Weekly Economic Update 09-12-25: Consumer Credit; Small Business Optimism; Producer Price Index; and Consumer Price Index

Rest in peace, Charlie Kirk.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I realize that this isn’t the place for what I am about to do. And I further realize that most, if not all of you, subscribe to this weekly blog to get economic data and perspective that is, to the very best of my ability, void of political bias and as objective as possible. I also realize that some of you may “unsubscribe" today and that is fine. Readers do it every week. But I have to get this off my chest.

The assassination of Charlie Kirk on Wednesday has had a profound effect on me. I can’t get over it, nor do I want to.

Those who know me well know at least two things about me. First, as many people do, I have my own beliefs and convictions, and I am very serious about them. They are formed by my worldview which is fundamental to who I am. I make no apologies for that, nor will I ever.

Second, I try very hard to show respect to those who have different beliefs and convictions, and I try not to let my own opinions cloud my objective judgement. In this blog, as in many areas of my life, I try to call balls and strikes. If your “team” or your “leader” can do no wrong, you aren’t in a political party…you are in a cult.

Many of you have commented to me about how you appreciate that, for the most part, I call balls and strikes in my commentary. Might I occasionally slip up? Sure. But I make an effort each week not to. Frankly, from my perspective, it can be quite humorous. During the previous administration, many people accused me of being too “right-wing.” Since January, I can’t tell you how many comments/e-mails/conversations I have had with people who accuse me of being too “left-wing.” When I taught both Applied Political Economy and Public Finance at Georgia Tech, my students routinely commented on how, after listening to me for an entire semester teach two classes that have a lot of content that lends itself to political bias, they still didn’t know what my personal politics were. Good! That is how it should be at a university! Professors should not let their bias infringe on their instruction.

Charlie Kirk’s whole focus was on going to college campuses and having open conversations with people who disagree with him. He was respectful and cordial. You may disagree with his worldview, his beliefs, and his politics, but of all the people on his side of the spectrum, you would be hard pressed to find someone more likeable. (Frankly, most aren’t very likeable at all.)

And he was killed for it.

I have said for years that if we can’t get back to a place where we can have honest disagreements, but still respect one another, the Republic is done.

There are many causes for how we arrived at this point, but if I had to pick just one, I would have to pick the legacy media. I get asked quite frequently to speak to the legacy media. I decline all requests. In fact, just this week, I was asked by the Wall Street Journal for an interview. I declined. “Right-leaning,” “left-leaning," or “middle of the road,” doesn’t matter. I loathe the legacy media in its entirety and want no part of it. I can’t express in words the extent to which I hold them in utter contempt. They long ago quit being the fourth estate, and now do little more than accentuate our differences in an attempt to foment uncivil discourse. I spent 10 years in a position where I had to talk to the media, and in all that time, I was NEVER quoted correctly and was nearly always taken out of context. They are vile.

And, with respect to our civil decline, social media is worse. LinkedIn, X, Facebook, TikTok, Bluesky, Instagram, Snapchat…I could go on and on. The only social media I have is LinkedIn and X, and those are solely to post this update. But after this week, I am seriously considering deleting both of those and becoming social media-free. I would no doubt be a better person for it.

And we need to be better. All of us. We can not accept where we found ourselves on Wednesday afternoon. If that becomes normal, then all is lost.

Now on to the economics of the week…

As my readers all know by now, the Bureau of Labor Statistics (BLS) revises its monthly job estimates in the months following the initial release, and those revisions are nearly always downward, and recently, have been quite large. In fact, the revisions have been so bad that the President fired the head of the BLS in hopes of finding someone who could accurately track the level of employment in the country.

What you may not know is that each year, the BLS also does what is known as a “benchmark” revision, where they go back and revise an entire year. This week, they released the latest numbers as a part of their annual “preliminary benchmark revisions” for the months April 2024 through March 2025. It would appear that for those 12 months, the job numbers were overstated by….911,000.

