Weekly Economic Update 10-24-25 Shutdown Edition #4: Existing Home Sales; and Consumer Price Index

I'm running out of stuff to write about....

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Responses to last week’s post were mostly positive, although I did get fewer “likes” than normal. People do love their government benefits.

Of course, the government shutdown continues, and no one really knows when it will end. Some thought that it would end after the “No Kings” protests. Apparently not. Others are suggesting the end of the month. I heard one “insider” say that perhaps Thanksgiving and the travel-related nightmare would push lawmakers to end it. Yet others have suggested the end of the year.

In short, no one knows. But it could be a while. I am hearing of organizations around the country - specifically academic institutions - that are instituting various forms of financial restrictions on travel, hiring, sub-contracts, etc. It makes you realize the extent to which academia is totally reliant on the Federal government. Closed for less than 30 days, and so many institutions of higher learning are already having cash flow issues. It is really quite disturbing.

From my personal perspective, it is difficult to come up with something interesting each week to write about while there is no economic data to review. In fact, as much as I dislike the Conference Board and its Leading Economic Indicators, I fully planned on reporting on it this week. However, it turns out that some of the Leading Economic Indicators are based on government data, so that isn’t being published either.

As an economist, I am currently in a desolate, lonely place with no clear direction. Economists live off data. Where there is no data, the economists perish.

I did stumble on an interesting article in Newsweek. It would seem that car repossession assignments are on pace to set a record this year at roughly 10.5 million. Wow! Apparently, the share of those that are actually repossessed has fallen such that the number that will actually be snatched away from drivers will come in around 3 million, but even that will be the second-highest level ever, bested only by the number posted during the “Great Recession” in the early 2000s.

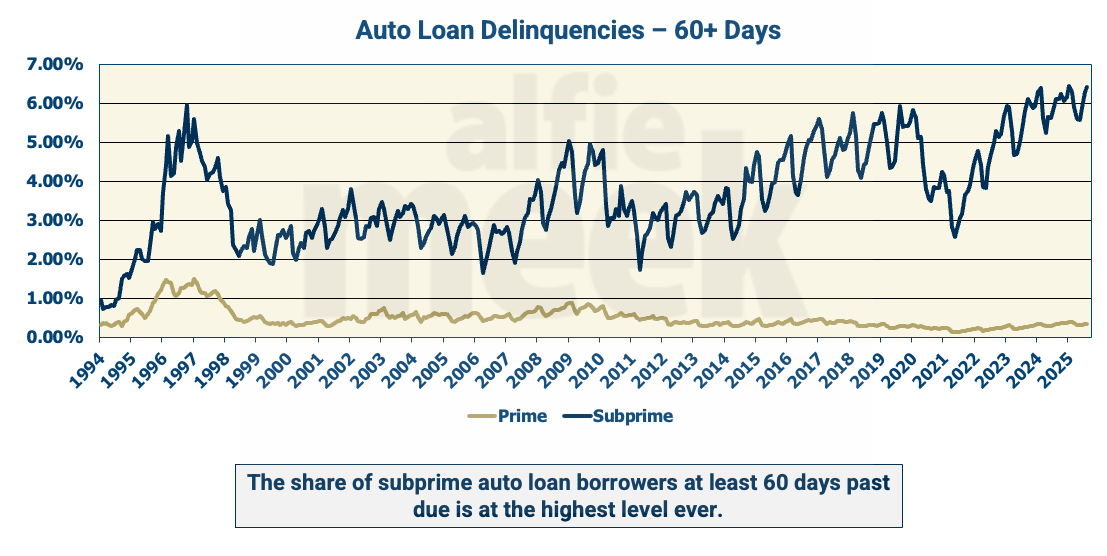

What does that say about the state of the U.S. economy when cars are being repossessed at a record pace? Of course, if you read this regularly, you shouldn’t be surprised, as I have shown that the number of subprime auto loans that are more than 60 days delinquent is at an all-time high.

Combined with the recent financial trouble experienced by the auto-parts maker First Brands and subprime auto lender Tricolor Holdings, this could perhaps be the first signs of significant cracks in the low-income consumer market. Certainly something to keep an eye on.

