Weekly Economic Update 12-06-24: ISM Manufacturing; ISM Services; Factory Orders; JOLTS; and November Employment

Job openings rise but so do quits. Payrolls rise, but household employment falls. The labor market is sending mixed signals.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Thanksgiving is behind us and Christmas is just around the corner. With a limited shopping season due to a late Thanksgiving this year, consumers appear to already be setting holiday records for retail sales. It will be interesting to see if the results from last weekend can be maintained throughout the entire season, or if the strong weekend results were a one-off. And if they continue, how much of it they add to their revolving debt totals.

One of the great things about the holiday season is that you get to spend time with family. For example, last weekend I got to spend some time with my nephew, who is in high school, but apparently reads the Weekly Update with some consistency. He shared with me some data he has been collecting. Specifically, he graphed my weekly use of exclamation points in the blog for 2024. He then discovered that it appears to be somewhat correlated with my discussions about inflation. Apparently, I get pretty worked up when discussing inflation. But the more alarming result was the shear number of times I use exclamation points each week. It appears to average somewhere in the 20 range. I peaked with 39 exclamation points in a June post and bottomed out with only 5 in a post in April. So, in the spirit of better writing, (and to mess with my nephew’s correlation analysis) there will be no exclamation points in this week’s post. So as you read it, mentally use a very dead-pan, monotone voice…you know…the way economics is usually reported.

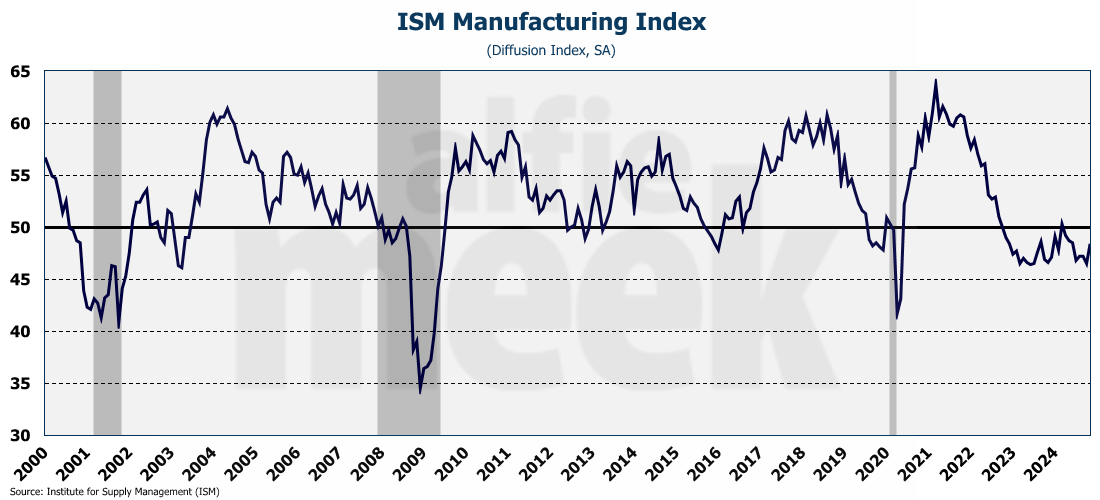

ISM Manufacturing Index

Since October 2022, the ISM Manufacturing Index has been below 50, which indicates that the sector is contracting. The most recent reading shows that the sector is still in decline, however, it did rise significantly in November to 48.4%, which exceeded expectations (full release here).

The improvement in the index is most likely a rebound from the poor October reading that included two major hurricanes (Milton and Helene) as well as the Boeing strike. Even so, there was some good news in the report.

The “employment index”, while still in decline, jumped up 3.7 points to 48.1%

The “new orders index” rose to an eight-month high of 50.4%

The “prices paid index” fell to only 50.3%. That is still above 50 but it does indicate that price increases facing manufacturers are slowing.

One of the interesting comments from the release was “After the election, we have seen an uptick in customers wanting to come back to the U.S. for making their products.” That could be good news. Perhaps the Trump Administration will provide tax cuts and regulatory relief that will benefit the manufacturing sector. But, at the same time, a trade war with major market economies could have the opposite effect.

