Weekly Economic Update 07-04-25: ISM Manufacturing & Services Surveys; Job Openings & Labor Turnover; and June Employment

Happy birthday, America!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Today marks the 249th birthday of the United States of America. To many, that may sound old (although apparently there are people that old still collecting Social Security), but in terms of nation-states, the U.S. is only now going through adolescence.

Those of us who are parents remember those awkward pre-teen/early teen years…and not in a fond way. Kids that age are moody, insolent, bad with money, struggling with identity, and completely self-absorbed, as everything is about them and their over-exaggerated drama.

Yep. That sounds a lot like America. Right in the middle of adolescence. We are moody. Just look at our elections - Bush, Obama, Trump, Biden, Trump - how will future historians explain that vacillation? We are often insolent in our dealings with other countries. We are horribly bad with money ($36 trillion in the hole). And at home, we can’t seem to agree on our national identity, and every day brings some new over-exaggerated drama that really isn’t.

As a parent of a child at this stage, you often wonder, “What have I done?” “Who is this monster I have created?” and “Is it possible to give this one back?” If they could see us today, I suspect that the Founding Fathers would be asking those same questions.

Fortunately, it is only a stage. People grow out of it, come into their own, and become well-functioning adults.

At least most do. Unfortunately, there are a lot of “adults” out there who never seem to mature beyond adolescence. Let’s hope that isn’t our country’s fate. Perhaps it is about time that, as a nation, we started to grow up.

ISM Manufacturing

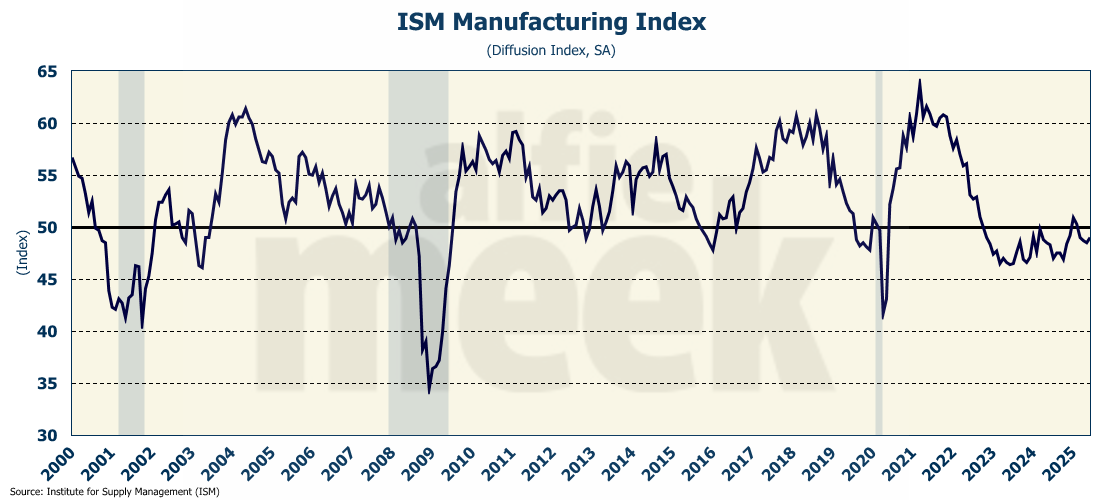

According to the ISM Manufacturing Survey, manufacturing rebounded slightly in June, moving up from 48.5 to 49, which was slightly better than expected and the highest level since February (full release here). Unfortunately, any reading below 50 means that the sector is contracting.

