Weekly Economic Update 08-09-24: Employment Report Re-Visited; ISM Services; Consumer Credit; and the Market was "Unburdened By What Has Been"

Sponsored by: LOCI Fiscal Impact Model

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

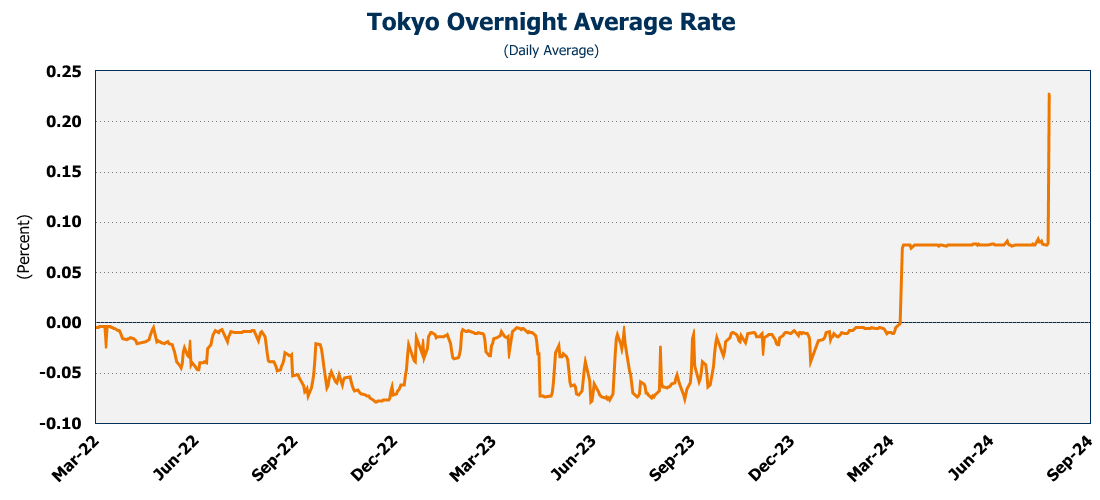

Well wasn’t this an exciting week! It looks like global markets are becoming “unburdened by what has been” - namely cheap money and the leveraged carry trade that has bid assets of all types (stocks, bonds, gold, crypto, etc.) to phenomenal highs. The Bank of Japan raising interest rates last week caused a global unwinding of the carry trade that has been going on for years. For those who may not be familiar with the term “carry trade” let me briefly explain.

For years, Japan has had NEGATIVE interest rates. So, investors could borrow Yen at low to negative rates, convert them to dollars, and purchase stocks (or other investments) with higher returns. Easy money.

However, the Bank of Japan raised rates by 200% last week. As a result, the Yen has strengthened significantly against the dollar. Yen yield goes up, dollar yield goes down. At the same time, the Yen/USD conversion rate goes down. Suddenly, those investors have to pay much higher interest rates on the Yen that they borrowed, plus are facing losses in their foreign exchange accounts. As such, they are unwinding their stock holdings (in the U.S. and elsewhere) to repay the Yen they borrowed.

But this, of course, makes the situation worse, because many of those same investors bought stocks on margin - i.e., they borrowed money to purchase stocks. As the prices fall, they are receiving “margin calls” to pay back those loans. For many, the only way to do that is to sell even more of their position, driving prices down further.

Add to that the weak macro economic data we have been getting over the last few weeks, including the employment report last Friday, and you get a market that is selling off like a blue-light special at K-mart. (Now that is a blast from the past for you old timers!)