That’s right. Even after all the previous monthly downward revisions, the number of reported jobs in the economy was still nearly 1 million too high. This is the largest negative annual revision in the history of the data. And, it comes off of last year’s negative revision, which was 818,000.

On the heels of this revision, the Vice President said “It’s difficult to overstate how useless BLS data had become.” Truer words were never spoken.

How are we to conduct any sort of timely policy analysis when the data is so horribly wrong? You can’t.

The President has nominated economist E.J. Antoni as the new BLS commissioner. Mr. Antoni was often a commentator on Fox Business and has raved about the poor quality of BLS data for years. Hopefully, Mr. Antoni will induce new and improved measures of data collection and modeling that will better reflect the realities of the modern economy. Ironically, if he does his job well, he may not hold the position long, as the coming months are likely to bring poor job numbers as the economy slows.

Consumer Debt

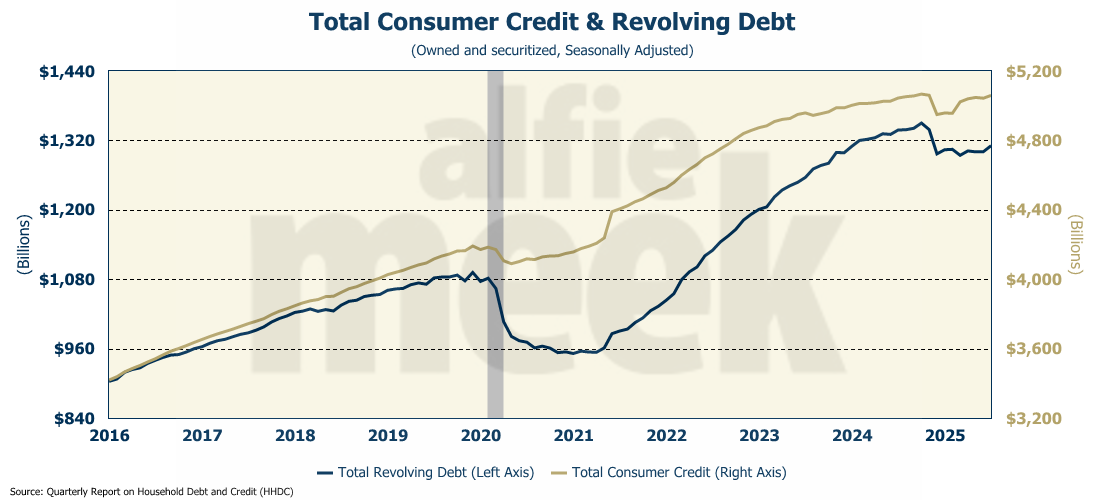

Total consumer credit rose $16 billion in July to $5.060 trillion…just slightly below the all-time record set in November 2024 (full release here). Revolving credit (i.e., credit cards) jumped $10.5 billion - the largest monthly increase in over 18 months. But even with the jump, total revolving debt is 2% below where it was a year ago.

