Weekly Economic Update 07-11-25: The Big Beautiful Bill; Consumer Credit; and Small Business Optimism

Consumers take on less revolving debt, and small businesses aren't expecting inflation.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I have enjoyed my week of vacation and, lucky for me, not much data was released this week - only consumer credit and the small business optimism index. I will get to both of those, but before I do…

Last Thursday, as I was wrapping up my work and getting ready to head out for my beach vacation, the U.S. House of Representatives passed President Trump’s signature legislation - the “Big, Beautiful Bill.”

The legislation does some very good things. It also does some very bad things. Of course, your definition of “good” or “bad” is highly related to the side of the aisle on which you reside.

If you have been reading this weekly update for any period of time, you know that I am concerned about the federal debt. In fact, it is my #1 concern. Nothing else really matters. If the country goes bankrupt, you don’t have a country. If the government defaults on the debt, the economy collapses. At that point, everything else is rather trivial.

The “Big, Beautiful Bill” increases the debt limit by $5 trillion. Under the most generous of economic growth assumptions, the federal debt still increases by trillions of dollars, with the government running annual deficits for years. Deficits that are measured in trillions. That’s TRILLIONS, with a “T”!

As I have said many, many times before, we are governed by unserious people. The “House Freedom Caucus” is a group of right-wing, “fiscally conservative” representatives that regularly rail against government debt and wasteful spending. Let’s see how these “fiscal hawks” voted on the Big Beautiful Bill…

Barry Moore (AL-1) - YES

Gary Palmer (AL-6) - YES

Eli Crane (AZ-2) - YES

Andy Biggs (AZ-5) - YES

Paul Gosar (AZ-9) - YES

Lauren Boebert (CO-4) - YES

Greg Steube (FL-17) - YES

Byron Donalds (FL-19) - YES

Andrew Clyde (GA-9) - YES

Mike Collins (GA-10) - YES

Russ Fulcher (ID-1) - YES

Mary Miller (IL-15) - YES

Marlin Stutzman (IN-3) - YES

Clay Higgins (LA-3) - YES

Andy Harris (MD-1) - YES

Eric Burlison (MO-7) - YES

Jim Jordan (OH-4) - YES

Josh Brecheen (OK-2) - YES

Scott Perry (PA-10) - YES

Ralph Norman (SC-5) - YES

Diana Harshbarger (TN-1) - YES

Scott DesJarlais (TN-4) - YES

Andy Ogles (TN-5) - YES

Mark Green (TN-7) - YES

Keith Self (TX-3) - YES

Chip Roy (TX-21) - YES

Brandon Gill (TX-26) - YES

Michael Cloud (TX-27) - YES

Ben Cline (VA-6) - YES

Morgan Griffith (VA-9) - YES

Tom Tiffany (WI-7) - YES

Harriet Hageman (WY-AL) - YES

That’s right. Every single member of the so-called “Freedom Caucus” voted to increase deficit spending and add trillions to the federal debt. Even Chip Roy of Texas, who serves as the policy chair of the caucus and is constantly on Fox News decrying government spending, voted for the bill. Cowards. Feckless, hypocritical, lying cowards, the whole lot of them.

“Fiscal conservative” is no longer a thing. It is a mythical creature, similar to a griffin or a centaur. They don’t exist. You might as well believe in Santa Claus or the Easter Bunny before you expect to find a “fiscal conservative” in Congress.

The reason for this is quite simple. Since WWII, we have deluded ourselves into thinking that, as a country, we were rich enough to provide everything to everyone. Healthcare for everyone over 65? Done. Yes, even Warren Buffett can have government-funded health care. Same with Social Security. What was intended to be a safety net for low-income retirees is now given to everyone, regardless of need. I am certain Bill Gates could make it without his Social Security check, but “he paid into it, so he “deserves” it.” Oh, and while we are at it, let’s not only provide for our own national defense, but let’s provide for the defense of all of Europe, parts of Asia, and wage endless wars in the Middle East. Excluding China and Russia, the U.S. spends more on defense than the next 40 countries COMBINED. We spend 2x what China and Russia spend COMBINED. But just add it to the tab.

You see, each of these buckets of spending has a constituency. Defense spending? The military-industrial complex. Medicare & social security? Aging baby boomers. Medicaid and other social programs? Lower-income citizens. These programs (along with interest on the existing debt) represent over 80% of the federal budget. You can’t solve the debt problem unless you are willing to deal with these programs. The “Big, Beautiful Bill” barely scratched the surface. Despite the apocalyptic cries from the left, the cuts will amount to a rounding error. No one will seriously address the issue, because each of these has a constituency that 1) either vote, 2) donate money, or both.

Unfortunately, there is no constituency for debt reduction. None. So it will lose. Everytime. Don’t believe me? Just ask the “fiscally conservative” members of the “Freedom Caucus.” They obviously don’t fear losing their seats because they added to the $36 trillion federal debt. No one ever loses their seat because they spent too much money. And that is the problem.

