Weekly Economic Update 08-02-24: Case-Shiller Home Prices; Consumer Confidence; ISM Manufacturing Index; Employment; and the Fed Speaks

Sponsored by: Economic Impact Group, LLC.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Another Fed meeting, another announcement holding rates steady. Eighth in a row. No surprise.

All we heard a few weeks ago was that there would be not one, not two, but THREE rate cuts this year! Well, there are only three Fed meetings left in 2024, and only ONE before the Presidential election. The market has priced in a 99% chance of a rate cut in September (yea…I’ve heard that before…..) regardless of the fact that it would come off as an EXTREMELY political move. And despite what Chair Powell said Wednesday, there is no way they don’t consider that in their decision making.

The Fed meeting dominated the economic news this week, but there was some data released to let’s get to it….

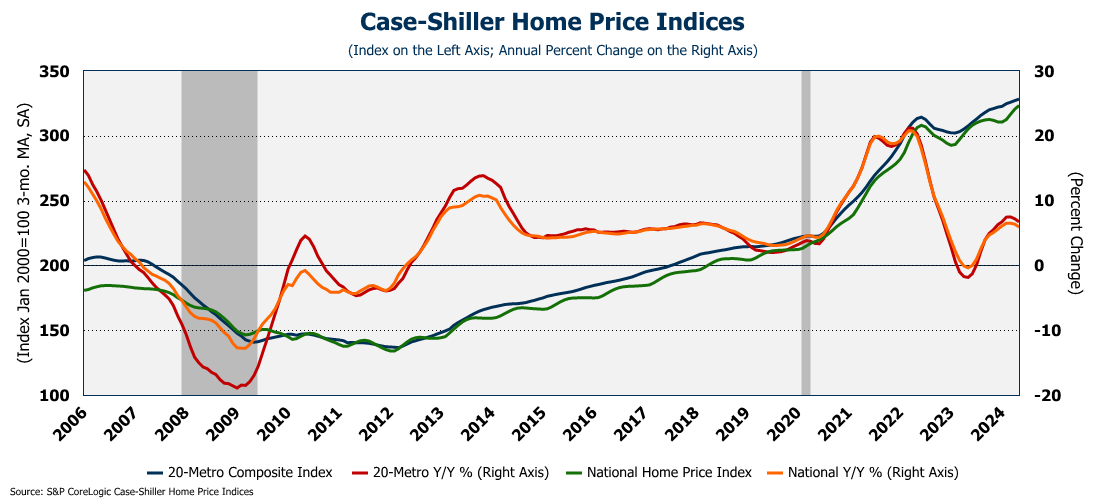

Case-Shiller Home Price Index

The price of homes in the 20 largest metro areas rose for the 15th straight month in May (data from Case-Shiller's lags by 2+ months) rising 0.3% month-over-month and 6.8% year-over-year! (Full release here) Prices in the Atlanta market (where many of my readers are located) are up 5.7% on a annual basis. Overall, prices are up 5.9% nationally. So, explain to me again why the Fed is going to cut rates while home prices are rising at 6%?

