Weekly Economic Update 10-03-25: JOLTS; Case-Shiller Home Prices; Consumer Confidence; ISM Manufacturing; and September Employment

The Federal Government shut down on Tuesday night. Has anyone noticed?

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

First things first…

HAPPY BIRTHDAY, MOM!!

(Not that she subscribes or reads this, but maybe someone will tell her…)

I write a LOT about inflation, mostly because it is an insidious tax that lowers our standard of living, increases poverty, eats away at our savings, increases interest rates, discourages investment, and suppresses consumer demand.

During the inflationary period we have lived through since 2021, there has been a disproportionate focus on the price of eggs. I can only assume that it is because everyone buys eggs, and so it became the benchmark for the “average” person’s cost of living. However, for the past five months, there has actually been deflation in egg prices as they have come back down to late 2022 levels. That is still high, as those were the days of 8%-9% inflation, but 2022 reset the price level for just about everything. You can buy eggs today for what you paid in late 2022.

No, eggs are not the problem. Of far more importance are those price increases that affect your very soul. That one thing that represents the very essence of life itself, and without which, the “pursuit of happiness” is but a meaningless concept, leaving one void of any real purpose.

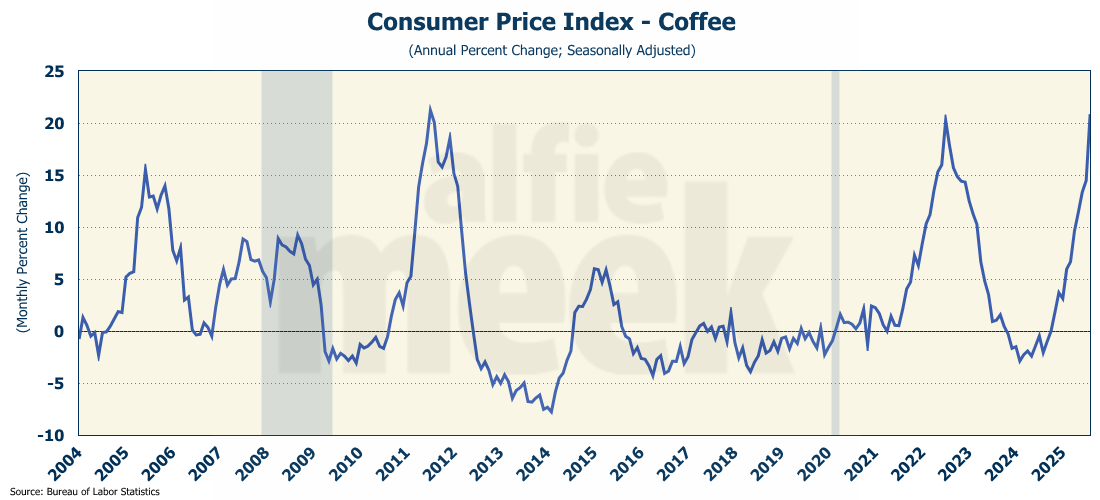

Of course, I am referring to coffee.

Coffee prices are simply out of control. On an annual basis, coffee inflation is running at 21%. That is higher than during the 2022 inflation peak, and is, in fact, the second-highest rate since they started tracking the price.

Because the U.S. lacks any capacity for large-scale domestic production, we produce less than 1% of what we consume. According to the Food and Agriculture Organization (FAO), global coffee prices are rising due to supply disruptions and poor weather in Vietnam, Indonesia, and Brazil. Brazil, in particular, is experiencing a drought that is impacting coffee production and is sure to raise prices further.

This can not stand. Given that the state legislature, in its infinite wisdom, once again decided not to provide me with even a cost-of-living adjustment, much less a merit pay increase, these coffee prices are eating into my rapidly depreciating income.

I am appreciative to all of you who regularly “buy me a coffee” in support of this weekly missive. I love coffee, and probably drink way too much. I once read that coffee is a metaphor for life. All of our jobs, money, and position in society are the cups. They are just tools and structures that contain the current story of our lives. The type of cup we have does not define, nor change, the quality of life we live. Sometimes, by concentrating only on the cup, we fail to enjoy the coffee.

So, enjoy the coffee…while you can still afford it.

