Weekly Economic Update 05-03-24: ISM Manufacturing and Services; Case-Shiller Home Prices; Consumer Confidence; Employment Cost Index; Job Openings and Quits; and Monthly Employment

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

What a week! There was so much to report that the update is too long for some e-mail providers and they may clip or truncate it in your Inbox. If so, visit the website (alfiemeek.com) or read it in the Substack app.

The Federal Reserve Board held their regular set of private meetings this week where they discuss what a disastrous mess they are in and how they are possibly going to extricate themselves from this monetary disaster. (That's not exactly how it reads in the minutes, but that is what is happening.) To no one's surprise, they chose to hold rates constant. Why? Because, in the words of Chair Powell, "rates are high enough to bring inflation down." What? Really? Recent data suggests otherwise. And in fact, he knows this. I love this statement from Wednesday...."inflation coming down is still my forecast...but I am less confident in that forecast given the recent data." I love it! Basically, "I'm sticking with my forecast despite all evidence to the contrary!"

Remember, this is the same person who assured us that inflation was transitory. It wasn't. He then told us that inflation was defeated and we could expect multiple rate cuts this year. There won't be any. And now, we are to believe that inflation is under control and not believe our lying eyes? Not buying it. But you have to give it to Chair Powell...he is often wrong, but never in doubt!

In early January I said that a March rate cut wouldn't happen, and in early February I said that I didn't expect ANY rate cuts to happen in 2024. It seems the Fed is finally catching up and coming to the same realization. And so is the market...and it isn't happy about it.

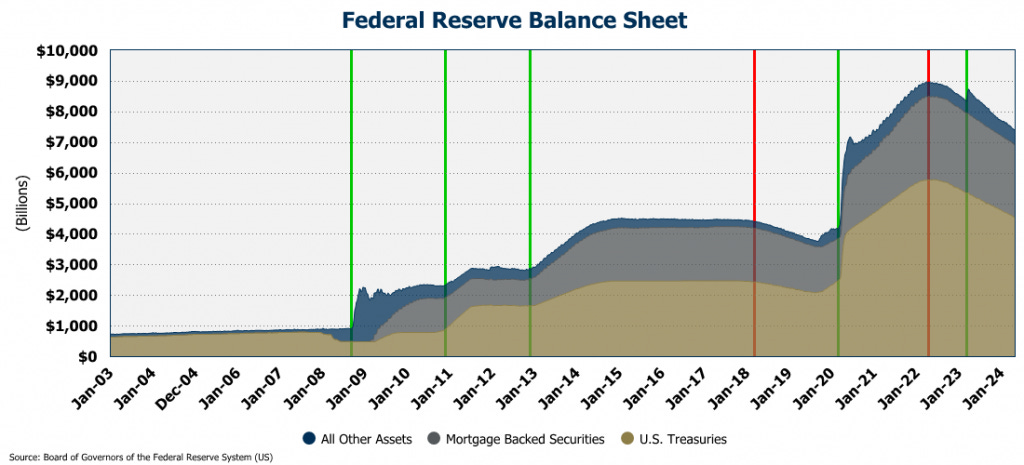

But perhaps my favorite part of the Fed statement was the following: "Beginning in June, the Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion." Ah! There it is! "Slow the pace of decline..." They have been doing such a great job lowering the balance sheet...but no more. Yes, they are going to continue to lower the balance sheet, but at a much slower pace. That of course, will be inflationary! But don't worry...inflation is under control....

