Weekly Economic Update 08-15-25: Retail Sales; Consumer Price Index; Producer Price Index; and Small Business Optimism

Government spending is back with a vengeance. And so is inflation.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Just when you thought things might be changing in Washington D.C., it turns out that in fact, everything remains the same.

In June, the U.S. posted a monthly budget SURPLUS of $27 billion. Monthly surpluses aren’t completely unheard of. In fact, we usually have one every April when income taxes are due. The Biden administration had six non-April monthly budget surpluses. However, this is the first surplus in the month of June in nine years. Even more interesting is the fact that the $27 billion surplus in June was, by amazing coincidence, the exact amount of revenue brought in that month from “customs duties” (which largely include tariffs). In fact, since the beginning of the year, through June, the U.S. brought in $108 billion in tariff revenue. Between DOGE-related cuts and enhanced revenue, some dared to dream that this unexpected June surplus could be a sign that fiscal responsibility may have returned to Washington.

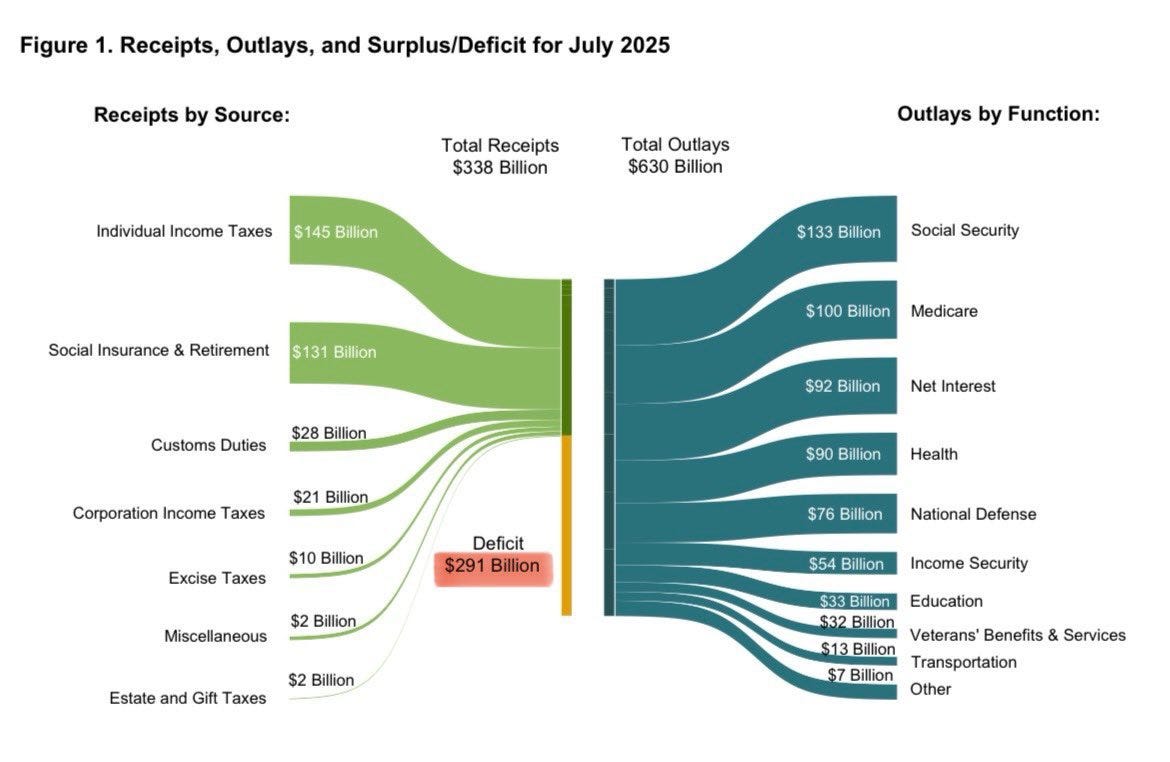

Alas, it was not to be. In July, the Federal Government ran a deficit of $291 billion. In one month, the deficit was more than a quarter of a trillion dollars. The Trump Administration is on pace to spend $7.6 trillion and borrow $3.6 trillion of it.