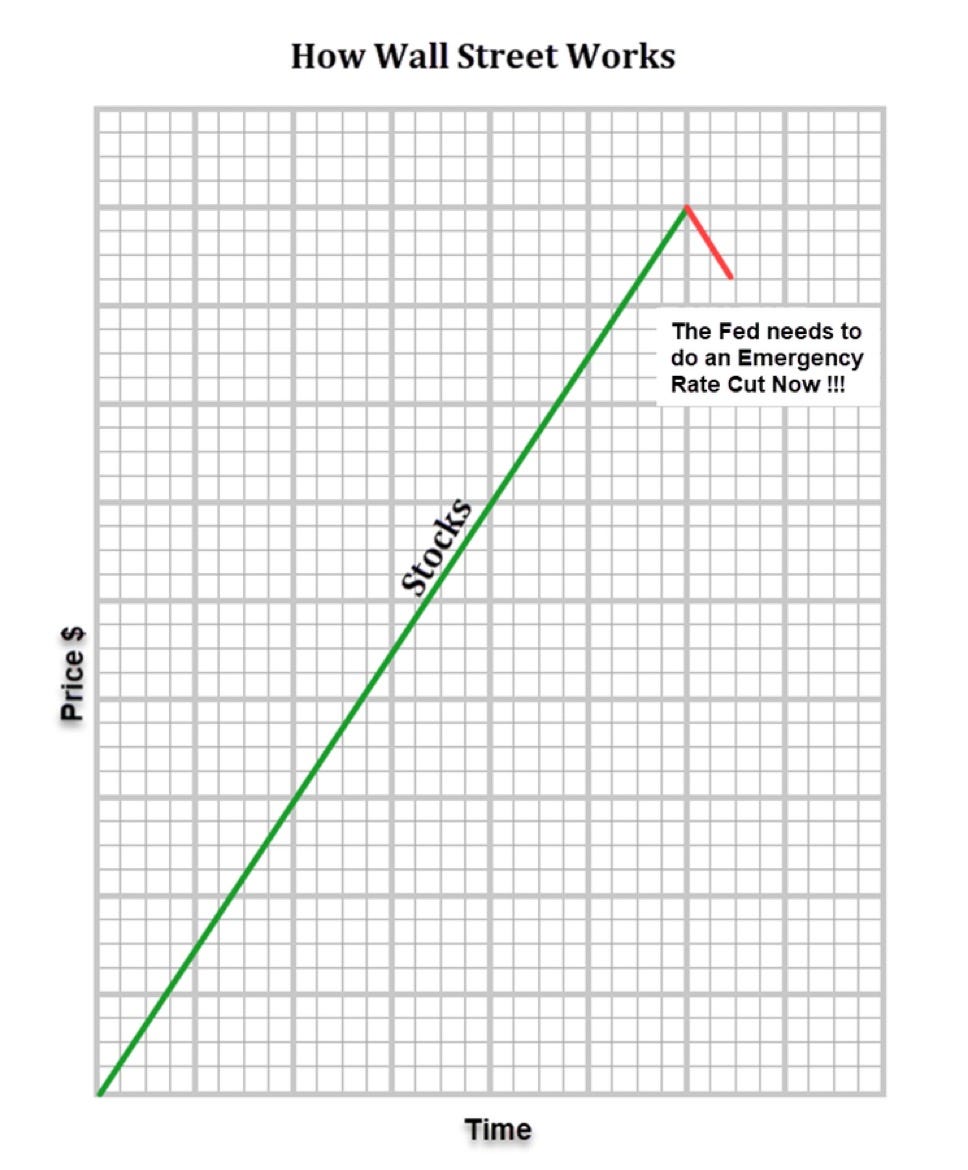

And while the Yen carry trade is huge, it isn’t the largest carry trade in the market. (You can guess what is.) All week long we heard people screaming for an emergency rate cut of at least 50 basis points. Just so I am clear, even with the events of this week, the market is up more than 10% since January 1; home prices are currently rising 6% on an annual basis; service inflation is running 4%; and although slowing, the economy added 144K jobs last month. And people want an emergency rate cut?!? Talk about a market that is addicted to free money. Apparently, this is how the market works now:

And it isn’t just the U.S. market. After the global panic Monday, Japan recanted their talk of future rate increases. I guess 0.25% is high enough for a country with a debt-to-GDP ratio of 263%! And with that capitulation, the Yen is toast and will now be heading to all-time lows, providing the only real way to deal with a 263% debt ratio other than simple default.

As for the U.S., I have come to the painful conclusion that the Fed will cut rates this year. Despite the market pricing in a 100% chance of a cut in September, I question if they will do it then because it will be seen as overtly political. And despite what Chair Powell says, they have got to understand how it will look. Such a move would erode what little credibility they have left. However, they meet in November, the day after the election, and by that time, if they haven’t raised rates, the barbarians on Wall Street will be at their door with pitchforks and torches. It will be a mistake and will undoubtedly be inflationary. But they will simply have no choice. The economy is slowing and the nation is more addicted to free money than J. Willington Wimpy is to hamburgers. (Another reference for you old timers.)

