Weekly Economic Update 12-12-25: Federal Reserve Interest Rate Decision; Personal Income & Spending; PCE Inflation; Consumer Credit; JOLTS; and Small Business Optimism

The Fed cut rates again this week, and said they don't see any inflation. Clearly they have their eyes closed.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Well, it is done. I have cancelled all monthly, bronze, and silver recurring memberships/subscriptions on the Buy Me A Coffee site. Now I just hope that all of you will continue your paid subscriptions on the SubStack site. I guess I’ll find out on January 2. I have to admit, I am looking forward to turning on comments and getting feedback from my subscribers each week. (Or at least I am now…let’s see what you all have to say…)

In 2025, my subscription base grew 86%! It looks like I will fall about 69 subscribers short of my year-end goal, but even so, I nearly doubled the number of subscriptions for the second consecutive year! Thanks to all of you who subscribe to and promote this blog on a regular basis.

This was another light week for economic data, and next week looks to be the same, although next week we will finally get the official November employment data and the consumer price index from the Bureau of Labor Statistics (BLS). However, this week we did get the last Federal Reserve meeting for 2025, and they decided to cut rates another 25 basis points.

In theory, the Federal Reserve has a dual mandate: to achieve maximum employment and stable prices (currently defined as inflation at 2%). Clearly, that isn’t truly the case as they are failing miserably at both. No, the Fed now has but a single mandate: to keep interest rates low enough so the government can cover the debt service on our ballooning $38 trillion debt. What else would explain the cutting of rates when inflation is running at nearly 3% and rising (see the PCE comments below)? And if they are cutting rates now, just wait until Kevin Hassett takes over the role of Fed Chairman in the middle of next year! In their statement this week, they said to expect only 1 rate cut next year. Uh, what are they drinking? If we have a Chair Hassett, late 2026 will see significant rate cuts, and by the end of 2027, inflation will be through the roof.

With more than 300 Ph.D. economists, you would think that the Fed would occasionally get its policy position correct. Scott Bessett had a great quote this week about the number of economists at the Fed:

“My worry is that the Fed is turning into universal basic income for PhD economists. I don’t know what they do. They’re never right.... if you were to look at the central value tendency versus how they’ve done, it’s shocking. It’s shocking. I said, if air traffic controllers did this, no one would get in an airplane.”

He’s not wrong. Like most institutions, the Fed suffers from “groupthink,” and bucking the trend does not lead to a successful career as a Fed economist. No doubt with Kevin Hassett running things next year, we will see policy papers from Fed economists explaining that, despite all the Nobel Prize-winning research to the contrary, lower rates and quantitative easing don’t actually cause inflation.

