Weekly Economic Update - 08-29-25: New Home Sales; Case-Shiller Home Prices; Durable Goods; Consumer Confidence; Personal Income & Spending; and PCE Inflation

It looks like rate cuts are coming soon. Inflation will be sure to follow.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

There was a lot of economic data released this week, but before we get to that, I need to make an acknowledgement.

Many months ago, I set up a “leaderboard” to encourage readers to share the update. There are certain “benefits” at certain levels of referral, the first level being that ten referrals that result in subscribers will get you public recognition in the update. Last week, Tommy Jennings, President of the Barrow County Chamber of Commerce, became the first person to achieve that goal. Tommy has been a huge fan of the update for a long time, and I appreciate all his support. Thanks, Tommy!

Many of you share the update weekly, and many of your referrals have no doubt resulted in new subscribers. Unfortunately, if you don’t use the “Invite Friends” link, there is no way for my system to track who did the sharing. So, thanks to all of you who share the update via forwarding e-mail, sharing the website, or simply by word of mouth. You may not get “official” recognition, but I appreciate your efforts.

On to the economic update…

In his Jackson Hole speech last week, Fed Chair Powell opened the door wide for a rate cut in September. At this point, it is a foregone conclusion. Given the disastrous revisions to the BLS employment estimates, the Fed has little choice but to turn from price stability (where they have failed miserably) to their other mandate - maximum employment. At this point, the only thing that could stop a rate cut would be a phenomenal August employment report on September 5th, and since no one believes the BLS employment reports anymore, a rate cut is a fait accompli.

That said, a rate cut will accelerate inflation pressures that are already moving in the wrong direction. We have PPI inflation growth at a 3-year high, and CPI inflation has been above 2% for 53 straight months. Cutting rates is inflationary. In addition, despite what you may hear from officials in the current administration, a rate cut is likely to result in HIGHER mortgage rates. The Fed controls the short end of the yield curve. The bond market controls the long end. The bond market will see a rate cut as inflationary, and rates will rise. Don’t believe me? The last time the Fed cut rates 100 basis points (exactly one year ago), the 10-year yield went from 3.7% to 4.7% and the 30-year mortgage rate went from 6.1% to 7.0%.

I’ll make a prediction. If the Fed cuts rates over the near term by 100 basis points, one year from now, both inflation and mortgage rates will be at least 100 basis points higher than they are right now.

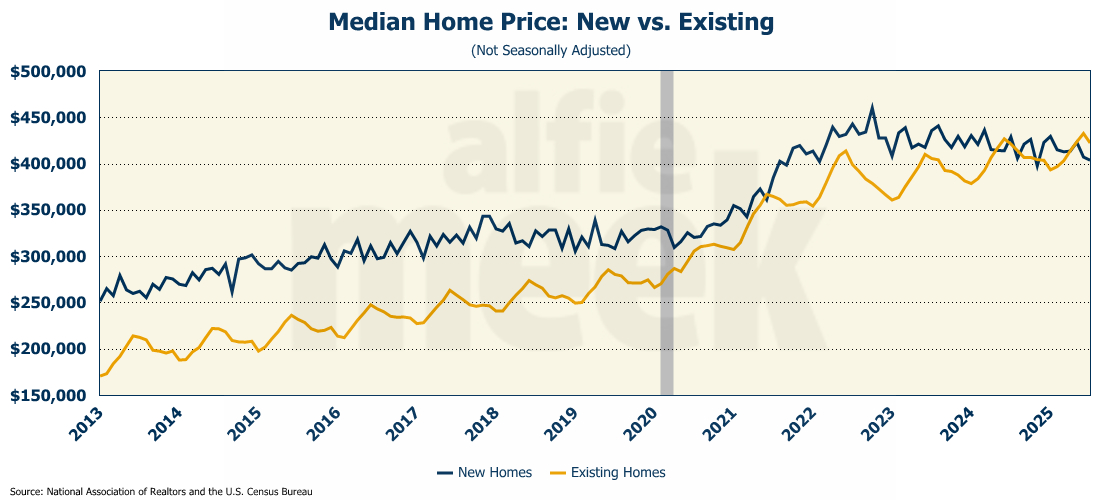

New Home Sales

Well, it is official. It is now cheaper to buy a new home than an existing one. Substantially cheaper. In July, the median price of a new home was nearly $20K LESS than that of an existing home (full release here).

