Weekly Economic Update 10-10-25: Consumer Credit...that's it....

No Federal government means no Federal data.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Before I start, I want to welcome the many new subscribers who joined this week after hearing my talks at both the Georgia Academy for Economic Development and Leadership Gwinnett. Thanks for signing up, and I apologize in advance that this week’s edition will be very different from the 113 editions that came before.

Next, I want to welcome my very first ever sponsor, PBJ Tech Hub. Thank you so much for your generous support of this weekly Substack!

I told my readers at the beginning of the year that I plan on moving to a paid-subscription model in January 2026. I simply have no other choice. The data vendor I use to keep up with the latest economic data and build all my charts and graphs is quite expensive - nearly $20K per year. Without sponsorships and paid subscriptions, I won’t be able to keep this going past January 2026.

If just 25% of my regular weekly readers paid $8 per month, it would easily cover my costs. Unfortunately, only 3% of my subscribers have a paid membership, and the number rises to 4% if you include those who contribute on an irregular basis.

Interestingly, that puts me right in the average of all Substacks. Truly excellent authors might push a 10% paid membership rate.

So, expecting 25% is unreasonable. Instead, I obviously need to enlarge my subscriber base…to over 7,000 weekly readers! I know many of you share this each week…please continue to do so and encourage them to sign up!

However, having my first sponsor will certainly help. Thanks again to PBJ Tech Hub! Perhaps they will be the first in a series of sponsors that will allow me to continue to make this available to everyone as I am doing now.

Enough about that. Let’s talk about the data….

There was no data this week.

(Well, isn’t THAT awkward. Asking people to financially support your weekly economic blog and then there is no weekly economic data to blog about…)

Actually, there was one piece of data, consumer credit, from the Federal Reserve. It would appear that quasi-government agencies don’t shut down, which is a pity because if ever there was an agency that needed to shut down, it would be the Federal Reserve.

Consumer Credit

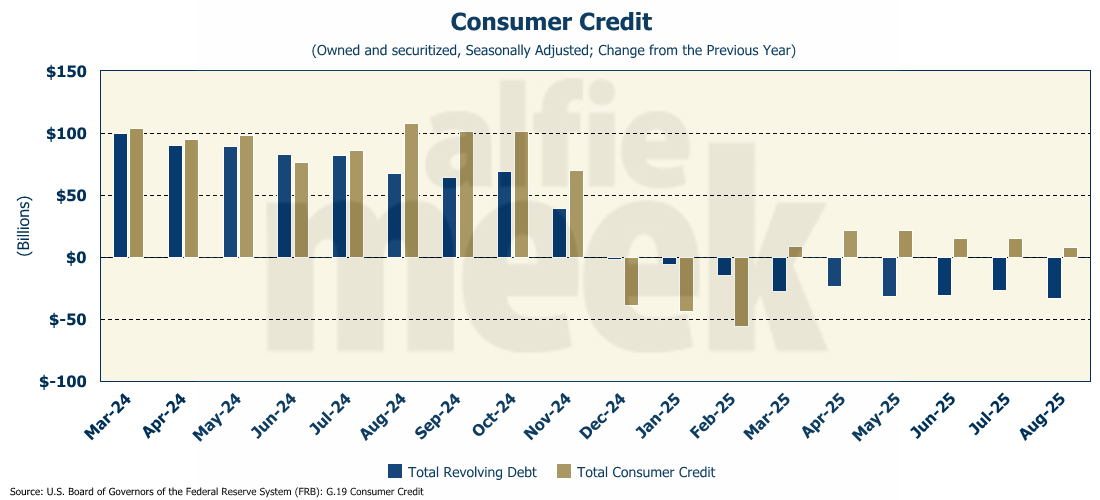

On Tuesday, the Federal Reserve released the latest data on consumer credit, and it supports what we have seen in other recent data…that the economy is slowing (full release here). In August, total revolving debt (i.e., credit cards) actually fell 6.0% as consumers became more concerned about rising inflation, a weakening job market, and increased overall uncertainty about the economy.

On a year-over-year basis, total revolving credit was down 2.5%, or $33 billion. August was the ninth month in a row that revolving debt has fallen. The last time revolving credit fell consistently (excluding after the pandemic) was in 2010 near the end of the "Great Recession” caused by the financial crisis.

Total consumer credit, however, was up 0.2% over August 2024, or $8.2 billion. Most of that growth was in auto loans and student loans.

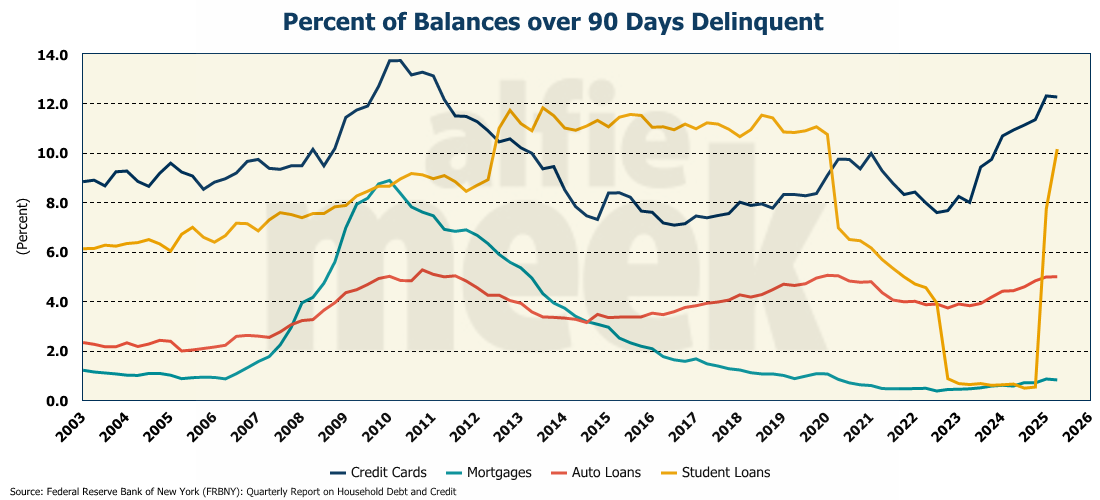

Delinquency rates for consumer debt more than 90 days past due are rising across the board. Credit cards - 12.3%; student loans - 10.2%; and auto loans - 5%. None of those are in “record” territory yet, but all three are moving in that direction and are close to setting records.

That is all we got this week. If the Federal government remains closed next week, I plan to give an overview of the FY25 actual revenues, new spending, and total spending obligations. And maybe discuss some of what is going on with gold.

One More Thing…

Finally, this week, I want to thank all my “bronze” level members who do subscribe for just $8/month. Dave Gmeiner, Colin Martin, Brad Wood, Carlos Alvarez, Steve Goins, Tommy Jennings, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, Charles Frazier, Barry Puckett, Matt Murphy, Penn McClatchey, Thomas Smith, Pat Graham, Sean McMillan, and someone with a “GTwreck” e-mail! (I still don’t know who you are, “GTwreck,” but thanks for your support!)

I also have a couple of supporters who have chosen the monthly “supporter” option - Rope Roberts and Sarah Jacobs. I thank ALL of you for your monthly support.

Now, if I can just get a couple hundred more of you to chip in, we can keep this weekly update going! Please click/scan the QR code below and consider supporting this weekly update on a monthly basis for just $8.