Now on to the data. Due to the government shutdown on Tuesday, some data wasn’t released, including the monthly employment report, which was supposed to come out this morning. If the federal government remains closed, next week’s update will be quite short, and you may be subject to more coffee-like essays…

Job Openings Labor Turnover Survey

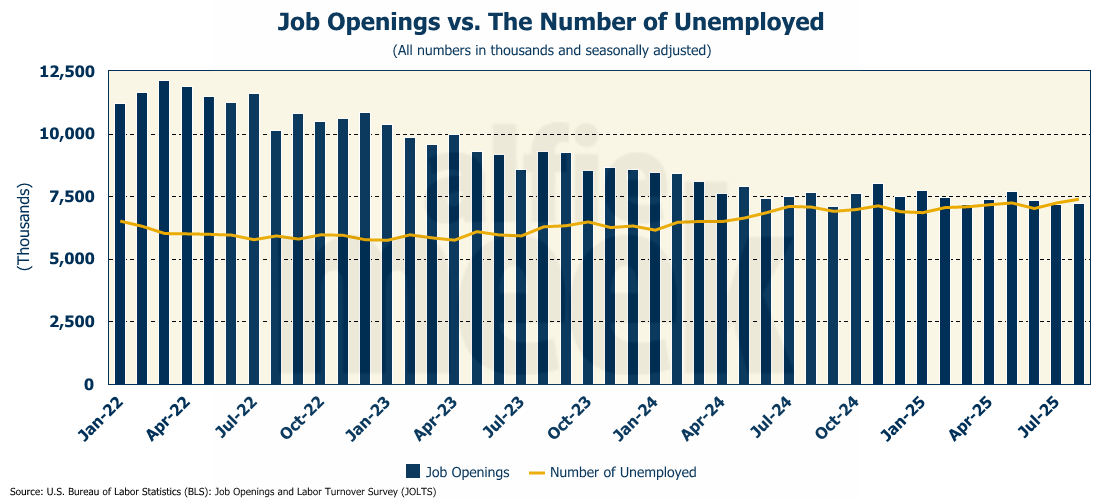

The week started on a sour note as the Bureau of Labor Statistics reported that job openings in August remained flat at 7.2 million, less than the 7.4 million level of unemployment (full release here). As I have mentioned before, we have never entered a recession when there were more job openings than unemployed workers (i.e., the labor market was supply constrained). As of July, we are no longer in that situation.

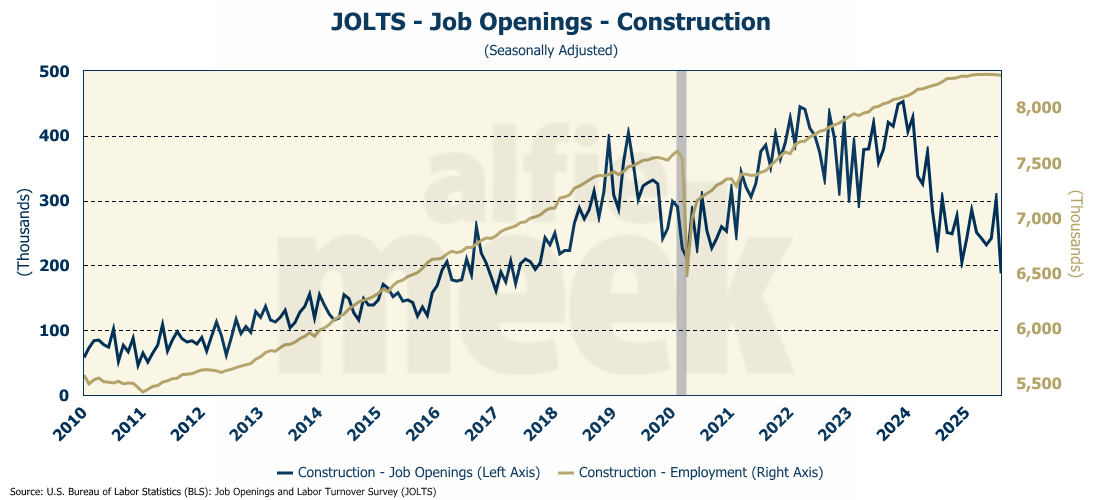

Job openings were weak across the board, but the decline in job openings for the construction sector is an ominous indicator of current and future economic conditions. Surprisingly (and somewhat inexplicably), overall construction employment remains high.