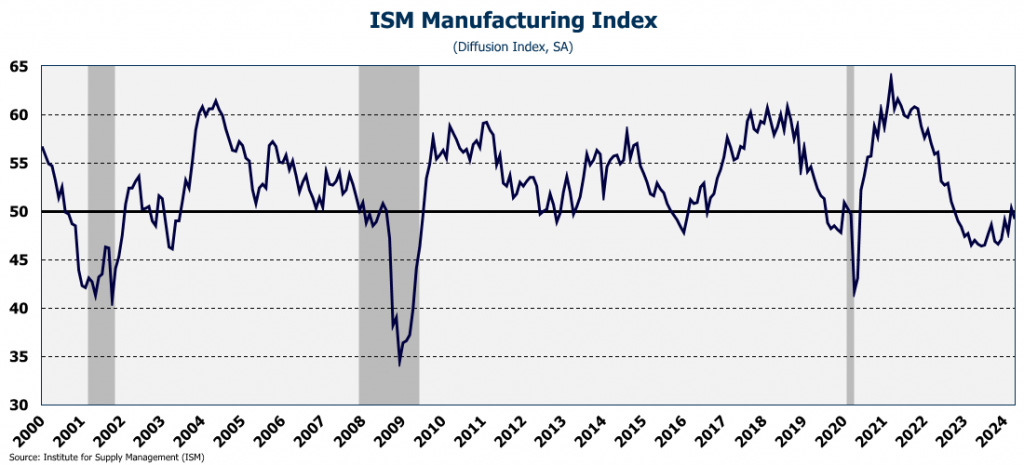

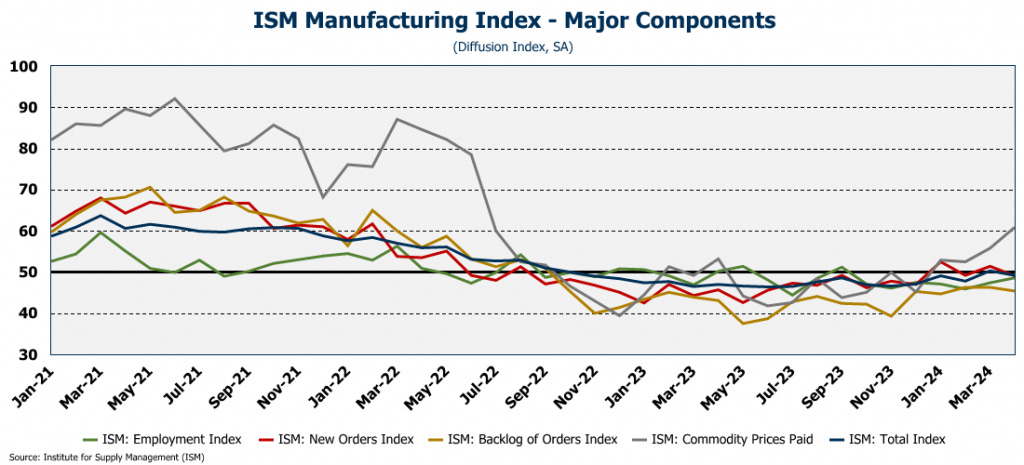

ISM Manufacturing

In a bit of unfortunate timing for the Fed, there is a lot of data this week showing the resurgence of inflation across the economy, and the first is the ISM Manufacturing index. For 17 months, the manufacturing index was below 50, indicating a contraction of the sector. It barely got above 50 in March, but fell back into contraction territory in April.

One of the big drivers was the huge 5.1 percentage point increase in the prices paid by manufacturers. The jump brought the price index to the highest level since mid-2022. That is a theme across much of the recent data...."prices are the highest since 2022." Clear evidence that inflation is not under control.

ISM Services

Not only did the manufacturing sector contract, but, for the first time in 16 months, so did the service sector. The ISM Services index came in at 49.4...the first time the index fell below 50 since December 2022. The services employment index fell further into contraction territory coming in at 45.9. And, continuing the re-accelerating inflation story, the services price index jumped 5.8 points to 59.2. So, the summary for the services sector...employment is down, prices are up, and the overall sector is in decline.