Personal Income & Spending

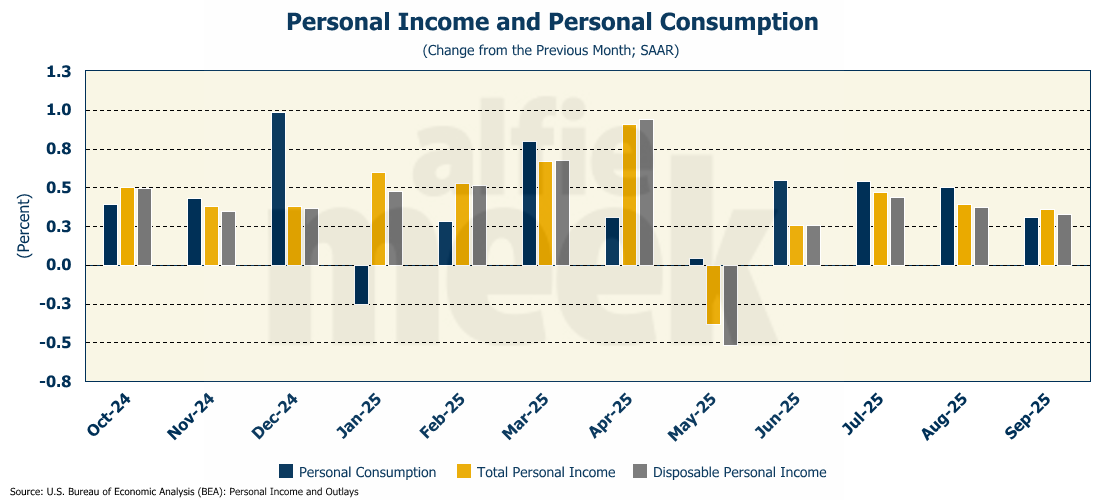

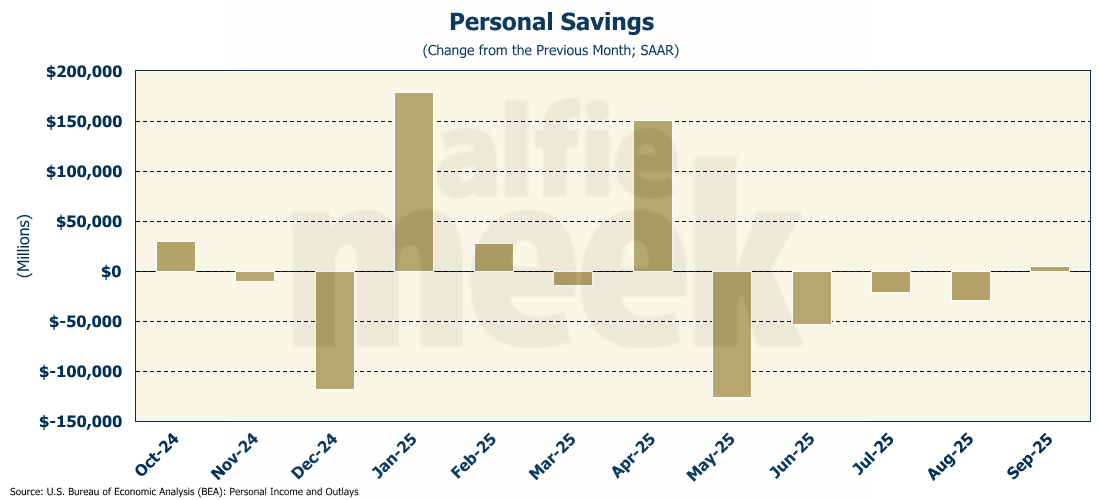

Still catching up from the government shutdown, the Bureau of Economic Analysis (BEA) released the long-delayed September data for personal income and spending this morning (full release here). Strangely enough, in September, for the first time since April, income grew faster than spending.

That, of course, means that for the first time since April, overall personal savings grew, but only by $5.2 billion, which wasn’t enough to increase the overall savings rate, which remained steady at 4.7% - the lowest since December 2024.

