Weekly Economic Update 08-08-25: ISM Manufacturing & Services; Factory Orders; and Consumer Credit

The Commissioner of the Bureau of Labor Statistics was fired...good riddance.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

The update on the first Friday of each month is always tough because the monthly employment data comes out at 8:30 am and I try to publish by 9:30 am, which gives me little time for comprehensive analysis. However, even with that short time, I was able to comment on last Friday’s dramatic downward data revision, which sent a shockwave through the media for most of last weekend, and resulted in the firing of the Commissioner of the Bureau of Labor Statistics, Erika McEntarfer.

To listen to the media last weekend, and much of this week, you would think that the firing of Ms. McEntarfer is the final nail in the coffin of our democracy. Just a small sample of the headlines that ran earlier this week…

But my absolute favorite headline ran in the N.Y. Times…..

I love the sub-heading - “Economists say unbiased data is essential for policymaking.” That’s true. You know what else is “essential for policymaking”? Timely and accurate data, neither of which has been coming from the Bureau of Labor Statistics (BLS) for more than three years.

Others and I mercilessly criticized the BLS during the Biden Administration for the huge downward revisions that occurred every month under the prior administration. Reporting good numbers one month, only to revise them down significantly over the next two months, when no one was paying attention. Frankly, at the time, it looked political. Now it appears to be just gross incompetence.

Understand, the revisions to the employment data last Friday were the largest revisions in my lifetime. More than 90% of the initially reported jobs didn’t exist. Combined with the revisions over the past three years, it is clear that something at BLS is broken. I have spent a career building statistical forecast and prediction models. If my models produced 90% errors, I would have adjusted them, or I would have been fired. Ms. McEntarfer didn’t make adjustments….so she was fired.

I realize that Ms. McEntarfer wasn’t the one doing the actual data collection and analysis. But she was in charge. She had the authority to suggest to the statisticians in her charge that perhaps they need to revisit the methodology they have been using since the 1950s to produce employment data estimates. COVID fundamentally changed the way we work. The shift to hybrid and remote work, the gig economy, the emergence of AI, workers changing jobs much more frequently, and/or taking multiple part-time jobs are all new realities of the labor market that the BLS needs to incorporate into its statistical models. It is painfully clear that they haven’t done so.

Without good data, how can policymakers make good decisions? It is very possible that if the previous two months' employment data had been correctly reported, the Fed would have cut rates last week. Reported data has consequences.

The headlines above suggest that the firing of Ms. McEntarfer will somehow erode trust in future economic data. I don’t see how…among those who actually use it, trust in economic data, especially from the BLS, was already at an all-time low, and I doubt it is going to be further damaged by the firing of the BLS commissioner. If future data releases are consistent with industry surveys, have less dramatic revisions, and what revisions there are happen to be both positive and negative, I suspect that trust in the data will actually improve.

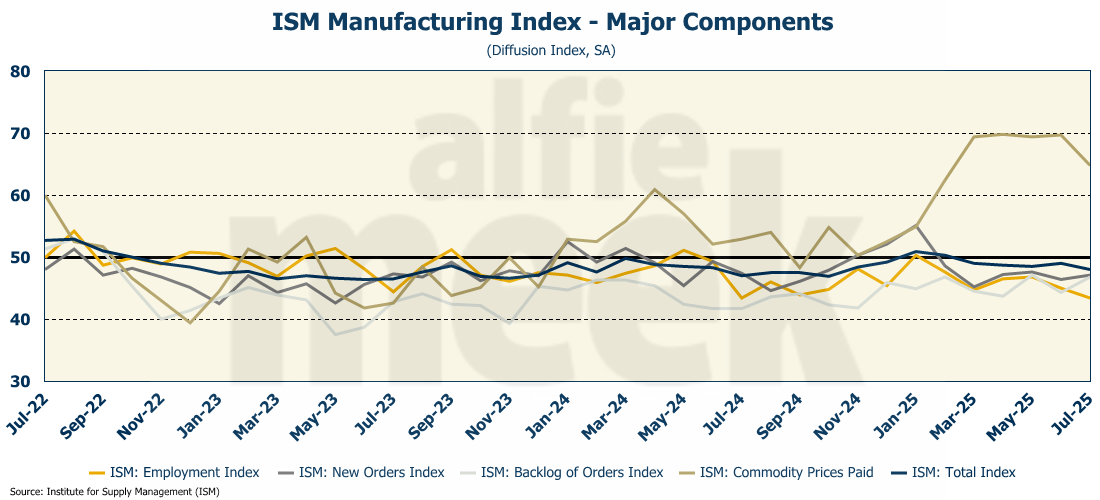

ISM Manufacturing Index

Manufacturing continues to struggle as evidenced by the latest data from the ISM manufacturing survey (full release here). The index fell from 49.0 to 48.0 in July, the lowest it has been since October 2024. The index remains below 50, an indication that the industry is contracting. With a few very brief exceptions, the index has been below 50 since late 2022.