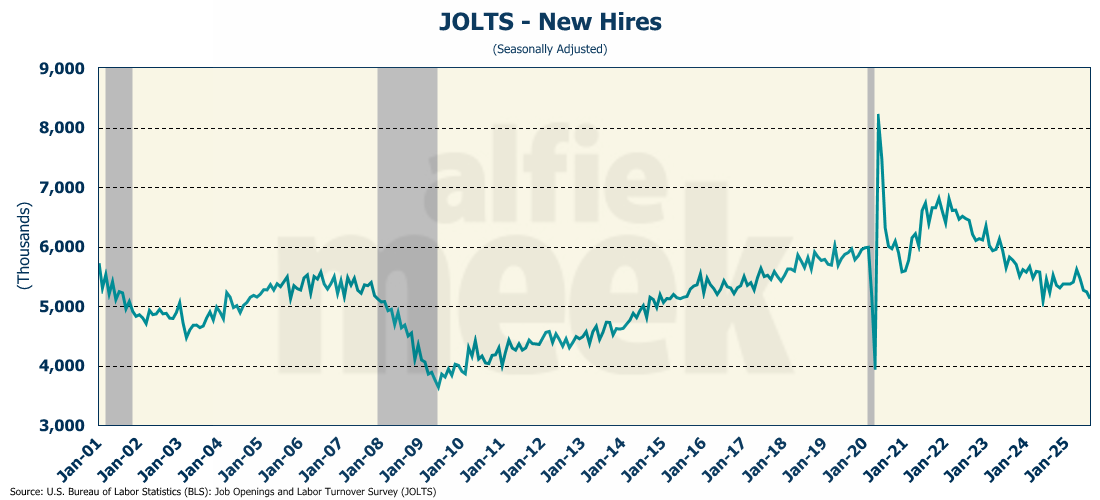

Continuing the poor news, the number of new hires fell to 5.1 million, the lowest since June 2024, and the second lowest since the COVID collapse in 2020.

