Weekly Economic Update 11-29-24: Consumer Confidence; New Home Sales; Case-Shiller Home Price Index; Durable Goods; Personal Income; PCE Inflation; and Third Quarter GDP

New home sales collapse, but prices continue to rise and consumers are confident. But inflation is creeping back in.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I hope everyone enjoyed being with family and/or friends yesterday as we celebrated Thanksgiving. I personally have so much to be thankful for…a wonderful family, fantastic friends, and amazing colleagues who inspire me every day. I have a job that I absolutely love; several hobbies that I enjoy; and two dogs that keep things interesting. I am truly blessed.

Before I get started on the economic data, I would like to briefly discuss something that came up last week. A long-time reader mentioned that I often repeat things I have said in the past. For example, when discussing CPI inflation, I often show the graph that compares 1970’s inflation to now and discuss the similarities between the two periods. I have showed that graph and discussed the comparison several times. I am sure that those of you who have been reading this for a while get it…you don’t need me to keep plowing that ground.

But that is just the point…you have been around a while. This blog is growing and adding new readers weekly. In November alone, the number of subscribers grew 12%! The purpose of this blog is to report on economic data that comes out monthly (or in some cases quarterly) in a way that non-economists can understand and without “spin.” Each month, there are new readers who may need the variables defined and be updated on the trend analysis. I will always try to add something, but given the nature of the data and new readership, there may be recurring themes. It is the nature of the beast and I hope you understand and will be patient as the readership continues to grow. Now, on to the data…

Consumer Confidence

According to the Conference Board’s Consumer Confidence Index, consumers expressed a little post-election increase in their feelings about both the current economy and their outlook for the future (full release here). In fact, consumer confidence rose to a 16-month high in November. But even with this increase, consumer confidence is still way below where it was pre-COVID. People are simply not back to the level of confidence they had in early 2020.

Although consumers are more confident overall, when you look at the subcomponents of the index, one component stands out - people’s plans to buy a home within the next 6 months. That number tanked in November. Not surprisingly, movement in that number seems to be inversely correlated to the 30-year mortgage rate, which has been rising of late.

New Home Sales

Speaking of buying a home…..new home sales absolutely collapsed in October falling 17.3% to an annual rate of only 610,000 units! That is the largest monthly percentage decline since July 2013 (full release here). On a year-over-year basis, new home sales are down 9.4%. However, despite the slowing sales, the median price of a new home rose to $432,800.

According to the Census Bureau, the decline was due in large part to hurricanes Helene and Milton and, of course, rising mortgage rates. Personally, I think rising mortgage rates were a bigger factor than the weather in the southern part of the country.

But frankly, there is something else going on. Something more fundamental. The cost of owning a home is getting out of control. Between mortgage rates, insurance, and maintenance costs, home ownership is expensive. Too expensive. And people are making a different choice. They are choosing to rent. And not as a temporary stop, but a long-term lifestyle choice. According to CoStar -

“roughly one-third of all tenants have decided to forgo homeownership altogether, while half view renting as a long-term choice, and fewer renters say they'd buy a home even if mortgage rates — near 6.8% — fall, according to a new Knightvest survey. A similar poll this year from mortgage giant Fannie Mae found about 33% of apartment tenants consider themselves permanent renters by choice or circumstance, while CoStar shows apartment demand hit a three-year high.”

If you are in the home buying/selling/lending business, that is a problem, and one of which you should be aware. We saw last week that home builders are excited about the opportunity to sell new homes under the incoming administration. Let’s hope they have a reason to be optimistic.

