Weekly Economic Update 12-19-25: November Employment; Home Builder Confidence; Retail Sales; and the Consumer Price Index

Wishing you all a very Merry Christmas!!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

This will be my last economic update for 2025. Next week is Christmas (more on that below), and, as I did last year, I have asked a friend to write a guest column for next week and give me a break while I spend time with my family. Last. year, he gave us a commentary on cryptocurrencies, and I believe he will be continuing with that theme this year. Since I get a lot of questions about cryptocurrencies, I thought this would be a nice way to kill two birds with one stone.

Also, one final reminder that unless you are a paid subscriber, you won’t receive the entire post on Friday, January 2. For those of you who are paid subscribers, I ask for your patience as I wade through the intricacies of SubStack’s paid subscriber system. It isn’t something you can test beforehand, so it might take me a week or two to get the kinks worked out.

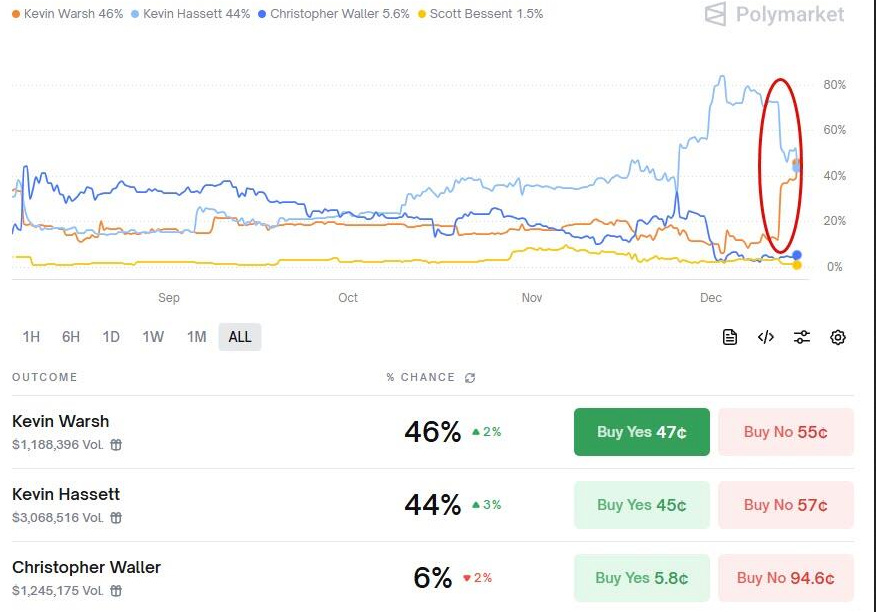

In economic news, the rate cut last week, and the impending appointment of Mr. Hassett to run the Federal Reserve, caused several business leaders to go to the White House to suggest another nominee. Apparently, they believe that Mr. Hassett would simply be a tool of the White House, and monetary policy would be far less “independent.”

While they are no doubt correct, one has to wonder why it has suddenly occurred to these titans of Wall Street that Mr. Hassett would be the President’s puppet? Kevin Hassett has been the frontrunner for months and has made no secret of the fact that he believes rates should be considerably lower. But, whatever the reason, as of last weekend, Mr. Hassett has lost his “front-runner” status to another Kevin…..Kevin Warsh, who is now a slight favorite according to Polymarket.

Apparently, Mr. Warsh is preferred by the likes of Jamie Dimon, the CEO of JPMorgan Chase. This is not surprising, given that when Mr. Warsh was on the board of the Federal Reserve during the 2008 financial crisis, he served as the board’s “liaison” to Wall Street and the banking community.

So, on one hand, it appears we have one Kevin who would presumably be a puppet of the White House, and on the other, a Kevin who would be a puppet of Wall Street. But regardless of which Kevin we get, they are both sure to cut rates significantly in the latter half of 2026. As the President said last weekend to the Wall Street Journal, “I think the two Kevins are great.” Mr. Trump wants a rate cut…badly. In fact, the President went on to say that the next Fed chair should consult with him on interest rates. To quote the President, “I’m a smart guy and should be listened to.”