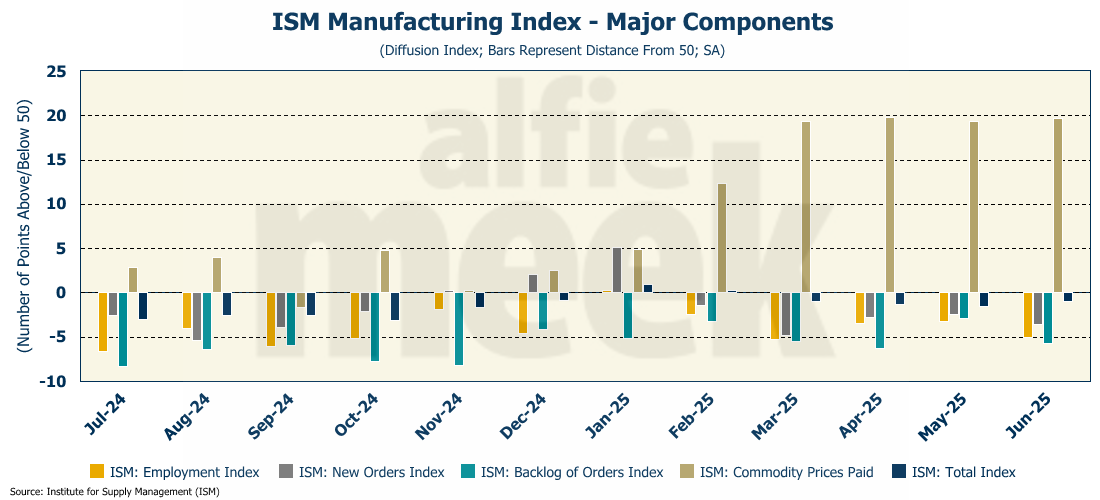

A look at the sub-indicies shows that employment and new orders fell further in June. Interestingly, the “prices paid” index continues to be quite high, reflecting manufacturers’ concern about tariffs and their link to higher prices going forward. As can be seen below, this has been a concern since the election, but to date, there has been absolutely no indication that this concern is warranted, as we have yet to see any price impacts at either the wholesale or consumer level.

ISM Services

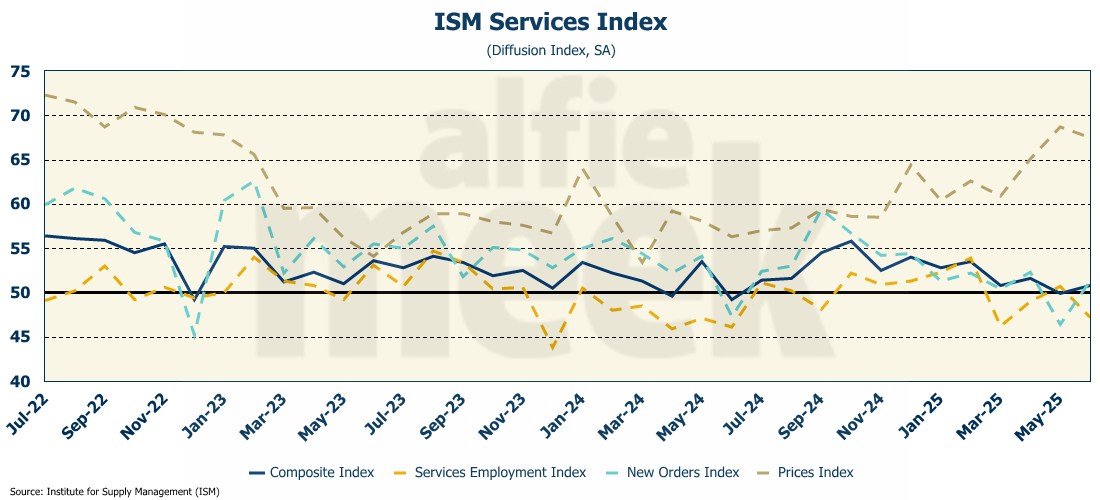

As was the case with manufacturers, service providers also seem to be concerned with tariff-related inflation. After a one-month drop below 50 in May, the ISM services index moved back into expansion territory, coming in at 50.8 (full release here). Even though the overall index was up, the underlying data was mixed. New orders were up, but service-sector employment fell, and survey respondents still report facing very high prices. But as noted in previous updates…while the “soft” survey data shows tarriff-related price pressures, the actual “hard” price data does not.

