Weekly Economic Update 11-28-25: Consumer Sentiment; Consumer Confidence; Retail Sales; and the Producer Price Index

Let the shopping begin!!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Today is the infamous “Black Friday.” The origins and original meaning of the term are somewhat debated, but most commonly, it is assumed that the term refers to when retail stores get out of the red and into the black for the year. I am not personally in the retail business, but if it took me 11 months each year before I got out of the red, I think I might look for another line of work.

But one has to wonder if the actual day is really that important anymore? I have seen “Black Friday” deals advertised for immediate consumption since Halloween. Are there really deals that only apply today? Do people still line up like cattle being led to the slaughter, just waiting for the doors to slide open at Walmart so they can trample each other for a 75” TV or an Apple Watch Ultra? I honestly can’t remember the last time I stepped into a physical store, and I promise you I have never wanted anything so badly as to go out shopping at midnight the day after Thanksgiving. I really don’t understand it, and can not comprehend why anyone would do it. For me, it falls into the same category as skydiving, snow skiing, playing Settlers of Catan, watching the NFL, or eating Thai food…absolutely no interest whatsoever.

Consumer Sentiment

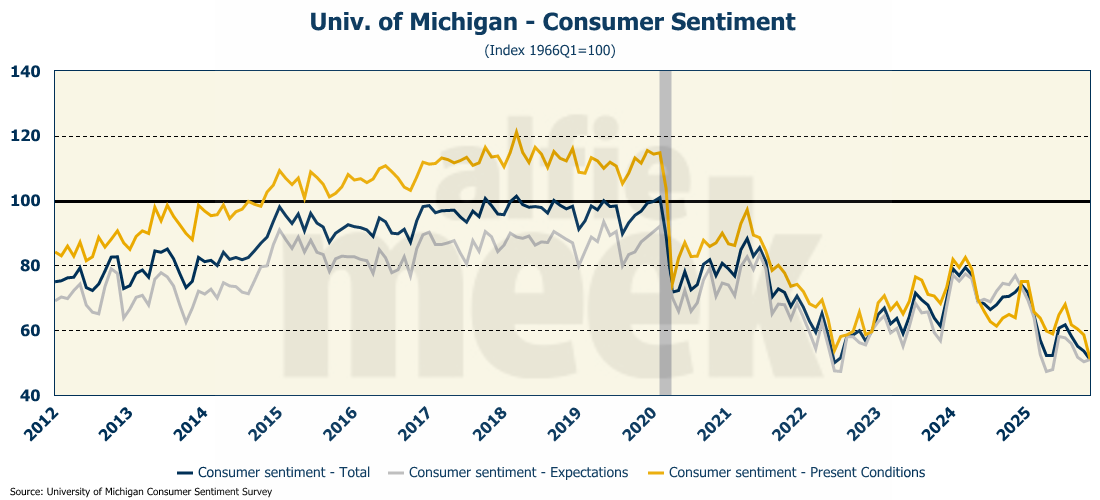

The University of Michigan released the final reading on consumer sentiment for the month of November, and the overall numbers fell 2.6 points to 51.0, which is the second-lowest level since the index began in 1952 (full release here).

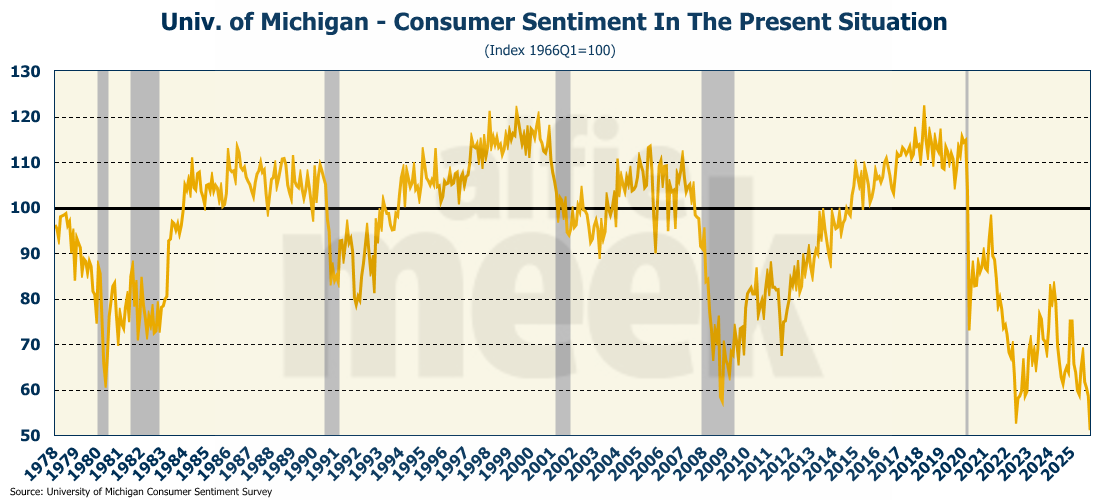

Looking at the sub-indices, consumer sentiment in the present situation plunged 7.5 points to 51.0, the lowest level in the survey’s history going back to when it began in 1978.