Looking at the components, every indicator (except prices) is below 50. The employment index fell to 43.4 - the lowest it has been since COVID. The input price index fell slightly, as fears of inflation due to tariffs are falling.

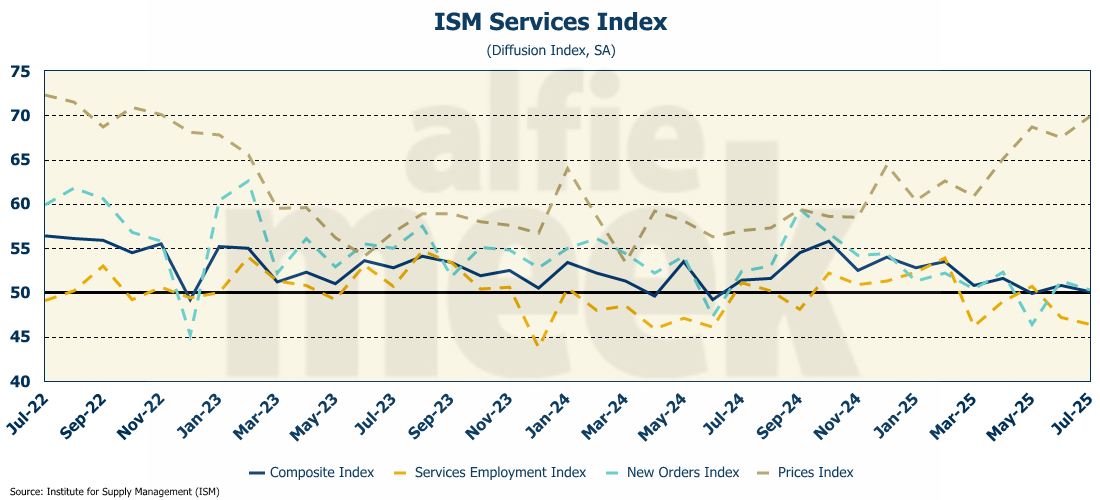

ISM Services Index

The services index fell in July to 50.1, keeping it just barely in “expansion” territory (full release here). That is the lowest the index has fallen since June 2024. The employment sub-index dropped to 46.4, falling for the fourth time in five months. Like the manufacturing index, this is one of the lowest employment readings since COVID.

Unlike the case with the manufacturing index, the prices-paid index rose in July to 69.9, the highest it has been since late 2022, when overall inflation was running at 9%. At some point, these price pressures are going to work their way out to consumers. Given that services represent a significant portion of personal consumption, when that happens, spending will slow as incomes are simply not keeping up with inflation, and the consumer is tapped out on debt. (More on that below.)

Factory Orders

Factory orders fell in June, dropping 4.8% (full release here). The drop was expected given that orders in May were largely the result of tariff-front-running. In fact, the 8.3% jump in May was the second largest monthly increase in 69 years! There was little doubt that orders would fall back in June. However, core orders (orders less transportation) rose for the second month in a row.

Consumer Credit

Finally, this week, we got data on consumer debt (full release here). Total consumer credit rose $7.4 billion in June. However, for the second consecutive month, total revolving credit fell slightly, falling $1.1 billion in June after a $3.8 billion drop in May. One is left to consider that perhaps consumers are beginning to reach the comfortable limits of their revolving debt.

For the entire second quarter, total household debt rose by $185 billion, a 1% increase from the first quarter. Total household debt now stands at $18.39 trillion and has increased by $4.24 trillion since the end of 2019, just before COVID. Nearly $13 trillion of that is mortgage debt, but the remaining $5.5 trillion is a combination of home equity lines of credit, auto loans, student loans, credit cards, and other consumer debt.

