Weekly Economic Update 10-04-24: Gold and Silver; Longshoremen Strike; ISM Manufacturing and Services Indices; and September Employment

Rising gold; wage demands; higher service costs, and a tightening labor market...inflation is coming back

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

This has been a very interesting week. In the same week I was required to appear for jury duty in my home county I was also subpoenaed to appear in another county to testify in a criminal trial! What are the odds?

Fortunately, spending a lot of time sitting in various courthouses around the state this week did allow me some time to read up on economic data. Several things captured my attention this week. One was the recent price movement in gold and silver…

Gold and Silver

If you follow precious metals at all, you know that the price of gold has been moving up rapidly in recent weeks. Gold is, of course, a hedge against inflation and a store of value. In that regard, it is “real money” since being a “store of value” is a primary function of money. (And I mean money in the truest sense…not “currency” which has very little store of value as we have seen in recent years.)

So, if gold is an inflation hedge, how does it compare against the “official” measures of inflation. If you just graph the levels of each, you get this…

That makes it look like gold is about where it should be given the level of inflation. However, that isn’t the correct way to look at it. The question really is, how have both changed in percentage terms. And if you do that, you get this…

So, while the “official” CPI says that prices have risen 212% since 1984, gold suggests that the number is more like 565%, or nearly 2 1/2 times as much!

By contrast, over the same period, silver has performed more in-line with the “official” CPI growing just slightly faster than CPI…

I have read a lot of articles recently that have claimed that “historically this ratio has averaged between 40:1 and 60:1.” That is actually not correct. Looking at the data, at least since 1984 to February 2020 (pre-COVID), the average has been 66:1 with a standard deviation between 54:1 and 79:1.

Now to be clear, I do not EVER give investment advice. However, this ratio might suggest that silver has some upside potential should you be so inclined to purchase precious metals.

On the other hand, it could mean that gold has gotten way out over it’s skis…but I think not. International market’s don’t typically work that way.

So, we are left with the interesting question “why is silver lagging gold in price appreciation?” Frankly, looking at the graph, the ratio has been around or above 80 since 2016. This isn’t a recent phenomena.

Let me suggest this…

As I pointed out back in April, the relationship between gold and the inflation-adjusted rate on the 10-year treasury is inverted...as the real rate on the 10-year treasury goes down, gold prices go up. In other words, when fiat money (currency) becomes cheap, "real" money rises in value. However, recently, as real rates continued to rise, so did gold.

Why? There are a number of possible reason, but I think one is because much of the world holds dollar-denominated U.S. debt as an asset on their books. However, we are printing money and issuing debt far in excess of what we will ever be able to pay back. The rest of the world, and certainly other central banks, understand this. They further understand that the only two ways out of this debt is an eventual outright default, or an implicit default through currency debasement. And the rest of the world is hedging against this eventual outcome and thus, there has been a much larger than normal demand for gold. And when demand for something goes up relative to supply, so does the price.

Silver simply doesn’t hold the same role as gold as an international currency foundation. Ergo, the price hasn’t kept pace with gold.

Longshoremen Strike

Something else caught my eye this week. In case you haven’t watched any news (and who could blame you) the International Longshoremen's Association (ILA) went on strike this week. The ILA is the largest union of maritime workers in North America, representing roughly 85,000 longshoremen, many of which work on the Atlantic and Gulf Coasts. I only mention it here because it had the potential to have a huge impact on the U.S. economy.

Late last night, they agreed to a very short-term agreement (or “suspension of the strike”) through January 15, 2025. Frankly, that isn’t surprising. I think if they had tried, the ILA couldn’t have over-played their hand any worse than they did. (And having a union leader who makes $900,000 per year as your spokesman probably isn’t the best idea either.)

Now, to be fair, the strike wasn’t a surprise. Everyone knew it was coming. Personally, I was convinced that the President would invoke the 1947 Taft-Hartley Act and order them back to work for a 90-day “cooling off” period. I mean, there is a major election coming in one month! There was no way the administration was going to allow a potentially major economic disruption one month before the election.

Once again, I was wrong. The President said he would absolutely NOT invoke the Taft-Hartley Act. He said he “doesn’t believe in it.” Wow. Give the man credit for sticking by his principles, but from a political perspective, that was suicide. (But then again, he isn’t running.) But apparently, even without Taft-Hartley, someone got to the ILA leadership and told them how badly this strike was playing in the political arena. They quickly agreed to work until just before the inauguration of the new President.