Ignoring whether or not the statement is true on its face, being smart isn’t the point. The Fed should retain some level of independence - from both the White House AND Wall Street. Jimmy Carter was a “smart guy” (and he didn’t mind making sure you knew it). He appointed Paul Volcker to be the Fed Chairman. That decision was VERY smart, but hugely detrimental to Carter’s political career, as Volcker raised the Federal Funds rate to almost 20% in an attempt to halt inflation, which was running almost 15%. Within 3 years, it was back below 3%. After a very quick recession in 1981-82, the economy went on a tear for almost two decades.

Carter chose the best man for the job, regardless of the political fallout. President Trump would be wise to do the same. But alas, we are likely to get one of the two Kevins. Is there a third “Kevin” option? Perhaps Kevin Bacon, Kevin Costner, or maybe Kevin Spacey. (I hear he needs a job.) Maybe Kevin Hart…he would at least make the post-meeting press conferences funny. I would take just about any other “Kevin” than the two that seem to be likely to get the job. Maybe that kid from Home Alone…

November Employment

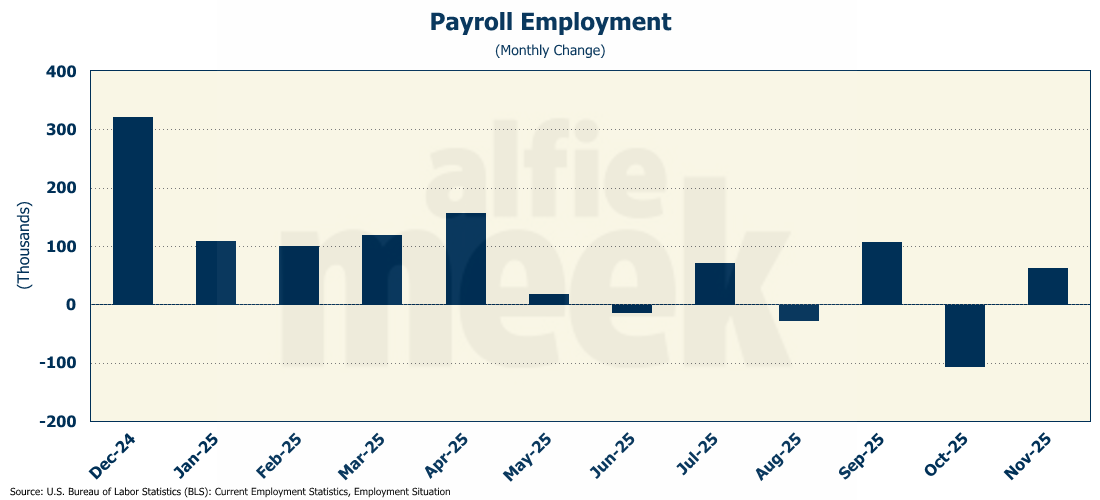

Thanks to the government shutdown, we haven’t gotten any “official” employment data from the Bureau of Labor Statistics (BLS) since September 5th. However, this week Christmas came early, and the BLS finally caught up and gave us data for both October and November (full release here). And of course, the data was mixed. In October, the economy lost 105K jobs, but gained 64K back in November.

Of course, some things never change - August was revised down by 22K and September was revised down by 11K. Combined, the two months posted are 33K fewer jobs than initially reported. On a three-month moving average basis, October was actually negative.

With respect to the household data, there will never be household data for October 2025, as that is survey data, and there was no one at work to do the survey. (Future trivia question…what was the unemployment rate in October 2025? Answer: There was no unemployment rate.) However, for November, the unemployment rate rose to a four-year high at 4.6%, which was higher than expected.

Overall, the household survey shows a VERY weak labor market. Not only was the unemployment rate higher than expected, but the new jobs reported by households were all part-time. The total number of full-time jobs fell by 983K from September, while the number of part-time jobs rose by just over 1 million over the same period.

