Weekly Economic Update 12-15-23: Inflation; Retail Sales; Federal Deficit; and Industrial Production

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

What a bizarre week. "Ivy League" college presidents find themselves in hot water; the House of Representatives voted to initiate an impeachment inquiry into the President; and the Federal Reserve flipped the script and suddenly decided that inflation is no longer a problem and it is almost time to turn on the money spigot. This last one is the most bizarre. Consider the following:

Chairman Powell on December 1, 2023 - "we’re not even thinking about rate cuts, let alone talking about them.”

Chairman Powell on December 13, 2023 - "rate cuts are something that is clearly a topic of discussion."

Wow! What a difference 12 days can make! And for the stock market, it was the 12 days of Christmas come early!

In my opinion, the only way to explain this "Powell Pivot" is that the Fed is scared of something. What that is, I don't really know. But I have four possible ideas:

They see deflation on the horizon and they want to head that off at the pass. The threat of deflation is real and is of much larger concern than inflation so they are responding now. (The M2/CPI lag chart I posted last month supports this position.)

They know we are already in a recession (as evidenced by dozens of indicators I have previously discussed) and they are getting ready to respond with lower rates in an attempt at the so called "soft landing." But if we are already in a recession, the "soft landing" ship has sailed.

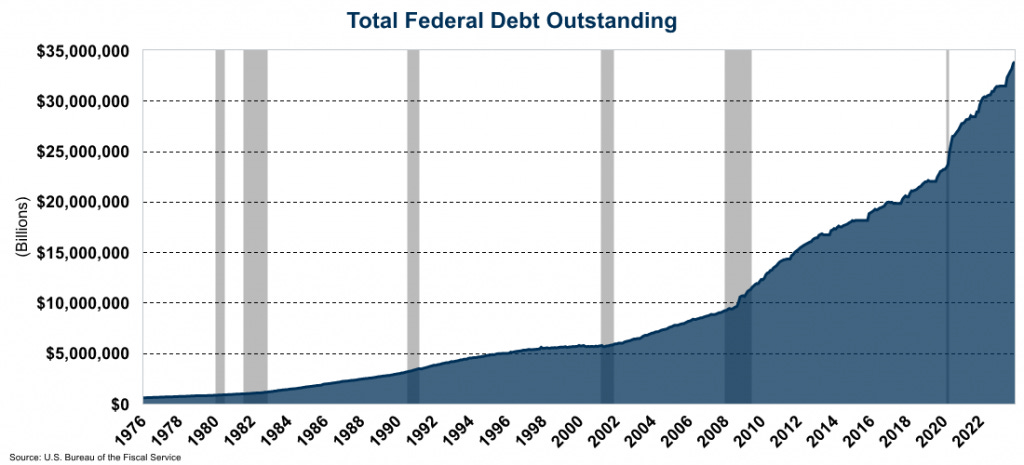

They know how much debt the treasury is going to need to issue in the coming months (both rollover and new debt) and they know that there are no more buyers in the market so they will have to once again engage in quantitative easing and expand the balance sheet to absorb that debt. (Powell claims that the Fed plans to continue balance sheet reduction, but said that if there is a recession, "quantitative tightening will no longer be appropriate.")

They know that they have to stop hiking rates because they can't hike them anymore! The interest on the Federal debt is simply too high and unsustainable (more on this below).

There may be some other reasons, but those are my top four with only a day or so to digest what happened. I certainly hope this is more complicated than election-year shenanigans. But whatever the reason, the fact remains, as we will see below, the battle against inflation is not over. But, then again, maybe it is...and rather than win the war, the Fed surrendered.

Final comment on this.....today (Friday) is the first day after a 2-week Fed blackout. (This is the period of time around policy meetings where Fed officials are restricted from speaking about Fed policy.) The first comment out of the gate was by NY Fed President Williams, who said that the Fed is NOT talking about rate cuts! What the heck is going on?!? That is the exact OPPOSITE of what Chair Powell said Wednesday! What a mess the Fed has made.

Consumer Price Index

So, what about inflation? The Consumer Price Index (CPI) rose 0.1% in November, and on an annual basis, prices are running 3.1% above the level of one year ago. That was a little hotter than expected as "experts" were forecasting no growth for the month. Core CPI (CPI less food and energy) remained constant at 4.0% where it has been for a few months. That is still double the Fed's 2% target. (But hey, I guess inflation is under control....) Overall CPI is dropping due to the decline in oil/gasoline while rents , used-vehicles, and medical services posted significant increases in November.

The larger concern is the rate of inflation in the Core Services less Shelter CPI (the yellow line in the graph below). It has been INCREASING the last two months and the November jump translates to a 5.3% annualized rate! This is an important gauge for the Fed as they consider factors beyond the "headline" CPI number. In this case, because our economy is so service-dominant, and because labor is the largest component of services, that number rising indicates rising labor cost. That should be a concern for the Fed, and is one of the main reasons that I have been saying that rate increases are still very possible and that the idea of a rate cut in early 2024 is a fantasy. Well, looks like I was wrong. I foolishly took the Fed at their word and didn't expect an about-face from their position just two weeks ago. At their meeting this week the Fed lowered their end of 2024 rate projection to 4.6% from 5.1%. Interestingly, in his statement on Wednesday, Chair Powell said the inflation "remains elevated and the path forward is uncertain." (But hey, I am going to go ahead and start cutting rates anyway because I am channeling my inner Paul Volcker and the late 1970s wasn't really all that bad...)