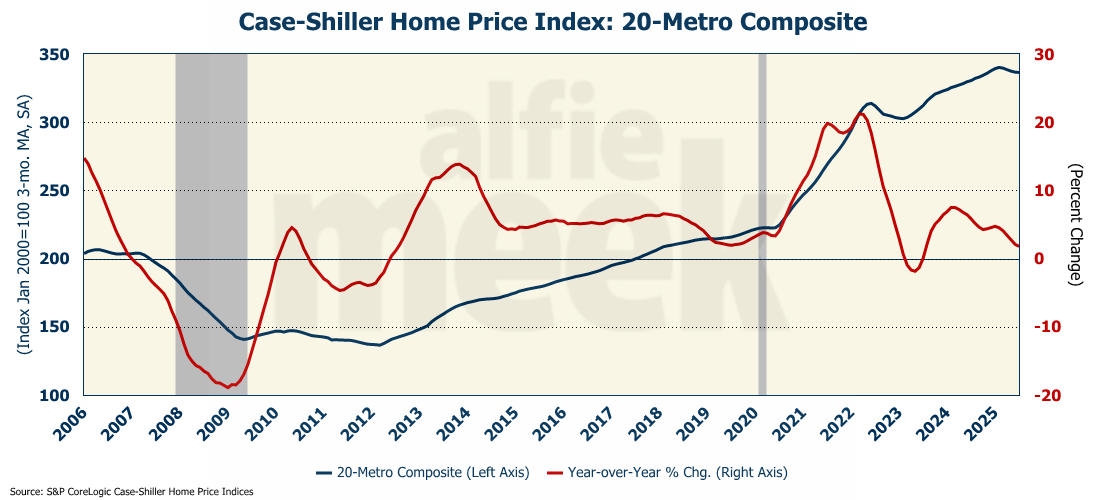

Case-Shiller Home Price Index

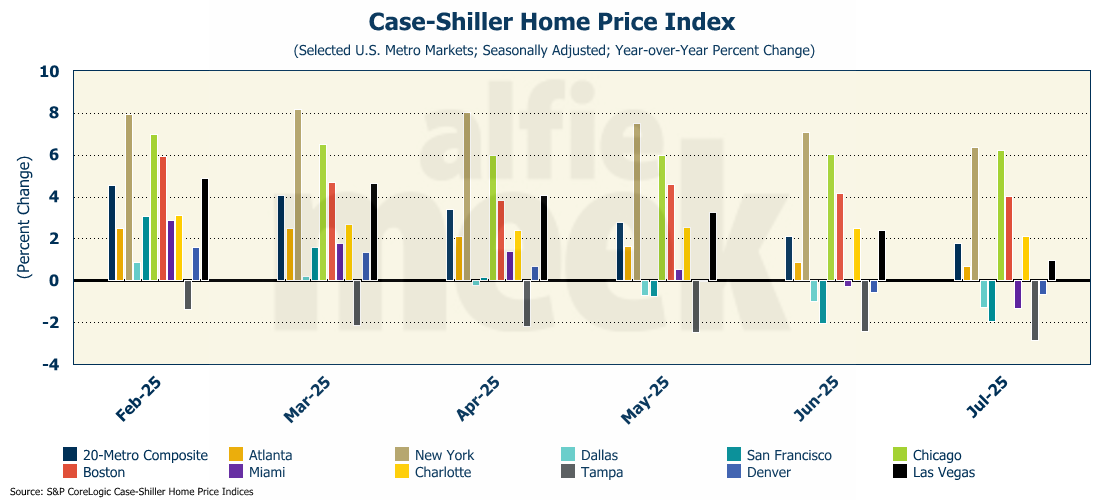

The Case-Shiller Home Price Index for July confirms what the more recent data has been telling us - that home price appreciation is slowing, if not in outright decline. According to Case-Shiller, in July, prices were up 1.8% over last year in the top 20 U.S. metro markets (full release here). However, that rate of growth is clearly slowing, and on a month-over-month basis, prices have actually been falling since March.

Looking at the markets individually, Tampa continues to lead in the decline, where prices are now down 2.8% from last year. In March, Tampa was the only metro market that was experiencing declines. Now seven of the 20 are showing a decline year-over-year.

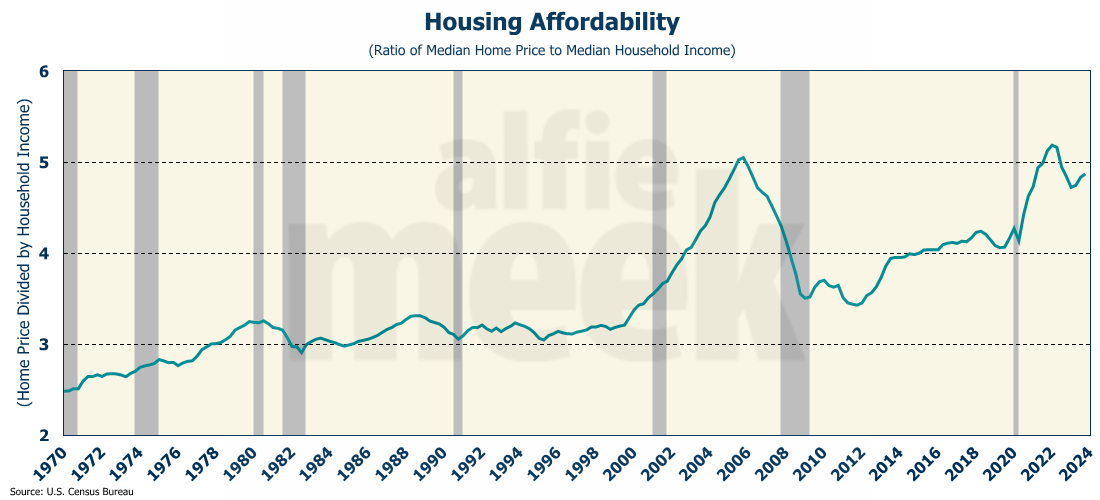

Fannie Mae recently released a report that said for housing affordability to get back to 2019 levels, one of three things had to happen:

Median home prices needed to drop by 40%

Median household income needed to rise by 60%

Mortgage rates needed to drop below 2.5%

None of those things is going to happen. Prices are starting to moderate, but housing will remain largely unaffordable (by recent historical standards) for quite some time.

Unless, of course, you believe the National Association of Realtors (NAR), whose “Housing Affordability Index” is sitting at 103, which means that the median income should be able to afford the median-priced home at current rates.