Job Openings & Labor Turnover Survey (JOLTS)

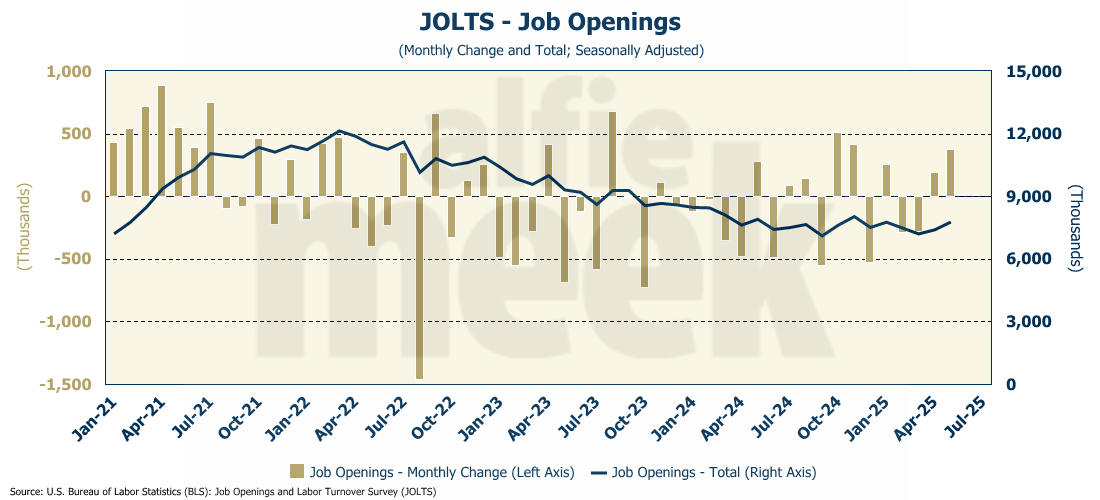

The number of job openings in May jumped up to 7.8 million, which was about 500K above expectations (full release here). This is the second month in a row that the number of job openings has far exceeded expectations, which suggests that perhaps the labor market is staging a rebound.

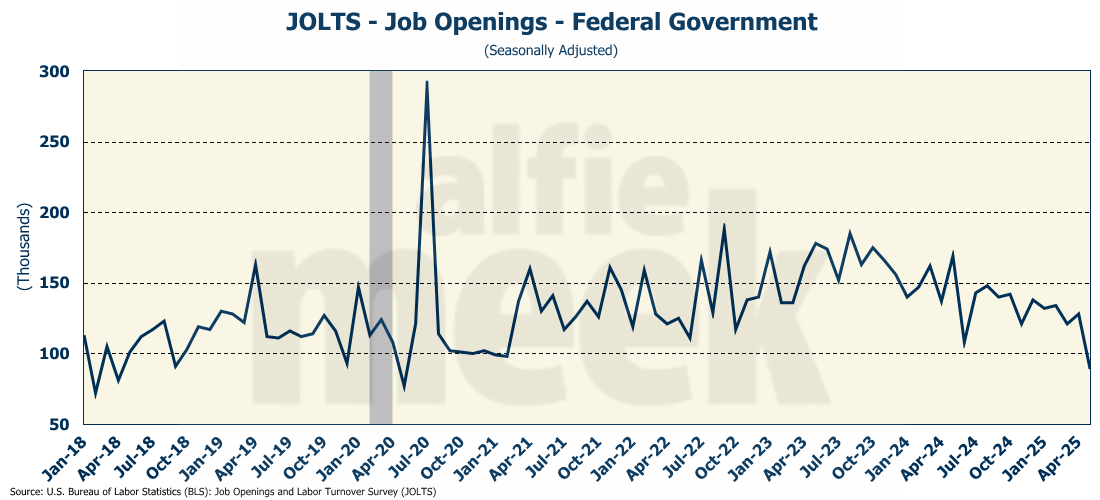

Not surprisingly, job openings with the Federal Government have plunged by 39K. Excluding COVID, you would have to go back to 2018 to find a month with a level of Federal job openings lower than those posted in May. I fully expect that number to continue to decline.