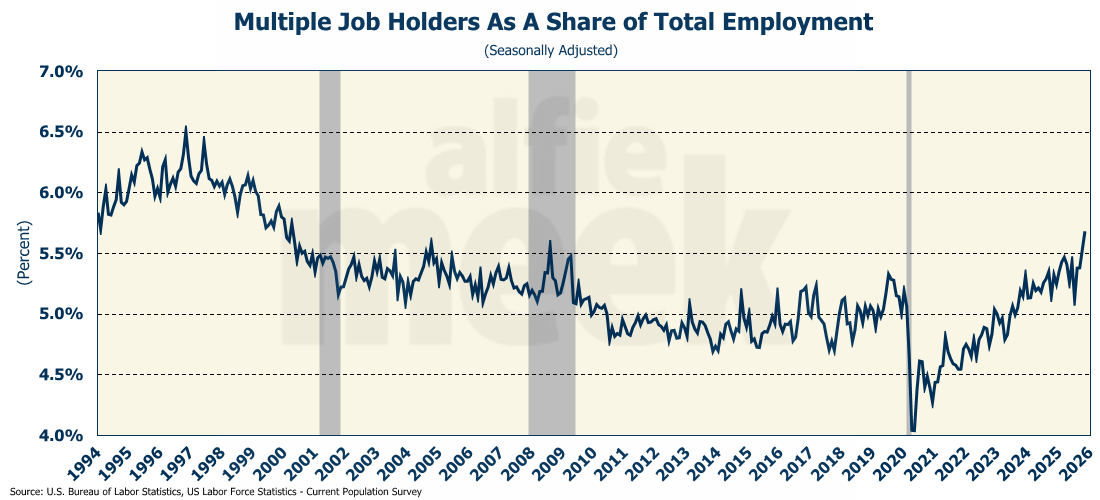

Also, the number of people with multiple jobs rose by almost 500K to 9.3 million, which is the highest level ever recorded. That number represents 5.7% of the total number of people employed. Multiple job holders hasn’t that high of a share of total employment since April of 2000.

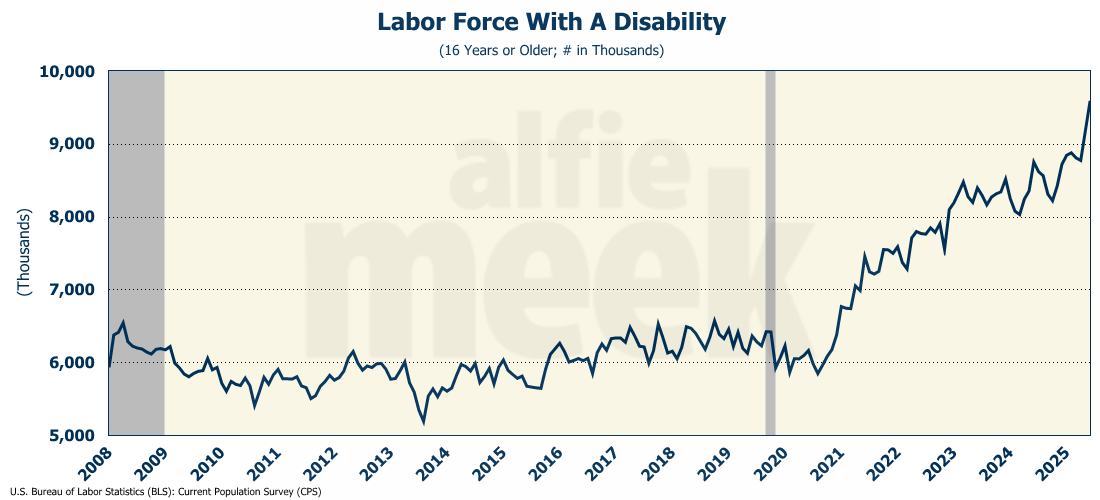

Finally, another interesting trend is the rapidly rising number of people in the labor force with a disability. In November, that number rose to an all-time high of 9.6 million, which is more than 40% higher than the number pre-COVID.

Overall, this report shows a significant weakening in the U.S. labor market heading into next year. That will impact the consumer, which, in turn, will impact GDP in 2026.

