Weekly Economic Update 09-20-24: The Fed's Decision; Retail Sales; Home Builder Confidence; Building Permits; Housing Starts; Existing Home Sales; Leading Economic Indicators; and the SPR

The Fed must really think we are all stupid.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

They finally did it.

On Wednesday, the Federal Reserve lowered the Federal Funds rate by 50 basis points. Most people (including me) were expecting a 25 basis point cut. That would have signaled a change in policy, but one that demonstrated a calm, considered approach with an understanding that while the economy may be slowing, there is still some work to do on inflation. But they went well beyond that. They panicked.

On a personal note, it means I lost a $1 bet because in the spring I was convinced that the Fed wouldn’t cut rates this year. However, from a larger macro perspective, it means that we can expect more - and quite possibly worse - inflation for the U.S. economy. I remind you, inflation tends to come in waves. We did this in the 1970s…then, Fed Chair Arthur Burns cut rates while inflation was already elevated. And now, we are doing it again.

Of larger concern is the Fed’s statement as to why they cut rates. I quote:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have slowed, and the unemployment rate has moved up but remains low. Inflation has made further progress toward the Committee’s 2 percent objective but remains somewhat elevated.

OK, so to be clear, they just said that economic growth is good, unemployment is low, and inflation is elevated…so they decided to cut rates? That makes absolutely no sense at all.

Because they are lying.

They know that, in fact, economic activity is not expanding “at a solid pace”, it is contracting; the labor market is in shambles with ALL job growth in the past year being in part-time work; and the most recent inflation numbers ticked up unexpectedly, and are not making “progress” toward their 2 percent objective. Looking back, every time the Fed cut rates by 50 basis points or more, we were just about to enter, or were already in, a recession. This was a panic move, plain and simple.

But the best quote of the day came from Chair Powell during his press conference:

“The US economy is in a good place and our decision today is designed to keep it there.”

He looked directly into the camera and, with a straight face, said that a crisis-level, panic-driven, 50 basis point rate-cut during a period with record highs for both stocks and home prices, and just six weeks before a presidential election, is needed because the "economy is in a good place."

They really do think we are stupid. There are only two options here….1) the Fed is overtly political and this was a move to juice the economy as early voting starts in several states or 2) the economy is already in recession, they know it, and they are trying to stop the bleeding. Or both. Either way, neither their official statement, nor Chair Powell’s remarks, make any sense.

However, the markets aren’t stupid, and by the end of the day on Wednesday, the 10-year treasury closed HIGHER which means mortgage rates and other borrowing costs went UP after the announcement. Guess that didn’t work out quite like they planned.

Retail Sales

I mentioned last week that when consumer credit explodes at the same time as delinquent credit is increasing, the threat of recession is real. Consumers have used up any “excess” savings and the credit card debt they are carrying is starting to hurt. In August, consumers certainly seemed to feel the pinch, although retail sales were up slightly by 0.05%. If you exclude motor vehicles, sales rose 0.08%. Both increases were a surprise (full release here).

On a year-over-year basis, retail sales were up 2.1%. But that is less than the “official” rate of inflation which means that, in fact, consumers are buying less than they were a year ago. (And there is little doubt that the “official” rate of inflation is significantly under-stated so the drop in spending is likely much worse.)

The reason that overall sales grew in August was due to a strong increase in “non-store” retailers, i.e., online sales. But food services (i.e., restaurants), general merchandise stores, clothing stores, furniture stores, auto parts stores, gas stations, and grocery stores all posted declines in August.

Home Builder Confidence

Not surprisingly, home builder confidence ticked up slightly in September as mortgage rates have been slowly falling over the past few weeks (full release here). As you can see below, home builder confidence tends to move right along with the inverse of the mortgage rate and the 30-year mortgage has fallen from a high of 7.6% about a year ago down to about 6.25% today. And everyone expects that the Fed rate cut will goose the drop even more.

Digging into the components, traffic of perspective buyers ticked up slightly as potential buyers have also been tracking the mortgage rates and anticipating the Fed’s cut. But the real driver of the increase was the six-month outlook for the builders which rose above 50 for the first time since May.