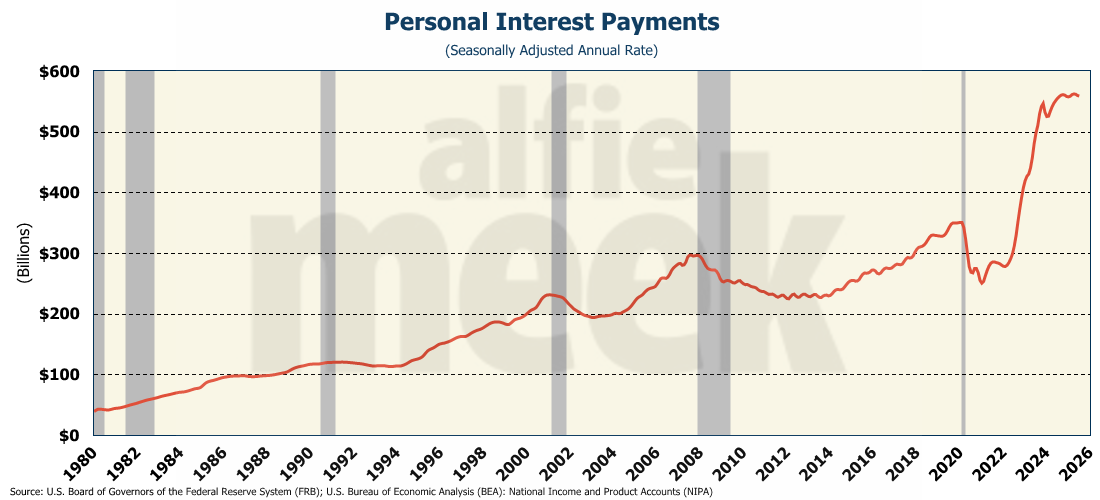

Consumers are paying $559 billion annually in interest on consumer debt. Credit card rates have come down slightly, but are still above 22% for those cards carrying a balance.

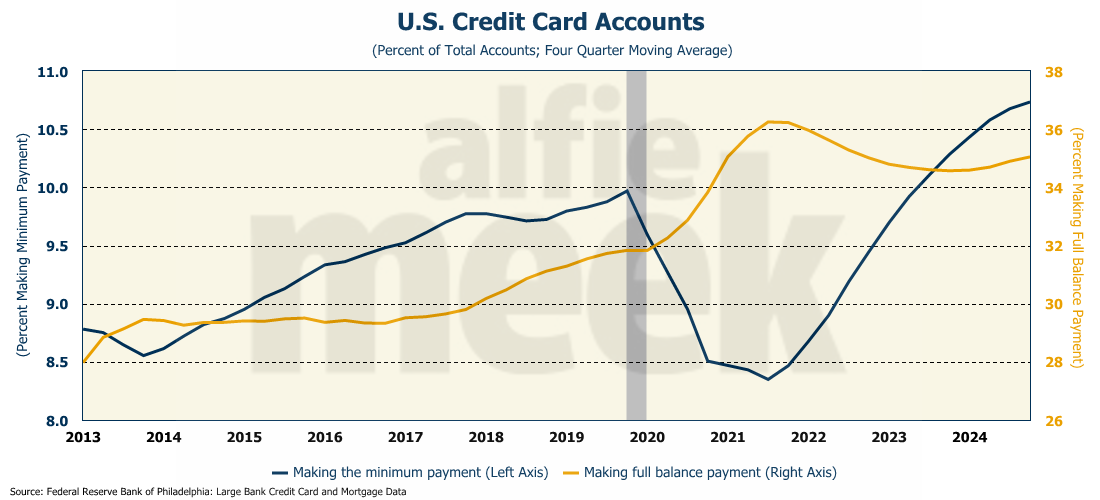

Speaking of those carrying a balance…the share of accounts that only make the minimum payment has been rising steadily since 2021 after everyone paid down their credit cards with government COVID checks. Unfortunately for them, the inflation that hit hard the next year (due in large part to those same checks) forced them to put basic living expenses on the card. And since then, the share of those paying the minimum has been rising.

It is encouraging to note that 35% of card accounts are paid off every month. To be honest, that is a lot higher than I would have thought.