Employment Report (Re-Visited)

Speaking of that employment report, because of my personal schedule Friday, I wasn’t able to dig as deeply into that report as I would have liked, so I want to go back and discuss some of what we learned.

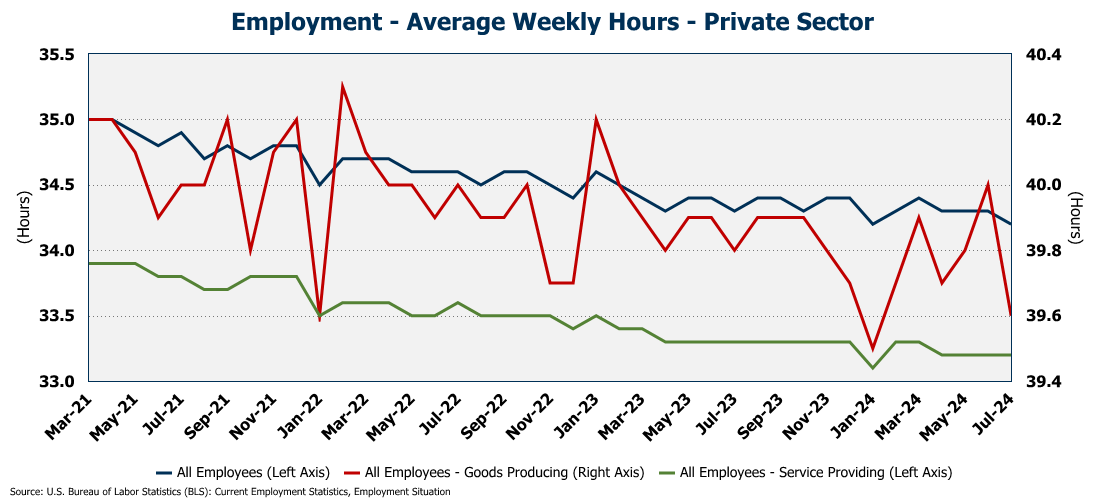

First, of note, is the fact that the average weekly hours worked by private sector employees continue to fall, and are now at their lowest level since COVID at 34.2 hours per week. The manufacturing sector is also trending down and came in at 39.6 hours in July.

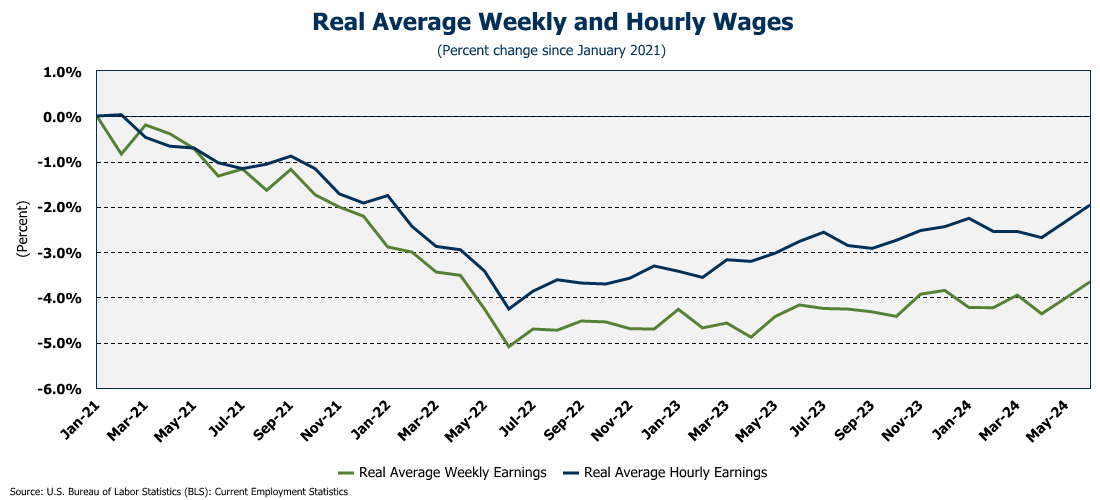

Next, average hourly earnings were up slightly in July. However, what really matters isn’t your hourly wage, but how much you took home at the end of the week. And if your working hours are down by a larger amount than your hourly wages rose, then your total earnings are falling. And that is exactly what happened in July. Further, taking inflation into account, REAL average weekly wages were down 3.6% since January 2021 through last June. We don’t have the July CPI yet (that comes out next week) but with nominal average weekly wage falling, inflation adjusted wages are bound to drop as well.