No offense to my many readers who are realtors, but I think the NAR is full of rubbish. How can this possibly be? In 1986, the index was at 100, and at that time, the ratio of the median home price to median income was 3.0. Now, they once again say the index is at 100, but the ratio of median home price to median income is 4.8. Both things can’t be true. Yes, the mortgage rate was higher in 1986 (10% vs. 6.5% today), but even taking that into account, I ran the numbers, and, as my friend from south Alabama says, “the math ain’t mathin’.”

But let’s be honest…the NAR is a private organization with a motive to convince people that housing is affordable. Try convincing first-time home buyers that housing is affordable. They aren’t buying it (pardon the pun) as the number of first-time home buyers has fallen to historic lows, and the average age of a first-time home buyer is at an all-time high of 38. Until prices or rates fall dramatically, or income rises dramatically, housing will remain largely unaffordable for the average consumer.

Consumer Confidence

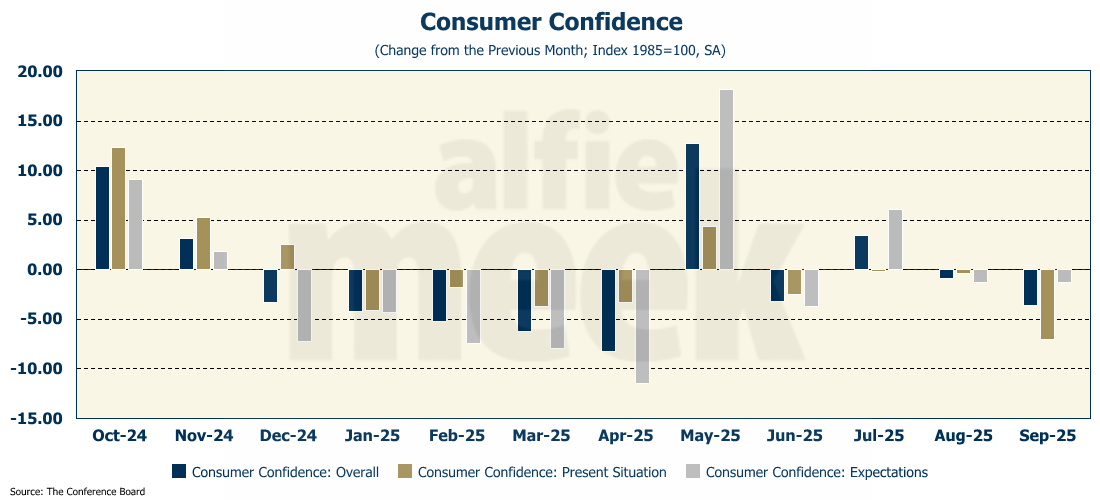

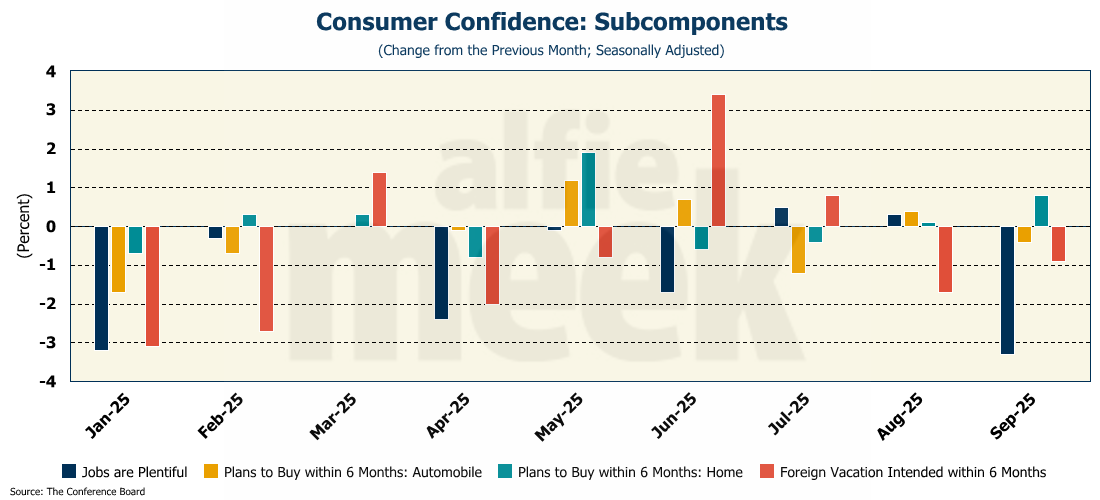

Consumer confidence plunged in September as consumers are worried about the labor market (as well they should be). According to the Conference Board, confidence fell 3.6 points, driven by a 7-point drop in consumer confidence in the present situation (full release here).