Small Business Optimism Index

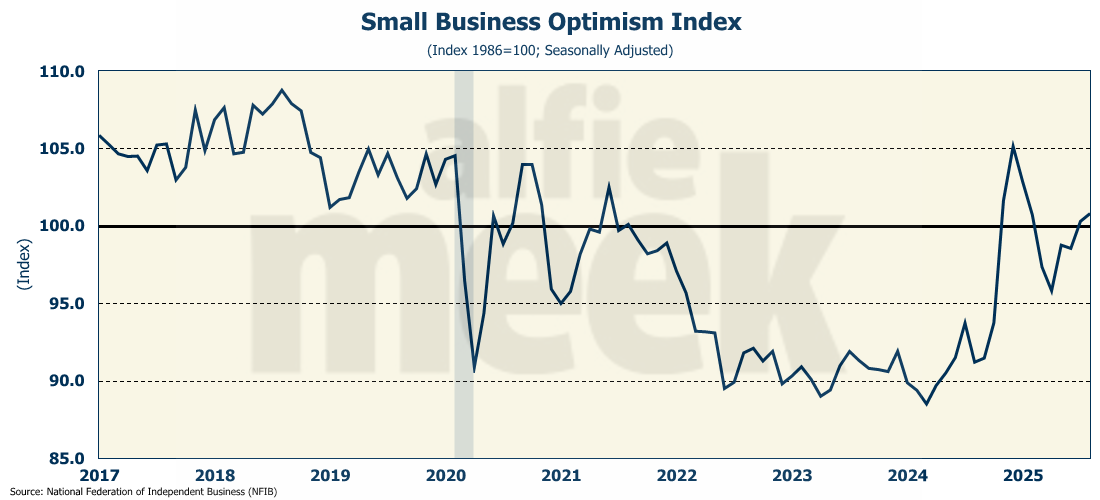

Small businesses were slightly more optimistic in August, as measured by the National Federation of Independent Business (NFIB) optimism index (full release here). The index has been rising since it plunged in April due to the administration’s tariff policy. But as the apocalyptic results that were forecasted have not materialized, small businesses are feeling better and moving back to where they were after the November election.

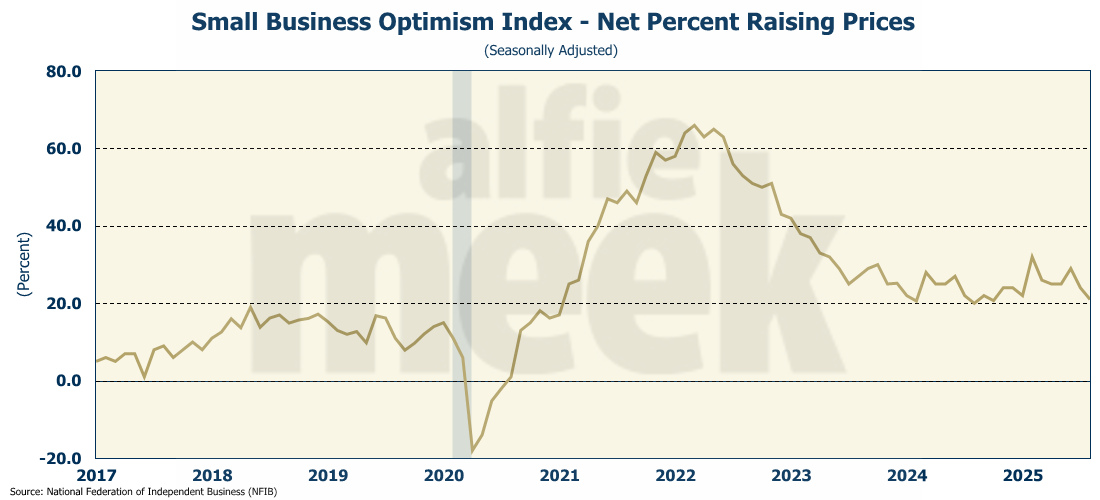

Further, the number of small business raising prices fell for the second month in a row, but is still higher than it was pre-COIVD.