PCE Inflation

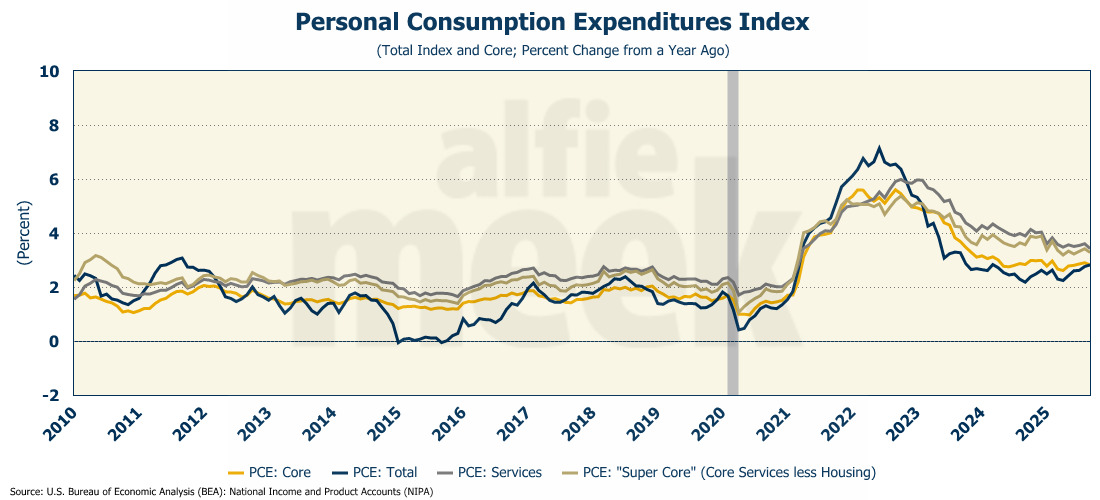

As with personal income and spending, the BEA also released the delayed September reading of Personal Consumption Expenditure (PCE) inflation this morning (full release here). In reporting this, there were several headlines that implied that inflation was under control or that there were no price pressures in the economy. I don’t know what they were reading, but I’m not sure how you get that from the actual data. The PCE index rose to 2.8% year-over-year, which is the fifth consecutive month that there has been an increase in the year-over-year number. Inflation is rising. That is the ONLY way to interpret this data.

Core PCE, the Fed’s most preferred measure of inflation, had been rising steadily since April, but did drop slightly in September, falling to 2.8% - still well above the Fed’s target. Of larger concern is service inflation, which, measured by the PCE index, is still running above 3.4% on an annual basis.

In their statement this week, the Fed said it “saw inflation coming down.” Exactly what are they looking at? You may recall back on May 4, 2024, when Chair Powell stood before the cameras and when asked about the possibility of stagflation, he said, “we will return inflation to 2%, and I don’t see the stag or the flation.” I wonder if he sees either now? The “flation” is certainly here, and with the rate cut this week, and the rate cuts that are sure to come late next year with the new Fed Chair, inflation will be well above the Fed’s target for some time to come.

Consumer Credit

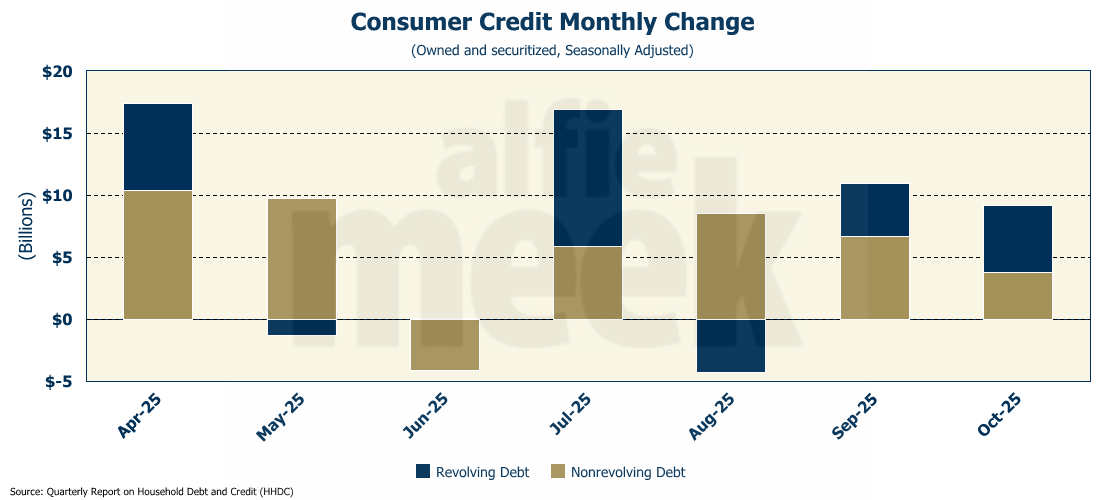

But consumers just keep right on spending. The latest consumer credit data shows that consumer credit rose by another $9.2 billion in October, $5.4 billion of which was an increase in revolving debt (full release here). That increase pushed the total level of consumer credit to a new all-time high of $5.084 trillion.