Why did they have to get them back to work before the election? Because going on strike and limiting the import of goods critical to the needs of western North Carolina, which is barely hanging on by a thread, was a horrible political move. A major purpose of the Taft-Hartley Act was to restrict what unions can do during periods of “national emergency.” You think the people in western North Carolina feel like they are in a “national emergency?” (Oh, and by the way, North Carolina is a “swing state.” Again…not surprising that someone got the ILA to take a deal to get this issue beyond the election.)

Or how about this for a bad political move - asking for a 77% pay increase (over 5 years) while everyone else’s wages are growing significantly less, AND OPENLY THREATENING TO KILL THE ECONOMY IF YOU DON’T GET IT! Look, I get it. Inflation stinks. What the ILA wants is compensation for past inflation (since they too have fallen behind in real terms) as well as some protection against future inflation - to which, ironically, their demands are going to significantly contribute. However, under the current contract, depending on seniority, a longshoreman can make between $150,000-$250,000 per year! There are a lot of people out there who would love to make that much money. Threatening to ruin everyone’s Christmas if you don’t get paid more than a 2nd year physician with 10+ years of college just isn’t a good look. (Perhaps a refresher of Dale Carnegie’s How to Win Friends and Influence People is in order.) But it’s OK, because last night they “settled” for a mere 62% raise.

But the one that really gets me is their demand for no future use of automation - and this issue is NOT yet resolved. Are they seriously asking for this?!? Chinese ports are fully automated, as are many European ports. Are they looking to make American ports the most labor intensive and inefficient in the world? Again, I get it…innovation causes disruption. People lose their jobs. Ask the makers of buggy whips or photographic film. I’m sorry your skill set doesn’t translate into any other industry, but you can’t stop innovation. Remember President Obama’s “war on coal?” Remember when NPR, The New York Times, and other media outlets suggested that coal workers should “learn to code?” Might want to think about signing up for some Python classes.

But for now, all is well. If you were one of those people at Sam’s Club last week that purchased 5 years worth of toilet paper, you may want to make sure you still have your receipt.

ISM Manufacturing Index

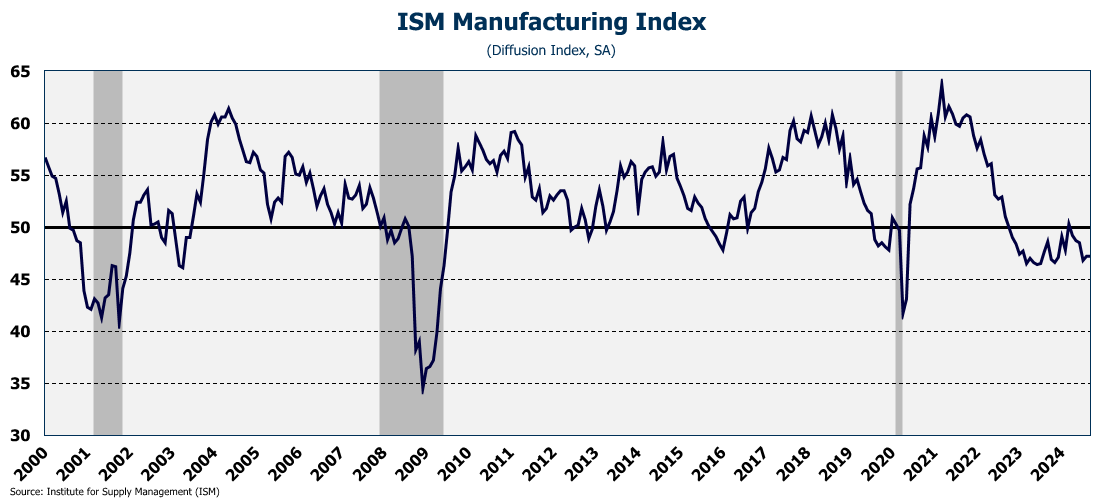

In September, for the 22nd time in past 23 months, manufacturing activity in the U.S. contracted (full release here). The index came in worse than expected at 47.2 - the same level as last month. Remember, this is a diffusion index so any reading above 50 represents expansion and a reading below 50 means contraction.

Under the hood, we see that manufacturing employment continues to decline and the Employment Index is getting back to COVID lows. The New Orders index also shows the sixth consecutive month of declining orders.

If there is one bright spot in the report, for the first time in 9 months, the Prices Paid Index fell below 50, meaning that prices paid actually declined during the month, which takes a little pressure off rising prices. However, that is of little comfort as geopolitical events may soon drive energy prices higher. Combined with the Longshoremen 62% pay increase, which is sure to lead to much higher costs, there is significant upside risk to future inflation.

ISM Services Index

If the ISM Manufacturing index showed weakness in September, the services index showed the exact opposite (full release here). The index exploded in September to 54.9 - the highest it has been since February 2023! The improvement was driven my a large increase in new orders, which also rose to their highest level since February 2023.