Existing Home Sales

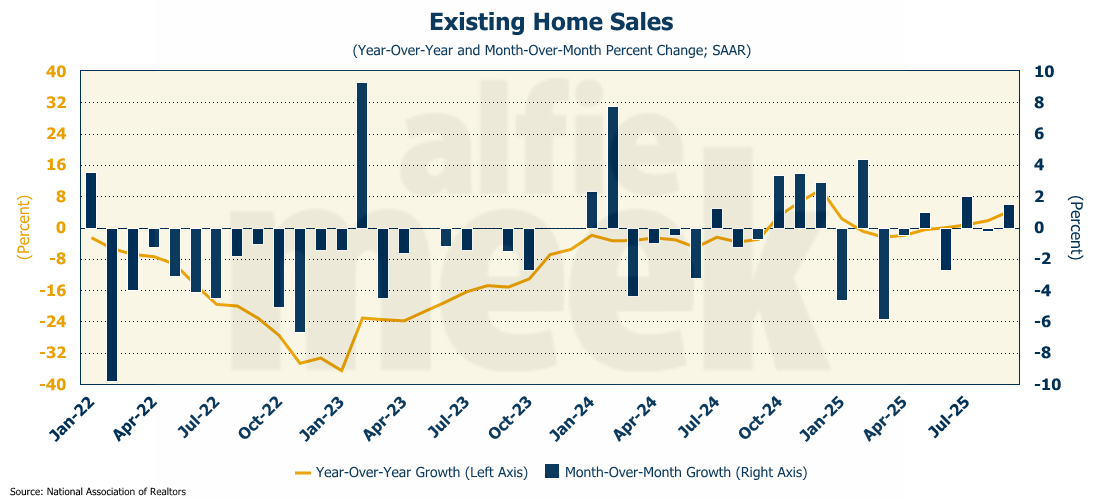

Data for NEW home sales is released by the Census Bureau, but EXISTING home sales data comes from the National Association of Realtors, and this week, they released the data for September. For the month, existing home sales were up slightly (1.5%) over August, and up 4.1% from last September.

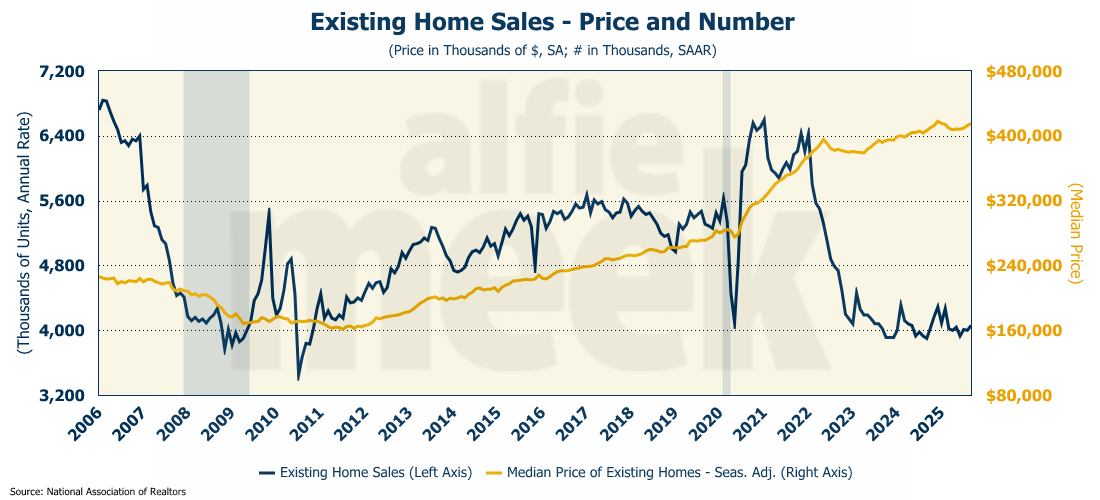

The slight increase may have been due to a small decline in the mortgage rate, but overall, 2025 is still looking to be one of the worst years ever for existing home sales. Last year was the worst year since 1995, with just over 4 million sales. It is quite possible that 2025 will be even lower. Unfortunately, even with the low level of sales, the median price ROSE to $415,500, which is 2.1% higher than last year.

