Weekly Economic Update 06-20-25: Retail Sales; Industrial Production; Home Builder Confidence; Building Permits and Housing Starts

All the economic data was bad and the world is on the verge of nuclear war. Rough week.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

At the beginning of every year, I travel around and give my “economic outlook” to various business and government groups. As we approach the mid-point of 2025, my original outlook is, for the most part, on track, as much of what I said back in January still holds.

It isn’t always that way, of course. Economic forecasting is more of an art than a science. After all, the economy is a large and complex system with a lot of moving parts that interact with one another in various ways. To make it even more difficult, in any given year, there are events that occur that no one could have seen coming. These are commonly known as “black swan” events, and in economist-speak, are “exogenous” to the system and therefore were not considered in the forecast. As any good economist will tell you, their forecast would have been perfectly spot-on had it not been for these unforeseeable, exogenous events.

I mention this because, given the geopolitical events of the past week, I feel that the accuracy of my 2025 outlook may be in jeopardy. So, for the record, I want to clearly point out that thermonuclear war in the Middle East would be an exogenous shock to the U.S. economy, and I make no representations about the accuracy of my initial forecast in the face of such a scenario.

With that said, let’s get to the economic data released this week. In short, it was generally bad across the board. I guess the threat of nuclear holocaust has everyone a little down these days.

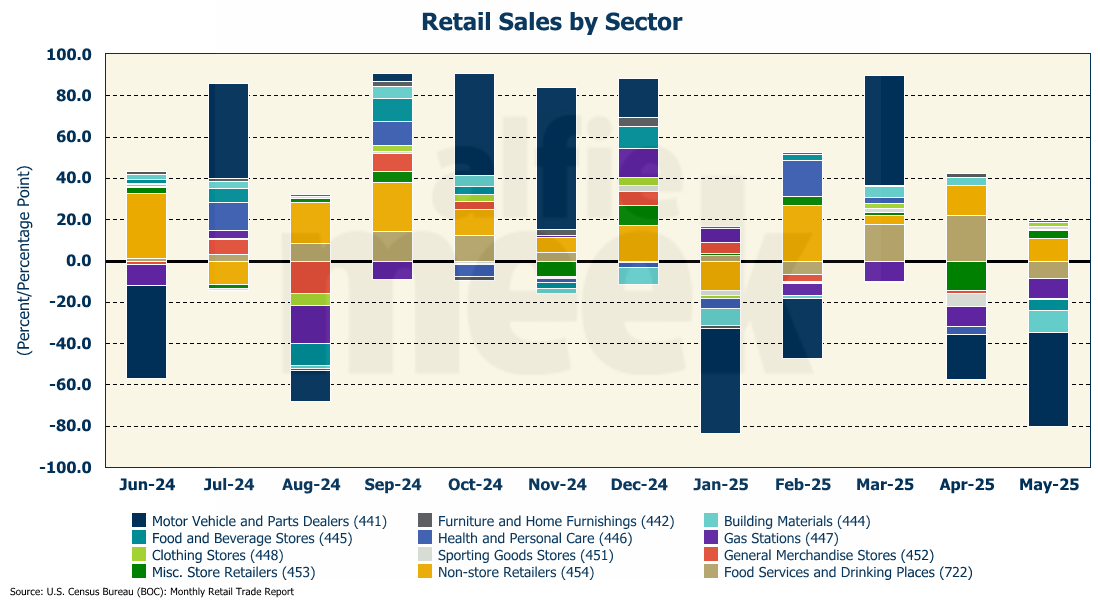

Retail Sales

First up this week, retail sales. Consumers pulled back in May as the reality of their ever-increasing debt burden and their growing inability to pay it may be starting to hit home. Retail sales fell 0.9% in June, much worse than what was expected (full release here). That was the largest monthly drop since early 2023. Motor vehicles were a serious drag on the monthly numbers, but even without autos, retail sales still fell 0.3%. To make matters worse, April retail sales were revised down, from an increase of 0.1% to a decrease of 0.1%. Adjusted for inflation, retail sales are running just 0.9% above last year.

Digging into the details, in addition to autos, gas stations also contributed to the decline, but that isn’t surprising given that gas prices have been falling of late. Building materials were down, which is also not surprising since the home builders are all depressed (more on that below). Surprisingly, food and beverage stores, as well as restaurants, were negative for the month as well. That is rare. Usually, restaurants are a positive contribution to retail sales. The fact that they were negative further supports the idea that the consumer is in rough shape.

Industrial Production

Consumers aren’t consuming, and producers aren’t producing. Total U.S. Industrial production fell 0.2% in May - the second decline in the last three months, and worse than the experts expected (full release here). One bright spot was manufacturing output which was up 0.1% after a sharp drop in April. However, if you remove auto manufacturing, output actually fell 0.3%. On an annual basis, manufacturing output is up 0.6% from one year ago…up only 0.5% if you remove autos.

Capacity utilization - a measure of how much of the U.S. potential output is actually being realized - fell for the third consecutive month and now sits at 77.4%.

Home Builder Confidence

As I mentioned above, according to the latest data from the National Association of Home Builders (NAHB), builders are somewhat depressed about the current state of the housing market (full release here). Home builder confidence fell to the lowest level since December 2022 and is coming dangerously close to the 2020 COVID lows.

All three index components declined in June, each falling by two points. That decline brought the “single-family sales” sub-index to the lowest level since 2012, when it crashed after the financial crisis/housing collapse.

Mortgage rates were up slightly in June, and combined with tariff uncertainty and the deteriorating financial condition of the U.S. consumer, the short-term future of the housing market doesn’t look good.

Building Permits & Housing Starts

And the hits just keep on coming. The last piece of data we got this week was for building permits and housing starts for the month of May, and like everything else this week, they were down. Way down. Permits and starts are the physical evidence of the dour mood of homebuilders discussed above.

First, building permits for the month of May were down 2.0%, and that followed a 4% decline last month (full release here). Once again, the drop was well below expectations. (I’m sensing a theme this week.). Single-family permits fell 2.7%, while multi-family permits fell 0.8%, driven in large part by a complete crash in permits for homes with 2 to 4 units.

Housing starts didn’t fare any better. Overall, housing starts fell 9.8% in May, falling to their lowest level since COVID, and coming in at only 1.256 million units - again, below expectations.

Single-family starts were actually up slightly, rising 0.4%, which represents a seasonally-adjusted annual rate of 924K units. However, multi-family starts fell 30.4%. That was the largest month-over-month drop in multi-family starts since early 2024.

One More Thing…

Thank you to the new subscribers I got after last week’s post. Three readers subscribed at the $8/month level. Unfortunately, I needed about 200.

Therefore, over the next few months, I plan to switch to a paid-subscription model. Only those with paid subscriptions will get the full update. That will bring my readership down from the current level of about 1,500 to only 25, but it will be 25 who really appreciate and value the information. Unfortunately, the only way to do that is through SubStack, not through “Buy Me A Coffee.” I will be reaching out to each of the 25 individually to make the transition as smooth as possible and move your subscription to the SubStack platform.

Until I can make the switch, however, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.