Consumer Credit

So, if the consumer has less income, they either have to stop spending, or borrow. Until recently, it appeared as if the U.S. consumer couldn’t grasp the concept of less spending, so debt increased at alarming rates. I previously referenced J. Willington Wimpy whose most famous line was “I will gladly pay you Tuesday for a hamburger today.” What a perfect word picture of the U.S. consumer.

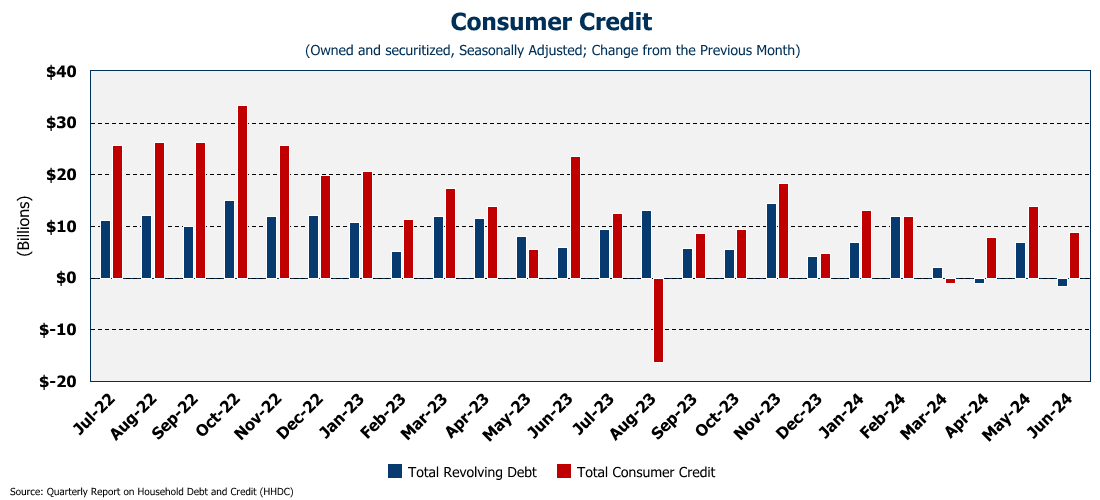

However, the data we got this week points to a slowing consumer (full release here). Overall, consumer credit rose $8.9 billion in June. While that may seem like a lot, it was significantly less than the experts were expecting, and the bulk of that was an increase in student loan debt. On an annual basis, total consumer credit is up 1.9% over the last 12 months. On the other hand, revolving credit (credit cards, etc.) actually FELL $1.7 billion in June - the second decline in the last three months. That hasn’t happened since the dark days of the pandemic.