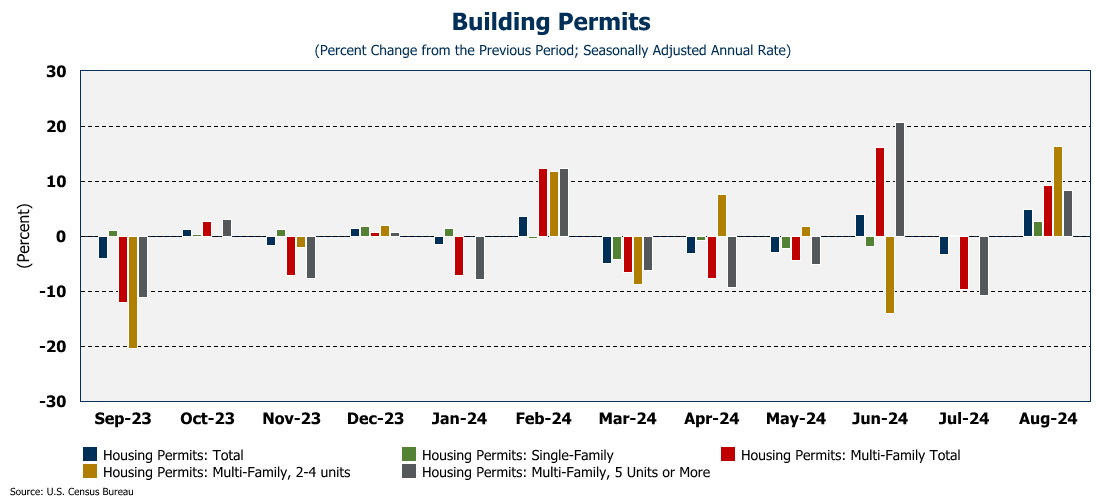

Building Permits

As a reflection of their improving confidence, building permits jumped 4.9% in August - much higher than anticipated, and the fastest monthly increase since February (full release here). The permit growth was mostly in multi-family buildings with 2-4 units, but all multi-family housing posted significant increases. Single-family permits were up only 2.8%, but that is essentially the first real increase in single-family permits since January.

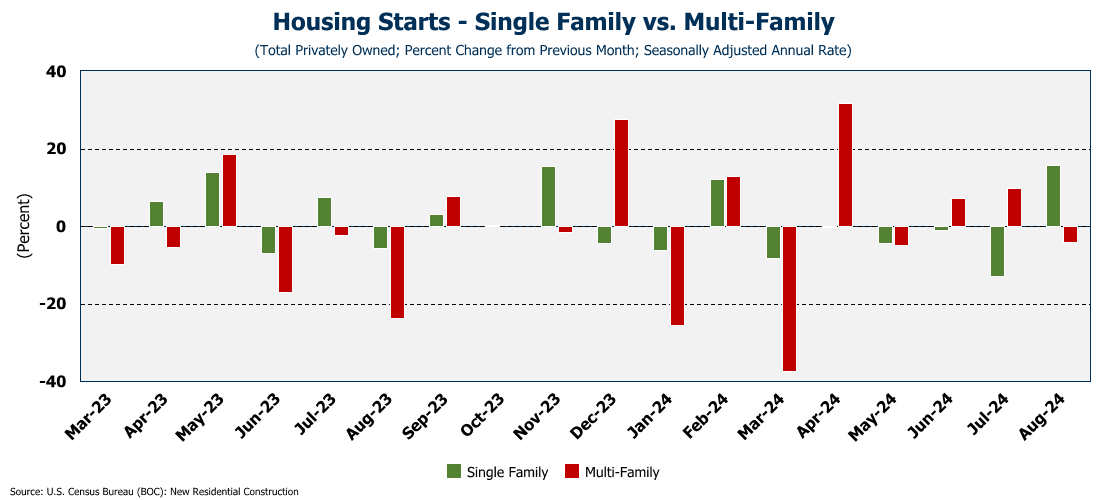

Housing Starts

As with permits, housing starts also saw the biggest monthly increase since February coming in at 9.6% in August, well above the 6.5% growth that was anticipated (full release here). Unlike permits, the growth in housing starts was all in the single-family category as they jumped 15.8% in the month. Again, those home builders are starting to feel optimistic about the future so hammers started flying in August.

