Weekly Economic Update 1-10-25: ISM Manufacturing; ISM Services; Consumer Credit; JOLTS Report; and December Employment

Consumer credit plunged in November as job hiring continues to slow...or does it?

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I opened up “comments” on the post last week and asked readers for feedback on ways I might improve this weekly post. I got exactly ZERO comments. I of course take that to mean that the Weekly Economic Update is perfect and needs no improvement.

Of course, that isn’t true. I’ll open up comments on a more frequent basis (possibly the first post of each month) and I look forward to getting some constructive criticism.

Not a lot of economic data this week, especially since the Federal Government was closed on Thursday for a “National Day of Mourning” and the funeral of former President Jimmy Carter. However, several members of the Federal Reserve Bank Board of Governors spoke this week, beginning with Christopher Waller, who, backs even MORE rate cuts in 2025. There were several memorable quotes from Waller’s talk, but one of my favorites was that price increases will not have “a significant or persistent effect on inflation and are unlikely to affect my view of appropriate monetary policy.” Huh?

Waller went on to say that he expects “a significant step-down in the 12-month inflation numbers through March.” OK. We’ll just have to see how well that forecast ages over the next three months. I’ll take the other side of that bet.

Speaking of inflation, some of my long-time readers will remember a segment I would occasionally include here called “Stupid Economic Statement of the Week.” I think the most recent edition was last May, and it came to us from Jared Bernstein, the Chair of the Council of Economic Advisors. However, most of these segments have come from Paul Krugman, Distinguished Professor of Economics at the Graduate Center of the City University of New York, Nobel-Prize winner, recently retired NYT columnist, and political shill. And it is that last one that gets him in trouble. Letting politics cloud your economic judgement can often lead to stupid economic statements. Well, this week, he is back!

And not only is he back, but now, as of December, he is publishing a DAILY Substack! Oh the ocean of “stupid economic statements” that this will produce! Unfortunately, I won’t have nearly enough time each day to wade into this vast wealth of nonsense. But perhaps I can occasionally bring you a nugget or two. Like this Wednesday when he suggested that the recent rise in the 10-year treasury may “reflect the horrible, creeping suspicion that Donald Trump actually believes the crazy things he says about economic policy and will act on those beliefs.”

No Paul, it doesn’t. It simply reflects that the bond market (and most everyone else that doesn’t work for the Fed) realizes that inflation has not been beaten and that the Fed’s intention of continuing rate cuts is only going to make the problem worse. Add to that the complete inability of the Federal Government to demonstrate any sort of fiscal responsibility, and the bond market is simply saying, “you have to pay me more of a premium to take on this risk.” It is simple economics Paul. And if you wouldn’t let your politics cloud your judgement, you would see that.

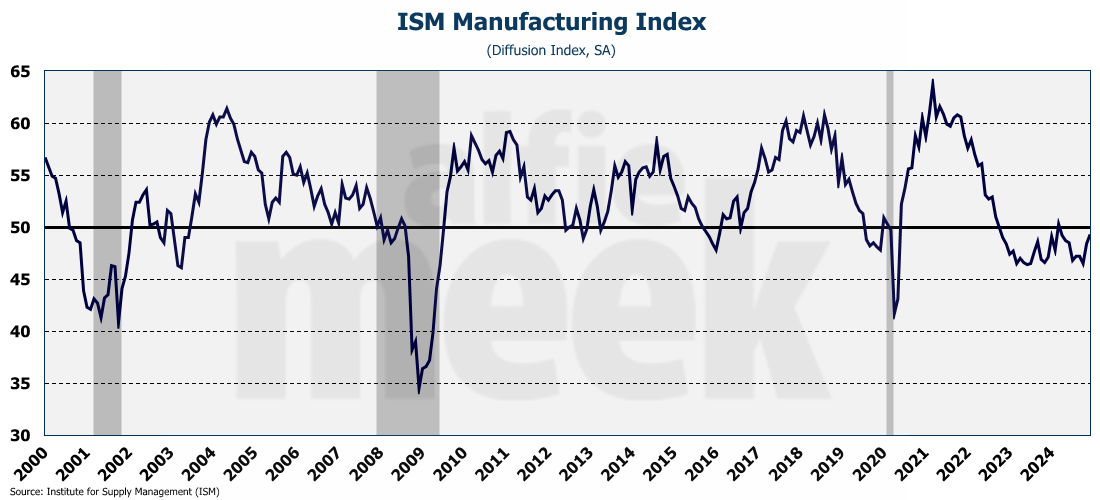

ISM Manufacturing

The ISM Manufacturing Index for December is still in contraction territory, but did rise in December to 49.3 which was higher than expected (full release here). By way of reminder, this is a diffusion index which means that if the number is less than 50, the sector is contracting, and if above 50 the sector is expanding. As you can see, with the exception of one month, manufacturing has been contracting since October 2022.