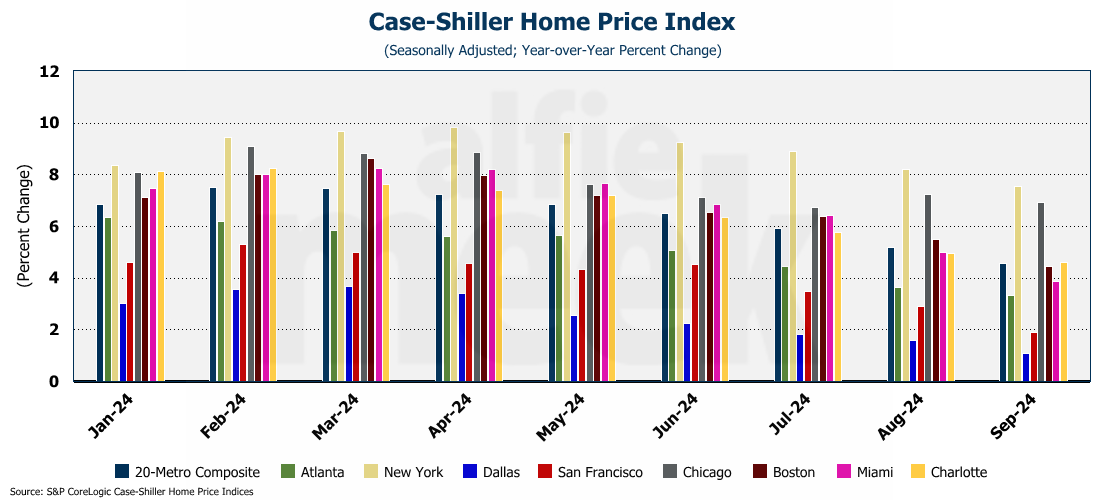

Case-Shiller Home Price Index

Even though the median price of a new home is still rising, the latest data from Case-Shiller shows that the rate of those price increases is slowing (full release here).

Nationally, prices rose at a 3.9% annual rate. Prices in the 20 largest cities once again rose in September, but at only 4.6% - the slowest rate in over a year. Cities like Dallas and San Francisco saw annual growth of only 1.1% and 1.9% respectively. While New York and Chicago are posting growth of 7% or more. Cities in the south like Atlanta, Charlotte, and Miami are hovering in the 3%-4% range.

Durable Goods

But enough about the housing market. Turning to industrial production, after falling for two months, orders for U.S. durable goods rose 0.2% month-over-month in October, and were up 2.7% from a year ago (full release here). The increase was significantly less than Wall Street was expecting. Total new orders have been virtually flat since March 2023.

If you take out transportation, orders grew only 0.1%. However, defense orders fell by 4% which helped pull down the entire sector. If you remove defense, orders grew 0.4% for the month. But any way you cut it, manufacturing is still in a slump.

Personal Income

For the first time since January, personal income actually grew faster than personal consumption in October (full release here). Nominal personal income grew 0.6% for the month, while total consumption only grew 0.4%.

Obviously, if incomes grow faster than consumption, that is positive for savings which grew by $75 billion in October. However, that doesn’t really offset the more than $280 billion in savings lost from February through September.

That increase did cause the savings rate to tick up slightly to 4.4%, which is still historically low.

PCE Inflation

Here we go! PCE inflation had been moving down steadily since March, but it jumped up noticeably in October. Core PCE (the favorite inflation indicator of the Fed) also moved up to 2.8% - the highest reading since April. PCE for services also rose and is now at 3.9%.

As I have pointed out for months, the fight against inflation has not been won. The Fed started cutting rates WAY to soon, and now we are seeing a return of inflation. These PCE inflation numbers should put an end to any talk of further rate cuts in December.

Third Quarter GDP (Revised)

Finally this week, we got the second reading on third quarter GDP and the number remained unchanged at 2.8% annualized growth (full release here). As a reminder, GDP growth was 3.0% in the second quarter. The slowdown was due to a drop in residential fixed investment, inventories, and net exports. The decline would have been worse, but for the acceleration in both consumer and government spending.

And the story really is that government spending. I am so tired of hearing people say, “the economy is strong!” I am not sure I would consider rising inflation, rising unemployment, and two years of declining manufacturing output “strong.” So why is GDP still positive? There is one simple reason…we are running a historic $2 trillion federal budget deficit. The budget deficit is running more than 6% of GDP! The only times it has been larger were World War 2, the Great Financial Crisis, and COVID. Not even during the Great Depression did the deficit get this high as a share of GDP.

Now that COVID is past us there is absolutely no excuse for running deficits this large. If we weren’t running this deficit and were even making an attempt at a balanced federal budget, the economy would be in shambles.

The Weekly Update on X

If you can’t wait until Friday to get this rundown on the week’s economic data, you will be happy to know that I am going to try to start posting individual data updates on X throughout the week. You can follow me on X at @alfiemeekGT. (I am new to the whole social media thing so your patience is appreciated!) I’ll experiment with this for a while and if people like it, I’ll make it a regular part of my weekly reporting.

Support The Weekly Economic Update

Thanks gain to all those who are members and support this effort on a monthly basis. If you would like to become a member or make a one-time donation, I invite you to click/scan the QR code below.

Until next week…..