Case-Shiller Home Prices

Despite higher mortgage rates, home prices just keep on rising...and they are rising at an increasing rate! According to Case-Shiller, the 20-metro composite index rose again in February (the data lags by several months) as prices in these metro areas are 7.3% higher than they were just 12 months ago. For the third consecutive month, prices in all 20 metros posted an annual increase. In Atlanta (my home market) prices were up 6.4% on an annual basis.

From a broader perspective, the national index was up 6.4% over the past year - the fastest annual pace since November 2022. Both the national, and 20-metro index are at all-time highs. Obviously, the shortage of homes for sale is driving this price increase. With mortgage rates 300+ basis points above the average existing mortgage, that shortage isn't likely to abate any time soon. As such, the expectation is that home prices will continue to see solid growth for the next 12-24 months.

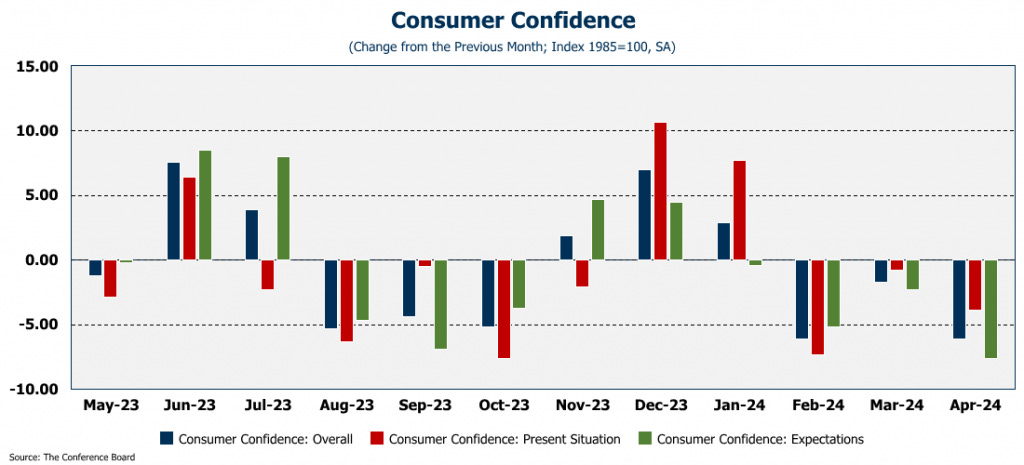

Consumer Confidence

The continuing rise in home prices is just one reason that consumers are feeling less confident in the U.S. economy. Rising prices for gasoline and food, high interest rates, domestic politics, and global unrest have driven consumer confidence to a 21-month low. Added to the list this month is concern about the labor market. Despite all the assurances we hear about the "strong labor market," Americans say it is becoming more difficult to find a job.

Not only has the overall index declined for the past three months, but both of the sub-indices - confidence in the present and confidence in the future - have also declined for three consecutive months. In fact, confidence in the future is getting dangerously close to reaching a 10-year low as Americans are turning very pessimistic on the economic outlook. Normally, that tends to not bode well for the incumbent in an election year...but nothing about this election year is in any way normal.

Employment Cost Index

As discussed last week, inflation continues to raise it's ugly head, and appears to not just be "sticky" but re-accelerating. In addition to the ISM and home prices above, we got further evidence this week of that proposition when data on employment costs for the first quarter were released. The cost of labor grew at an annualized rate of 4.8% in the first quarter, the fastest it has grown since late 2022 when the overall CPI was running at more than 8%. Simply put, persistent wage pressures are going to keep inflation elevated for the foreseeable future.

According to the data, people who work for state and local governments gained somewhat higher pay than non-union private-sector employees. (However, as a State of Georgia employee, I can tell you that my compensation grew at an annual rate of 0.0% in the quarter, and the second quarter will be the same. The third quarter looks to grow about 1.5% so I am doing my part to keep inflation down!)

