Weekly Economic Update 05-24-24: Fed Officials; Existing Home Sales; New Home Sales; Household Debt; Durable Goods; and Consumer Sentiment

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

There wasn't a lot of data released heading into the Memorial Day weekend and I spent most of the week at a conference, so the update will be short. Most of the week was filled with speeches by various Federal Reserve officials, most of which were not newsworthy. However, Fed Governor Christopher Waller did speak on Tuesday morning and threw cold water on any talk of a rate cut. He said he wants to "see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy." That was good to hear - especially since there have been ZERO months of good inflation data so far! Regular readers know that I fully expect "higher for longer" to be the status quo for quite some time. I think his comments show that a rate cut is not on the horizon. (And as of last week, I have a $1 bet with a reader that there won't be a rate cut this calendar year so now I am really invested in their policy decisions!)

However, he was also thoroughly dismissive of a rate hike - a move that the Fed needs to make and should have made months ago. Waller said, "...the data suggests that inflation isn’t accelerating and I believe that further increases in the policy rate are probably unnecessary.” Really?!? Not accelerating? May I refer you to the data and various graphs I have shown in just the last four weeks:

ISM Manufacturing Index currently shows a 5.1% increase in the prices paid by manufacturers, bringing those prices up to the highest levels seen since 2022.

ISM Services Index prices-paid sub-component jumped 5.8 points in the most recent month.

Bureau of Labor Statistics Employment Cost Index grew 4.8% in the first quarter, the fastest pace of growth since 2022.

Personal Consumption Expenditures (PCE) Index increased to 2.7% in the latest reading. PCE Services rose to 4.0%.

Conference Board Consumer Confidence Index latest survey showed consumers are feeling less confident due to rising prices.

University of Michigan Consumer Inflation Expectations one year from now jumped to 3.3%.

Annualized, CPI is running 4.6% over the first four months of the year. CPI services is running 5.6%.

What the heck is he talking about? "The data suggests that inflation isn't accelerating?" The data shows the exact opposite! I seriously wonder if Waller has even looked at the data!

Even though Waller doesn't see it "accelerating," thankfully he does admit that inflation is "sticky" i.e., not coming down fast enough. But his next quote takes the cake..."there’s something more fundamental going on that is making inflation a little stickier than what we saw at the end of last year. We’re still all trying to figure out what it is.” What?!?! STILL TRYING TO FIGURE OUT WHAT IT IS?!? Oh, I don't know...how about that you printed $7.5 TRILLION and it is still sloshing around in the economy!! Maybe THAT is what it is?

"Still trying to figure out what it is." Good grief these people.

Existing Home Sales

And thanks to all that money sloshing around, and the resulting increase in interest rates, the 30-year fixed-rate mortgage was above 7.2% at the end of April. Is it any surprise then that existing home sales fell again last month to an annual rate of 4.14 million units? That rate was below expectations and represented a 1.9% decline from a year ago.

At the same time, while sales are falling, prices are rising! The average price rose slightly to $400,201 (seasonally adjusted) last month. It is simply supply and demand. There is no supply since existing home owners are simply not going to put their houses on the market and lose that amazing sub-3% mortgage rate!

The National Association of Realtors did point out that sales of homes priced $1 million or more posted the biggest increase among all price categories, surging 40% from a year ago. Not sure that means much, however, because between inflation and lack of supply, the sheer number of homes that are priced above $1 million is growing daily! But for those of you who are feeling house rich as you see that value increase, remember....your house isn't worth more...the dollar is worth less.

New Home Sales

Like existing home sales, NEW home sales also fell in April, dropping 4.7% in the month - much more than the 2.2% drop that was expected. On an annual basis, new home sales are running 634K units...roughly the same level as 2022. And of course, big surprise, last month's data was revised down. Overall, sales were down 7.7% from April last year.

Once again, however, even with the falling number of sales, prices are still high with the average median sales price of a new home just north of $433K. About 40% of new homes sold were below $400K.

Total Household Debt

The New York Fed released new data on household debt in the first quarter of 2024. In total, households now carry a record $17.7 trillion in total debt - up 24% in four years. Of course, with inflation, economic growth, and an ever increasing population, you would expect this number to always be rising. However, the pace at which it rises is what is important. In 2013, mortgage debt was $7.8 trillion. In just 11 years that number has grown 60%.

Households have $1.6 trillion in auto loans - 8% of which transitioned into delinquency in the first quarter (on an annualized basis). Another 3% moved into "seriously delinquent" status (more than 90 days past due). Households are also carrying $1.1 trillion in credit card debt - 9% of which transitioned into delinquency in the first quarter (again, on an annualized basis). Another 6.9% became "seriously delinquent."