Digging into the data, the number agreeing with the statement “jobs are plentiful” fell to the lowest level since COVID. The number of consumers planning to buy a car or take a foreign vacation in the next six months also fell. Interestingly, the number of consumers planning to buy a home in the next six months was up, likely due to the recent pull-back in mortgage rates.

ISM Manufacturing

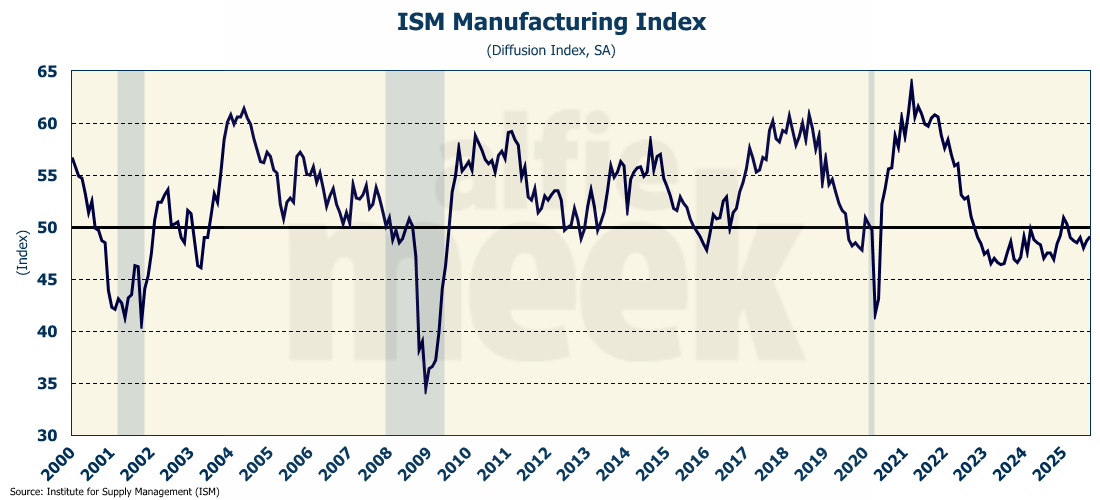

For the seventh consecutive month, the ISM Manufacturing Index shows the sector is contracting (full release here). For September, all the sub-indices were also below 50 - employment, new orders, and back orders. Of course, the only sub-index above 50 is the prices paid index, which is down from the highs earlier in the year, but still well above 50.

According to one transportation executive cited in the report:

“We believe we are in a stagflation period where prices are up but orders are down … customers are not willing to pay the higher prices, so they are just not buying.”

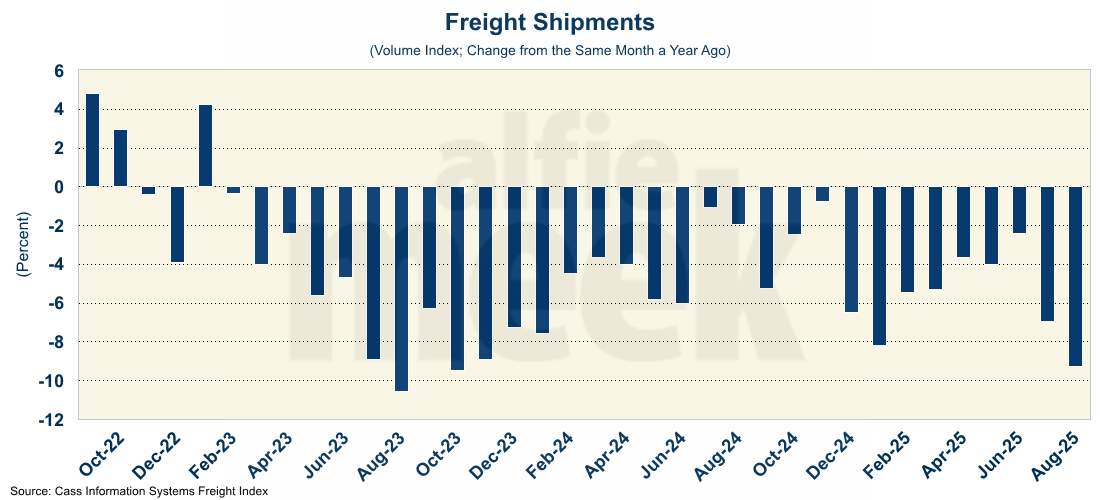

While the ISM survey is considered “soft data,” there is a piece of “hard data” that I like to look at - the volume of freight shipments. And, if you look at that, it confirms what the index is telling us. Freight volume has been down on a year-over-year basis for 31 consecutive months…about the same length of time the ISM index has generally been below 50.