I get that people are struggling, but who exactly is the University of Michigan interviewing? This reading is lower than the “Great Recession” that followed the financial crisis. It is lower than the plunge in confidence during COVID. It is even lower than it was in the 1981 recession, when the 30-year mortgage rate reached 18%!! Are things really that bad right now? Because if they are, then we are in a lot of trouble!

This is probably not the best news to get on “Black Friday” and it certainly doesn’t bode well for the Christmas season. We often hear the term “K-shaped” economy. What does that actually mean? In technical terms, it means that some parts of the economy are performing well, while others struggle or decline, creating a divide. This is visualized as a “K” graph, with one line trending upward and the other trending downward. Let me give you an example. As mentioned above, the consumer sentiment in the present economy hit a 41-year low. That is because the bulk of the population is feeling economic pressure. However, those few at the top of the income ladder, who are likely heavily invested in equity markets, are feeling great as the overall market has recently soared (last week not withstanding).

This is just one example of many of our bifurcated economy. And it is not healthy or sustainable in the long run.

Consumer Confidence

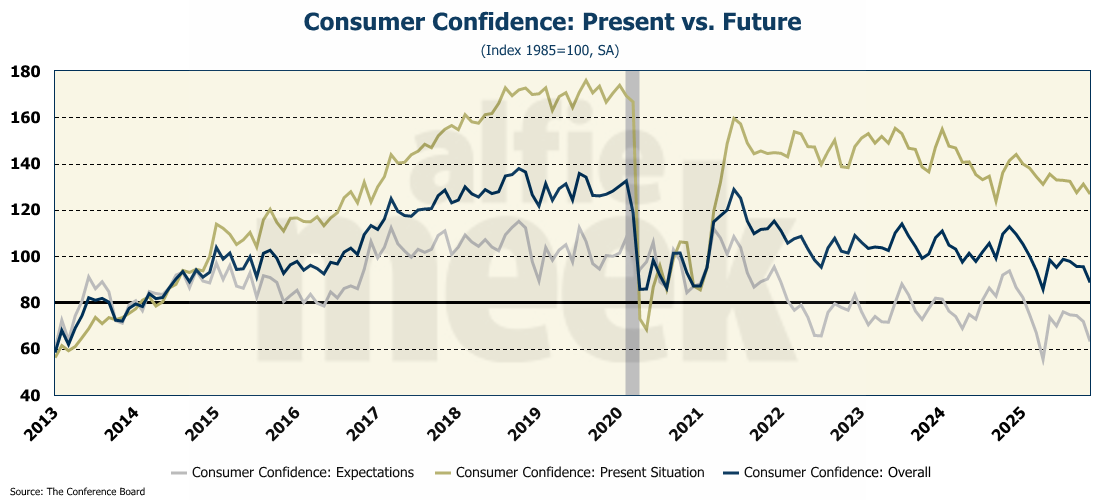

It seems it isn’t just the people talking to the University of Michigan. On Tuesday, the Conference Board released the latest data on consumer confidence, and like consumer sentiment, it absolutely collapsed, dropping to 88.7 in November (full release here). However, unlike the consumer sentiment number, the confidence number was driven by a collapse in consumers’ expectations about the future, not present conditions.