Home Builder Confidence

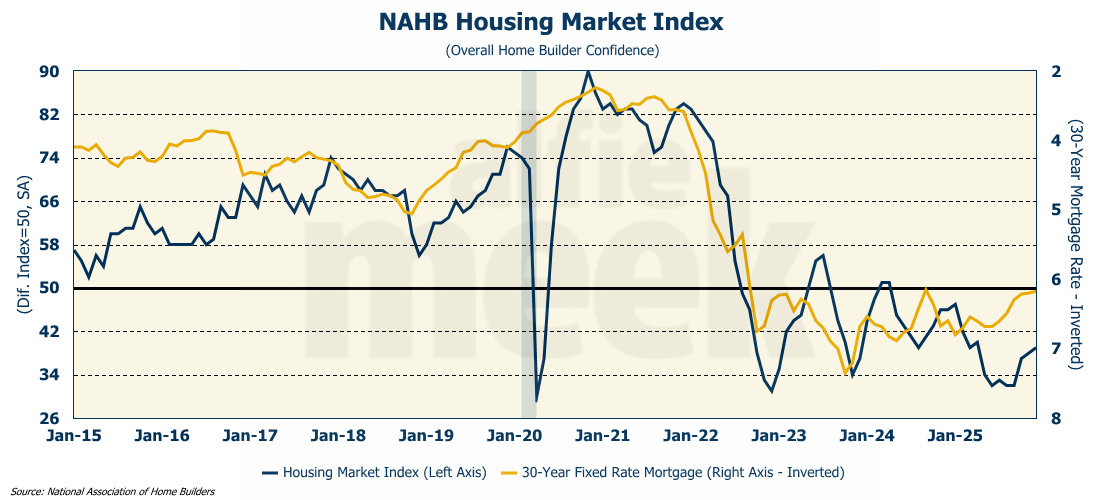

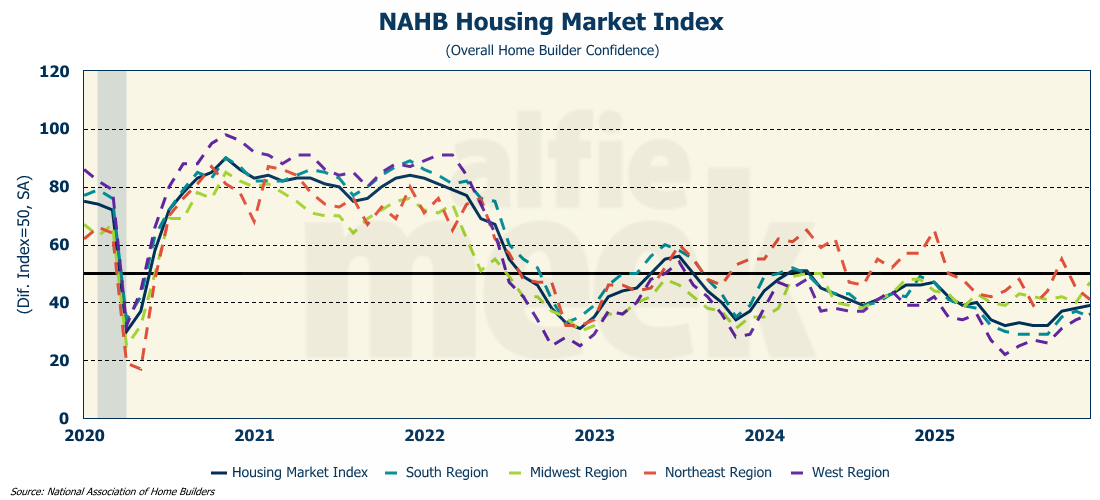

According to the National Association of Home Builders (NAHB), builder confidence edged up just 1 point in December to 39 as mortgage rates have been stuck in the low six range for several months (full release here).

In December, 40% of builders reported cutting prices - the second consecutive month the share has been at 40% or higher since early in the COVID pandemic. Further, 67% of builders reported using sales incentives in December, the highest percentage since COVID.

On a regional basis, the Midwestern part of the country performed the best, with builder confidence rising 7 points to 47. However, that is still below 50, which means that even in the Midwest, there are more builders saying the housing market is “poor” versus “good.” The overall index hasn’t been above 50 since April of 2024, and until mortgage rates come down significantly, it isn’t likely to move above 50 anytime soon.