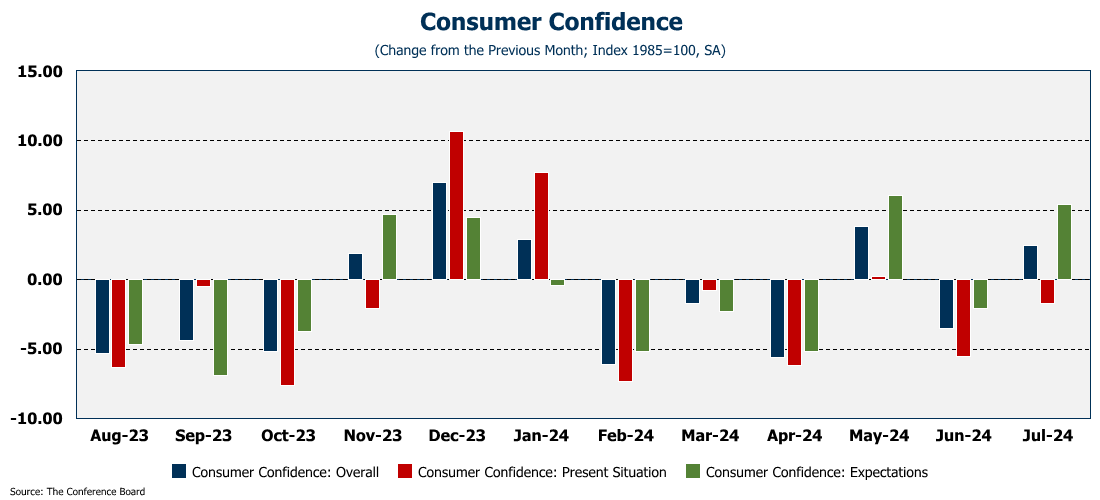

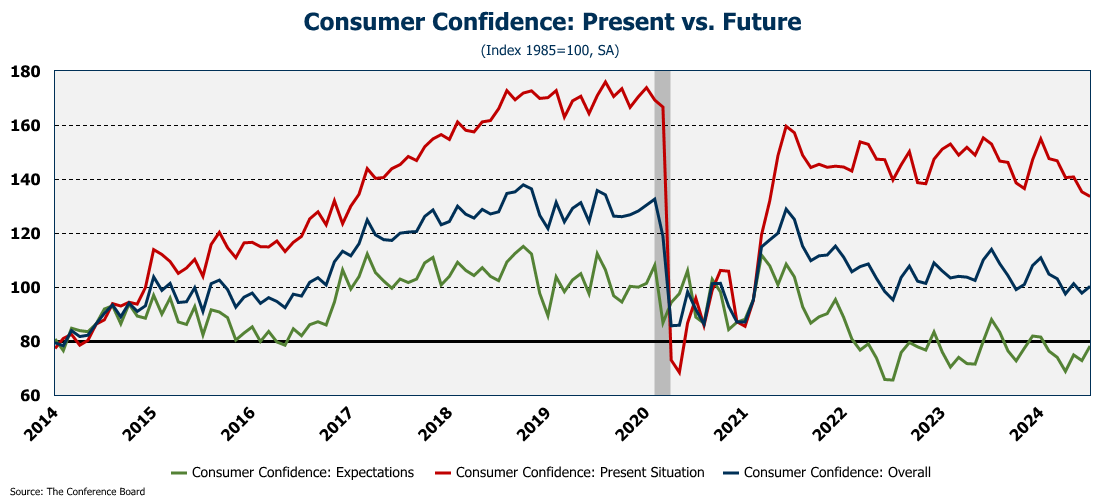

Consumer Confidence

Overall consumer confidence rose 2.5% in July to 100.3 (full release here). Or did it……

Turns out that, for the eighth month out of the last nine, the Conference Board revised the previous month’s confidence reading DOWN. In the case of June, the downward revision was significant, moving the initial reading of 100.4 down to 97.8. That is a 2.6 point revision! Moving the number from 100.4 to 97.8 allowed the July reading of 100.3 to be an “increase.” You know, if the do this every month, we can always have a consumer confidence reading moving in a positive direction.

Even with their revisions, confidence in the present situation still dropped 1.7% and is sitting at the lowest level since April 2021.