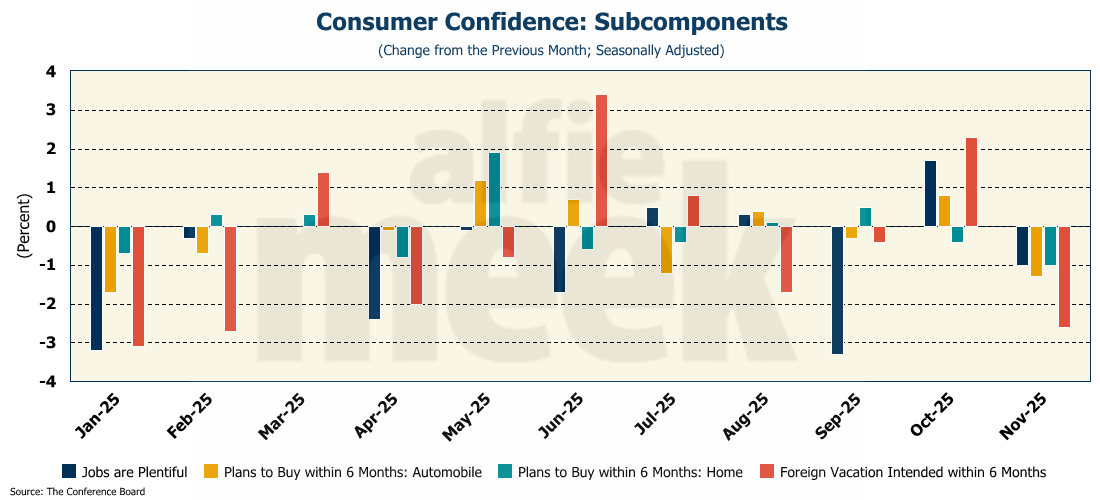

That becomes even clearer when you look at the subcomponents of the index. The share of people who plan to buy an automobile, buy a home, or take a foreign vacation in the next six months all fell sharply in November. In addition, in a reversal from October, the share of respondents who said “jobs are plentiful” also fell.

This is not what you want to see heading into the holiday shopping season. Consumers are not at all confident about the economy right now, or their place in it, and that doesn’t bode well for retailers looking to get “out of the red.”

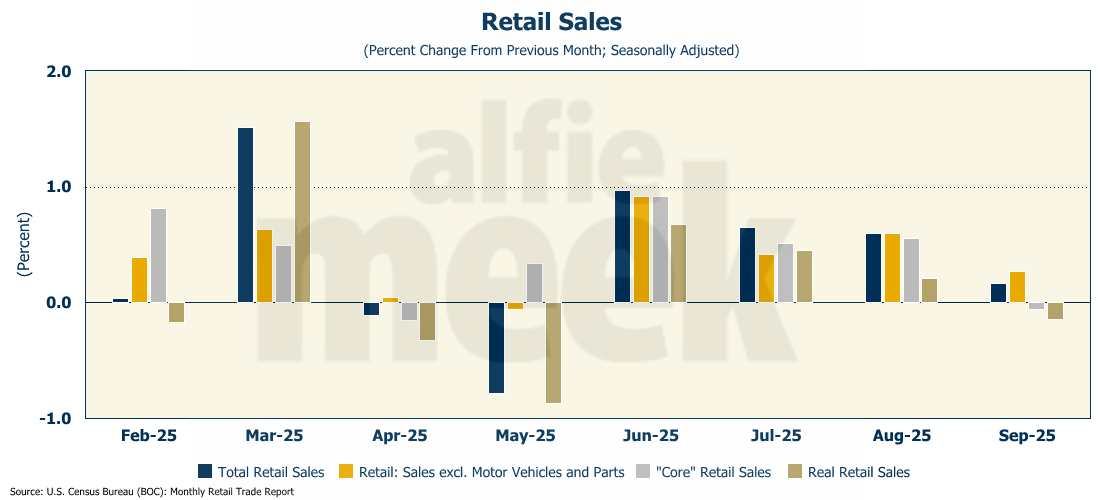

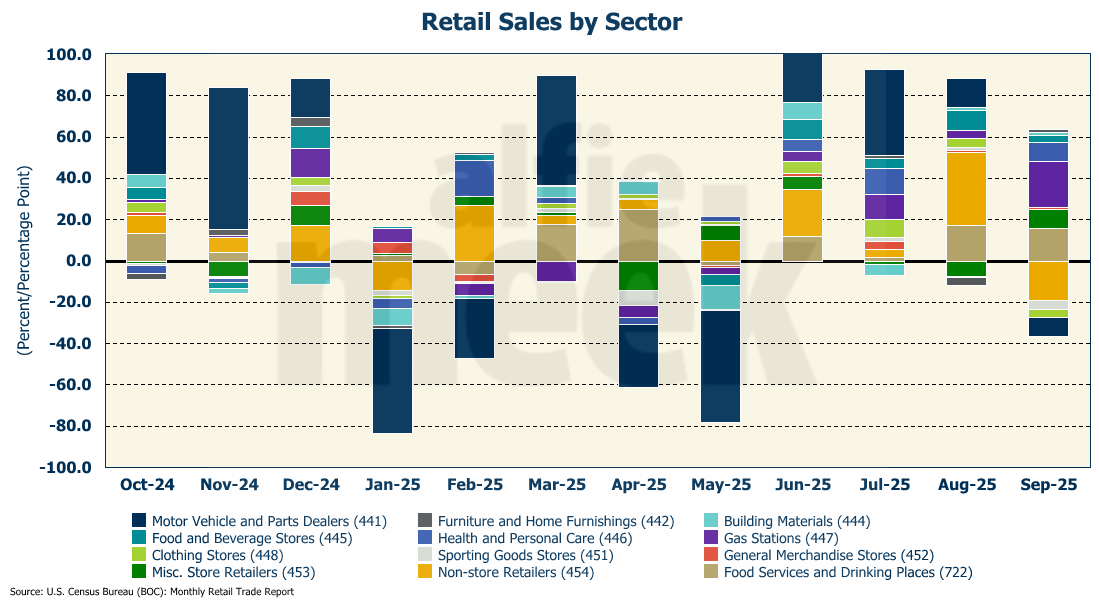

Retail Sales

The folks at the Census Bureau are slowly getting back to work after their 43-day vacation, and data is starting to trickle out. On Tuesday, they released the long-delayed retail sales numbers for September (full release here), and the numbers are consistent with the sentiment and confidence numbers above. According to the government, retail sales in September grew only 0.2%. That was slower than expected and the slowest rate since May. But that was nominal growth. Adjusted for inflation, retail sales actually fell 0.1%, again, the worst showing since May.