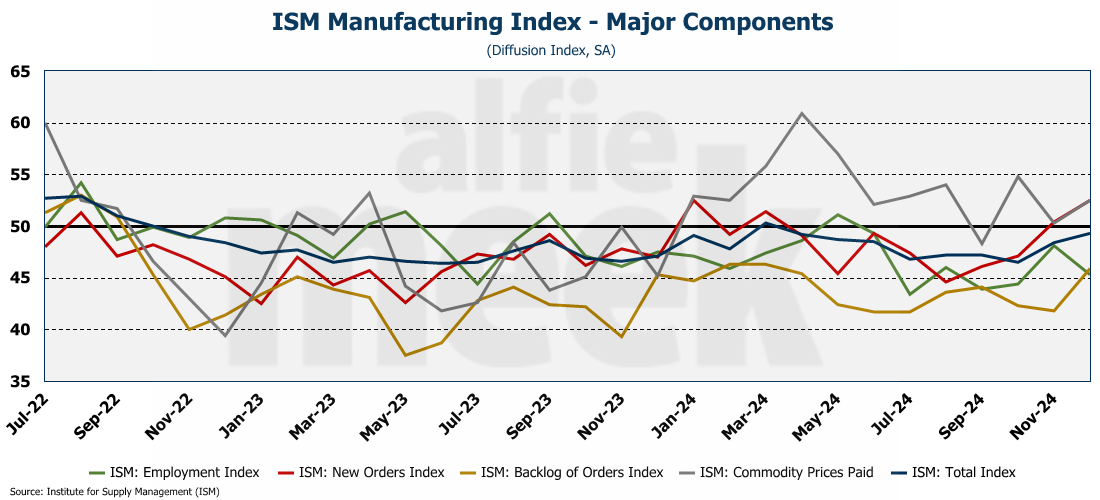

Looking deeper into the data, the new orders sub-index rose, but is still well below 50. Prices paid also rose, and that sub-index is well above 50 suggesting that manufacturers are facing increasing prices…not a good indication of future inflation.

Unfortunately, the employment sub-index fell further suggesting further weakness in manufacturing employment. It will be interesting to see what we get Friday in the December employment report.

Of note, JP Morgan compiles a similar diffusion index for the entire GLOBAL manufacturing sector. The data isn’t public so I don’t usually report or have access, but they did announce that the entire global manufacturing sector fell below 50 at the end of 2024, indicating a contraction in manufacturing around the world.

ISM Services

If manufacturing is in a slump, the same can NOT be said for services. The ISM Services Index rose in December to 54.1 - well past expectations and the third highest reading in 16 months (full release here).

However, once again, we need to look under the hood. The Prices Paid sub-index absolutely exploded from 58.2 to 64.4 which is the highest reading since February 2023. How long have I been writing that inflation has not been beaten. And on this data, the odds for more rate cuts have fallen sharply.

The Employment sub-index dropped slightly, but remains well over 50 suggesting that employment in the service sector continues to expand.

Consumer Credit

Now for the shock of the week. Total consumer credit fell $7.5 billion in November. And while that is surprising in and of itself, the bigger shock is that the entire drop was driven by revolving credit (i.e. credit cards) which fell a whopping $13.7 billion! That is the biggest monthly drop since the COVID crash shut down the economy (full release here).

This drop in revolving credit is significant. Take a look at a long-term graph of revolving debt, and notice that drop at the end. You just don’t see those types of changes in a single month outside of, say, a global pandemic or significant recession.

For some reason, the consumer hit a wall in November and decided to stop spending. Perhaps consumers decided that buying more stuff while carrying a balance at 22.8% isn’t the best financial move. Or maybe, with Christmas coming up, they took a breather before extending themselves even further. Certainly, this makes the December number all the more interesting. Was this just a one-time breather, or has the consumer finally hit a wall? One thing is certain….every previous time revolving debt fell this much, the U.S. was all ready in, or about to enter, a recession.

Job Openings and Labor Turnover Survey (JOLTS)

The Bureau of Labor Statistics (BLS) reported an unexpected jump in job openings in November as the number soared to nearly 8.1 million (full release here). That is the first 8+ million number since last May. That is the second consecutive monthly increase, and it occurs at the same time the number of unemployed people is also moving higher. That is the largest two-month increase since March of 2022 when we were still dealing with COVID impacts.