Consumer Credit

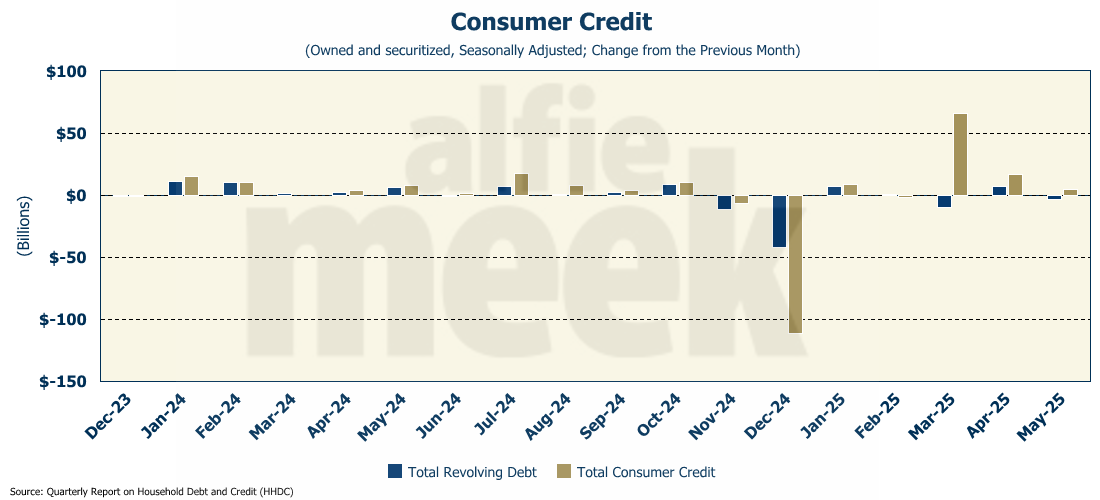

Speaking of spending too much money…the U.S. consumer spends way too much money, as evidenced by the ever-increasing level of consumer debt. Total consumer credit rose another $5.1 billion in May (full release here). However, growth in consumer debt is clearly slowing. The last three months have seen credit grow $66B, $17B, and $5B, respectively.

The growth in May was driven entirely by increases in non-revolving credit (i.e., student debt and car loans) as total credit card debt actually fell by $3.5B. This is the second time in three months that revolving credit has declined. Declines in credit card debt are often an indication of either 1) an impending reversal of economic conditions and/or 2) households that are maxed out on debt and no longer want, or can no longer get, more credit.

Small Business Optimism Index

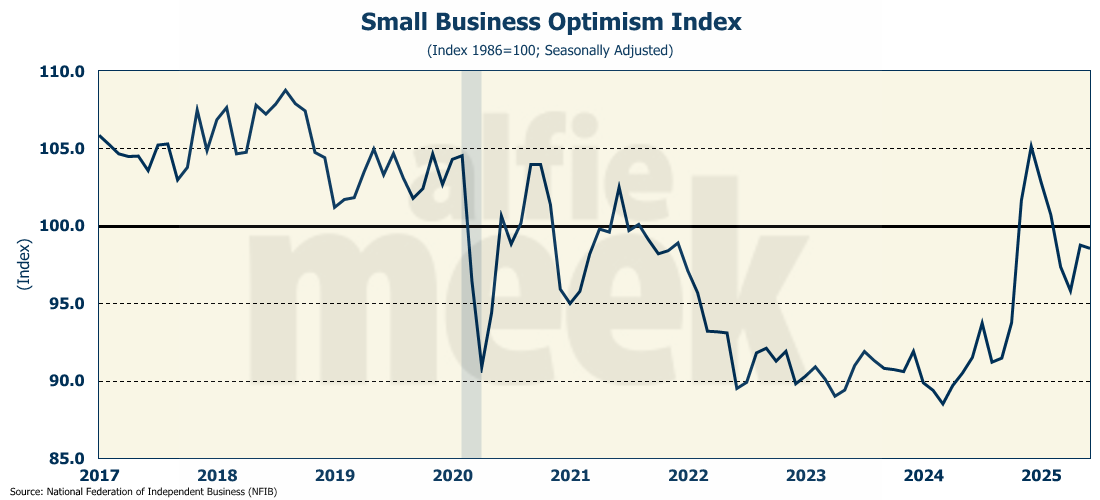

The only other piece of economic data released this week was the Small Business Optimism Index, which fell slightly in June to 98.55 (full release here).

According to the report released by the National Federation of Independent Business (NFIB), both the share of business owners expecting better business conditions and the share of expecting higher real sales volumes fell 3 percentage points in June.

Interestingly, only 11% of business owners said that inflation was their single biggest issue. That is a drop from May, and the lowest reading since September 2021. I guess those nasty tariffs haven’t been harbingers of inflation after all. (Kind of like I have been saying.).

One More Thing…

I failed to mention it last week, but last week’s update was the 100th post for the Economic Update!! When I started, I didn’t think it would get this far, but thanks to all of you, it continues.

Toward that end, this week I want to thank all my “bronze” level members who subscribe for just $8/month. Dave Gmeiner, Colin Martin, Brad Wood, Carlos Alvarez, Steve Goins, Tommy Jennings, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, Leigh-Ann Danley, Charles Frazier, Barry Puckett, Matt Murphy, and someone with a “GTwreck” e-mail! Thanks for all your support!

I also have a few supporters who have chosen the monthly option - Rope Roberts and Sarah Jacobs. Thank you both for your monthly support!

If you find this to be worth a few bucks a month, I invite you to become a member at any level by clicking/scanning the QR code below.