But again, when you have an ever-increasing series, it is the rate of growth that matters. Mortgage debt is up only 3.3% over last year...not a big surprise with the level of mortgage rates and home prices slowing the housing market. However, while first mortgage debt is not rising quickly, debt on home equity lines is up 10.9% annually and growing rapidly. Similarly, credit card debt is up 13.1% as people are using both home equity and credit cards to meet their basic needs on a week-to-week basis. But these two sources of credit have significantly higher servicing costs.

That servicing cost is leading to an interesting phenomenon in the mortgage market. A friend in the mortgage business told me something this week that absolutely shocked me. He is seeing a lot of applications from potential borrowers wanting to do cash out refi's to payoff low rate first mortgages because their credit card and other debt payments have become unmanageable. Their blended rate of credit card debt, auto loans, and other junk debt is higher than the current 7% on a new 30-year mortgage. Given the huge jump in home prices, they have a lot of equity, and they are tapping that at a higher rate and extending that debt payment out over 30 years. This tells me that the consumer is done. Once you have traded a sub 3% mortgage for a 7% mortgage to help manage your other debt, you are tapped out.

But then again, the ability of the U.S. consumer to spend and consume never ceases to amaze.

Durable Goods

Last month, we were told that durable goods orders surged 2.2% in March. Well, guess what....that has now been revised down to only 0.8%. In fact, over the last 14 months, durable goods data have been revised down 9 times, and the downward revisions have been significantly larger than the 5 upward revisions. As I have said many times, revisions come with the territory, but statically, sometimes the data are revised up, and sometimes it is revised down. But for the past two years, revisions across all economic data have been down more than 80% of the time. If not intentional, then something is seriously broken with the data collection methodologies used across all government statistical agencies.

Another downward revision in the March data was for shipments of non-defense capital goods excluding aircraft. For the month, it was revised down from +0.2% to -0.3%! In other words, instead of growing, it shrunk. That is a significant drop as this is a key measure of business spending and used in the GDP calculations.

For April, the growth in all durable goods orders was only 0.7% (which means by next month, it will probably be revised negative). Virtually all of the growth in new orders for durable goods was due to defense which jumped 15.2% for the month! (I guess we know how the $95 billion in foreign aid for Ukraine, Israel and Taiwan was spent! It is a good time to be a defense contractor/weapons manufacturer.)

New orders excluding transportation grew only 0.4% in April. We use this measure as a more stable indicator of the industrial economy because transportation orders tend to be so volatile. For example, Boeing reported only seven new orders in April, down from 113 in March. (But, when you put things in your fuel tanks that can ignite and blowup the plane, people tend to look for other options.)

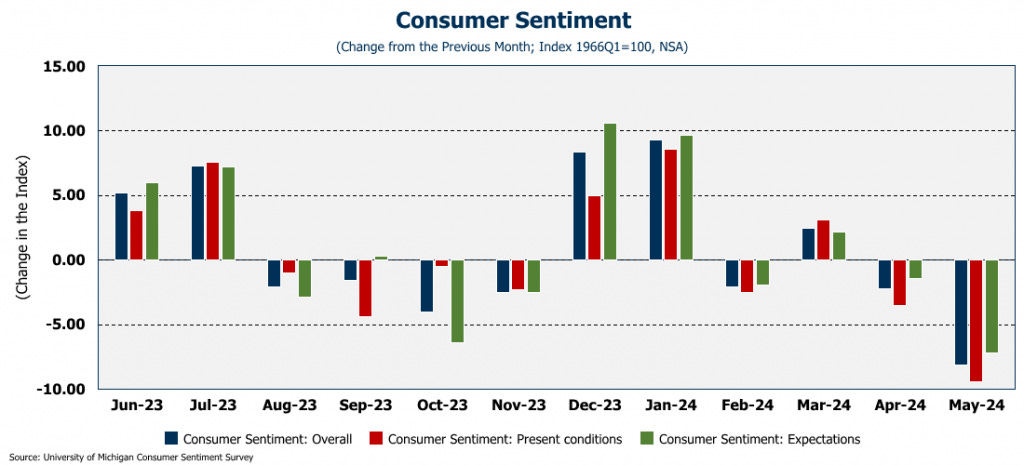

Consumer Sentiment

Finally this week, the University of Michigan released their final read on consumer sentiment for May. It really didn't change very much from the advanced reading we got two weeks ago. The drop in consumer sentiment in May was still significant, but not quite as bad as the initial read. Most of the improvement from the initial read was due to consumers feeling a little better about future inflation, but their sentiment was still well down from April levels.

Final Thoughts...

To close on a serious note, as we enter the Memorial Day weekend, I encourage you to remember those who gave their life in service to our country. My grandfather served in Europe in WWII, and even though he made it back home, when I read the letters he wrote, it drives home the extraordinary price paid in blood for what we enjoy today. Memorial Day is more than hot dogs, ice cream, and a trip to the lake. At the very least, we owe them our remembrance. This weekend, give them that.