Weekly Economic Update 06-14-24: CPI and A Discussion About Inflation

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

It is summer! And, for the first time since I started this weekly update last August, I have a lot of vacation coming up, starting this week. In fact, as this goes out on Friday, I will be fishing off the coast of New Orleans! Therefore, during the summer, occasionally the weekly update will be a little different, and I may even have one or two guest writers. And if I can't get a guest writer, I may, for the first time, miss a week here or there. (But I'll try my best not to.)

This week, we did get CPI before I left for New Orleans so I will report on that. However, I also want to take this opportunity to briefly comment on what the CPI represents - inflation. Inflation is the single biggest factor driving the domestic economy right now and many people don't fully understand it. But first, let's look at the data.

Consumer Price Index (CPI)

For the month of May, the headline Consumer Price Index (CPI) took a much-needed breather and was unchanged from April. As such, on a year-over-year basis, the index dropped to 3.3% - still well higher than January, but a move in the right direction. As can be seen below, for the past year, CPI has simply bounced around between 3.1%-3.7%, still well above the 2% target. Core CPI is sitting at 3.4%

However, "super core" (core services less shelter) was steady and is still running above 5%! As I have said many times, services represent the significant amount of consumer spending and that rate is still way too high. Interestingly, the "shelter" component (which is removed from "super core") is running 5.4% year-over-year; rent is running 5.3%.

Since January 2021, CPI has not posted a single monthly decline. The "unchanged" in May is the closest it has come. However, within that number, some basic necessities are posting huge year-over-year gains. For example, over the last 12 months, car insurance is up 20.3%; overall transportation is up 10.5%; car repairs are up 7.2%; and electricity is up 5.9%. Going all the way back to January 2021, overall CPI is running 19.5%. Food and housing are running 22.2%. But hopefully, the May number suggests a slowing in the near future.

So, what does this mean for a rate cut? By itself, not much. First, the Fed relies more on PCE than CPI, and second, they would need to see 3-4 months of this type of reading before a rate cut in 2024 would be on the table. I'm sticking with my forecast of no rate cuts in 2024.

Inflation - What Is It Exactly?

Since I am traveling the latter part of this week and won't be able to address any other data releases, I want to use the space here to dig a little deeper on inflation. As I speak to various groups, I get a lot of questions, and I hear a lot of misconceptions, about inflation. So, maybe a little primer on the subject would be worthwhile.

Let me start with what inflation is NOT. It is NOT an increase in price. Price increases are a result of inflation. However, other factors can also create price increases. For example, prices can rise due to a change in consumer tastes; a natural disaster; a new tax; supply disruptions; additional regulations; etc. I come across a lot of people - in person; on-line; in the media - who want to blame sustained inflation on one or more of these factors. I'll address some of the more popular excuses below.

So what is inflation? It is an increase (or an "inflating") of the money supply. That's it. Nothing more. Sustained levels of inflation that result in an across the board rise in prices are not driven by supply shocks, corporate greed, or war in eastern Europe.

Nobel-prize winning economist Milton Freidman famously said "Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced ONLY by a more rapid increase in the quantity of money than in output." That's it. Inflation is when the money supply grows faster than real output.

Irving Fisher, an American mathematician and economist, formulated what we call the "equation of exchange" that is very helpful in understanding the relationship between money growth and inflation. The equation is MV=PY where "M" is amount of money in the system; "V" is the velocity of money (how often it is used in a single year to purchase goods); "P" is the price level; and "Y" is real income/output. To make the equations dynamic we can show it as %∆M + %∆V = %∆P + %∆Y. (Read "%∆" as "percent change.") A simple re-arrangement of the factors and we get the equation for a percent change in the price level: %∆P = %∆M + %∆V - %∆Y.

Generally, the velocity of money (V) is fairly constant. Further, output (Y) is determined by the stock of labor, capital, and technology, and by definition, money has no impact on "real" variables. Which leaves the change in the money supply as the only factor impacting the change in the price level. But people don't like that answer - especially those in power who get blamed when people can't afford housing, food, or insurance. They want to blame it on other factors like supply chain disruptions from COVID; greedy corporations; or Putin's war in Ukraine. There are other excuses as well, but these three seem to be the most popular so I will address them each below.

Excuse #1: Supply Disruptions from COVID Caused Inflation

Let's suppose that supply disruptions from COVID are driving our inflation, and not money growth. To demonstrate how that would work using the Fisher equation, let's assume V and M are constant. In that case, for prices (P) to rise 1%, the growth rate in real output (Y) would have to decrease by 1%. And to be the cause of sustained inflation, this would have to be going on over time.