This huge increase in debt over the past 5 years really isn’t a surprise. What previously passed for “middle-class” life in America is now largely unaffordable for most people, and to make ends meet, consumers are piling on more and more debt. In addition to the usual credit card, “buy now, pay later” financing schemes are becoming more and more popular. Back in March, DoorDash announced a partnership with Klarna to allow customers to pay for their delivered meals over time. Now Costco is getting into the game….

Costco is now offering a buy-now, pay-later option for online shoppers through a new multi-year partnership with Affirm.

The installment plans will allow customers to select the payment option at checkout for purchases ranging from $500 to $17,500.

Customers will be checked for eligibility in real time and can choose a monthly payment plan that fits their budget.

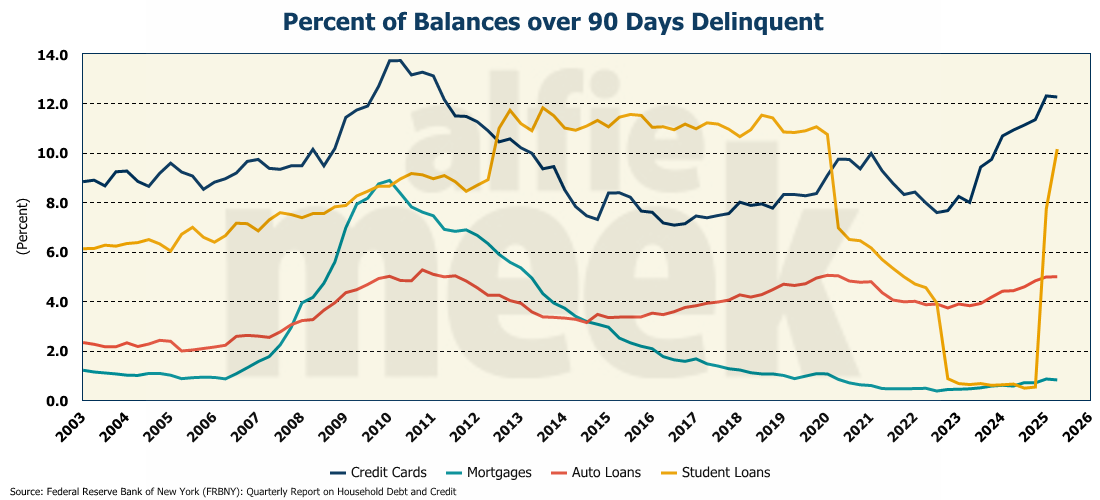

With incomes lagging, delinquency rates on that debt have been rising, and the share of balances that are “seriously” delinquent (>90 days) is rising as well. However, the big shock in the second quarter data was the delinquency rate for student loans. The end of the repayment moratorium and the resumption of reporting of delinquent student loans on credit reports has led to a huge jump in delinquencies, with more than 10% of all student loan debt more than 90 days past due. That represents $165 billion. And Fed officials expect seriously delinquent balances to keep rising to at least pre-pandemic levels in the 11%-12% range.

Looking at the data by age is even more disturbing. Among those student loans that are seriously delinquent, the highest rate of delinquency is for those over 50! Who still has student loans over 50?!? Doctors? Lawyers? I don’t know, but delinquency rates for that group, as well as those between 40-49, are already above pre-pandemic levels. There is no doubt that the repayment of these loans will have a deleterious effect on consumer spending.

One More Thing…

Finally, this week, I want to thank all my “bronze” level members who subscribe for just $8/month. Dave Gmeiner, Colin Martin, Brad Wood, Carlos Alvarez, Steve Goins, Tommy Jennings, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, Leigh-Ann Danley, Charles Frazier, Barry Puckett, Matt Murphy, Penn McClatchey, Thomas Smith, and someone with a “GTwreck” e-mail! Thanks for all your support!

When Thomas Smith signed up last month, he said, “Bronze Level is the best deal in Atlanta (or maybe Georgia and beyond!). Alfie's weekly letter is concise and readable. Who knew economic analysis is fun!” Thanks for the kind words, Thomas! Glad you enjoy it!

I also have a couple of supporters who have chosen the monthly option - Rope Roberts and Sarah Jacobs. Thank you both for your monthly support!

As I do each week, I want to invite you to join this group and click/scan the QR code below to join or just “buy some coffee” in support of this weekly update.