Weekly Economic Update 09-13-24: August Employment Re-Visited; Consumer Credit; Consumer Price Index; Producer Price Index; and Consumer Sentiment

Have we finally reached the beginning of the end for consumer spending?

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I was traveling last Friday morning and didn’t have much time to digest the August employment report before I had to publish the update. Having had some time now to digest all that was included in that report, I want to start this week by re-visiting the August employment data we got last week.

August Employment - Re-Visited

As I reported last Friday, the August employment report showed only 142K new jobs created in the month, which was slightly below expectations. However, as I have said many times in this update, not all jobs are created equal. When we dig a little deeper, we find that the economy added 527K part-time jobs, but lost 438K full-time jobs! Now, before you do the math, I am aware that 527 less 438 does not equal 142. Keep in mind, there are two surveys for employment - the establishment survey and the household survey. The establishment survey tells us that there were 142K new jobs added to payrolls. But not all jobs show up on corporate payrolls. So, they also survey households. In August, households reported a net loss of 438K full-time jobs, but a net gain of 527K part-time jobs. Over the past 12 months, households have reported a net gain of 1.01 million part-time jobs, but a net loss of 1.02 million full-time jobs!

As I have said before, when all the job creation in your economy is from part-time jobs, you don’t really have a “strong” labor market. And who exactly is taking all these jobs? Turns out, it is foreign-born workers. Since February 2022 (the month before the COVID shutdowns) the number of native-born employees is DOWN 608K. However, the number of foreign-born workers is UP 3.9 MILLION. So all the net new employment has been filled by foreign-born workers.

How can this be? It is the result of an aging workforce. The older workforce was made up primarily of native-born employees. When COVID struck, the labor force participation rate of those workers who were 55+ plunged and has not recovered. Many just called it quits and are enjoying retirement. However, the younger generation has many more foreign-born workers as a share of their labor force, and their labor participation rate is much higher than it was pre-COVID. As a result, employment growth in this country is being driven by foreign-born workers and there is little in the demographic data to suggest that will change anytime soon.

Consumer Credit

Last month it was looking like the U.S. consumer was finally slowing down and coming to grips with their ever-growing level of debt. But no. In July, total consumer credit exploded by $25 billion…more than 2x the level that was expected (full release here). Revolving credit (e.g., credit cards) grew by $10.6 billion, the largest monthly increase since February and the 2nd biggest increase of the year.

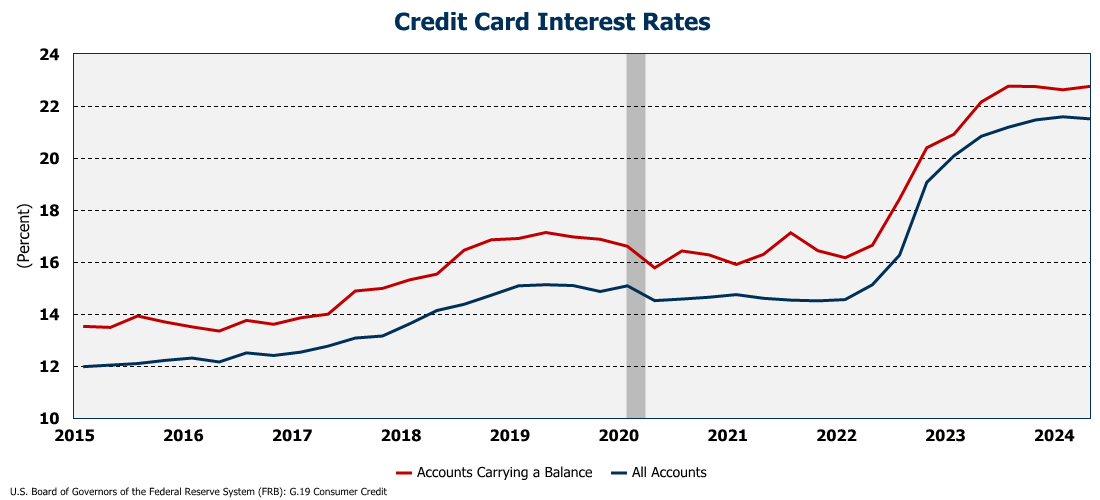

The average rate on a credit card carrying a balance is now at a high of 22.76%! Total credit card balances are now sitting at $1.2 trillion and growing at more than 10% per year. That is a lot of debt service! In fact, personal debt interest payments are now at $543 billion per year, and households spend about 14.2% of their disposable income on debt service. Surprisingly, home equity debt is growing at 11.8% per year, despite the high rates. In short, households are doing whatever they can to maintain their level of spending. And it won’t end well. Case in point…this week Citi Bank said that they were seeing people using their cards more and more for necessities like groceries and gas and less for non-essential items. That isn’t good. Further, several banks, reported this week that credit delinquencies were running several points higher than anticipated. When consumer credit explodes at the same time as delinquent credit is increasing, the end is near with respect to personal consumption. And as personal consumption slows, the threat of recession becomes very real.