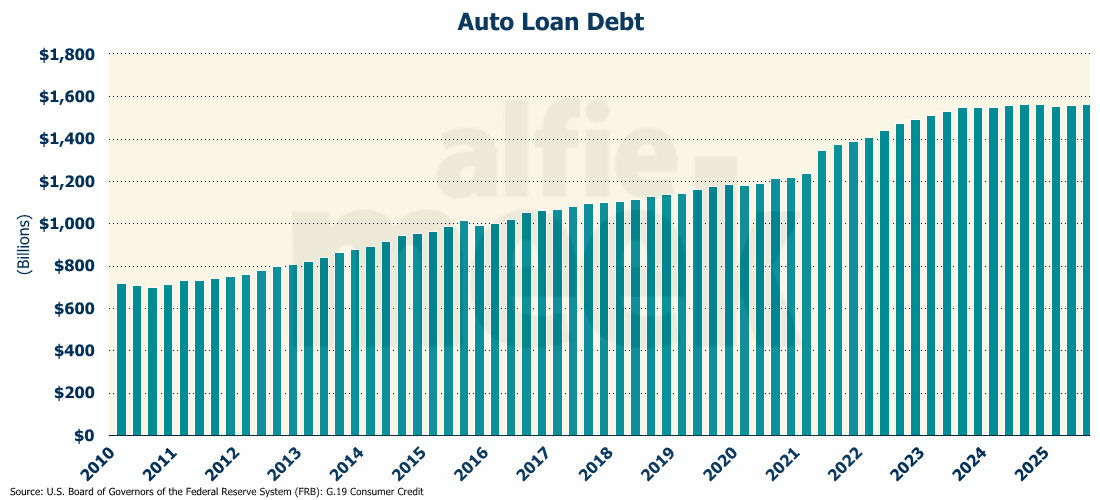

Part of the increase in nonrevolving debt included an increase of $4 billion in auto loan debt, bringing the total auto debt to $1.564 trillion. Just a few weeks ago, Kelley Blue Book reported that the average new car price hit $50,000 for the first time ever. The average amount financed by new car loans also hit a new record high of $41,000.

Where will the consumers’ ability to spend end? The recent Black Friday saw 95% of sales volume financed, mostly on credit cards. That wouldn’t be so bad except that, according to surveys, more than two-thirds (67%) of those will not be paid off within 30 days. Further, about $1 billion was spent using Buy-Now-Pay- Later schemes, which are the just about the worst possible consumer debt and don’t even show up in the traditional consumer debt statistics.

Job Openings and Labor Turnover Survey (JOLTS)

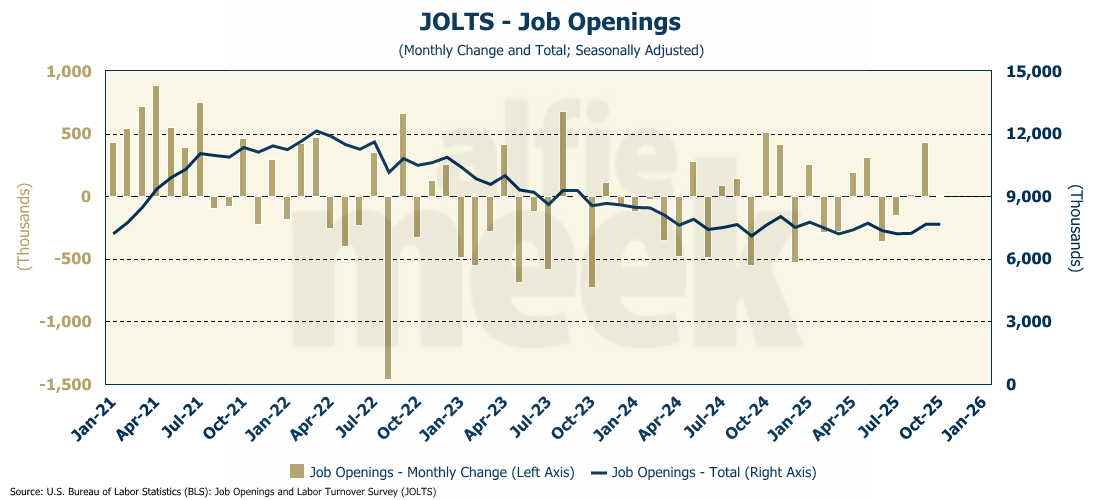

Due to the government shutdown, we haven’t had a JOLTS report in two months, and the last time we got one, for August, job openings were few and far between. However, according to the data released this week, job openings soared in September, increasing 431K, the largest monthly increase since October 2024 (full release here). October added another 12K on top of that.