Retail Sales

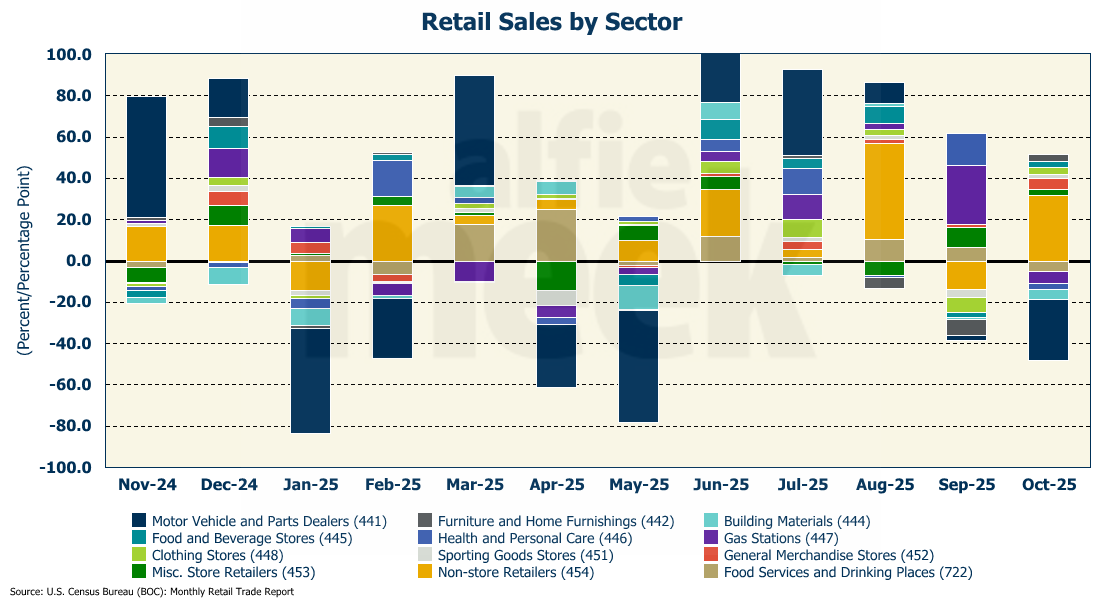

Retail sales data is still lagging, and this week brought us the numbers for October (full release here). The numbers were significantly lower than anticipated, with October retail sales coming in virtually the same as September. That pulled the annual number down to 3.5% - the lowest since May.

However, “core” retail sales (retail sales excluding food service, autos, gas, and building materials) posted a strong growth of 0.9% during the month, suggesting that consumers were out early shopping for deals for the upcoming Christmas season. And you can see from the chart below that most of that was done online (“non-store retailers”).

Even so, the overall retail sales number is concerning. Back in January, my forecast for GDP for this year was 2.25%. Through the first two quarters, GDP has averaged about 1.6%. Like everything else, the third-quarter data has been delayed and should be out next week. But as of now, the Atlanta Fed estimates that the number will come in at 3.5%. Assuming they are correct, that would make the 2025 average 2.23% through three quarters. Not bad on my part.

Unfortunately, these retail sales numbers suggest that the fourth quarter is off to a bad start and will be less than stellar, which will bring down the overall annual GDP number to something lower than my forecast. In fact, it is possible that for the year, the economy grows less than 2%. We will find out in the spring.