At one point, the price of a new home got as high as $460K. Prices have fallen 12% since then. This may be a signal for the housing market. Builders appear to be waking up to the realities of housing in the United States. Clearly, existing homeowners have not. Even so, on a seasonally adjusted basis, the price of existing homes has fallen over the last two months. Perhaps existing homeowners are starting to come to grips with reality.

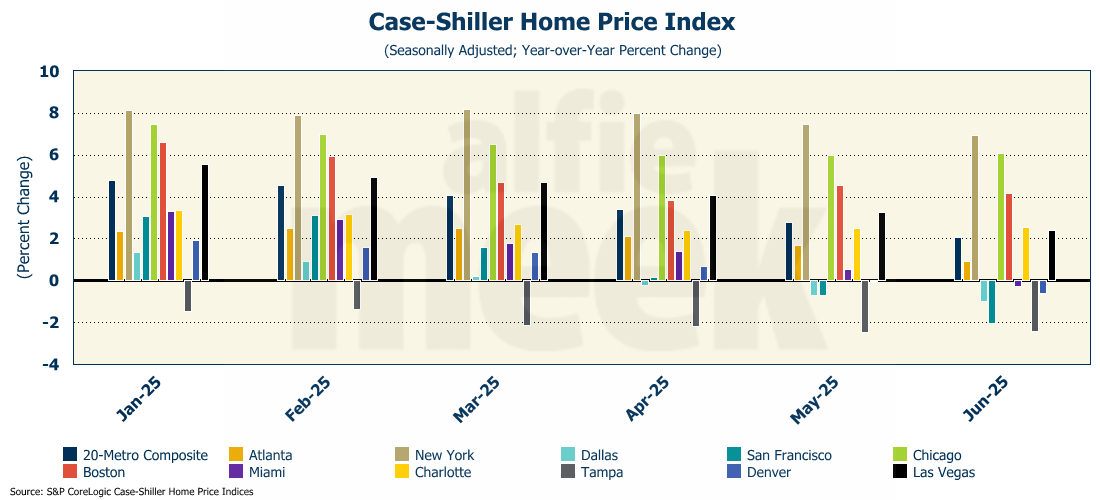

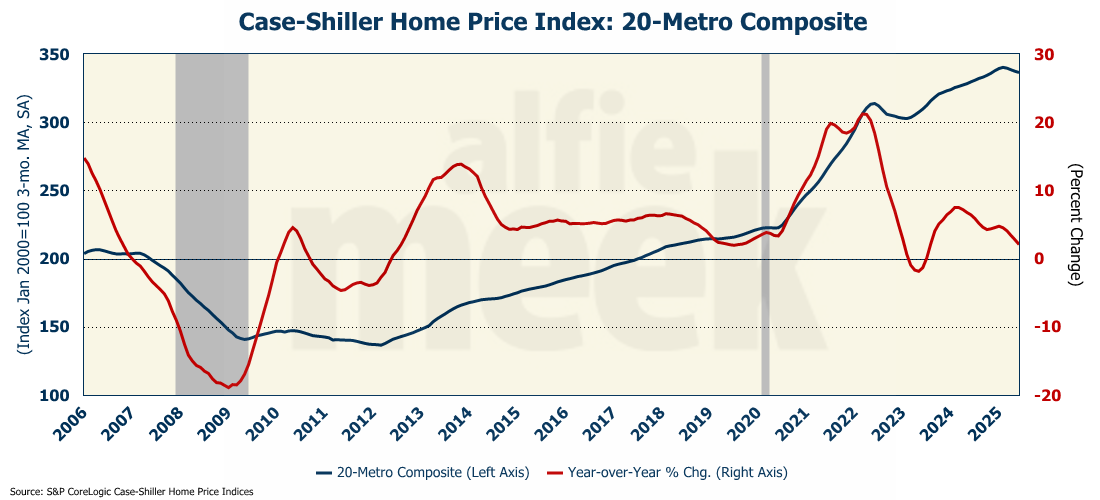

Case-Shiller Home Prices

Confirming this turning point in the housing market is the Case-Shiller home price index, which showed that prices in the country’s 20 largest metro areas fell for the fourth consecutive month (full release here).

Each month, more cities move from price growth to price decline. This latest report saw Miami and Denver move into negative territory while declines in both Dallas and San Francisco accelerated. And home prices in Tampa continue to be a disaster.

Even with the decline, on a year-over-year basis, prices are still up 2%. However, that rate is slowing dramatically and could easily move into negative territory in the coming months.