With the number of job openings rising, openings still exceed the number of people looking for a job. What is interesting is that even with job openings rising, the number of hires dropped significantly in November and hiring has clearly been trending down since early 2022.

Not surprisingly, with hiring slowing and the number of unemployed rising, the quit rate has fallen sharply and is now down to it’s lowest level since June of 2020 and well below pre-COVID levels. Clearly, workers are not optimistic about their ability to find a better, higher-paying job in this environment.

December Employment

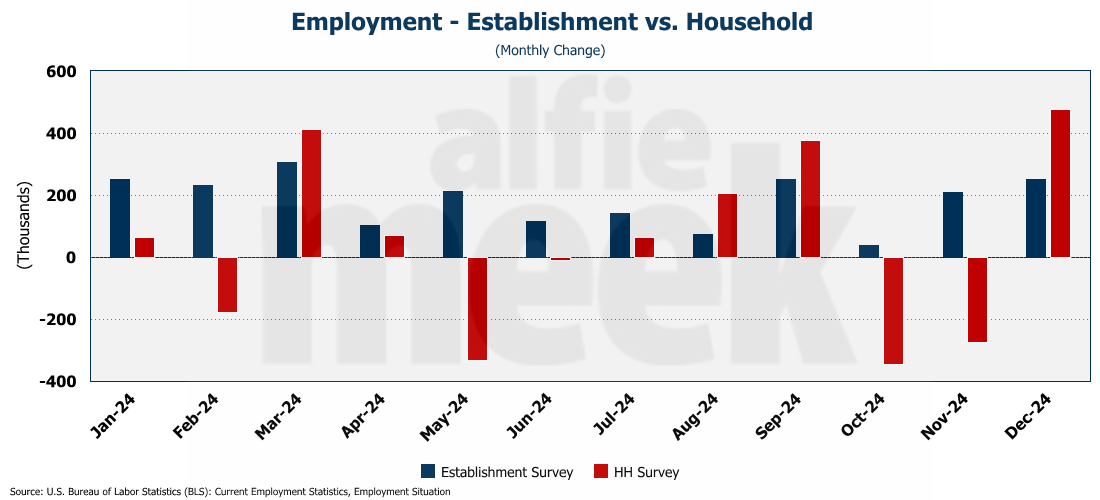

Which leads us to the final employment reading of 2024. “Experts” were expecting 160K new jobs and for the unemployment rate to remain steady at 4.2%. But the report provided quite the surprise….in December there were 256K jobs added to the economy and the unemployment slipped to 4.1% (full release here).

Employment as measured by the household survey performed even better with household employment rising 478K after two months of declines. Unfortunately, most of those were part-time jobs. But it was enough to drop the unemployment rate slightly to 4.1%. The broader measure of unemployment known as “U6” fell sharply from 7.7% to 7.5%. That is a 6-month low. For those that may not be aware, U6 takes the standard unemployment rate and adds to it those who are marginally attached to the workforce or are working part-time for economic reasons. It is a somewhat better measure of the available labor force, and it dropping suggests a tightening labor market.

So wait a minute….the quit rate is falling, new hires are falling, but job creation is rising faster than expected and unemployment is falling? That doesn’t seem right. Something is off a little in the data, unless those new establishment jobs are mostly part-time. The household data suggests that may be the case.

So, what does all this mean? It means that the Fed had it wrong. (No surprise there.) Rising employment of this magnitude and a falling unemployment rate is inflationary. As of this writing, the 10-year yield is up 10 basis points. (So much for mortgage rates coming down any time soon.) The betting markets are now expecting only 1 rate cut in 2025 and that not until much later in the year.

Christopher Waller and many of the other Fed Governors are simply wrong. Inflation is going to continue to be a problem for 2025, and frankly, it is the biggest threat to the new administration’s agenda. But maybe that is what the Fed wants.

One More Thing…

Finally this week, I want to thank all my “bronze” level members who subscribe for just $8/month. Dave Gmeiner, Steve Goins, Colin Martin, Brad Wood, Tommy Jennings, Carlos Alvarez, Chad Teague, and someone with a “GTwreck” e-mail! Thanks for all your support!

As I do each week, I want to invite you to join this admirable group and click/scan the QR code below to join or just “buy some coffee” in support of this weekly update.

I could turn on “subscriptions” within the Substack app, but that would then put this behind a paywall and I want to continue to build my audience. Several of you have committed to a subscription in Substack, but have not yet converted that commitment to “Buy me a coffee.” If you want to support this effort, I encourage you to do that.

Until next week, stay warm and enjoy the weekend.