Consumer Price Index

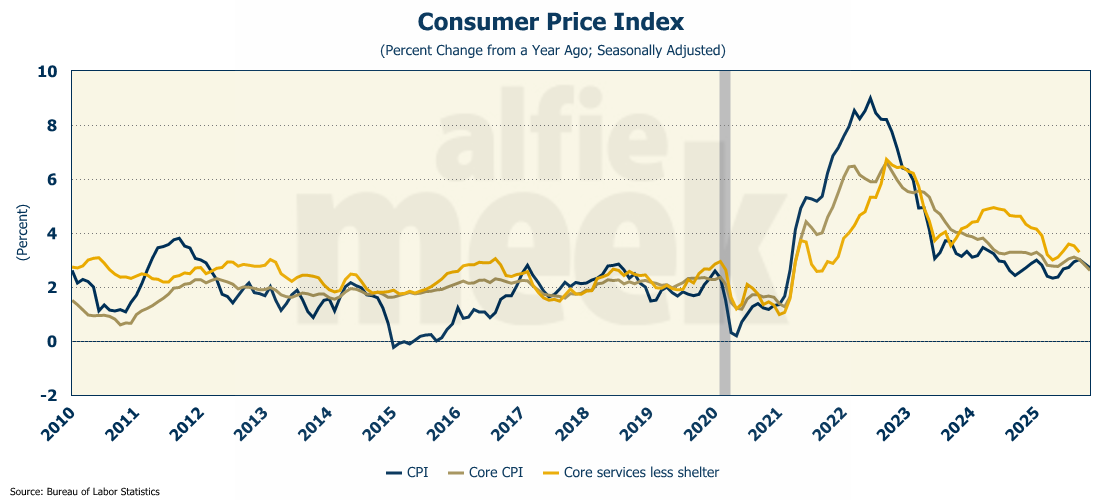

Finally, this week we got the November CPI (full release here). (As with the unemployment rate, it appears there will never be an October 2025 CPI, which is going to cause havoc with models and analysis going forward…especially next October when there will be no year-over-year comparison.)

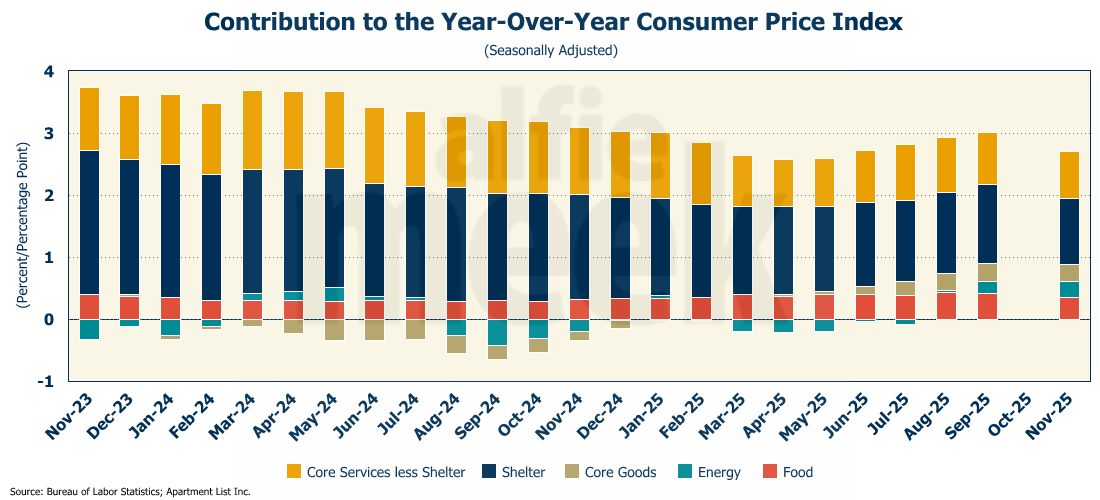

On a month-over-month basis (well, sort of…November over September), the index rose 0.2% and was up 2.7% from November 2024. That was an unexpected sharp drop from the annual rate of 3.0% in September.

Core CPI also fell sharply from 3.0% in September to 2.6% in November. Core services inflation also fell from 3.3% to 3.0% over the same period.