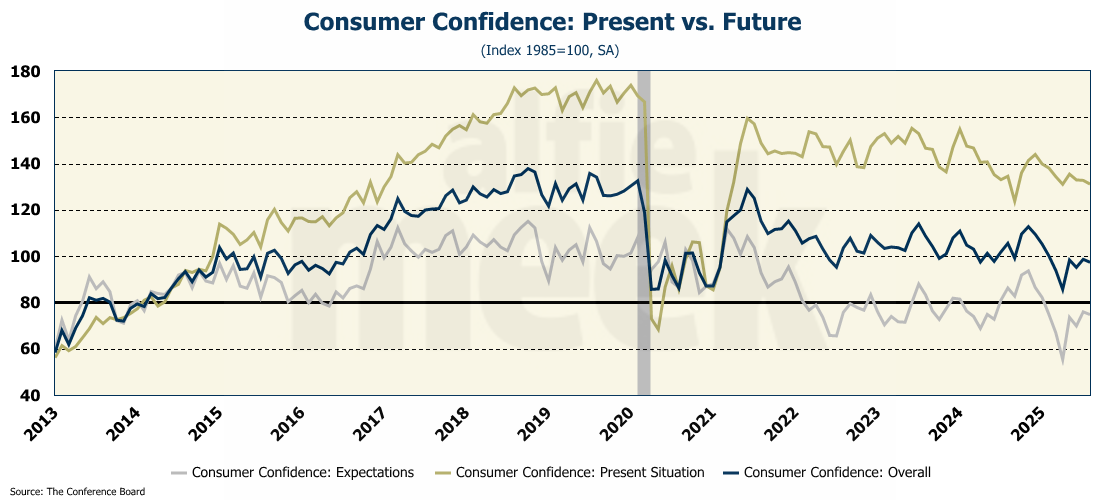

Consumer Confidence

Consumer confidence fell slightly in August, but in general, is still at the level it has been at since May (full release here). Confidence in the present situation - based on consumers’ assessment of current business and labor market conditions - fell 1.6 points, while the Expectations Index - based on consumers’ short-term outlook for income, business, and labor market conditions - dropped 1.2 points.

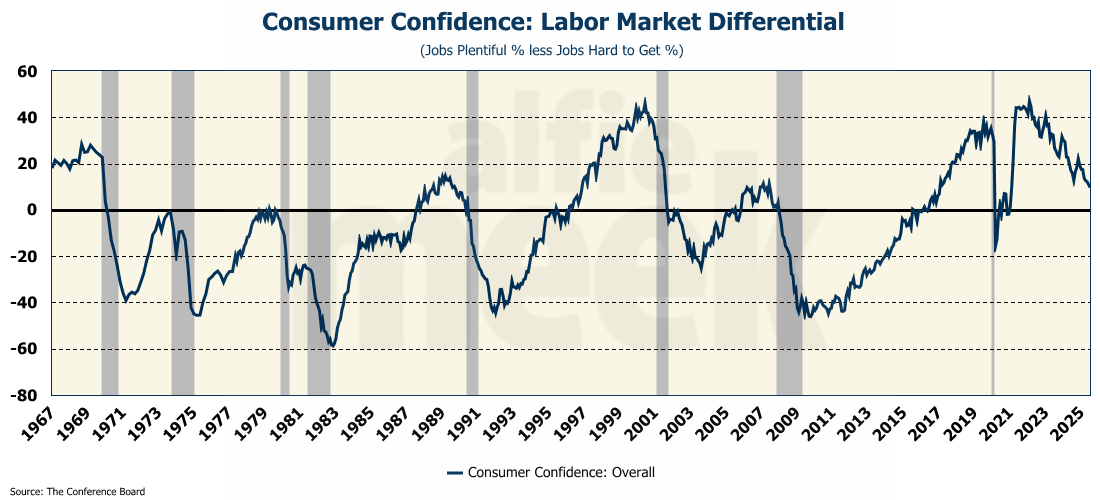

With respect to the labor market, the share of those saying that “jobs are plentiful” fell slightly while the share saying that “jobs are hard to get” rose. As such, the differential between the two continues to decline. That differential tends to move into negative territory during recessions.

