Weekly Economic Update 11-10-23: Consumer Credit; Consumer Sentiment; and the Federal Reserve Balance Sheet

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

On Wednesday, I had the privilege of presenting an economic update to the Advanced Technology Development Center (ATDC) Signature CEO event in downtown Atlanta. These were just some the CEOs of the companies in ATDC, Georgia Tech's high-tech incubator. I want to thank Chris Nedza, the Lead Entrepreneur in Residence for inviting me to speak. It was a fun group and I hope they found something useful in my comments.

The way the calendar fell this month, there was very little economic data released this week. On Tuesday we got an update on consumer credit, and Friday brought us preliminary results on November consumer sentiment. Other than that, it was just Federal Reserve Bank Presidents speaking all week...and I don't usually bother to report on that because they all say the same thing, (or they directly contradict one another) and none of it is very clear and and it is rarely newsworthy. However, yesterday (in addition to dropping the "F" bomb on a live mike) Chair Powell said "we are not confident that we've achieved sufficiently restrictive policy." That is Fed-speak for it is too early to say that rate hikes are a thing of the past. I've been saying to anyone who will listen that I am not buying the idea that the Fed is done with rate hikes, and just last week I said that I didn't see rate cuts on the horizon. Powell just confirmed my suspicions.

In any event, with such little economic data this week, this update will be short. But next week, we get a whole host of data on CPI, PPI, retail sales...I'll be making up for this week's brevity in next week's edition!

Consumer Credit

Could it be that the consumer finally has no more money to spend? Are the credit cards finally maxed out? Total revolving debt grew only $3.1 billion in September, and while that may sound like a lot, it is far weaker than the $10 billion monthly average of the past two years. Similarly, total credit only grew $9.1 billion...slightly below expectations and far below the range of $20-$30 billion seen in recent months.

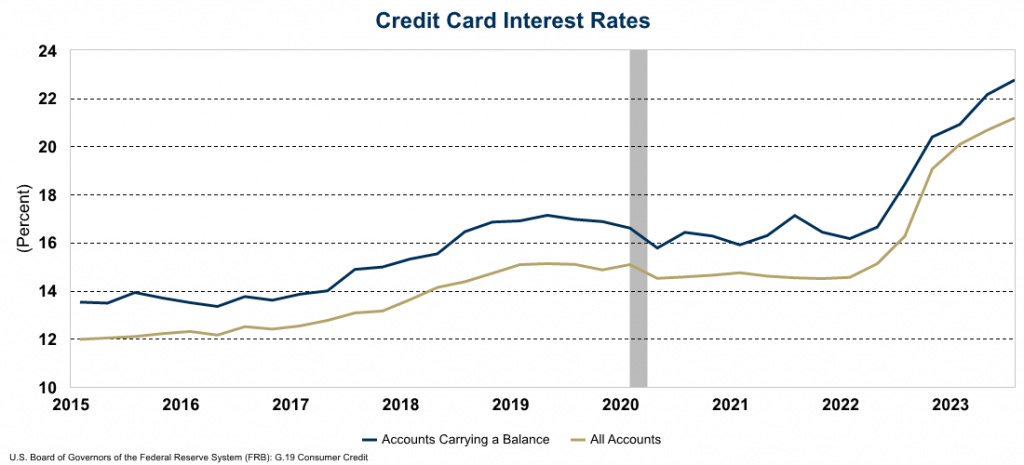

The slowdown in revolving credit had to come eventually as consumers are running out of savings (the savings rate is down to 3.5% and trending down). Further, real wages are flat, and rates on credit card balances hit a record high of 22.77%. Given that credit card balances (a subset of total revolving debt) are just over $1 trillion (up $400 billion since 2013), that 22.77% interest rate is going to take a big chunk out of household income.

In fact, it is taking such a big chunk, many people are just not paying. Both the number of credit card loans, as well as the number of new balances that are "seriously delinquent" are up more than 50% over last year. In fact, in the third quarter, the level of "seriously delinquent" balances is up more than 56% over 2022.

With respect to nonrevolving credit, student loans shrank by a record $27.8 billion as 1) the Biden administration is aggressively forgiving what they can, and 2) now that total student debt forgiveness is off the table so borrowers have started making payments. However, auto loans grew by $14.2 billion, which is a slowdown from recent quarters, but still impressive since the rate on the average auto loan is pushing double digits and, as we reported last week, Internet searches for "give car back" have soared to a record high and the percent of sub-prime auto loans 60+ days late is at the highest level ever recorded.