If they aren’t shipping, they aren’t manufacturing. The sector is clearly in recession, if not stagflation, as suggested by the executive quoted above.

September Employment

Due to the government shut down, we didn’t get the official BLS employment data for Septebmer today. However, on Wednesday, ADP released its numbers for September private employment. I don’t usually report on the ADP number as it always comes out a few days before the official BLS estimate, and I would rather go with the official government number - despite the recent ineptitude of the bureau’s data analysts. However, if there is no official government number, I’ll go with what I have. (By the way, on Wednesday, the President pulled his nomination for E.J. Antoni to lead the BLS, so the job is available if any of you are interested…)

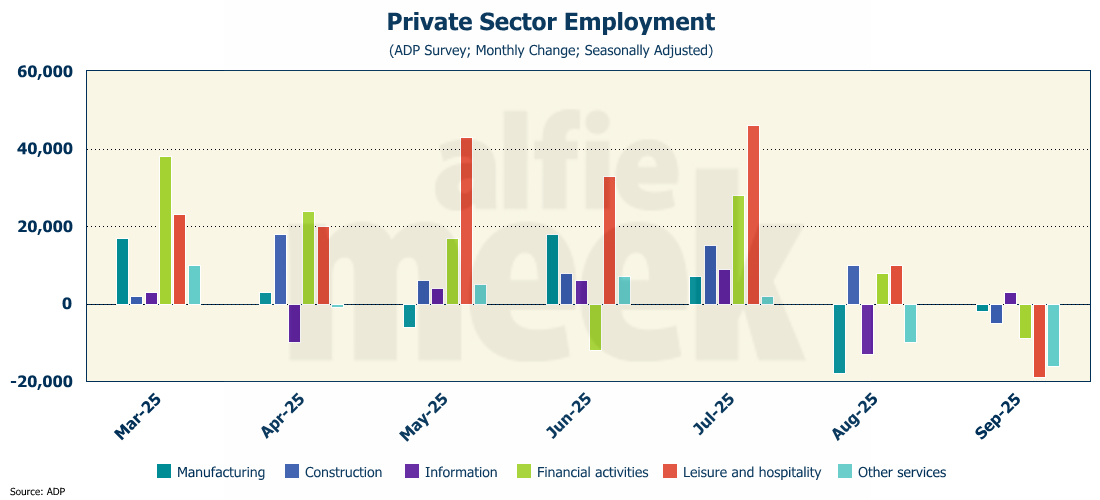

According to ADP, private-sector payrolls DECLINED in September by 32K (full release here). ADP doesn’t always match BLS. In fact, sometimes they are significantly different. But often the trend is consistent. In June, both showed a decline in overall private sector employment. In August, ADP was down 3K while BLS showed weak, but positive growth. For September, ADP is down 32K. Maybe it is good that the BLS is closed…

Looking at specific industries in the ADP report, nearly every major sector experienced job loss…manufacturing, construction, financial, leisure, and other services. Only information technology showed any job growth in September.

Given that the government shut down on Tuesday, the JOLTS report could be the last “official” government employment data we get for a while. Looking at both the BLS and ADP data, as well as the JOLTS data discussed above, it is clear that the labor market is slowing. That could encourage the Fed to cut rates further when they meet later this month. And that will only lead to even higher inflation.

One More Thing…

On the first post of the month, I like to recognize my gold and silver members. Special thanks to my two “gold” level members, Andrew Hajduk and Beth Truelove, with the White County Chamber of Commerce, and my three “silver” level members, Dan McRae, Chuck Fitch, and Greg Whitlock. Their support helps cover the costs associated with putting this together each week. (And supports my coffee habit.)

As previously mentioned, if you would like to help support this effort, please consider clicking the link below and “buy me a coffee” or two. Your support is greatly appreciated.