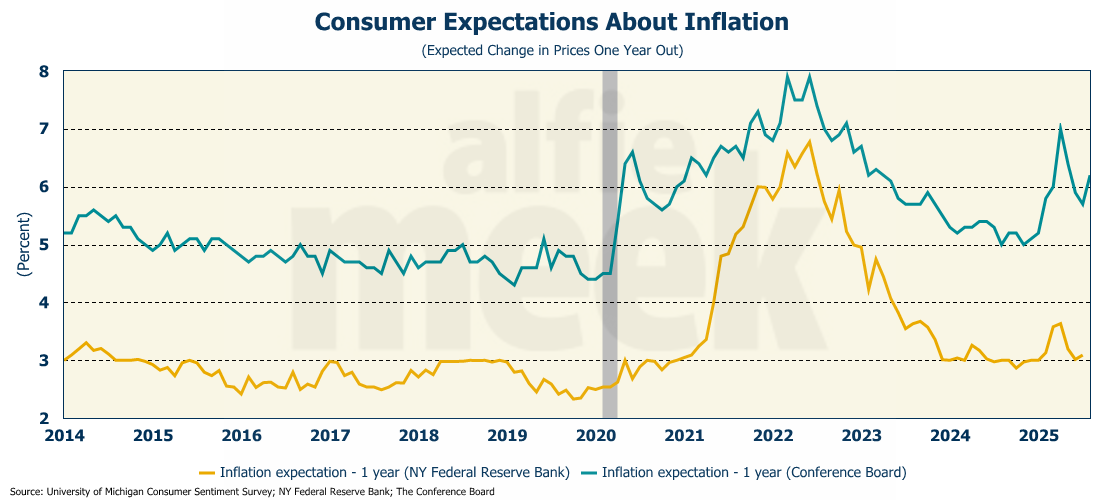

Consumers’ average 12-month inflation expectations moved up slightly in August to 6.2%, after falling for three consecutive months. Even with the increase, it is still below the peak of 7.0% set in April. One does have to wonder why the Conference Board's sample inflation expectations are consistently much higher than the NY Federal Reserve Bank’s survey. While inflation will be higher one year from now, a move to 6.7% in the “official” indexes is absurd.

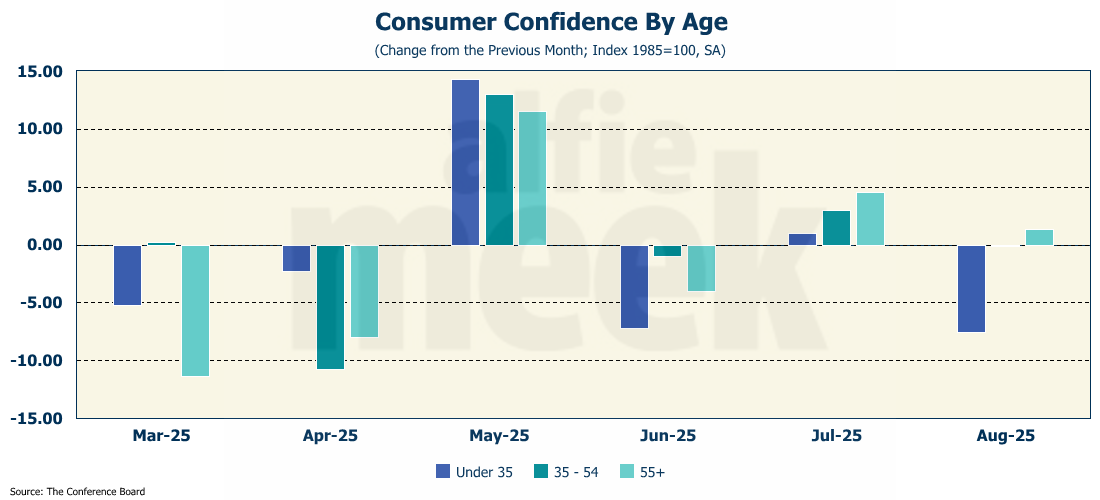

Interesting to note that the biggest drop in consumer confidence was for those under the age of 35, while the confidence of those over 55 moved up for the second month in a row.