For the 10 years before COVID, real output in the U.S. grew at an annual rate of 2.4%. For supply shocks to raise inflation by 1%, real growth would have to drop to 1.4%. In other words, for inflation to increase 1% in a year, there would need to be a supply disruption so great, that it dropped annual real output by about $250 billion. And that is just for a 1% price increase. To get to 9% the disruption would have to shave off $2.3 trillion from real output. And that is just for one year. To have sustained inflation, you would need continuous supply shocks, each one larger than the last. However, the U.S. Bureau of Economic Analysis tells us that since 2021, the U.S. economy has actually grown FASTER at an average real rate of 2.9% per year!

The math simply doesn't work. COVID-related supply disruptions are NOT the cause of sustained inflation.

Excuse #2: Greedy Corporations are Causing Inflation

Supply shocks came and went, and yet inflation remained. So, the blame naturally turned to the filthy, greedy corporations. The argument goes something like this...supply shocks during COVID gave corporations cover to raise their prices, and when the supply chain issues were resolved, they kept their prices high, increasing their profit margin. Now, with higher margins in place, they continue their price gouging and THAT is why we are still dealing with inflation! After all, just look at the size of a Snickers bar!!!

There are several problems with this, but due to time and space, I am going to limit myself to some high-level comments. First, and foremost, there is absolutely no evidence for the assertion that that corporate profits are greater now than before COVID. Between 2010 and 2020, real corporate profits rose an average annual rate of 3.9%. Since the beginning of 2022, real corporate profits have grown at an average annual rate of 2.0%. In fact, 4 of the last 8 quarters have seen corporate profits DECLINE!

In response, I am told to look at the earnings of the S&P 500. In the first quarter of 2024, earnings for the S&P 500 grew 5.4%, the highest growth rate since the second quarter of 2022! The problem with that analysis is that this is being driven by the "Magnificent Seven" - Nvidia (NVDA), Meta Platforms (META), Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), Apple (APPLE), and Tesla (TLSA). These companies posted 48% earnings per share growth in the first quarter. Take these 7 out, and the remaining 493 companies would have reported a year-over-year earnings DECLINE of 2% rather than growth of 5.4%.

In short, this isn't the way the economy works. For all corporations across the board to consistently post "above average" profits and drive up prices, you would have to have wide-spread collusion across every major sector of the economy! Why? Because consumers would start to substitute one good for another. For example, if beef producers colluded to keep beef prices high to gain "above average" profits, consumers would simply move to chicken. The collusion would need to be across not only beef, but all beef substitutes. Because we see all prices rising, essentially you would need collusion across the entire supply-side of the economy. And, of course, there would be a huge incentive for a particular company to lower their prices and gain market share! That incentive would drive companies to cheat, which would collapse the collusion and profits would settle back.

I could develop this much more, again using the Fisher equation, but I hope you get the point. Corporate greed is simply not a driver of the sustained inflation we are experiencing.

Excuse #3: Putin's War in Ukraine

This one is almost laughable, but it was pushed by the Administration for a while, and I do still hear it occasionally so I need to address it. Russia invaded Ukraine on February 22, 2022. As you can see from the graph below, CPI inflation was already running at 7.9% in February 2022 (vertical dark red line), and had been accelerating rapidly for almost one year before that occurred. In fact, CPI peaked just four months later, and has been coming down steadily since, so you might as well conclude that the war in Ukraine actually caused inflation to decline! Of course, drawing either causation from the war is clearly absurd.

So What is Causing the Inflation?

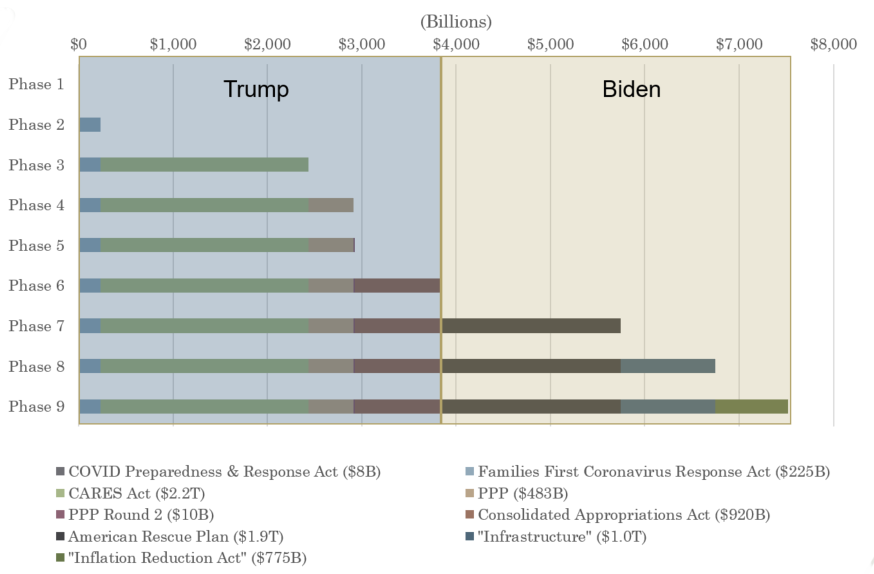

Hopefully by now you are convinced that, as Milton Friedman said, money creation in excess of real growth is the cause of inflation. When COVID hit, our government did the only thing they are really good at....they threw vast sums of money at the problem. You may recall:

COVID Preparedness & Response Act ($8 billion)

Families First Coronavirus Response Act ($225 billion)

CARES Act ($2.2 trillion)

Paycheck Protection Program a.k.a. PPP ($438 billion)

PPP Round 2 ($10 billion)

Consolidated Appropriations act ($920 billion)

American Rescue Plan ($1.9 trillion)

Infrastructure Bill ($1.0 trillion)

Inflation Reduction Act ($775 billion)

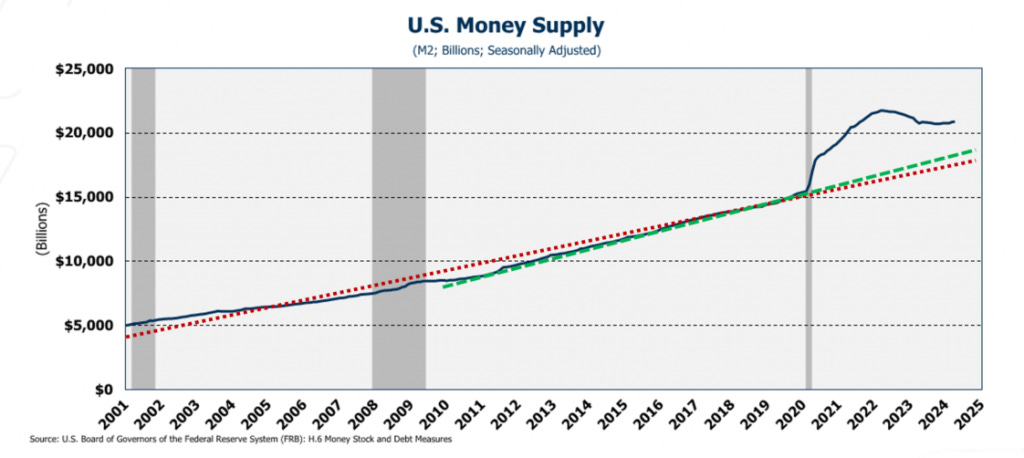

All told, $7.5 TRILLION was thrown at the problem. Unfortunately, the government didn't have $7.5 trillion in the bank. So they did it by essentially "printing" it and growing the U.S. money supply by 40% between 2020 and 2022. Understand what that means. Two out of every five dollars ever created in the history of the United States were created between 2020 and 2022. And, as you can see below, while they did try to shrink the money supply during 2023, it is once again growing and is still several trillion dollars above any reasonable trend line you want to apply to the data.

Recently I was reviewing an old text from graduate school - Money and the Economy - written by my professor, Dr. John Klein, who was, if I recall correctly, one of Milton Friedman's graduate students at the University of Chicago. In talking about government deficits, he writes "If there is a deficit, it should not be financed by selling securities to the central bank. Such a move would be extremely inflationary." He was absolutely right. But THAT is EXACTLY what the government did. As you can see below, the central bank purchased securities and exploded their balance sheet in 2020 taking it from just over $4 trillion to $9 trillion in the matter of just two years. The consequences should have been obvious to anyone with even a basic understanding of economics. It was right there, even in a simple graduate economics text book written in the 1980s.

Slightly more than half of the over spending was done under the Trump Administration, and the rest was done under the Biden Administration. Both administrations (and their respective congresses) are equally guilty.

In fact, the case can be made that since price level changes tend to lag the money printing by 18-24 months, the high inflation rates of 2022 can be tied to the initial COVID spending of the Trump administration. The additional spending of the Biden administration just added fuel to the fire and is one of the reasons, despite this week's flat inflation number, that I am very concerned about a second wave of inflation on the horizon.

I have only scratched the surface, and I could go on and on, but I hope I have provided enough evidence and explanation for you to understand that the reason we are dealing with high prices is that we printed way too much money over the past four years, and since output hasn't kept up, there is too much money chasing too few goods. The value of your dollars is going down as it takes more of them to buy the same amount of stuff.

Friedman's quote about inflation continues...."Inflation is always and everywhere a monetary phenomenon...it is made or stopped by the central bank." Tuesday we heard from Fed Chair Powell about how the Fed is fighting inflation. You have to laugh at the irony. Central banks don't fight inflation...they cause it. Chair Powell is like the fire fighter that is also an arsonist...fighting the very problem he created.

Final Thoughts

If you are interested more information on this subject - as well as other topics like price controls, abolishing "junk" fees, price gouging, CEO pay, etc. - written in a clear, easy-to-understand, non-academic style, I recommend The War on Prices: How Popular Misconceptions About Inflation, Prices, and Value Create Bad Policy. It is written for the lay person and explains all these concepts in a very non-academic, and easy to understand way - far better than I ever could.