Non-revolving credit jumped by nearly $15 billion which was the largest monthly increase since June 2023, and the second largest increase since late 2022! This includes auto loans, student loans, etc. It is interesting to note that student loan debt actually declined by $8.3 billion in the second quarter, but auto loans grew by $8.5 billion! In total, excluding mortgages, U.S. households have $5.3 trillion in debt. But like the credit cards above, people are struggling to meet their debt obligations. Ally Bank reported that delinquencies for car loans were running much higher than anticipated, and net charge-offs were also above expectations. They pointed out that they are “dealing with a cohort of borrowers … who have been struggling with cost of living and now are struggling with an employment picture that’s worse.” Yep. Higher debt; lower wages; and a poor job market….that equals a recession.

One last interesting point….who holds that consumer debt? Yes, depository institutions like Ally hold the largest share at 41.6%. But you may be surprised to learn that the second largest holder of consumer debt in this county is the Federal government at 29.6%! That is because the Federal government now holds all student loan debt. The Federal government actually holds more consumer debt than all finance companies and credit unions combined!

Interesting relationship we have with our government. They print the money, causing inflation, then we go into debt, and they hold the debt. When you owe someone money, to a very real extent, you are beholden to them. They can control you. Having the Federal government holding more than one-quarter of all consumer debt is not a good situation and one that needs to be reversed.

Consumer Price Index (CPI)

Overall, CPI continued it’s decent back to something normal in August coming in at 2.6% year-over-year (full release here). However, of concern is the core measure of inflation (which removes the volatile food and energy sectors) which came in hotter than expected and actually accelerated in August to 3.3% year-over-year, or 3.4% annualized.

This is not the what the Fed wanted to see heading into their September meeting which is, unfortunately, sure to result in a cut in the Federal Funds rate (and cost me $1 as I’ll lose a bet to a member of BENS). However, with core inflation heating up, a 50 basis point decrease has got to now be off the table.

“Super Core” inflation (core services less shelter) is still running hot at 4.5%, but has now fallen for 5 consecutive months. But within that measure, there are some really big numbers. For example, if you drive a car, you know that your auto insurance rates have gone up dramatically. Since January 2021, auto insurance is up an astounding 55.7%! Energy is up more than 30%. Unfortunately, wages and salaries are up only 12.8% which explains the credit numbers I discussed above.

Producer Price Index (PPI)

To compound the inflation picture, after core CPI came in hotter than expected (and moving in the wrong direction) on Thursday, the Producer Price Index (PPI) came in hotter than expected rising 0.2% in August (vs. 0.1% expected). After falling last month, the PPI for services returned to an upward trajectory growing 0.4% in the month. On an annualized basis, that represents 4.6% producer inflation for services (full release here).

Core goods PPI also came in hotter than expected, and like core CPI, core PPI turned UP in August. In fact, core final demand, core goods, and services PPI all turned up in August. The only major measure of PPI that didn’t turn up is the overall final demand number. This is NOT good news for a Federal Reserve that is contemplating cutting rates next week. But as I have mentioned many times, they are between a rock and a hard place. Inflation is not beaten, but the labor market and overall economy are on the verge of a recession - if not already there.

Consumer Sentiment

Finally, this morning we got the preliminary look at the University of Michigan’s Consumer Sentiment survey for September (full release here). Surprisingly, consumer’s feelings about both the present situation and future expectations ticked up a bit for the second month in a row. Consumers seemed a little more optimistic about the direction of prices, but more pessimistic about the labor market.

Not surprisingly, looking at the partisan breakdown, confidence continued to rise for Democrats, was virtually flat for Independents, and dropped further among Republicans. It is important to note that this survey was completed before the debate last Tuesday night. We’ll see how the numbers end up when they release the final index later this month which should include some post-debate interviews.

One Last Thing…

You may have noticed a new header on the e-mail this week, as well as some cleaned up logos/graphics across the site. Thanks to my good friend and one of the world’s most talented artists, Don Jolley, who could no longer stand to look at the graphics I developed. (He says I need to stick to economics and let him do the graphics. Can’t argue with him there.)

Like last week, I will be traveling again next week. Looking forward to seeing many of my readers in Savannah next week at the GEDA Annual Conference. Please come up and say “hello.” Fall seems to be the “conference” season and spending my evenings at dinners and receptions cuts into the time I have to put out this update. However, I hope to publish next Friday morning per usual as we should be getting interesting data on retail sales, building permits, housing starts, and industrial production.

As always, thanks to all my supporters. Last week I got support from Kathy Oxford, Caitlin Dye, and Ginny Blakeney, among others whose names were not attached to their generous contribution. If you would like to support this effort, you can click the link below and “buy me a coffee” (or two, or three, or five…..)

Have a great weekend.