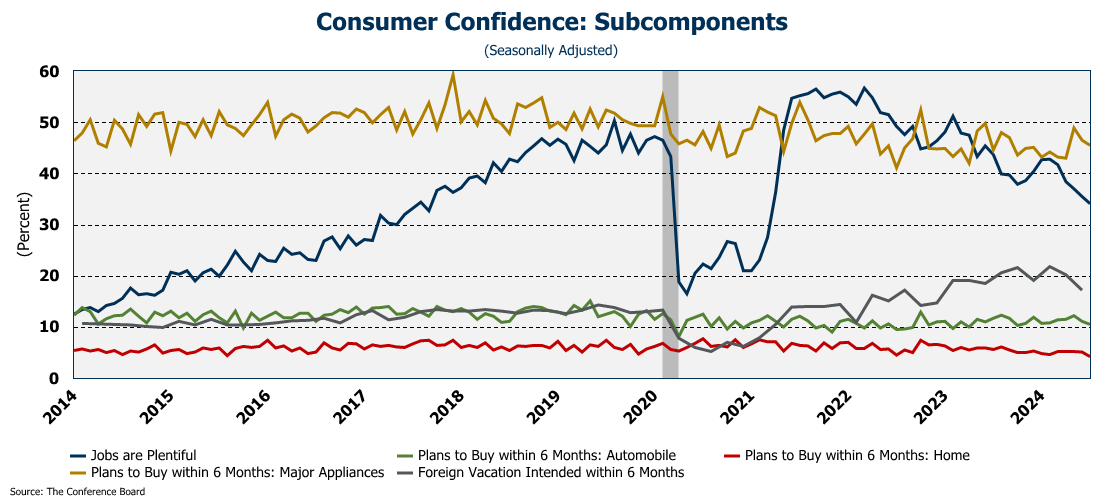

The only thing holding the overall index up was consumers’ confidence about the future. Really? Consumers are confident about the future? Let’s dig into the data. Plans to buy a major appliance in the next 6 months? Down 1 point. Plans to buy a car in the next 6 months? Down 0.6 points. Plans to buy a house in the next 6 months? Down 0.9 points. Plans to take a foreign vacation in the next 6 months? Down 3 points. And finally, those who say “jobs are plentiful”? Down 1.4 points. But yet, consumer confidence in the future rose 5.4% Go figure.

I am always intrigued by revisions to consumer confidence? How does that happen? Do people come back and say, “No wait! Come to think of it, I was much less confident last month than I thought?” Want to bet that next month we get a downward revision in the future confidence numbers?

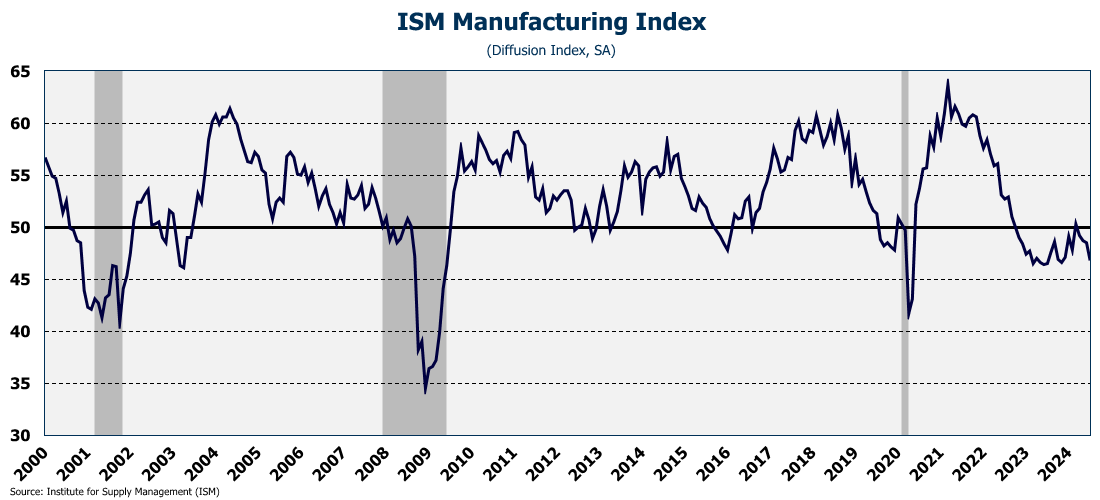

ISM Manufacturing Index

The decline in the manufacturing sector continues as the ISM manufacturing index plunged to 46.8 (full release here). That was much weaker than the 48.8 that was expected, and is the lowest the index has been since last November. Remember, this is a “diffusion index” which means that any reading below 50 indicates the sector is contracting. With the exception of one month, the index has been below 50 since late 2022. In June of 2023 the index got as low as 46.4, which, with the exception of the COVID shut downs, is the lowest it had been since the Great Recession. We are very close to re-visiting those lows.