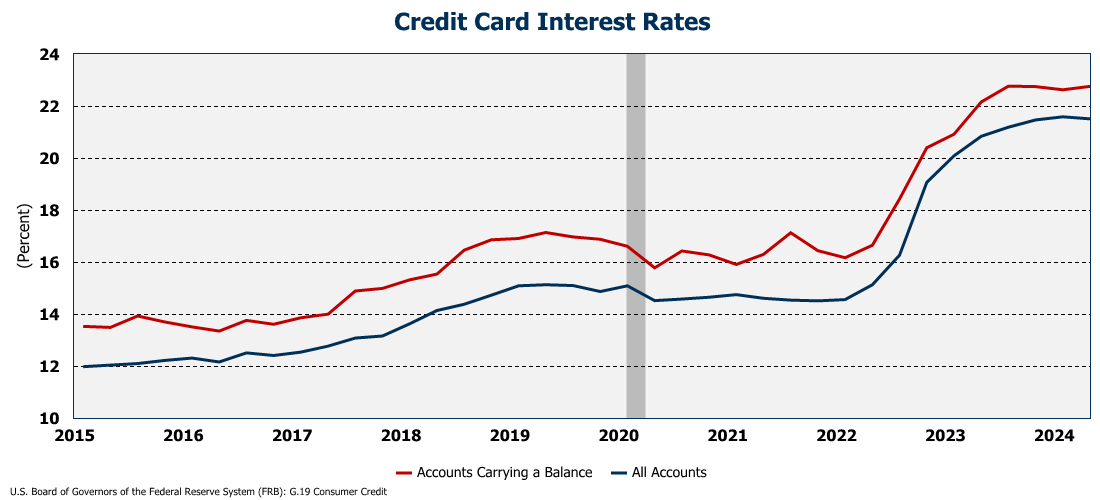

This type of movement in the use of revolving credit is indicative of households feeling financial stress and is usually only seen when the economy is heading toward a recession. To put it in perspective, in the six years before COVID, there were only 5 months in which revolving credit was negative, and most of those were around the holiday season when credit usage can swing wildly month to month. In the regular course of business, it just doesn’t happen that often. With credit card rates on balances hitting a record high of 22.76%, consumers may finally be tapped out.

And what happens then? The problem with Wimpy’s promise to “pay you Tuesday for a hamburger today” is that when Tuesday came, he never paid. Over the next couple of weeks we will get data on charge off rates and credit delinquencies for the second quarter and I suspect that we will see both are on the rise.

ISM Services

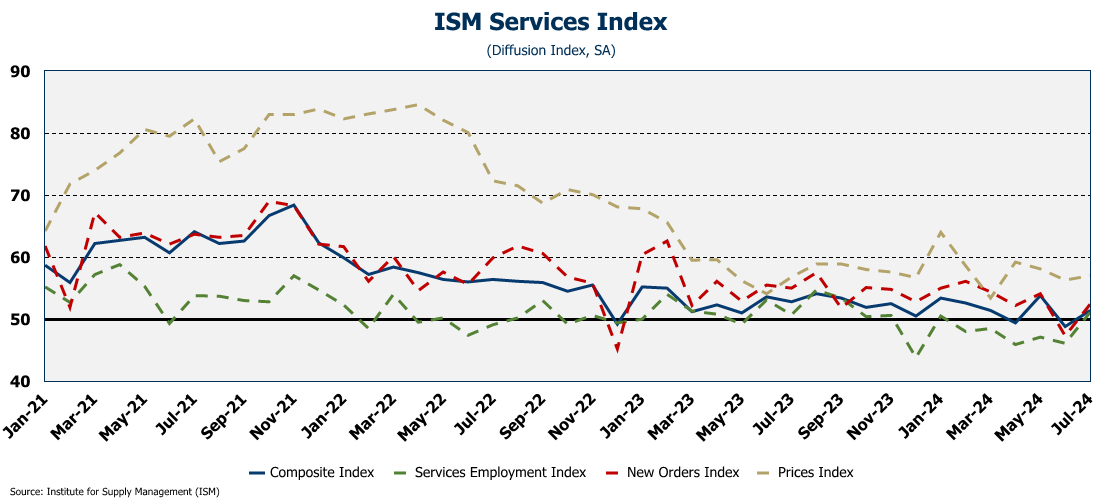

After the very weak ISM manufacturing survey that came out last week, and the stunning decline in the major indices on Monday, we got a small bit of good news Monday morning when the ISM Services index for July was released (full release here). The composite index rose to 51.4 from 48.8 the previous month. Like the ISM Manufacturing index, this is a “diffusion index” which means a reading above 50 indicates an expansion in the sector. With only three separate one-month exceptions, the index has been above 50 since the COVID shutdown.

A look at the sub-indices shows that everything moved up in July. New orders were up, and surprisingly, despite last week’s jobs report, so was the employment index. According to the ISM survey, employment in the services sector had been in decline since January, but actually moved into expansion territory in July. Unfortunately, the prices index also moved up, with the prices index moving sharply up from 56.3 to 57.0. Survey respondents reported higher wages and transportation costs driving up their costs. Again, that doesn’t bode well for future inflation.

Final Thoughts

First off, I want to give a shout out, and a “thank you” to Colin Martin who “bought me a coffee” last week! Thanks for your support of the Weekly Economic Update!

As a reminder, the full Weekly Economic Update will be behind a paywall starting sometime in October. Free subscribers will only get the initial snippets of the post. I hope you will consider a paid subscription.

Next week will be a big week for economic data with both PPI and CPI giving us an update on inflation; retail sales giving us an update on the consumer; and housing starts and building permits giving us an update on the housing market. Should be an interesting week.