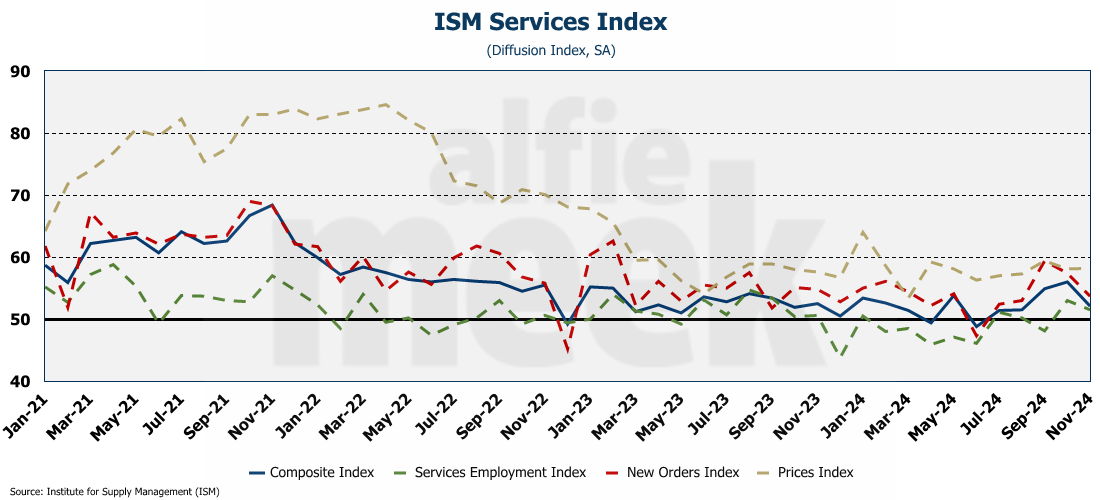

ISM Services Index

While the ISM Manufacturing Index rose, the ISM Service Index fell in November to 52.1 which is the largest monthly drop since June (full release here). This was unexpected as a lot of the hard data and recent readings of the ISM Services Index have all suggested that the services sector is doing well. To be clear, the index was still above 50 which indicates that the sector is expanding, but at a much slower rate in November. The decline in the index was driven in large part by a decline of 3.7 points in the new orders component. Unfortunately, the prices paid component did not drop and is still well in expansion territory which doesn’t bode well for future services inflation, which is already running hot at more than 4.6% and rising.

As with manufacturing, the impact of the incoming administration on the service sector could be mixed. Companies are hoping for a declining interest rate environment and business friendly policies which will give the sector a boost. However, tariffs and a potential trade war could impact the cost of electronics and other components needed by the sector.

Factory Orders

After two months of decline, orders for manufactured goods rose slightly in October (full release here). Factory orders excluding transportation goods were up 0.1%, and orders excluding defense, were up 0.3%.

As demonstrated by the ISM Manufacturing Index above, the manufacturing sector has been in decline for more than two years, and there is little reason to expect a significant turnaround in the near term.

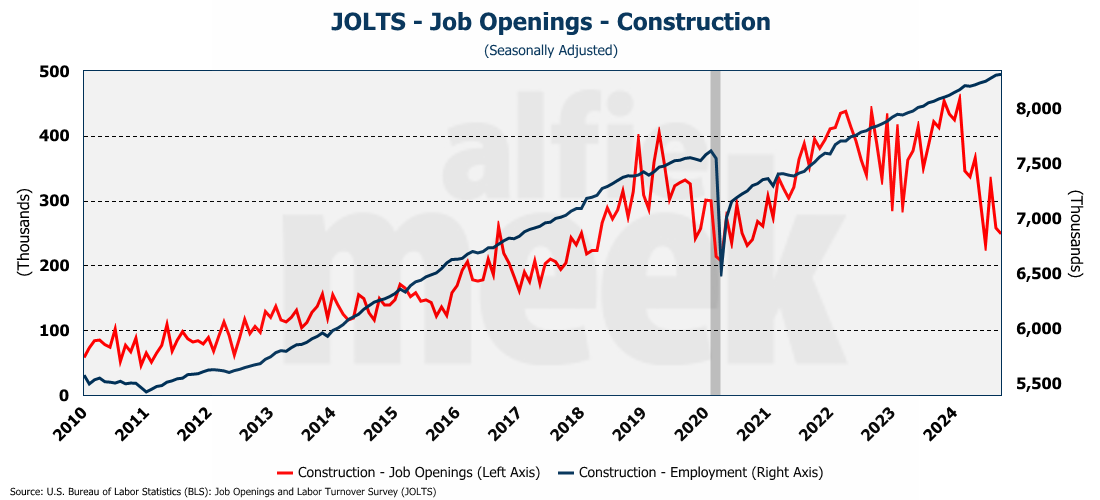

Job Openings and Labor Turnover Survey (JOLTS)

The number of job openings unexpectedly rose by 372K in October which represents the largest monthly increase in over a year (full release here). Even with the large increase, it doesn’t offset the drop of 489K experienced in September. For 2024, job openings are down 1.15 million, and they are down 1.9 million over the past 12 months.

Professional and business services led the way with 209K openings, followed by accommodation and food services with 209K. Shockingly, the number of openings in the federal government decreased by 26K. (Perhaps they can read the writing on the wall.)

For several months, I have been skeptical of the number of jobs being reported in the construction sector given that housing starts have been trending steadily down for two years and the number of job openings has fallen off dramatically. Yet, magically, construction employment continues to steadily climb. I think we are going to be in for some serious downward employment revisions early into next year…just in time to blame the “employment collapse” on the new administration.