Existing Home Sales

Despite the eternal optimism currently sweeping over home builders, buyers aren’t quite there yet, as existing home sales fell further to an annual rate of only 3.86 million units (full release here). That is the lowest level since October 2023, and the second slowest pace since 2010. Even so, the median price rose to $406,900 on a seasonally adjusted basis. On a year-over-year basis, sales are down 4.2% and haven’t had a positive reading since July 2021. At the same time, prices are up 3.1% from a year ago.

Sales are dropping but prices keep going up. And first-time home buyers are getting punished. In August, first-time home buyers made up only 26% of all sales, matching an all-time low. Investors or second-home buyers purchased 19% of homes, up from 16% a year ago.

One assumes that buyers have been anxiously anticipating the Fed’s cut and for mortgage rates to drop and therefore, have been holding back. Here is the problem…the market has also been anticipating this and rates have been dropping. In fact, most of the impact to mortgage rates of this cut is already built in to the current 30-year rate. And with all that pent-up demand, if rates drop, what do you think is going to happen with prices? They sure won’t be coming down.

Leading Economic Indicators

Finally this week, we have the monthly reading of the Leading Economic Index, which, once again, fell (full release here). For 32 consecutive months the index has either fallen or been flat. What is interesting is that when we shutdown the economy for COVID, the index bottomed out at 100.3 in April of 2020. In August, the index actually dropped below that level to 100.2. So, the leading economic indicators are now below where they were when the entire economy was stopped in 2020. And we are to believe that we aren’t in a recession. Right.

Update on the Strategic Petroleum Reserve (SPR)

Remember back when inflation was really running hot and the price of gas was rising and the President told us it was all due to the “Russian invasion?” You may recall that in order to relieve some of the price pressure at the pump (and in reality to relieve the political pressure of the moment) the President opened up the Strategic Petroleum Reserve (SPR) and allowed that oil to be used to bring down prices at the pump. He took nearly half of our “strategic” reserve (clearly I have an incorrect understanding of the word “strategic”) to lower consumer prices by $0.40/gallon (according to the Treasury Department) and promised to fill it again when prices dropped.

Well, prices have dropped. In fact, they were around $120/barrel when he made that move and they have been in the low-to-mid $80’s for most of this year. The administration said they would re-fill the SPR when the price dropped below $79. The price is now in the $70-$72 range.

To be fair, they have starting replacing some of the oil, but here is the problem. The Energy Department only has $841 million to buy oil. At current prices, that will buy 12 million barrels. They need to buy 270 million barrels to replenish what they took out. In other words, they are 96% short. And with the deficit already running at about $2 trillion, my guess is that the SPR will remain half-empty for quite some time. I’m not sure that saving $0.40/gallon in 2022 was worth significantly weaking our national security, but maybe that is just me.

One More Thing…

I have been saying for months that the free version of this update will be coming to an end sometime in October and I will be moving to a paid subscription model. My plan is to host live chats for subscribers during major economic events; allow subscribers to comment on all posts; and provide paid subscriber-only posts on specific topics. Free subscribers will still get some of the update, but most of it will be behind the paywall.

At least, that was my plan. However, there have been so many generous readers “buying me coffee” each week using the link below, that I am considering keeping things the way they are. Last week’s contributors included Chris Nedza, Chris Braun, and several others whose names were not attached to their contribution.

This week I am going to open up comments. I want to hear your thoughts as to how I should proceed. Please take a moment to share your thoughts and feedback - not just on the subscription model, but on any aspect of the update. Last time I did this I got some great feedback that precipitated some changes to what I provide each week. I want to make this publication as useful as possible.

And if you want to keep things the way they are…please click the link below and “buy me a coffee!” (Or several…..I do love coffee!)

Until next week……..