Weekly Economic Update 09-27-24: Consumer Confidence; Case-Shiller Home Price Index; New Home Sales; Personal Income & Spending; and PCE Inflation

Don't believe your lying eyes! The economy is great!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I am going to apologize in advance. This was a CRAZY busy week for me and I simply did not have time to dig into the data like I would have liked. There was a lot happening in the economic world with the presidents of all the Federal Reserve banks out and about talking with various groups, and trying to justify their big interest rate cut. Unfortunately, I simply didn’t have time this week to read and follow all they had to say, but I heard enough to know that they think inflation is beaten and the labor market is now their top concern. I hope they are right. I fear they are not.

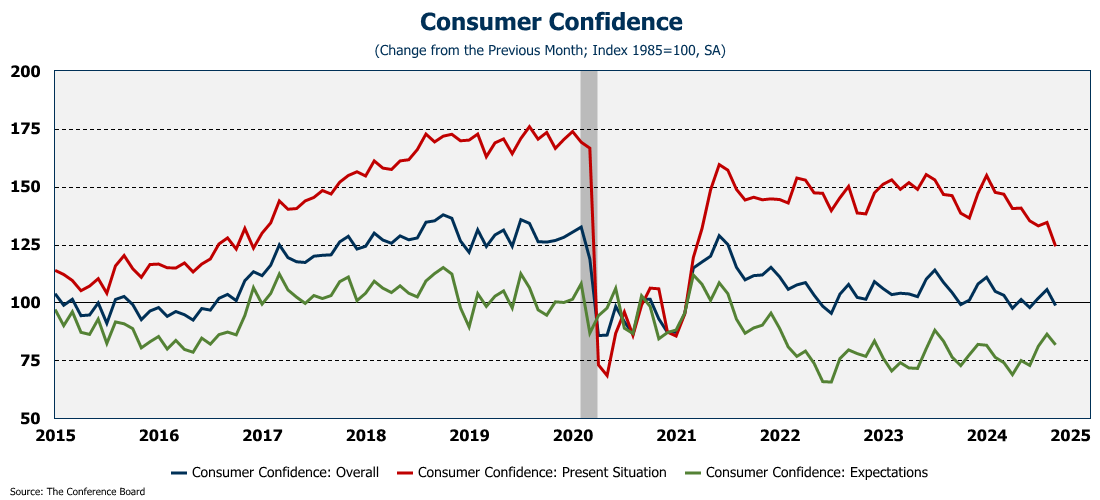

Consumer Confidence

Last week, the retail sales data showed us that consumers were feeling a little skittish about the economy, and pulled back on their spending. On Tuesday, that was confirmed as the September consumer confidence number from the Conference Board posted its largest monthly drop since August 2021 (full release here).

The drop was lead by a sharp decline in consumers’ feelings about their present situation which fell to its lowest level since March 2021. And why do consumers feel bad about their present situation? Maybe because prices are up, wages are growing slowly, and jobs are hard to come by? Makes sense. However, according to Dana Peterson, the Conference Board Chief Economist, everything is great!

“The deterioration across the Index’s main components likely reflected consumers concerns about the labor market and reactions to fewer hours, slower payroll increases, fewer job openings — even if the labor market remains quite healthy, with low unemployment, few layoffs and elevated wages”

So, to summarize what she said…people are feeling down because they think things are bad, but in reality, those people are wrong and things are actually going quite well. Or, to put it another way, don’t believe your lying eyes, everything is great!

The arrogance of these people. Maybe things are great for over-educated, highly-paid economists sitting in a cushy office in New York, but for most normal people, times are tough. And they know it….despite what Dana Peterson thinks.

Case-Shiller Home Price Index

Case-Shiller is always an interesting piece of data, because it lags so much and comes out well after the fact. Even so, it just confirms what we all know….home prices are still rising - both nationally, and in the 20 largest metro areas (full release here). Nationally, home prices were up 5.5% year-over-year in July, and 5.9% for the 20 largest metro areas. That is the slowest rate of grow in 8 months, and the rate of growth appears to be slowing, but at nearly 6%, home prices are growing much faster than the “official” inflation rate, and are certainly growing faster than incomes, making home ownership less affordable by the day.