Consumer Sentiment (Preliminary)

Which leads us to the Univ. of Michigan preliminary reading on November consumer sentiment...and for the fourth month in a row consumer sentiment dropped, falling another 5% in November to 60.4. Consumer expectations about the future of the economy, dropped 4% to 56.9. And consumer expectations about inflation one year from now, rose from 4.2% to 4.4%. In short, concerns about high prices, high interest rates, wars in Gaza and Ukraine, and domestic politics are weighing on the minds of consumers as we enter the holiday season. And they only see inflation getting worse from here.

Federal Reserve Balance Sheet

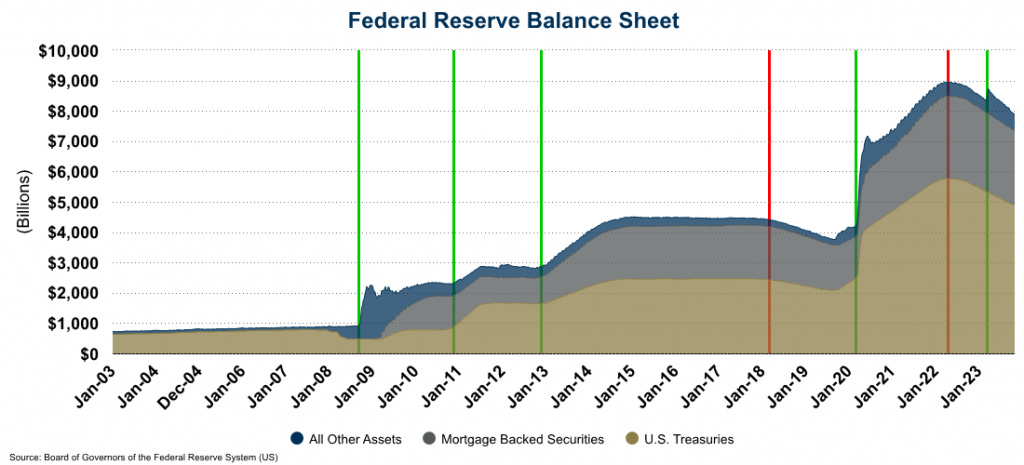

The media talks a lot about the role the Federal Reserve plays in setting interest rates. Not as well know is that in addition to setting the Federal Funds Rate, the Federal Reserve can use its balance sheet to meet their dual primary goals of maximum employment and stable prices. The Fed decides what assets it holds, and whether to expand or shrink its holdings. When the Federal Reserve buys debt instruments like treasury notes or mortgage-backed securities, it is signaling a looser monetary policy to support the economy (sometimes referred to as "quantitative easing" or "QE"). Conversely, the sale of assets is a policy tightening approach that constrains financial conditions and asset values (referred to as "quantitative tightening" or "QT").

As you can see from the graph below, the Federal Reserve dramatically expanded its securities holdings in response to the economic shocks of the 2008 global financial crisis and the COVID-19 pandemic. The first three green bars mark "QE1", "QE2", and "QE3". In 2018 the Fed began the process of slowly unwinding these positions, but then in March 2020, in response to COVID-19, they exploded their balance sheet by purchasing U.S. treasuries to help fund the $7.5 trillion in government spending that led directly to our current inflation problems. At one point in 2022, the balance got up to just under $9 trillion! However, since then, (with the brief exception of the collapse of Silicon Valley Bank) they have been slowly unwinding their position and have successfully reduced the balance sheet by more than $1 trillion.

This reduction is significant for a number of reasons, but a very interesting one is that the Fed is now a net seller of U.S. treasuries. It is interesting to note that both China and Japan are also currently net sellers of U.S. treasuries. Until recently, these were the three largest BUYERS of U.S. debt. So, if the three largest buyers of U.S. debt are now net sellers of that same debt, then who is going to buy the $1.5 trillion in new debt that the Treasury Department plans to bring to market this quarter? Whoever it is will likely demand a higher yield to take on the risk. In fact, yesterday, the government tried to borrow an additional $24 billion...and it was a complete disaster. There simply were not enough buyers and the rates had to dramatically rise to entice people to buy. Even then, the "primary dealers" (i.e., big commercial banks) had to buy 25% of the issuance. (The primary dealers are the buyers of last resort who have to buy what no one else picks up.)

But a larger question remains...why is the U.S. bringing an additional $1.5 trillion to market in the first place? Since the budget deal reached last May, the U.S. as added $2.3 TRILLION to the total federal debt...in just 5 months! This was MAYBE understandable when we were throwing money at COVID, but now, one has to wonder why are we running such massive annual deficits and adding such astronomical numbers to the national debt. It simply is not sustainable.

One Final Note...

During the upcoming Thanksgiving and Christmas season, due to travel and all the other activities that go along with the holidays, I may not be able to produce this update each week. But if I miss a week here or there, I will still cover all the latest data when I do publish. And, instead of an update, I might just drop one or two brief articles on other topics. Until next week...