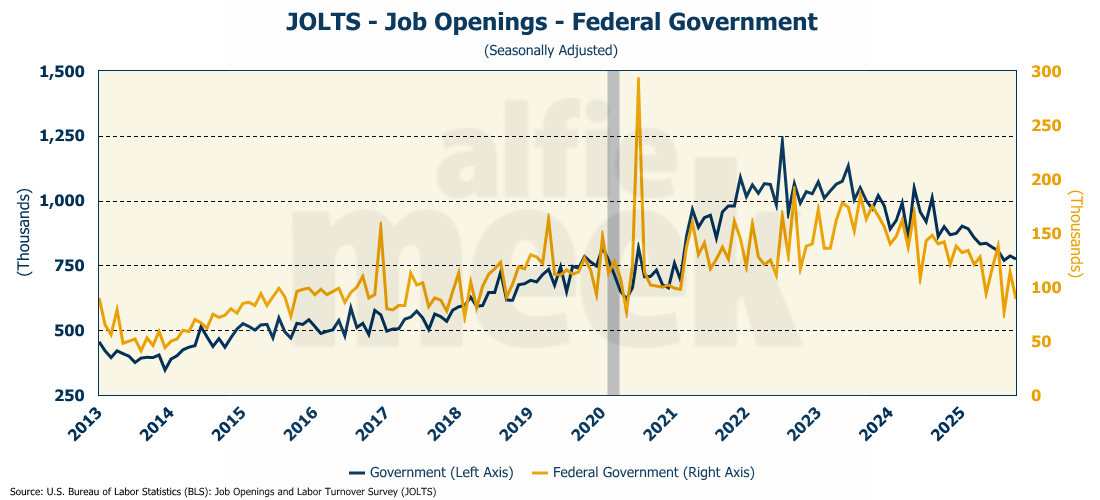

The largest increase in job openings was in manufacturing, trade, transportation, and utilities. Not surprisingly, government job openings continue to free-fall, and job openings for the federal government are less than half the level experienced during the Biden Administration and are approaching levels not seen in nearly a decade.

We are still waiting on the official employment data from the BLS, but, despite other recent labor market indicators, the JOLTS data seem to suggest that the job market may be stronger than the Fed thinks. Their rate cut last Wednesday would certainly suggest that is the case, especially since they said that they expect unemployment to remain “elevated.” We’ll see if they are right.