Looking at the detail by sector, “non-store retailers” (aka, online retailers) saw the largest drop, followed by motor vehicle and parts dealers, clothing stores, and sporting goods stores.

Obviously, this data is a bit old, but it supports the theory that the consumer is slowing. The question is, are they really slowing down or just saving up for the upcoming Christmas season? I suspect it is the former, but as we have seen in the past, never bet against the U.S. consumers’ ability to spend money.

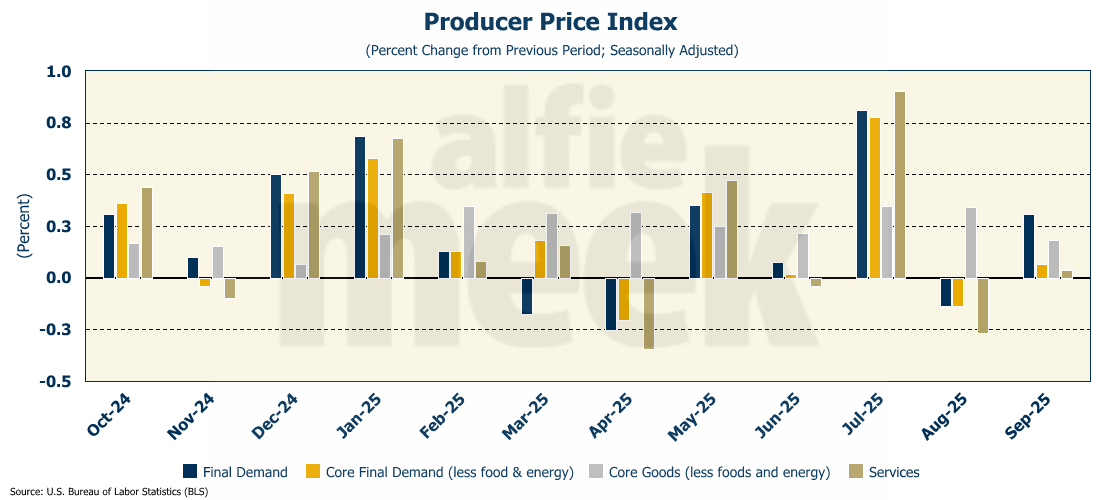

Producer Price Index (PPI)

In addition to the employees at the Census Bureau, the employees at the Bureau of Labor Statistics (BLS) are also getting back into the swing of things and were able to publish the Producer Price Index for September (full release here). For the month, producer prices were up 0.3%, which kept the year-over-year number steady at 2.7%. However, in a reversal from August, core final demand and services costs at the wholesale level rose in September, albeit only slightly.

This is the last inflation data that the Fed will get before its December meeting, and it probably wasn’t enough to move the needle. Clearly, inflation is not slowing down, and recent rate cuts will only make that worse. The question that remains is whether they will add more fuel to the inflation fire by cutting rates further. Chair Powell seemed to indicate not. But then again, Chair Powell won’t be Chair Powell for very much longer.

One More Thing…

This is usually the least-read issue of the Weekly Economic Update each year, as no one is thinking about the economy while spending time with family during Thanksgiving. However, I feel compelled to remind you that after next week’s post, I will be turning off all recurring charges for monthly, bronze, and silver members on the Buy Me A Coffee site. Everyone will continue to receive the weekly economic update for free through the January 2nd issue. I will be turning on paid subscriptions on January 5th, and only those who have a paid subscription will receive the entire weekly post on January 9th. As a new bonus, beginning with the January 9th issue, I will be turning on comments for each post, and I look forward to getting your comments and engaging with my paid subscribers.

IF you have already pre-paid for an annual bronze, silver, or gold on Buy Me A Coffee, do NOT make a pledge at this time. I will extend your subscription on the SubStack site automatically.

I am sorry for all the complications, but they do not make switching platforms easy!

Finally, let me remind many of you who may have already made a pledge, but did it one or more years ago, that it will go into effect when I turn on paid subscriptions, so please make sure you still want to subscribe at that level.

If you want to offer one-time support, you can still click/scan the QR code below.