Producer Price Index

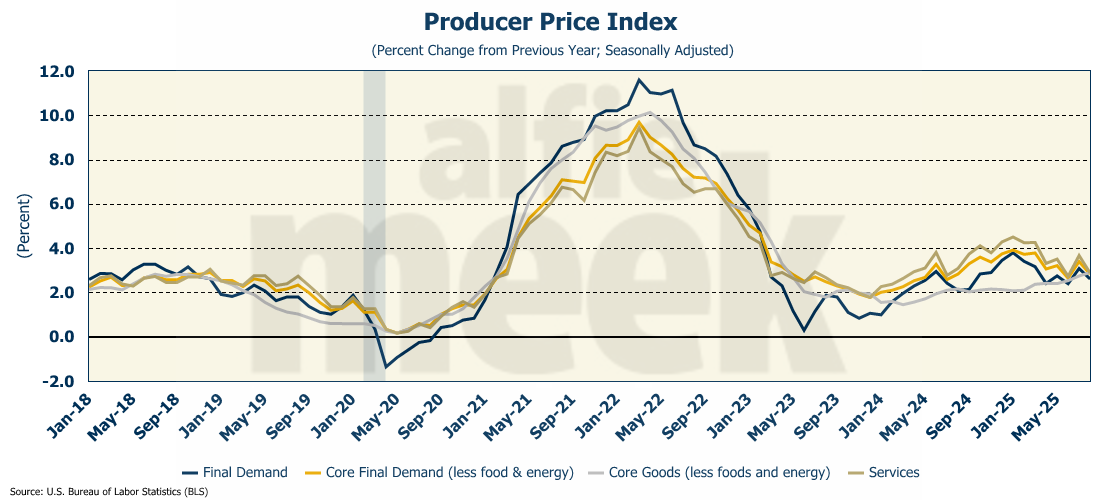

On Wednesday, we got the latest read on producer prices, and the numbers were stunning (full release here). In August, producer prices FELL 0.1% for the month, and the year-over-year rate plunged from 3.1% in July to 2.6% in August. Core PPI also FELL 0.1%, and the year-over-year rate dropped from 3.4% in July to 2.8% in August.

Services PPI also fell from 3.7% in July to 2.9% in August on an annual basis. That is only the second time the reading has been below 3% in the past year.

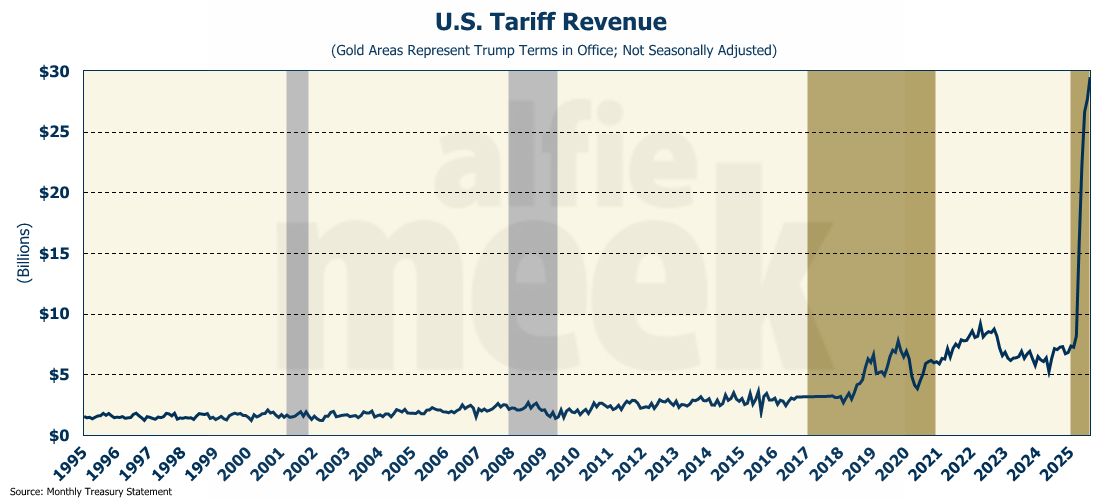

I have been saying for months that tariffs are NOT inherently inflationary. They just aren’t. And to suggest that they are simply demonstrates a gross ignorance of economics. And the tariffs that the administration has imposed are quite insignificant relative to overall consumption. The U.S. has collected more than $121 billion in tariff revenue since April, and most of that has NOT been paid by U.S. consumers, but by foreign producers. (Again, see my post on demand elasticity for an explanation as to why.)