I realized that no one else believes this, or at least they don’t seem to be willing to say it, but the federal debt is the single most important issue in our country. Look at the chart. We spent $92 billion in net interest in July. More than on health care. More than on national defense. Nearly three times more than we spent on education.

But as bad as the net interest number is, we spent 2.5 times that much on Social Security and Medicare, not to mention other “income security” programs. We have got to get our spending under control, and that obviously includes making significant (and politically career-ending) cuts to entitlement programs. We simply can not afford these programs. We are broke. And if I am the only one standing here pointing out that “the emperor has no clothes,” then so be it.

Retail Sales

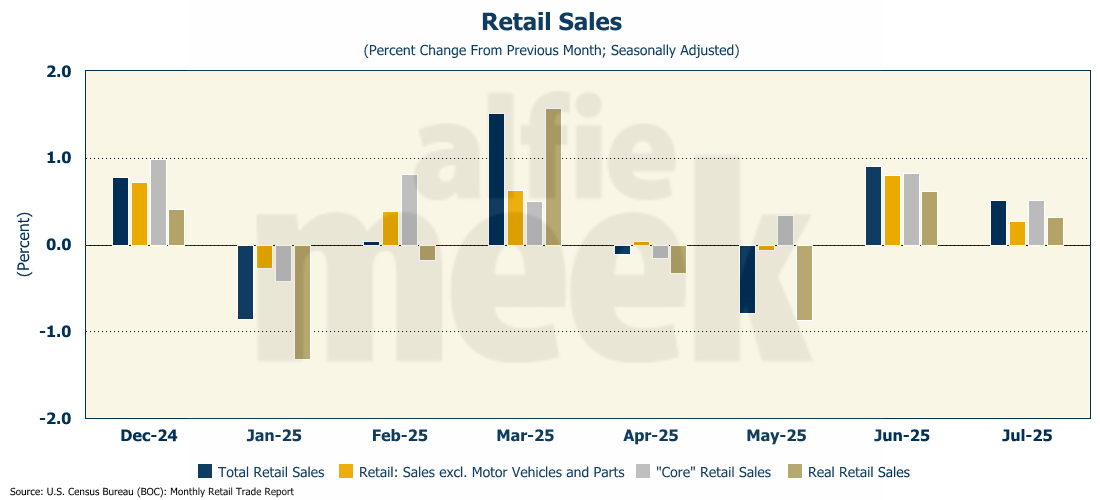

Retail sales data for the month of July was released this morning and the numbers were in line with expectations (full release here). Overall, retail sales were up 0.5% in July, bringing the year-over-year increase to 3.9%. Adjusted for inflation, real retail sales were up 0.3% in July and were running 1.2% over last July. In fact, on a year-over-year basis, real retail sales have now risen for 10 consecutive months.

The U.S. consumer just keeps right on spending. When you look at the aggregate levels of debt, the growing share of debt moving into deliquency, and the rising number of outright defaults, one has to wonder how the consumer is keeping it up.

Turns out the answer is right there in my question. In “aggregate” the numbers look good because the top 20% continue to grow their spending. In fact, the top 20% have grown their spending at a rate twice that of inflation since 2020. At the same time, the middle and the bottom 40% are barely keeping up with inflation...and using credit and debt to do it.

The top 10% of income earners represent 48.3% of all personal consumption, and that number has been steadily increasing. The top 20% represent almost two-thirds of all spending. It is this spending that is keeping the economy afloat and is why the retail sales numbers continue to come in so well. But the economy is becoming increasingly bifurcated between those with a lot of disposable in come and those without. And the gap seems to be widening. Not a good situation for the economy or for future political stability.

Consumer Price Index

Overall, prices in July rose 0.2% from June, and were 2.7% higher than last year (full release here). In June, the annual increase was also 2.7%. But, wait! What about the tariffs?!? In June, Fed Chair Powell announced, “everyone I know is forecasting a meaningful increase in inflation in coming months from tariffs." Well, perhaps Chair Powell needs to broaden his circle of friends, because the dreaded tariff inflation has not, and very likely will not, materialize.