Durable Goods

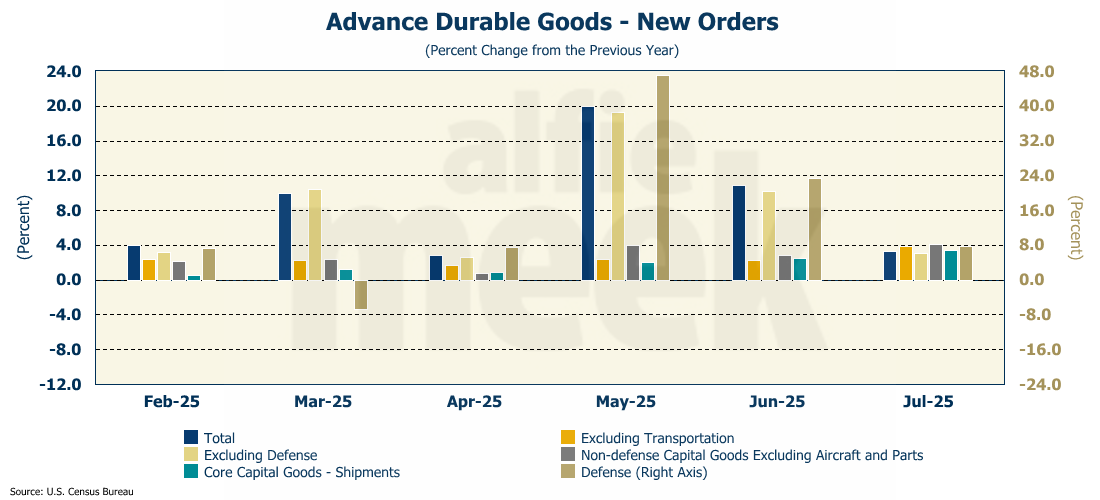

For the month, durable goods orders fell 2.8%, but were still up 3.3% from one year ago (full release here). Core durable goods (durable goods less transportation) were up 3.8% for the year - the fastest pace in three years. Core capital goods shipments (which feed directly into the equipment investment part of GDP) rose 0.7% in July and were up 3.4% for the year. That’s a good start for the third-quarter GDP.

Personal Income & Spending

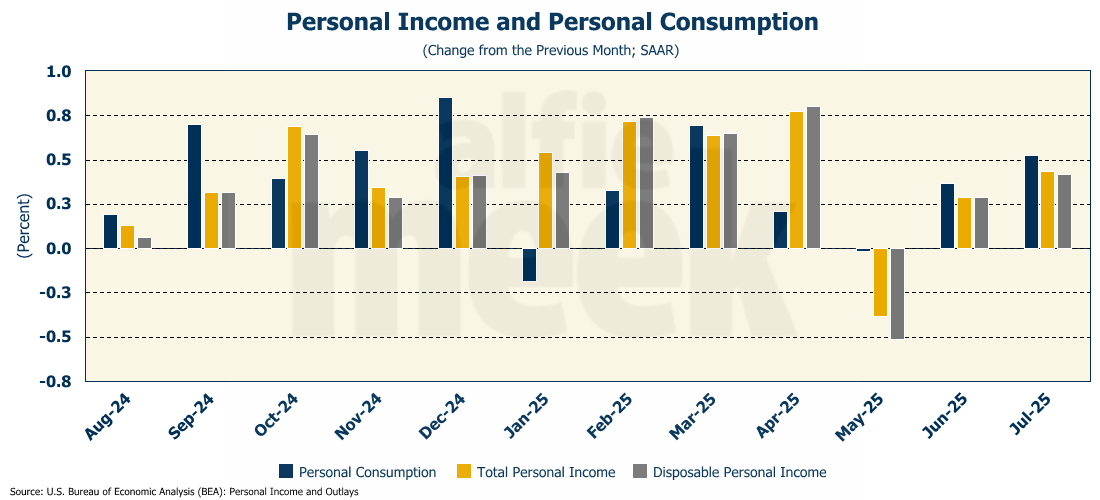

Both personal income and spending for July came in right at expectations (full release here). Personal income grew 0.4% in July and is up 5% from last summer. Given that inflation is running around 3%, real incomes are growing. That’s a good thing.

Unfortunately, personal consumption grew 0.5% in July, as savings fell $17 billion. We spent more than we took in. How shocking. However, there is some good news…on an annual basis, consumption is up only 4.7%…less than income, which results in aggregate savings being up by $54 billion over the past 12 months.