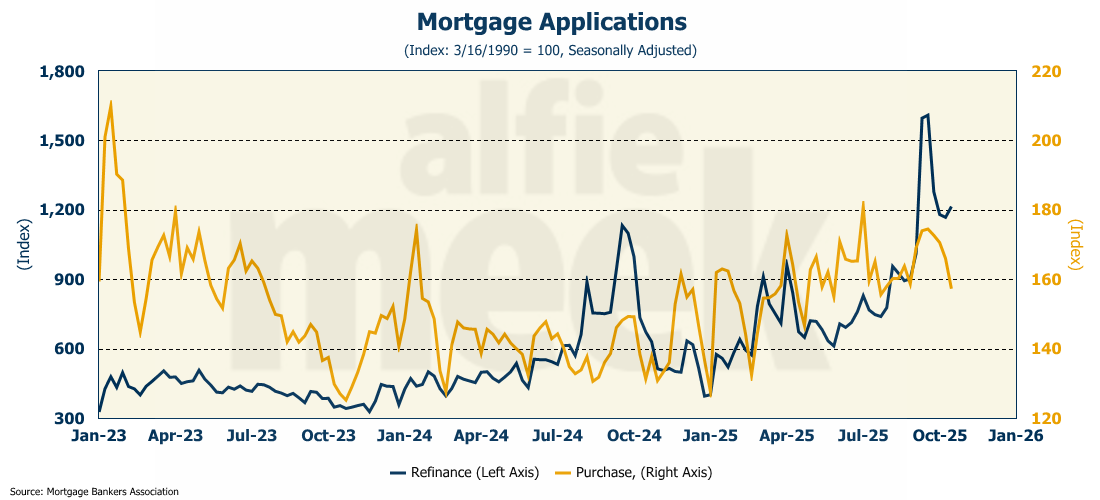

The near-term future for existing home sales doesn’t look good, as mortgage applications for new purchases are trending down and are at the lows experienced last spring. Conversely, refinancing applications have experienced a recent surge as the 30-year rate has been moving toward 6%.

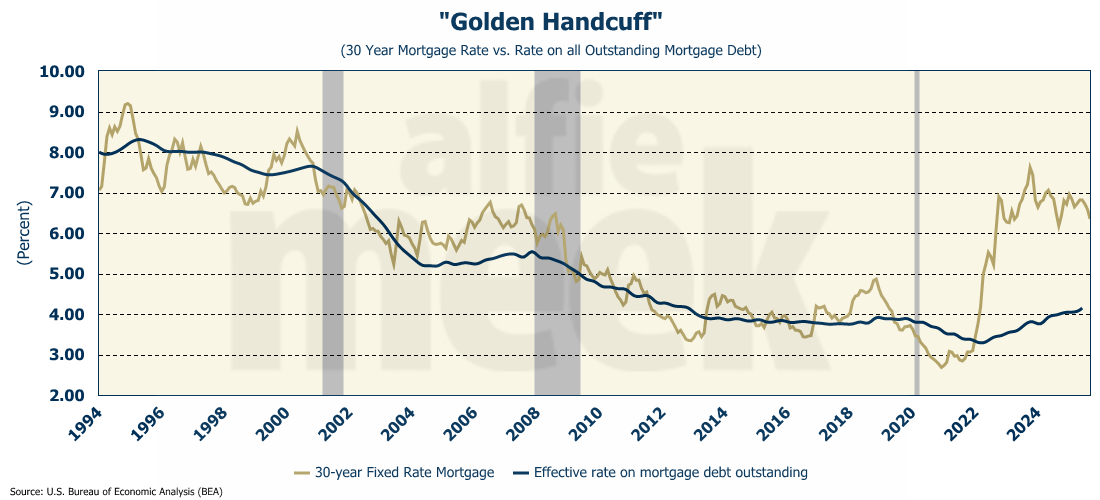

But the gap between the current rate and the existing rate for all outstanding mortgages is still huge by historical standards, meaning people are not likely to want to put their home on the market and swap their low rate for one almost twice as high.

Consumer Price Index

Apparently, the only bit of government data important enough to bring back some of the staff of the Bureau of Labor Statistics (BLS) is the Consumer Price Index (CPI). Originally, it was thought that the Fed needed the data for its meeting next week. But that didn’t hold water because they summarily ignore it.

No, it turns out that the real reason is that they needed to determine the Social Security Cost of Living Adjustment (COLA). Now THAT makes a lot more sense.