As I have said repeatedly, the inflation that is coming is due to excessive growth in the money supply, and you see that clearly when you look at services inflation. “Super core” (services less shelter) jumped 0.6% in July (hottest since January) and was up 3.6% for the year. It was only 3% just a few months ago. Services represent a large portion of consumer spending and, by definition, are not directly influenced by tariffs. For example, the big increases in the index in July came in medical services and airline fares.

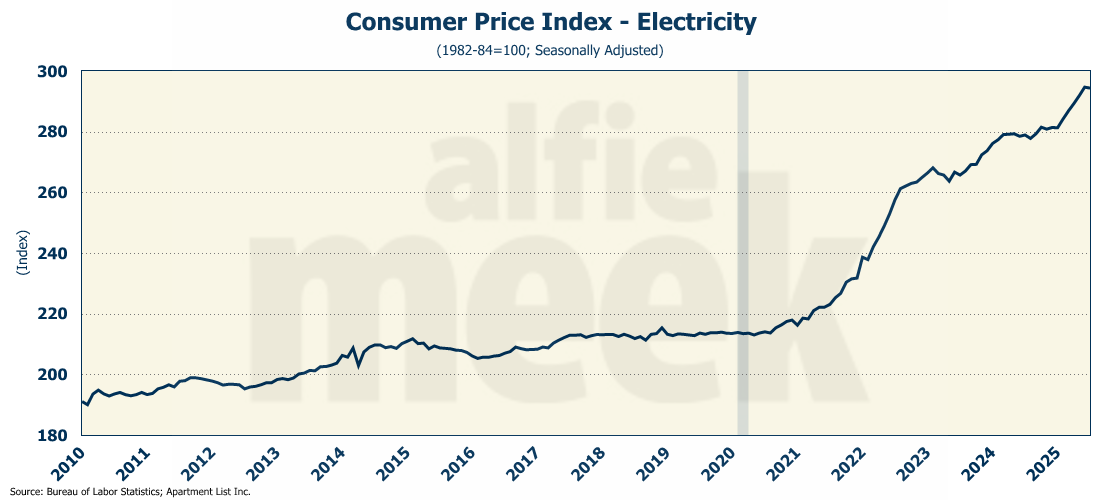

Another interesting note…the price of electricity is skyrocketing. With the adaptation of electric vehicles, and the proliferation of data centers to drive the AI revolution, the supply of electricity has not kept up with demand. When demand outstrips supply, the price must go up. This will be an interesting chart to follow over the next few years.

Oh yeah…one more thing…the price of eggs fell for the fourth consecutive month.