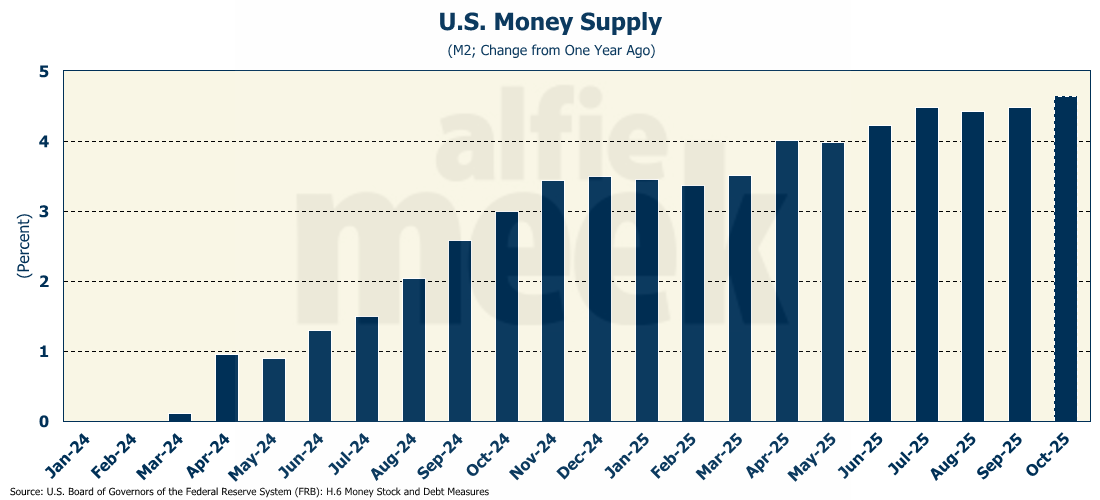

Despite the expansion of the money supply and the cutting of interest rates, the CPI has been falling since August. While interest rate cuts can take 12-18 months to work through the economy, this decline is still surprising given that the money supply has been growing more than 4% since the spring.

So what is driving the drop in the CPI? Housing. More specifically, the “shelter” component of the index. Two years ago, inflation was running 3.1% and shelter was 2.3 percentage points of that, or more than 75% of the inflation being experienced by consumers. Today, despite the fact that energy inflation is higher, goods inflation is higher, and food inflation is roughly the same, overall inflation is running only 2.7% because shelter inflation has dropped significantly. Two years ago, shelter inflation was running 6.5%. Today it is 3.0%. As such, the share of shelter in the overall number is half what it was two years ago.

So why is shelter inflation coming down? Because home prices are stalled (owners’ equivalent rent) and rents are falling (rent of primary residence). Those are the two components that make up “shelter” inflation.

Of course, “owners’ equivalent rent” is a hypothetical measure of housing cost for homeowners, and represents the amount home owners would pay to rent their own home in the market, or the rent they forgo by not renting it out. But home owners don’t actually experience that inflation. However, they do actually experience core goods inflation, food inflation, and energy inflation.

And rents are falling because the supply of multi-family housing far exceeds the demand due to 1) over building and 2) the self-deportation (or at least the slowing inflow) of foreign workers. Once this gets worked out of the system, and falling interest rates kick-in, along with the promised quantitative easing that the Fed has already announced for next year, inflation will be back. This drop is temporary, and to quote one official at Goldman, “beware the noise” in this report.

One More Thing…

Christmas is unquestionably my favorite time of year. I never tire of hearing the classic Christmas songs and carols, and I even like a few of the newer songs. One of my very favorites is “Christmas is With Us Again” by Eden’s Bridge. Some of the lyrics are as follows:

The fine decorations, they light up the town

It is crowded and bustling with thousands around

And it’s all a big business, though profits are down

And Christmas is with us again

And it’s tatty and tawdry and shabby and stale

And the spirit of Christmas is lined with fine ales

And we spend all our money, complain at the price

Forgetting the reason, the birth of the Christ.But we’re swimming in seasonal good will and cheer

It’s the finest, the very best time of the year

And we’re bound to enjoy it all now that it’s here

Now that Christmas is with us again.I have waited all Autumn to celebrate birth

When the One Son of God became flesh on this earth

But we’re milking the season for all it is worth

And Christ is forgotten again.

I hope this season, you won’t forget the true meaning of Christmas. Among all the hustle and bustle, remember that Christmas is more than gifts; more than lights; more than parties; even more than a time to spend with family. It is the day we set aside to celebrate the one Son of God, Jesus Christ, becoming flesh, dwelling among us, and giving His life as a sacrifice to provide us salvation and reconciliation with God. He is the Light of the World, and the only hope for mankind. If you don’t know Him, I invite you to investigate Him; research His claims; and learn more about the best Christmas gift ever given.

“For to us a child is born, to us a son is given; and the government shall be upon his shoulder, and his name shall be called Wonderful Counselor, Mighty God, Everlasting Father, Prince of Peace.” - Isaiah 9:6