But again, despite the fall in Federal Government openings, overall, job openings were up, thanks in large part to more than 310K new job openings in accommodations and food services. There were another 91K new job openings in finance and insurance.

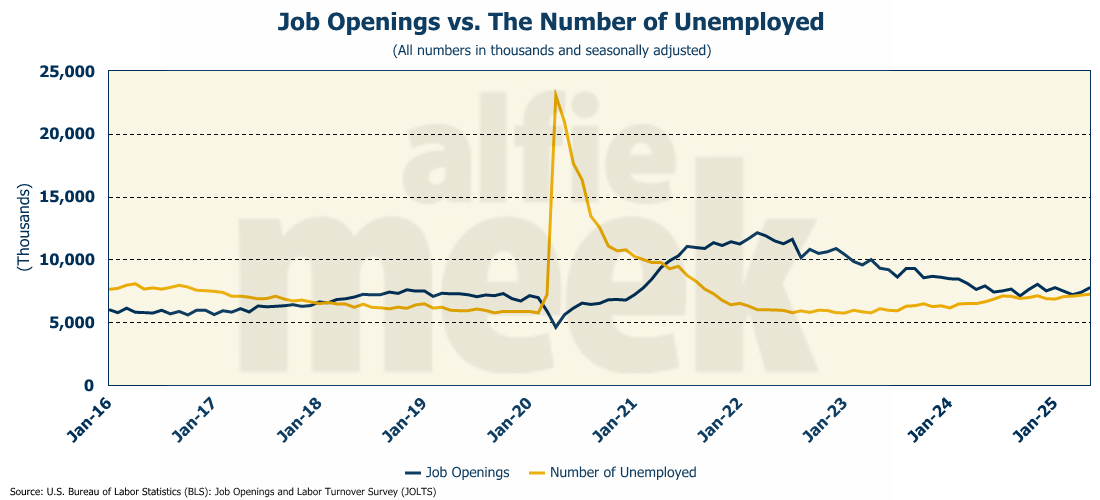

The U.S. labor market is not demand-constrained, as there are 532K more job openings than there are unemployed. A recession has NEVER started in a period when there were more job openings than unemployed workers.

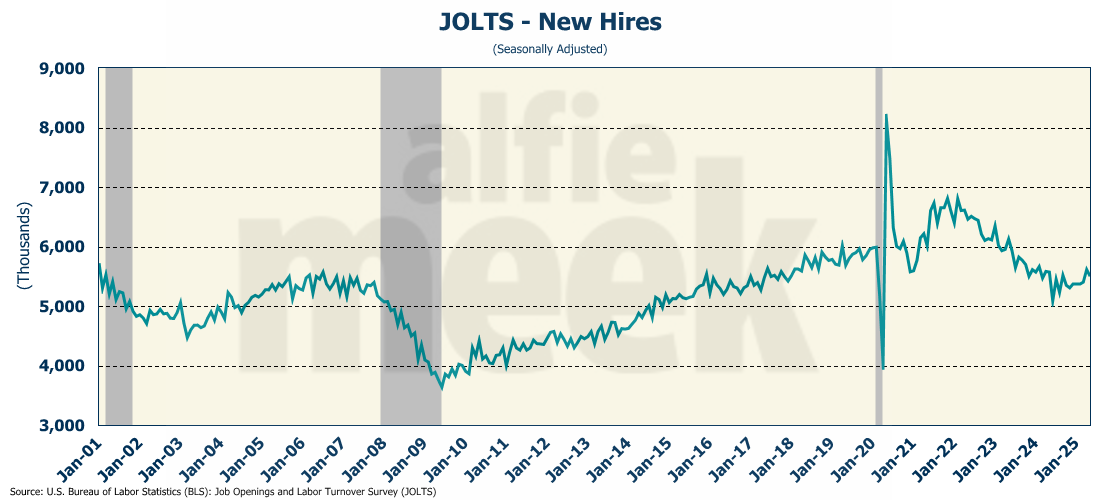

While the number of job openings is welcome news, the number of actual new hires did fall by 112K. Even so, the number of new hires has clearly been on an upward trend since June of last year.