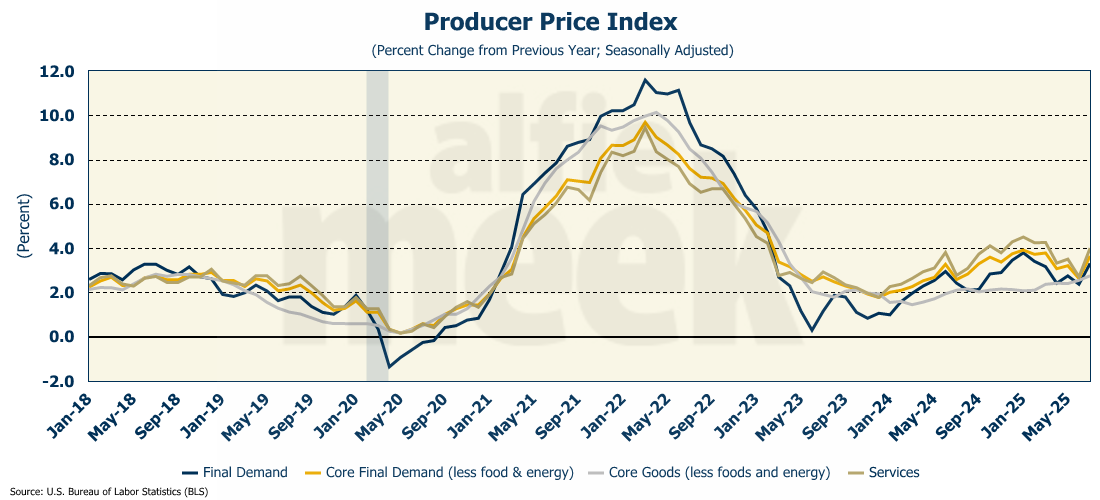

Producer Price Index

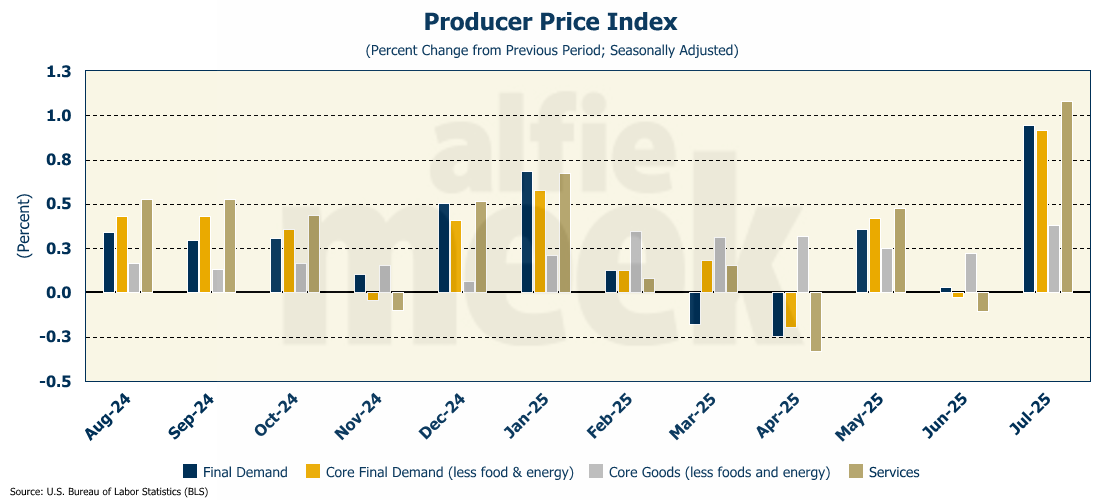

Well, if consumer prices were flat in July, the same can not be said for producer prices. The Producer Price Index (PPI) rose 0.9% in July…the largest monthly increase in three years (full release here). In fact, the last time the PPI rose this much in one month was back when overall inflation was running about 9%. On an annual basis, PPI is up 3.3% over last year.

The headlines coming out of this report were reliably predictable….TARIFFS! The only problem with that is that the primary driver of this PPI number was services. The index for final demand services moved up 1.1% in July, the largest monthly increase since March 2022. Further, over half of the July increase is attributable to margins for final demand trade services, which jumped 2%. Some service cost increases include airline passenger services, up 1% In July, and portfolio management costs rose 5.8% for the month. Other service sectors with significant increases include data processing (3.5%), cable subscription services (4.2%), and passenger car rental (5.4%). Please explain to me how these are tariff-related?

Lastly, despite all the apocalyptic wailing by the media, it would appear that the new BLS director, E.J. Antoni, isn’t yet cooking the books for the Trump Administration, as this PPI reading should give the Fed serious pause as they consider a rate cut in September.

Small Business Optimism

When the President was elected last November, small business optimism rose sharply, as it often does when a Republican wins the White House. However, it soon fell back as the news of tariffs sent a wave of terror through the small business community. However, as it has become increasingly clear that the predicted tariff-induced economic doom was little more than the false cry of “wolf,” small business optimism has been moving up, and rose back above 100 in July (full release here). It is now above the 52-year average of 98.

In general, things appear to be looking up for small businesses. July showed a notable improvement in overall business health. Further, the net percent of small business owners expecting better business conditions rose 14 points from June to a net 36% - well above the historical average. And finally, 33% of small business owners had job openings they could not fill in July, and 14% plan to create new jobs in the next three months. It would seem that the threat of a tariff-induced recession was significantly overblown.

One More Thing…

The Weekly Economic Update added several new subscribers this week, and I encourage you all to go back and read the previous week’s posts to get a fuller picture of the current state of the economy. And, if you like what you see and find it useful, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.