Finally, the “quit rate” surprisingly rose in October as the number of people quitting their job was up 228K, the biggest monthly increase since May 2023. Generally, a rising quit rate is considered an indicator of a strong labor market as people feel comfortable leaving their job to find a new one. However, before we jump to that conclusion, let me point out that 1) the quit rate is still well below pre-pandemic levels and 2) this may have something to do with people who quit their jobs when their place of employment was destroyed by a hurricane. Let’s see how it looks next month before we read too much into this one-month increase.

Employment

Finally this week, we got the numbers on employment for the month of November, and they came in better than expected at 227K new jobs (full release here). And what is interesting, is that the revisions for both September and October were UP by a combined 56K (up 32K up for September and up 24K for October). When was the last time that happened? Not for a long while. On a three-month moving average basis, the number of new jobs in November was 172K - the highest three-month moving average since May.

Once again, government and healthcare dominated the job growth with 54K and 33K new jobs respectively. Over the past 12 months, these two have represented 54.3% of total job growth in the establishment survey.

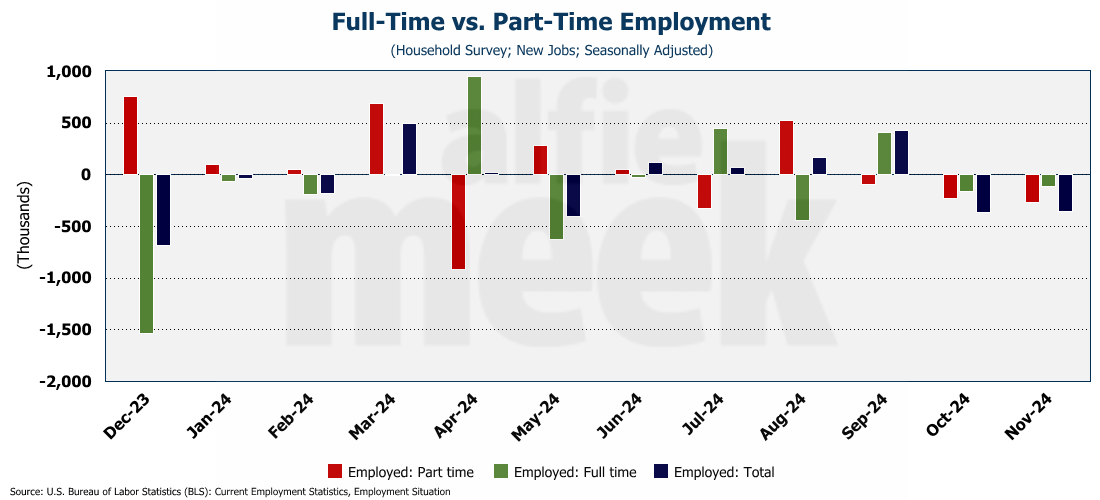

However, as usual, the household survey is telling us a very different story. In fact, according to the household survey, total employment DECLINED for the second month in a row as the gap between the establishment survey and the household survey continues to widen.

Not only did household employment fall for the second month in a row, but the loss was again across both part-time, and full-time work. Households reported losing more than 260K part-time jobs and more than 110K full-time jobs.

Yet, with all this job loss, the unemployment rate stayed the same at 4.2%. How can that be if the number of employed fell by over 350K and the number of unemployed rose by 161K? It is because, overall, 193K simply dropped out of the labor force. In fact, over the past two months, 413K people have dropped out of the labor force. That is a concern and something of which the Fed may want to take notice.

This exodus has caused the labor force participation rate to drop to 62.5%. For in the 25-54 age range, it has dropped to 83.5%, the lowest level since April. For those over 55, it has dropped to 38.4%…not much higher than the all-time, post-COVID low of 38.2%.

If there was one bright spot in the report, average hourly earnings were up 0.37% in November, an 4% year-over-year. Given that this is faster than inflation, real wages increased for the month.

One More Thing…

Some of you started following me on X this week (@AlfieMeekGT) and I was able to get a few posts up. Doing a weekly update is hard enough, so getting the daily posts out will be a challenge, but I hope to get those worked in.

And a special monthly shout-out (although with no exclamation point) to my gold and silver level members - Andrew Hajduk and Dan McRae and…..”Someone” (although I could probably deduce a name from the e-mail, I won’t since they chose not to leave a name.) And thank you to another “someone” with a Hotmail account that joined as a Bronze-level member this week. (They also didn’t leave their name….) All of your support is greatly appreciated.

If you would like to become a member or make a one-time donation, I invite you to click/scan the QR code below.

Only 10 more subscribers needed to hit a major milestone before 2025. Please continue to share with your networks. Thanks again.