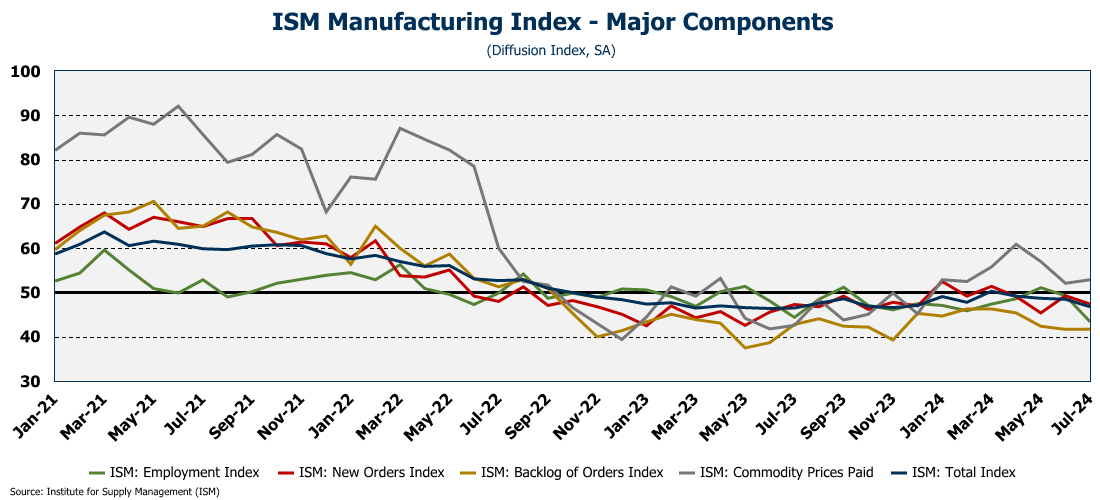

If we dig deeper and look at the components, nearly everything fell. The Employment Index tanked, dropping to 43.4, the lowest it has been since the COVID shut down. The New Orders Index tumbled to 47.4, and the Backlog of Orders Index was flat at 41.7.

Oh, wait….there was one sub component that didn’t fall. The Commodity Prices Paid Index rose for the month July. Great. Employment is down and prices are up. What was it the Fed was saying about inflation on Wednesday?

The market sold off significantly on Thursday after the ISM report was released. As I have said before…if the Fed cuts rates this year, it won’t be because they have beaten inflation…it will be because they are trying to avoid a recession. The manufacturing sector has been in one for nearly two years. Hiring has slowed, production has stalled, and purchasing activity has slowed as companies have expressed concern about future sales. That doesn’t bode well for the country’s economic outlook.

Employment

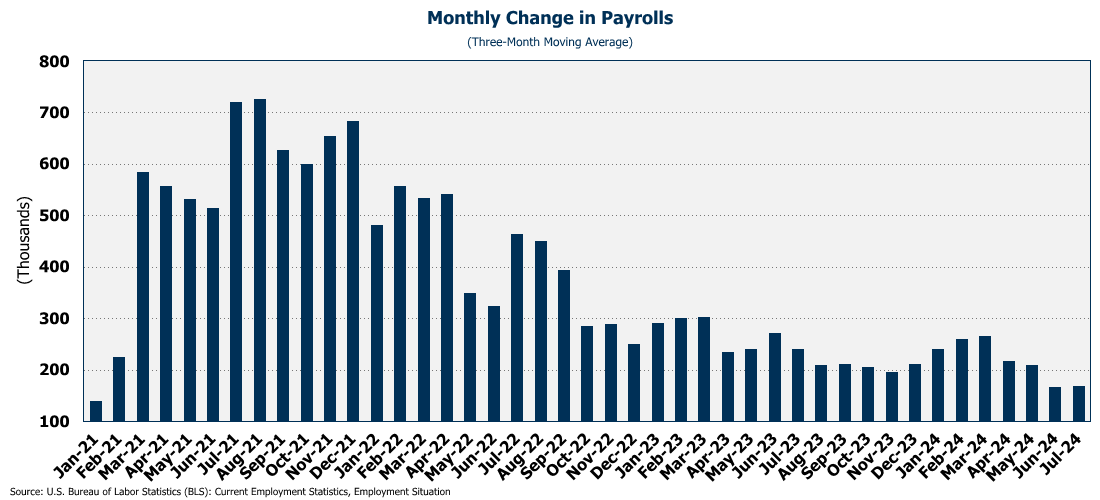

Speaking of the country’s economic outlook, this morning we got the employment numbers for July. And they were no good. Economists were expecting 175K new jobs and for the unemployment rate to remain steady at 4.1% However, the number came in at only 114K and the unemployment rate exploded to 4.3%. That may not seem like a big jump, but for the unemployment rate, 0.2 points is a HUGE move. And, in a surprise to no one, the June number was revised DOWN from the initial report of 206K jobs to 179K jobs…a 13% drop. As I have said before, this is why I used a 3-month moving average and you can see from the chart below that employment growth is clearly decelerating.