So, will this encouraging JOLTS report lead to a strong June jobs report….

June Employment

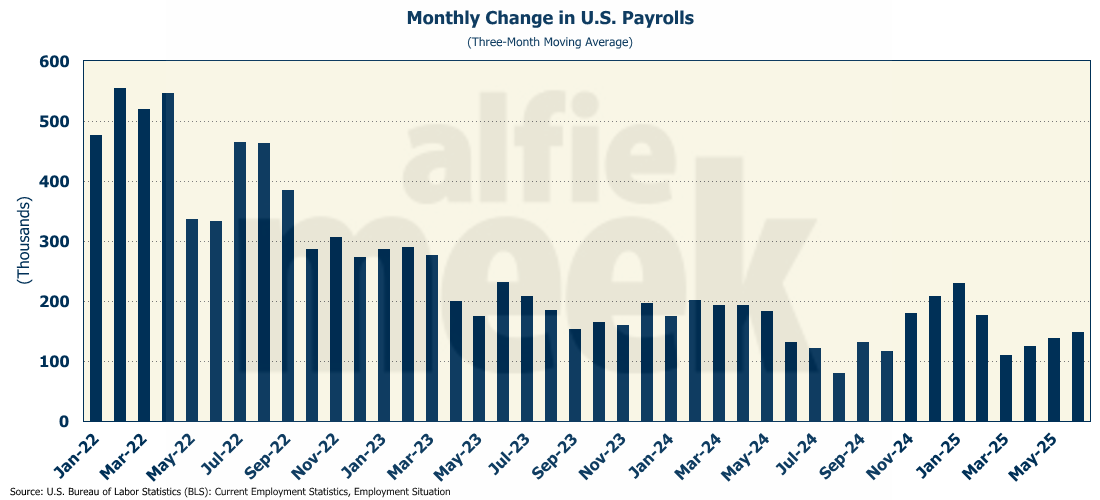

Finally, this week, we got the June employment report. Expectations were for an increase of 106K, with unemployment remaining at 4.3%. The number came in much better with the U.S. economy adding 147K payroll jobs in June, and the unemployment rate falling to 4.1% (full release here). Even more amazing is that both the April and May numbers were revised UP - April by 11K and May by 5K. Once these revisions are incorporated, the three-month moving average is showing a clear upward trend.

