedly made the number higher. But March was going to be the first "clean" reading of the year. So here we are. And the "clean" read came it hot as well.

But the big number is the "super core" (core services less shelter). That number absolutely exploded 0.7% for the month, moving to over 5% on a year-over-year basis. That number has been moving up since September and is now the highest it has been since early 2023. That is a problem as services represent the majority of consumer purchases. And it is a good thing we remove shelter from that number because shelter and rent inflation are both currently running at 5.7%.

I don't know how much more evidence we need that the Fed has not beaten inflation. It is sticky and it is not going away anytime soon. I have been showing the graph below for several months now. A second wave of inflation is not out of the question, especially since Congress continues to spend like a drunken sailor and the Fed seems unwilling to even consider further rate increases.

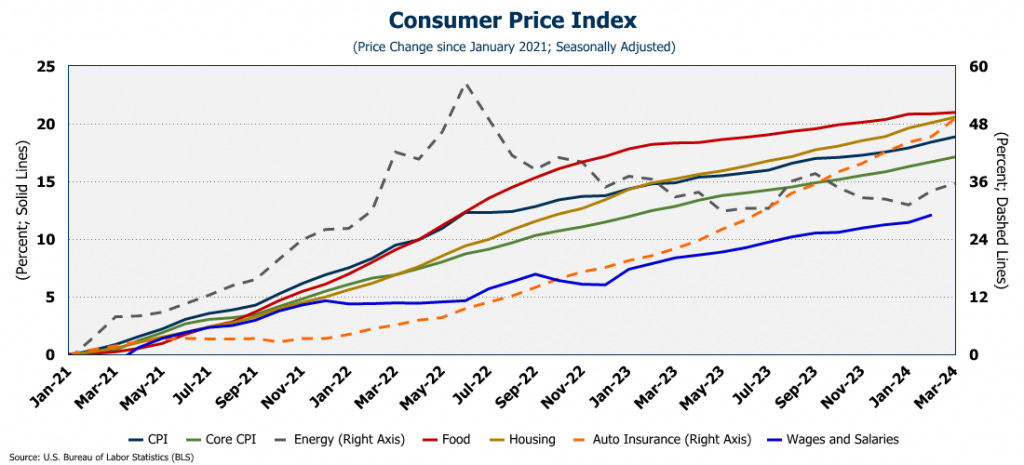

While overall prices are up 19% since January 2021, some of the critical items consumers purchase are even higher. Food is up 21.0%; housing is up 20.6%; car insurance is up 49.1%; and energy is up 35.6%. Over the same period, wages and salaries are up only 12.1%, which is why so many people have turned to second or third part-time jobs to help make ends meet.

Producer Price Index

As with "super core CPI", the Producer Price Index (PPI) rose in March at the highest rate since April 2023 coming in at 2.1% year-over-year. Core final demand (less food, energy, and trade services) rose to 2.8%, its highest level since last September. Again, this is the third month in a row where core PPI "came in hotter than expected.

Between this week's CPI and PPI data, it should be clear enough that inflation is once again rising and that the Fed hasn't done enough. Later this month we will get Personal Consumption Expenditures (PCE), and that will be the nail in the coffin confirming the resurgence in inflation. The 10-year treasury is back above 4.5%. The 30-year fixed rate mortgage is back above 7.0%. And the Fed won't be cutting any time soon.

Final Thoughts...

Monday is tax day. And as you finish your tax returns I want to remind you that your personal income taxes basically pay for two things....national defense and interest on the federal debt. In the latest month for which data is available, the seasonally adjusted annual rate of spending on defense was $1.02 trillion. The same number for federal debt interest was $1.03 trillion...slightly MORE than national defense. (That number is expected to be $1.6 trillion by December if the Fed doesn't cut rates.) Added together, you have $2.1 trillion. For the last 12 months, the federal government collected $2.2 trillion in individual income taxes. So, as the money is automatically deducted from your accounts on Monday, that is what you are paying for...national defense and interest on the debt. And with this week's inflation numbers, rates aren't coming down any time soon. My guess is that by next April 15, your taxes may barely cover the interest alone.

As I pointed out two weeks ago, since 1800, 51 out of 52 countries with a debt to GDP ratio above 130% have defaulted. We are currently at 124% and will be at 130% before too long. I also said that "a sovereign debt default would have catastrophic consequences."

I get asked all the time, what would a sovereign debt default actually look like? How would it impact the economy? For a whole lot of reasons, that is a tough question to answer. For one, I don't believe there has ever been a default by a country that held the world's reserve currency. That alone makes it tough to forecast, although that does make the entire scenario much worse. Further, there are different ways to default, which would obviously impact the fallout.

A friend of mine (and regular reader of this update) recently recommended a book to me, The Mandibles, by Lionel Shriver. I just finished it, and found it to be very entertaining. In short, it is a fiction novel in which the author envisions a sovereign default by the U.S. and the book tells the story of one wealthy family, the Mandibles, and how the default impacted four generations of their family.

In short, the President declares a "reset" on the national debt, rendering all treasury bonds void. Obviously, the dollar crashes, and is replaced globally by a new reserve currency, the Bancor (an international monetary unit originally proposed by John Maynard Keynes), administered by a Russian- and Chinese-led consortium of countries that obviously does not include the US. In fact, the U.S. refuses to participate in this currency, so much so that holding Bancors is considered treason. So does owning gold, and all privately held gold, down to wedding rings and teeth, must be surrendered to the government.

The story is a little slow to get started as the author has to lay some economic foundations for the reader - although I personally LOVED the early chapters for just that reason. It is also filled with humor, albeit sometimes dark and/or dry, and provides some interesting irony that might come with such a collapse, as when a prosperous Mexico builds a border wall to keep out illegal Americans. Another example is Lowell, a tenured professor of economics, who provides extensive lectures on the reasons for the crash, but soon discovers that professors of economics are among the most dispensable jobs when the economy implodes. (And THAT hit a little too close to home.....perhaps I should learn an actual skill.......)

I don't mean to suggest that this story represents exactly how such a default would impact our economy, but it does provide some food for thought as our country adds nearly $1 trillion in new debt every 100 days, and there seems to be absolutely no desire on behalf of our leaders to exercise any sort of fiscal responsibility. If you are looking for another book to take to the beach this summer, and are the type of person that subscribes to weekly economic newsletters, you may want to consider picking this one up.