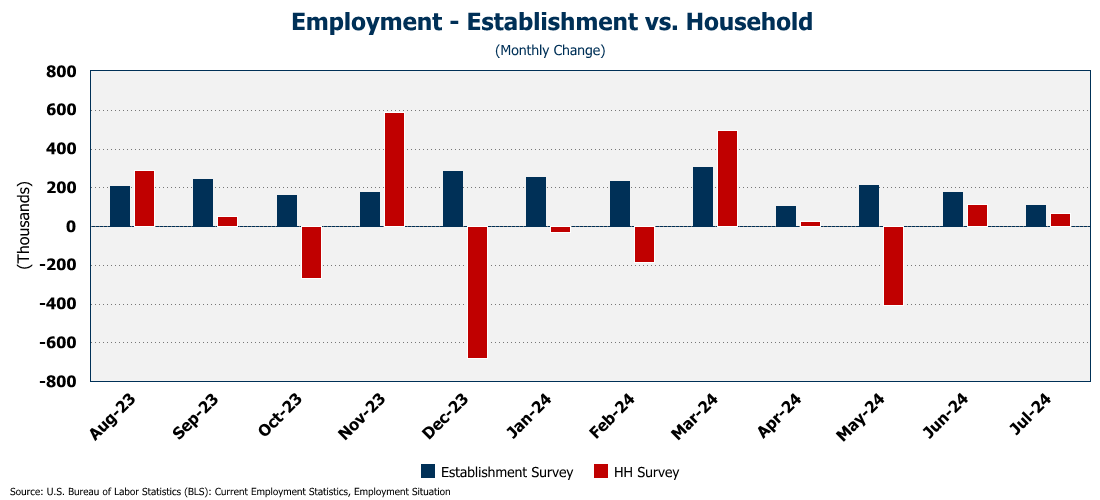

According to the household survey, employment was up only 67K. However, for the second consecutive month, both the establishment and household surveys moved in the same direction!

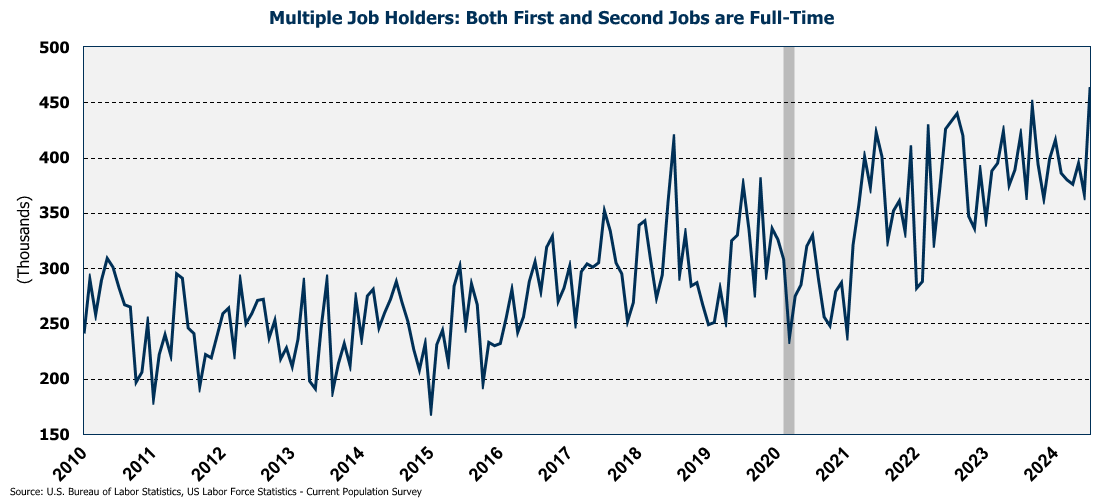

The larger problem, however, continues to be that people need multiple jobs to make ends meet, and showing up on multiple payrolls inflates the establishment survey which then makes the economy look better than it is. Digging into the data, we see that the number of people with TWO FULL TIME JOBS rose to an all-time high of 464K!

I have to admit that this employment report is making me, for the first time, re-think my position on a rate cut this year. However, as I said above, if they cut, it won’t be because inflation is gone, it will be to avoid a recession. The problem is, it will trigger more inflation. The Fed is between a rock and hard place. And the government’s irrational spending spree over the past 4 years has put them there. And now we all get to pay the price.

Final Thoughts

It is a short update this week as there really wasn’t a lot of new data released. Next week looks a little light as well with only ISM Services and Consumer Credit being released. Maybe I can find something interesting to discuss. However, the Fed presidents will start their speaking tours and they usually provide us with a few good laughs.

Later this month the Weekly Economic Update will celebrate its one-year anniversary! Thanks again to all those who read regularly and share it with others. And a special “thank you” to those who have already pledged to become a subscriber when paid subscriptions go live in October! The comments people have been leaving are very encouraging! And, to anyone who wants to support this work now, feel free to visit my new site at “buy me a coffee!”

Until next week….