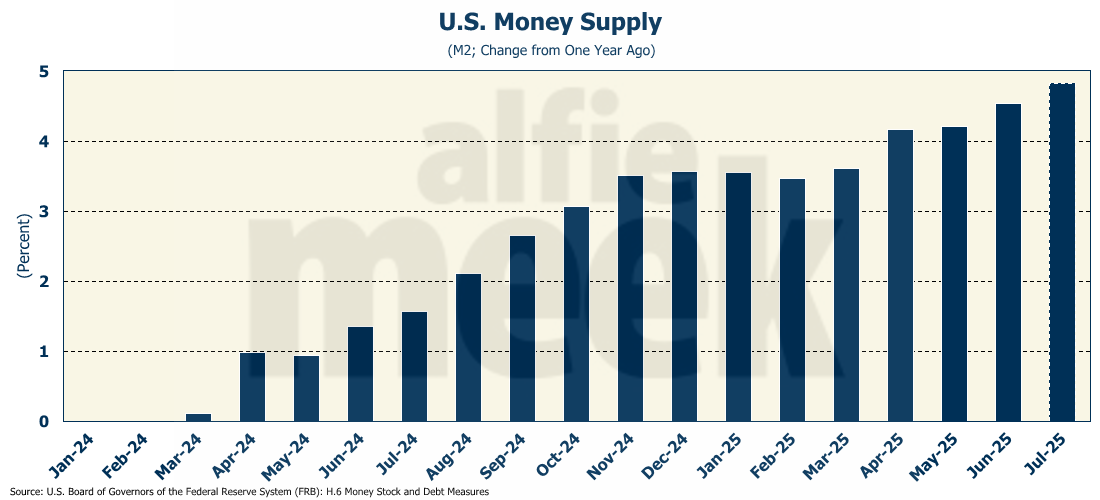

The problem, of course, is that the thing that DOES drive inflation is growth in the money supply…and the money supply in the U.S. is growing at an increasing rate. That WILL cause inflation in the coming months, which will, no doubt, be blamed on tariffs by the previously discussed vile and ignorant media.

Consumer Price Index

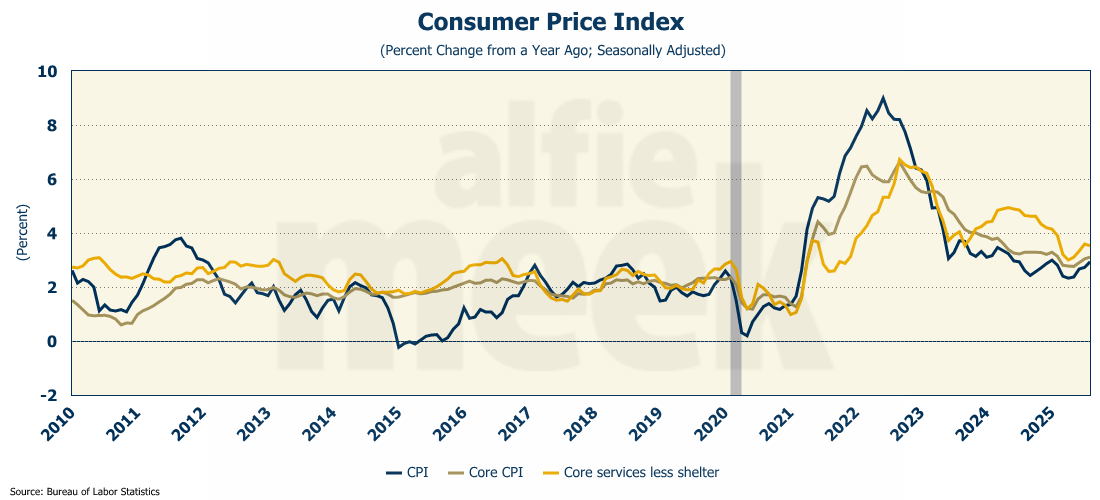

Speaking of money-supply growth driving inflation….if the PPI showed some deflation in August, the Consumer Price Index (CPI) certainly did not. CPI rose an astonishing 0.4%, and jumped to 2.9% year-over-year from 2.7% in July (full release here). Core CPI (CPI less food and energy) rose to 3.1%. Surprisingly, SUPER-Core (CPI Services less shelter) actually fell slightly to 3.5%.