Unfortunately, the Services Employment index dropped below 50 indicating a net loss of jobs in the sector despite the increase in overall activity. Also of concern was the fact that prices paid also rose for the fourth consecutive month, and are now at the highest level since January. Inflation in the service sector is coming back, and given that two-thirds of consumer spending is for services, perhaps this wasn’t the best time to cut the Federal Funds rate by 50 basis points.

Signals for the return of rising inflation are everywhere. Between rising tensions in the Middle East, the longshoremen pay increase, the rise in service costs, and the easing by the Federal Reserve, the recipe for inflation is all but cooked. There is simply no way to avoid it.

September Employment

The last bit of data we got this week was the September employment report, and it came in MUCH hotter than expected (+254K actual vs. +150K expected). In addition, the unemployment rate dropped to 4.1% (full release here). Surprisingly, both the July and August number were actually revised UP for a total of 72K additional jobs!

On a three-month moving average basis, employment moved up in September. One month does not make a trend, but it is certainly better than another decline.

As you dig further into the report, you see that most of the new jobs are in health care and leisure & hospitality - two sectors that are, on average, low wage. In fact, 69K of the jobs were in eating and drinking places….a very low-wage sector.

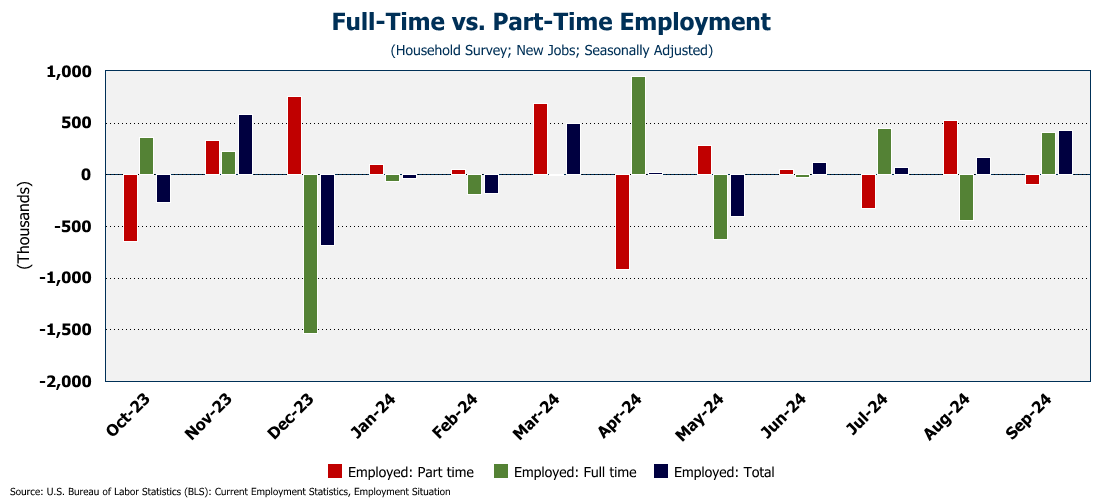

But that is the establishment survey. What about the household survey? Well, it was pretty good too! According to the household survey, an additional 430K people reported being employed, and most of them reported having a full-time job!

Unfortunately, there is a lot of ground to make up. Over the past 12 months, the economy has added a net of 813K part-time jobs while losing a net of 485K full-time jobs. But the September number certainly helped move those numbers in the right direction.

So here is the question…is the job market as soft as Chair Powell thinks? This report would certainly suggest it is not. And if that is the case, and the labor market continues to tighten, that would put pressure on wages. In fact, average hourly earnings in this report were up for the second consecutive month to a rate of 4% in September. And wage pressure is inflationary. And that would mean that the 50 basis point cut the Fed just gave us, was absolutely the wrong medicine. Maybe that is why overall rates have gone UP since the cut on September 18th.

Thanks for the Support

Well, October is here. This is when I was going to turn on the paid subscriptions. However, given how many of you are generously supporting this effort each week through the “buy me a coffee” link, I am going to keep going without activating the pay wall. As long as the support continues, I am happy to continue to operate as I have for the past 14 months.

Once again, many of you contributed last week. Special thanks to Chris Braun, Tommy Jennings, Andrew Hajduk, Colin Martin, Brad Wood, Dan McRae, Carl Snezek, Dave Gmeiner, Louise, and several others who didn’t attach a name to their support. (Each week I want to publicly thank my supporters, but if you would prefer your name NOT be listed, just let me know in your support comment.) If you enjoy this update and want to keep it going, please click or scan the link below.

I also appreciate the comments. Here are a few from last week…

Thanks again.