Weekly Economic Update 10-20-23: Retail Sales; Industrial Production; Housing Starts; Home Sales; and Builder Confidence

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

In the midst of all the international turmoil dominating the daily news cycle, there was quite a bit of economic data released this week, including a substantial amount of data on the housing market.

Retail Sales

But first, on Tuesday we got September retail sales data and what a shock it was! The Census Bureau reported that retail sales grew at a monthly pace more than double what economists were expecting. On a y ear-over-year basis, retail sales were up 3.75% over September 2022. The media went wild and once again proclaimed that "the consumer remains strong!" But wait.....that was NOMINAL retail sales. In other words, those numbers are NOT adjusted for inflation. We learned last week that CPI was running 3.7% on a year-over-year basis. So, that means that the growth in retail sales just represents people buying the same stuff they bought a year ago, just at higher prices! The consumer isn't getting ahead...they are just barely keeping up! And, what spending they are doing, they are putting on the card as revolving debt now stands at $1.3 TRILLION and is growing at an 11% annual rate every month.

Housing Market

October data on home builder sentiment shows that the reality of the housing market is starting to "hit home" for home builders. The National Association of Home Builders (NAHB) sentiment index dropped for the fourth straight month as measures of current and expected sales, as well as a gauge of prospective buyer traffic, dropped to their lowest levels since early 2023.

That data was reinforced on Thursday when the National Association of Realtors released data on the sales of existing homes. Existing home sales dropped to their lowest level in 13 years while the median sales price only dropped about $1,000. Even with the drop, the median price is still up 3.7% since January.

The French philosopher, Gaston Bachelard once said, “If I were asked to name the chief benefit of the house, I should say: the house shelters daydreaming, the house protects the dreamer, the house allows one to dream in peace.” That benefit is becoming more and more distant for a huge number of young Millennials and Gen Z. First-time home buyers made up 27% of sales, far below the 40% historical average. These young buyers are being priced out of the market because of high interest rates, which not only impact mortgage loans, but also increase the cost and availability of builder development and construction loans. It is interesting to note the correlation between home builder confidence and mortgage rates (graph below).

According to NAHB Chief Economist Robert Dietz, "the housing affordability crisis can only be solved by adding additional attainable, affordable supply." Unfortunately, the building permit number released Wednesday showed that additional supply is not in the pipeline. Overall, building permits dropped 4.4% from a year ago, led by multi-family permits which dropped 14.3% on an annual basis...their largest decline since January 2022.

Finally, ATTOM released its Q3 2023 U.S. Foreclosure Market Report, which reported a total of 124,539 properties with foreclosure filings (e.g., default notices, scheduled auctions or bank repossessions) which is a 28% increase from the previous quarter and a 34% increase from a year ago. In total, there were 37,679 U.S. properties with foreclosure filings in September 2023, up 11% from the previous month and 18% from September 2022. Clearly, high prices, weak wage growth, and expanding revolving debt loads are taking a toll on the family finances and making the mortgage payment is becoming difficult for more and more households.

Industrial Production

Industrial production unexpectedly jumped 0.3% in September posting it third-consecutive positive (albeit small) year-over-year gain. Manufacturing sector production also showed a surprising increase of 0.4% in September. However, on a year-over-year basis, manufacturing production remains lower than it was a year ago for the 7th consecutive month. Both of these were expected to remain flat. Looking forward, the UAW strikes will likely mean these numbers will be much lower in October. In fact, "Business Light Vehicles-Autos" production plunged 6.2% in September, and that was BEFORE the auto workers went on strike.

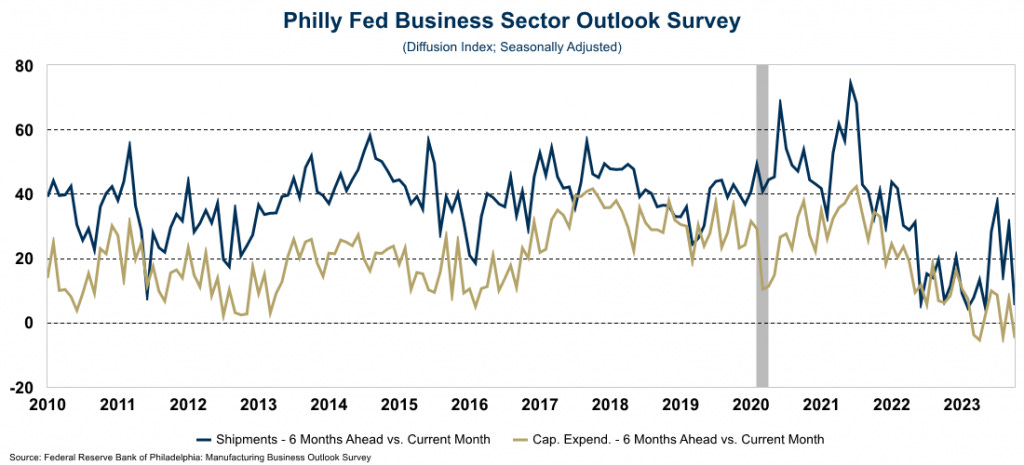

On Thursday, we got the Philadelphia Fed Manufacturing Business Outlook Survey. This survey tracks regional conditions in the Northeast. The report provides a snapshot of current manufacturing activity in the region, as well as a short-term forecast of manufacturing conditions based on how the survey respondents feel. It generally provides an indication of conditions throughout the country and is closely monitored by Wall Street. The index was -9 for October, the 15th negative reading in 17 months.

While general activity remained negative, the future indicators declined significantly. The future shipments index dropped 15 points to its lowest reading since May, and one of the lowest readings since 2008. Similarly, the future capital expenditures index fell into negative territory offsetting the previous month's increase. In short, manufactures in the northeast are not feeling good about where they will be 6 months from now.

Recession?

So, where will we be six months from now? Over the past few weeks we have showed some data that would indicate a recession is on the horizon. By way of recap...

The Yield Curve. One of the most reliable leading indicators of a recession, preceding every recession since 1956 with only 1 false signal. The yield curve has been negative since July 2022.

Consumer Expectations. A reading below 80 in the Consumer Confidence Index for Future Expectations tends to signal a recession. The index has spent quite a lot of time below 80 since March 2022.

Truck Transportation Employment. We haven't mentioned this recession indicator before, but it is interesting to see what truck transportation employment does prior to, and during recessions. It drops...significantly. And since June of this year, it has fallen off a cliff.

So, what does all this mean? Well, it isn't good. By this time next week we will have our first look at 3rd quarter GDP. The Atlanta Fed is predicting a reading of 5.1%!! (We all need some of whatever it is they are smoking at the Atlanta Fed!) The consensus forecast among economists who are reasonable (and don't work at the Atlanta Fed) is closer to 2.0%. But so far, from where I sit, the data hasn't looked strong - residential fixed investment is down, industrial production has been flat, and personal consumption is barely keeping up with inflation. The only possible variable supporting GDP is government spending...and that is something of which there seems to be an endless supply.