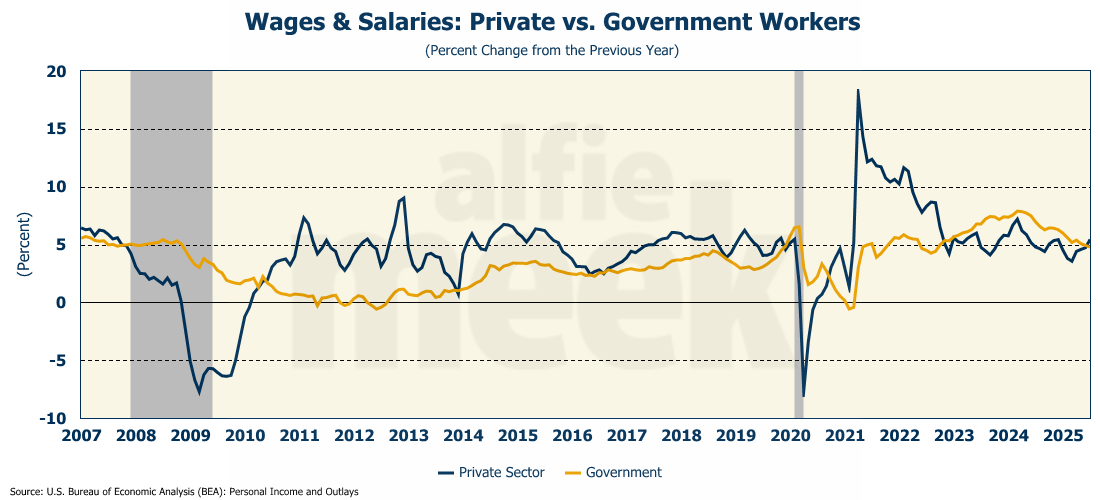

One interesting note. For the first time since late 2022, the income of private sector workers is rising faster than that of government workers - 5.1% vs. 4.8% respectively.

PCE Inflation

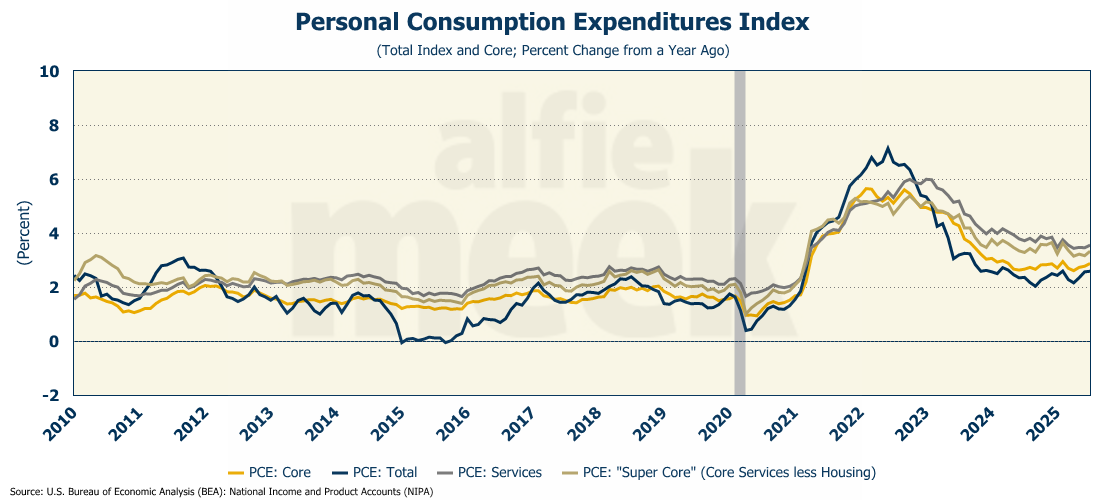

And lastly this week, we received the numbers for July inflation as measured by the Personal Consumption Expenditures (PCE) index - the “Fed’s favorite inflation indicator.” As was the case with income and spending, everything came in exactly as expected (full release here). For the month, the index rose 0.2% with prices year-over-year coming in at 2.6%, level with last month. However, core PCE (PCE less food and energy) rose 0.3% for the month (as expected), bringing the year-over-year number up to 2.9%…the fourth monthly increase in a row. And before you start blaming tariffs, realize that most of the inflation is in the service sector. Service PCE also rose for the month and now stands at 3.6% year-over-year. (I’m sure that Chair Powell would say that the lack of tariff inflation is “transitory.”)

Clearly, the FED never completed its task of bringing inflation back to its target. And how could they? They are printing money like there is no tomorrow. And with their renewed focus on the labor market, as I discussed above, the coming rate cut in September will only make inflation that much worse.

One More Thing…

I hope everyone has a great Labor Day weekend as our nation celebrates the “official” end of summer. I, for one, am looking forward to the fall - my favorite time of the year.

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort. (My own sister cancelled her subscription this week, so I need at least one of you to step up and take her spot!)