New Home Sales

Despite falling mortgage rates, the sale of new homes in August fell 4.7% to a seasonally adjusted annual rate of 716K units. The median price also fell, but continues to bounce around the $420K level (full release here).

What is interesting, however, is that the number of new homes completed and for sale has been steadily rising, and is now at the highest level since 2009. So, that begs the question….is this still a “supply” issue? Or is it more of an “affordability” issue?

I ask, because supply is up and as rates have come down, mortgage applications for home purchases haven’t really improved that much…..

…but mortgage applications for refinancing are taking off! This shouldn’t be too surprising. Lowering your monthly cost of housing frees up cash that can go to cover other consumer spending as prices keep rising and credit card debt is getting difficult to service. It could also go to paying off some of that credit card debt. It might even be going back into the home for improvements.

However, a more interesting scenario is that it could be coming out of one home to help in the down payment of the next home. If so, then the cash unlocked due to lower refi rates will just go toward the price of new purchase, which would spark a significant increase in median home prices!

By the way, it is interesting to note that a few days before the big 50 basis point rate cut, the Bureau of Labor Statistics reported the first annual increase in shelter costs since March 2023. So, shelter inflation was already moving the wrong way and now we may be about to see even higher home prices. Great.

Personal Income & Spending

In August, both consumption and income rose, but less than was expected (full release here). In fact, the monthly rise in income was the smallest since July 2023, and consumption saw the weakest growth since January. The isn’t surprising as we got very weak retail sales numbers for August just last week.

Unfortunately, this month also brought MASSIVE revisions in the historical income and consumption data. Since it was just released this morning, I am going to have to take some time to dig through all that and report on it later. However, one big change was the savings rate, which miraculously, has nearly DOUBLED from all previous reporting! Last month savings for July was reported to be 2.9%. Now, the July rate has been revised to 4.9% and August dropped slightly to 4.8%. Magic.

One more interesting note in the data. You can sure tell that it is an election year! Look at how the government has been handing out money since January! Can you imagine where the consumer would be if the government wasn’t pumping out over $4.4 trillion in transfer payments to your fellow citizens?

Personal Consumption Expenditure (PCE) Inflation

What you are going to hear in the media today is that the personal consumption expenditure (PCE) measure of inflation dropped again in August to 2.1% proving that the Fed has almost achieved their target and inflation has been beaten (full release here).

What you are NOT likely to hear is the following:

Core PCE, the Fed’s favorite measure of inflation, ROSE for the second month in a row from 2.6% to 2.7%, the highest since April.

Services PCE ROSE to 3.7% after having been falling for 4 months.

PCE “Super Core” ROSE to 3.3% after also having been falling for 4 months.

So no. Inflation is still with us. Now that the Fed has started their cutting cycle, and, if their speeches this week can be believed, they expect to go at least another 100 basis points in the near future, we can expect another wave of inflation to really pick up sometime next year. Thank you Chair Powell.

One More Thing…

I opened up comments on last week’s post to get reader input on whether or not I should move forward with my move to paid subscriptions or stick with the “buy me a coffee” strategy. Not a single person responded via comment.

However, in a way, many of you did respond…by “buying me a coffee!” Special thanks this week to Joel Richwine, Tommy Jennings, and my buddies Steve Goins and Dave Gmeiner who all contributed. Plus one or two others whose names were not attached to their contribution. If this keeps up, I won’t need to move to a paid subscription and will keep everything as is. If it drops off, I’ll re-visit it then. So, if you enjoy this update and want to keep it going, please click the link below.

Finally, I enjoyed seeing many of you last week in Savannah. I was so encouraged by all of you who came up and told me how much you enjoy this weekly blog. I was also happy to hear about how many of you share it. Please keep it up! My next goal is 1,000 subscribers, and at this pace, I think I can hit that in just a few months.

Thanks again.