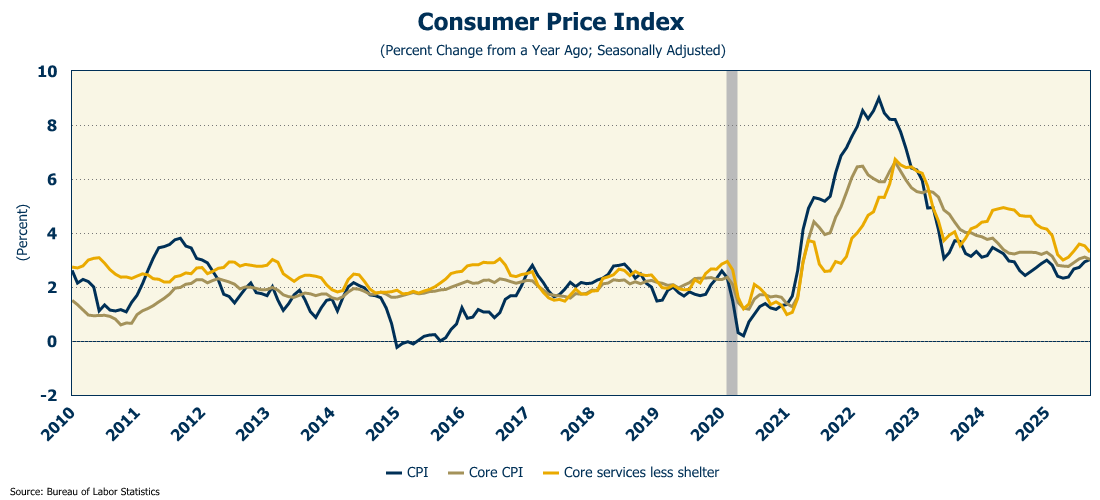

For September, the CPI came in at 0.3% over August, which represents an annual rate of 3.0%. That is a slight increase over the August annual rate, but less than the 3.1% that was expected. The markets reacted positively, even though inflation moved in the wrong direction. Funny how sometimes markets move on “expectations” rather than reality.

In all honesty, the markets were probably reacting more to core CPI, which actually slowed in September, also coming in at a 3.0% annual rate. “Super core” (services less shelter) also dropped, coming in at 3.3%, the lowest it has been since May.

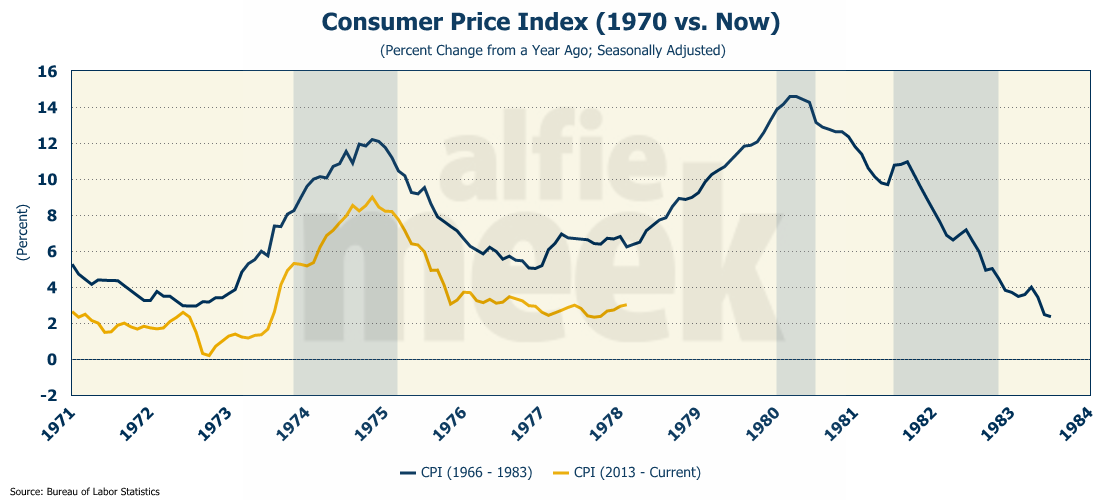

The increase in CPI shouldn’t be surprising and continues to follow the historical pattern. With the Federal Reserve very likely to cut rates at least two more times this year, inflation should continue to accelerate throughout 2026.

One More Thing…

Next week, I will be on vacation, enjoying a bit of fishing with some friends. If the government remains closed, it is highly likely I won’t bother to publish an update, as there is no non-government data scheduled to be released. My streak of publishing for 115 consecutive weeks will come to an end.

And, as awkward as this is given the lack of data recently, let me remind you that if you have a paid monthly membership through the “Buy Me A Coffee” website, be on the lookout for an email with details about how to move that over to SubStack. Also, for those of you who have already made a “pledge” on the SubStack site a year or more ago, when I turn “paid subscriptions” on in early January, those pledges will instantly execute. Please review your pledge and make sure you still want to move forward at that level.

If you do not yet have a paid subscription but would like to support this effort, please make a pledge on the SubStack app. If you would like to simply offer one-time support, you can still do that by clicking/scanning the QR code below.