Small Business Optimism

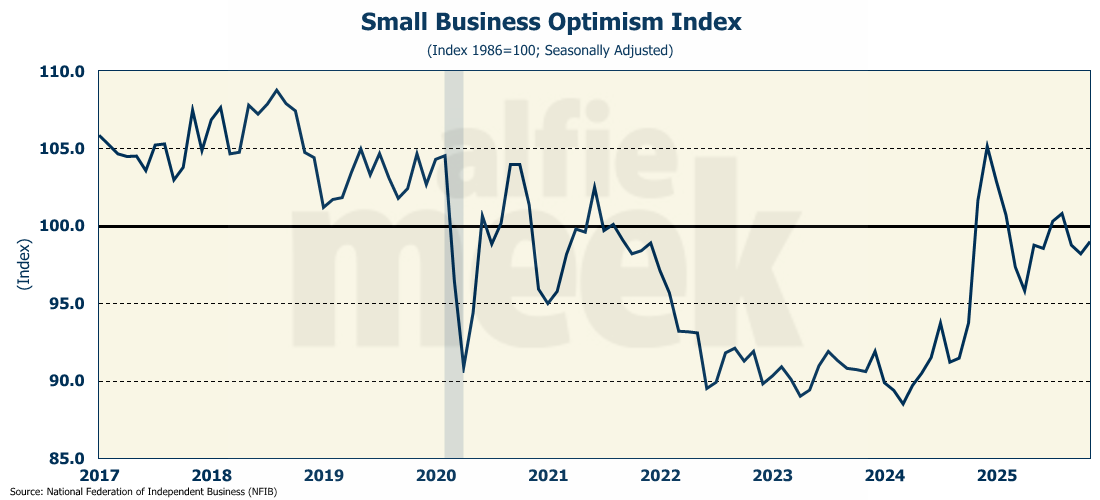

Finally, this week, according to the National Association of Independent Businesses (NFIB), small business optimism unexpectedly improved in November, rising almost a full point to 99.0, which is slightly above the 52-year average of 98 (full release here). However, the “Uncertainty Index” also rose 3 points to 91.0. That increase was driven by owners reporting uncertainty about capital expenditure plans over the next three to six months.

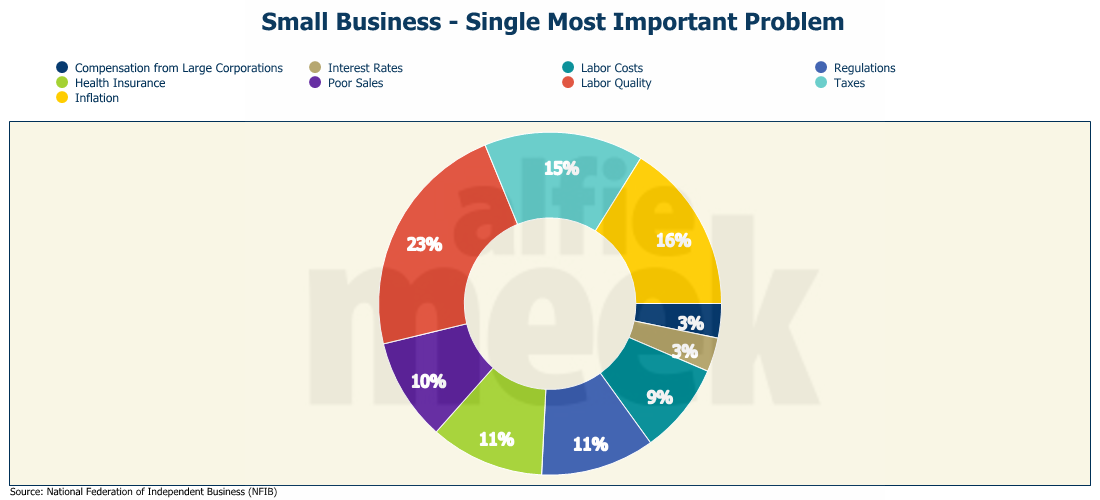

By a large margin, the single most important problem reported by small businesses was still “labor quality.” However, 5% fewer businesses reported that as #1 in November than in October. The share of businesses choosing “inflation” or “health insurance” as the single most important problem grew, which is not surprising, given that inflation is rising and most companies just came through their annual open enrollment period.

Speaking of inflation…In November, the share of owners raising average prices rose 13 points from October to a net 34%, the highest reading since March 2023 and the largest monthly jump in the survey’s history.

One More Thing…

The Christmas season is the most wonderful time of the year! It is a time for charity, for celebration, and for reflection. On a personal note, 2025 had its share of low points and high points. We lost my dear mother-in-law in the spring, but around the same time, my youngest son got engaged to a most wonderful young lady, and I am so excited for what their future holds.

I will write more about the true meaning of Christmas next week, but as we celebrate the season of advent, I pray that you take some time to truly enjoy everything there is about Christmas. Enjoy your family; enjoy some time off work; enjoy the exchanging of gifts; and enjoy the endless possibilities of a New Year!

And enjoy a good book. Last weekend, I re-read Charles Dickens’ A Christmas Carol. Everyone knows the story, as it has been interpreted and portrayed in countless ways by everyone from Kermit the Frog to Mickey Mouse, to Jim Carrey, to George C. Scott (my personal favorite). But if you have never actually read the book, I encourage you to do so. Light a fire, get a steaming mug of hot chocolate, and sit down for a couple of hours to read the story as Dickens wrote it in 1843. I think this will be my own personal new Christmas tradition.

Until next week, Merry Christmas!