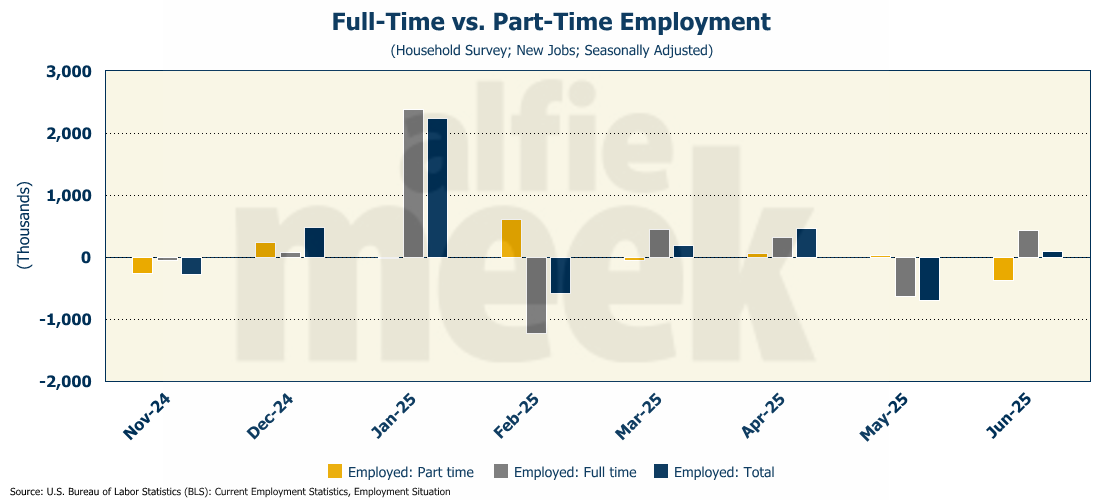

For once, the household survey was consistent with the establishment survey, as household employment also posted an increase. However, unlike the recent past, when household employment growth was entirely driven by part-time employment, in June, full-time employment increased 437K and part-time employment fell 367K. Swapping part-time jobs for full-time jobs is a sign of a healthy labor market.

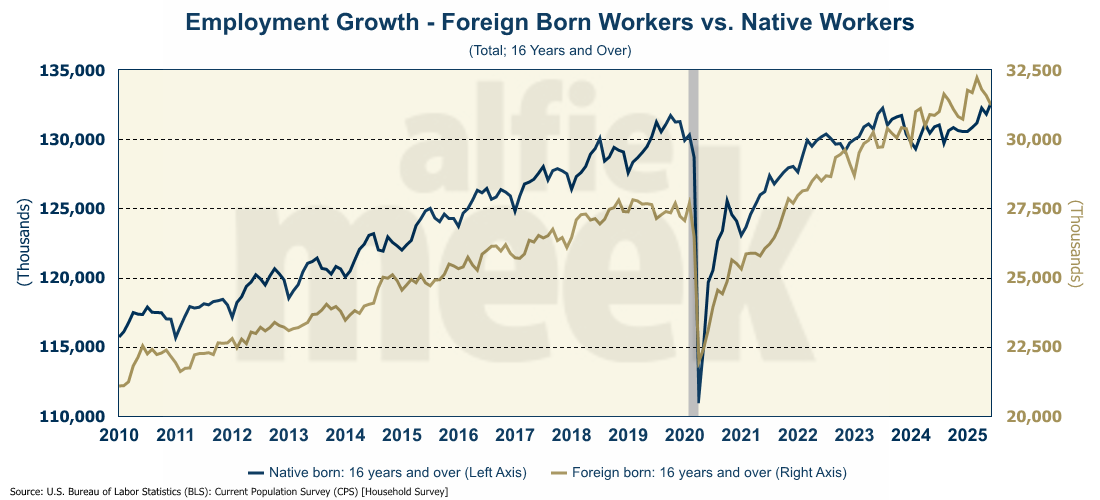

Lastly, the number of native-born workers jumped 830K to an all-time record level of 132.7 million. At the same time, foreign-born workers dropped 348K to only 31.2 million, the lowest level so far this year.

In short, this was a very strong report. Unfortunately for the administration, it was too strong - there is absolutely no chance of an interest rate cut in the foreseeable future.

One More Thing…

As usual, in the first post of the month, I recognize my gold and silver members. Special thanks to my two “gold” level members, Andrew Hajduk and Beth Truelove, with the White County Chamber. In addition, I would like to thank my “silver” level members, Dan McRae, Chuck Fitch, and Greg Whitlock. The regular support of these members helps offset the cost of maintaining access to the data providers that allow me to produce this update each week. If you are a regular reader and find this useful, I would ask that you please consider a membership. Just click/scan the QR code below to join or even just “buy a coffee!”

I will be taking a much-needed summer vacation next week. As is often the case, I may or may not publish an update while on vacation….it just depends on how good the weather is at the beach! So, if you don’t see an update next Friday, you will know why.