And no. This isn’t because of tariffs. How do I know? Because the largest drivers of the “all-items” index were services. Shelter rose 0.4%, with “lodging away from home” rising 2.3% for the month! The index for air fares rose 5.9% in one month, and that followed a 4.0% increase in July. Services are driving the increase in CPI, and they have NOTHING to do with tariffs.

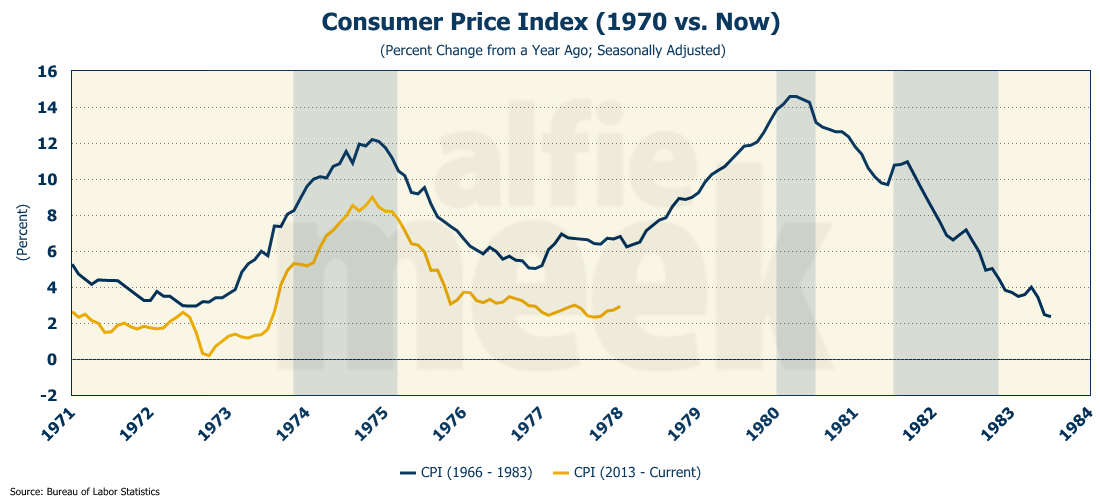

Those who have been with me for the last two years know I have been predicting this for quite some time. As sure as day follows night, inflation follows money supply expansion. It just does. We also know that more than 80% of the time when you have a rapid rise in inflation (as we did in 2022), another one is soon to follow. I refer you once again to the 1970s….

The pattern is clear. When the Fed meets next week, they are going to lower rates. Given the weakness in the labor market, they have no choice. And that is just going to make inflation that much worse.

One More Thing…

I will be in Savannah next week at the Georgia Economic Developers Association annual meeting. If you are there, please stop me and say “hello.” I look forward to seeing many of you there!

Finally, this week, I want to thank all my “bronze” level members who subscribe for just $8/month. Dave Gmeiner, Colin Martin, Brad Wood, Carlos Alvarez, Steve Goins, Tommy Jennings, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, Charles Frazier, Barry Puckett, Matt Murphy, Penn McClatchey, Thomas Smith, and someone with a “GTwreck” e-mail! Thanks for all your support!

I also have a couple of supporters who have chosen the monthly option - Rope Roberts and Sarah Jacobs. Thank you both for your monthly support!

As I do each week, I want to invite you to join this group and click/scan the QR code below to join or just “buy some coffee” in support of this weekly update.