In the PCE data last week, we saw that services inflation was running hot at 4.0% and moving in the wrong direction. That is likely to continue as a major cost component of services is labor, and unionized service workers saw their wages explode at a record pace of 5.9% in the quarter! Those labor costs are going to filter through to consumers in the coming months, keeping inflation high, and making it very difficult for the Fed to even consider cutting interest rates.

Job Openings and Quits

As I mentioned above, Americans say it is becoming more difficult to find a job. The Job Openings and Labor Turnover Survey (JOLTS) confirmed this as the number of job openings fell by 325K - the biggest monthly drop since late 2023. The number of job openings fell to 8.5 million...the lowest level since February 2021 when the economy was climbing out of COVID. This is the 20th consecutive year-over-year decline in job openings.

The largest decline in the number of openings was in construction, which is an ominous sign for the future of the housing market....if you are building fewer houses, you need fewer workers. The number of job openings in construction fell 182K in March which was largest monthly decline on record.

Another measure of the strength of the labor market is the quit rate. Obviously, when workers are confident they can find a better job elsewhere, the quit rate goes up. Well, in March, the quit rate plunged to 2.1% as people are choosing to stay with their current employer rather than look elsewhere.

Employment - Payrolls and Household

The big data release this week was April employment and wages. Expectations were for 240K new payroll jobs with a steady unemployment rate of 3.8%. However, the number came in at only 175K new jobs, and the unemployment rate moved up to 3.9%! This confirms what Americans said they were feeling in the consumer confidence report, and what the JOLTS data told us about the labor market. As has recently been the case, about half the new jobs were in health care and social assistance.

To better see the trend, I like to look at the three-month moving average in the jobs numbers. For the first time in 5 months, the three-month moving average declined. Everything in this report is transmitting that the labor market is slowing down....which is EXACTLY what the Fed wants to see.

However, according to the household survey, there were only 25K new jobs and the gap between the number of payroll jobs, and the number of households who are working continues to widen, indicating that Americans continue to have to work multiple jobs to make ends meet. In fact, the number of people who are working multiple jobs is up 8.8% from last year to 4.4 million. That isn't surprising when you see that average hourly earnings only rose 0.2% in April, once again, slower than inflation. However, because the number of hours worked per week declined in April, despite the rise in hourly earnings, average WEEKLY earnings fell 0.8%! If your earnings are falling, having multiple jobs is the only way to keep your head above water.

And that is why part-time employment continues to be the story. The number of people who are employed part-time for economic reasons (meaning that there are unfavorable business conditions, and inability to find full-time work, or seasonal declines in demand) rose to 4.5 million. One year ago it was 3.7 million.

The unemployment rate doesn't count these people. Nor does it count people that are "marginally attached" to the labor force (i.e., those who want to work, but haven't looked for 4 weeks) or have simply become discouraged and stopped looking for work all together. There are other less known measures of unemployment that try to pick these people up specifically, one known as "U-6" which grabs the marginally attached and those that are part-time for economic reasons. U-6 is now at 7.4%. But it doesn't go far enough. You also need to add in all those who are not in the labor force but report wanting a job, and the number climbs to 9.6% which is a "true" measure of the level of unemployment. For a measure of labor underutilization, you could also add those who are working part-time by choice, and you find that nearly 1 in 4 people in the labor force are not working full-time.

Final Note...

One final note for this week...we have had some time to digest the first quarter advanced GDP numbers that came out last week. Yes, the report showed slowing growth, but of the 1.6% total GDP growth, nearly 1.2% was from personal consumption of healthcare, housing, and insurance! So, to be clear, non-discretionary spending represented 75% of the quarter's economic growth! Add to that the fact that personal interest payments are up to $538B. (They were about half of that in 2021.) People are running out of money and discretionary spending is taking a hit.

And federal debt service now close to $1.1 TRILLION. We added another $586B to the federal debt in the first quarter...and that got us what? Federal spending added $17.3B to GDP. So $586B in new debt for only $17.3B in economic growth. We are in big trouble.