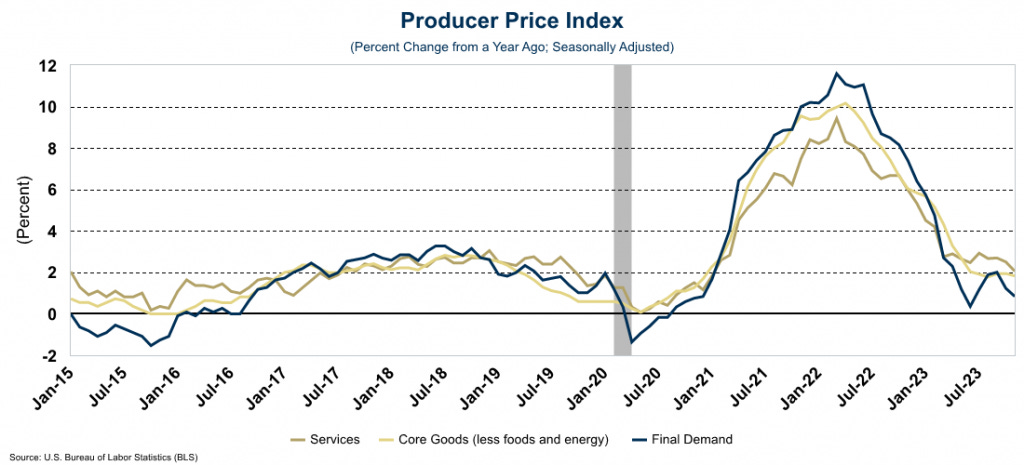

Producer Price Index

If there is one place where it appears inflation might be tamed, it is producer prices. While consumer prices are still elevated, producer prices are flat and are getting ready to move into dis-inflation territory. In November, producer prices were unchanged from October (mostly due to plunging oil prices) and on a year-over-year basis are up less than 1%. And even if you ignore the drop in oil, "core" PPI is now running 1.8% year-over-year and the PPI for services is down to 2.1%. Further good news is that intermediate PPI, (which is considered a leading indicator to final PPI) is firmly in deflationary territory at -4.1% year-over-year.

This is all great news, but keep in mind that commodity prices can have a major impact on PPI, and they can turn on a dime. China could turn on the stimulus driving up demand; OPEC+ could make a policy change on how much oil to pump; etc. You just never know. For example, one interesting piece of data in the report....food prices at the producer level rose 0.6% led by a 59% increase in the price of eggs - another outbreak of avian flu could keep egg prices elevated for some time and that will likely filter down to consumers. (On Tuesday, Cal-Maine Foods wrote in a press release that 684,000 laying hens - 1.6% of its total flock - have been affected by avian flu.)

However, for now, these PPI numbers are good and suggest lower inflation going forward - which is perhaps what the Fed sees as well. As pointed out, the dropping price of oil is having a significant impact on energy prices at both the producer and consumer level. If prices continue to drop (or even at current levels) it would be prudent for the Biden Administration to re-fill the Strategic Petroleum Reserve and replace the 300 million barrels they took out to help offset gas prices the last two years.

Retail Sales

As if the week couldn't get any stranger after the Fed's shocking announcement on Wednesday, on Thursday morning we learned that November retail sales were much stronger than expected. Economists were expecting a 0.1% decline in November, but instead, retail sales rose 0.3% for the month and are running 4.1% over last November! Even adjusting for inflation, that is a 1% year-over-year increase, and the largest annual increase since January. If December comes in strong, we may very well be headed to an above-average holiday season.

I just don't get it. Where are people getting all this money? Credit cards? Buy-now-pay-later services? I see blockbuster retail numbers like this, and then I see headlines like this:

Something just isn't adding up for me. Last week we got the employment report and the unemployment rate is at 3.7%. So, on one hand, if you look at the labor market, everybody has a job...but nobody can afford anything! Of course, the unemployment rate doesn't account for income level. A lot of households haven't been able to get their income to keep up with inflation. But then you get these blowout retail sales numbers! We are being told that with high interest rates, reduced personal savings, more than $1 trillion in existing credit card debt, and persistent inflation, consumers are still in the mood to spend. I don't get it.

I did come across some articles by people who follow this closer than I do, and here are a couple of interesting explanations:

"spending comes from younger segments of the upper-middle class, who, while not necessarily affluent, have sufficient income to meet their needs and indulge in leisure activities and luxury purchases. Many are embracing buy-now-pay-later (BNPL) platforms, contributing to the growth of these services," - Boston Consulting Group

"spending patterns align intuitively with people prioritizing present enjoyment amid uncertainty about the future." - The Brookings Institution (This is also known as "doom" spending - spending money despite economic and geopolitical concerns. In the past we described it as "eat, drink, and be merry for tomorrow we die" which is a paraphrase of 1 Corinthians 15:32.)

Whatever the reason, it simply can not continue. Despite the Fed's best efforts, money is not infinite, and at some point this will come to an end. I fear it won't be pretty.

U.S. Budget Deficit

Speaking of money not being infinite, the U.S. government clearly thinks that it is! The federal budget deficit increased a whopping $314 billion in November, up from $249 billion in the same month last year! Revenues rose, but expenses rose faster. Imagine that.

Not surprisingly, interest on the debt was $66.3 billion higher over the first two months of the fiscal year than in the same period in 2022. (Federal budget year starts in October.) Net interest expense was $659 billion last fiscal year, which is nearly double from three years ago.

The FY 2023 total budget deficit was $1.7 trillion. With absolutely no legislative changes (not likely) it will close to $2 trillion per year for the next decade and interest on the total debt will be well over $1 trillion annually. Simply put...we're broke.

Industrial Production

Not surprisingly, industrial production rebounded in November, led by a sharp increase in motor-vehicle production as striking auto workers returned to the factories. Even so, on a year-over-year basis, total industrial production was still down -0.4% from 2022, and manufacturing production was down 0.8% from 2022, which was the 9th consecutive year-over-year decline. This, like most other indicators, show the manufacturing sector is likely in recession.