Weekly Economic Update 12-20-24: Retail Sales; Industrial Production; Home Builder Confidence; Building Permits &Housing Starts; Existing Home Sales; Personal Income; PCE Inflation and Final 3Q GDP

Lots of data released this week heading into Christmas.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

This will be my final post of the year. I will take next week off to celebrate Christmas with my family and have some time off. However, there will be a final post on December 27th as I have asked a friend to put something together on Bitcoin. I’l be back on January 3rd for another year of weekly economic updates.

There was a LOT of economic data released this week ahead of the Christmas holiday. But the economic news was headlined by the fact that, despite overwhelming evidence of inflation’s resurgence, the Fed decided to cut rates by another 25 basis points this week. At this point, a second wave of inflation is all but certain. In fact, in their own statement, they said they saw inflation going UP slightly in 2025, moving back down in 2026, and getting back to their target in 2027. They did cut their forecast for rate cuts next year down to two from four. But why two? The reporters in the room continued to ask the Fed chair “if you are expecting inflation to increase next year, what is the rationale for even two rate cuts?” He had no good answer…because there isn’t one.

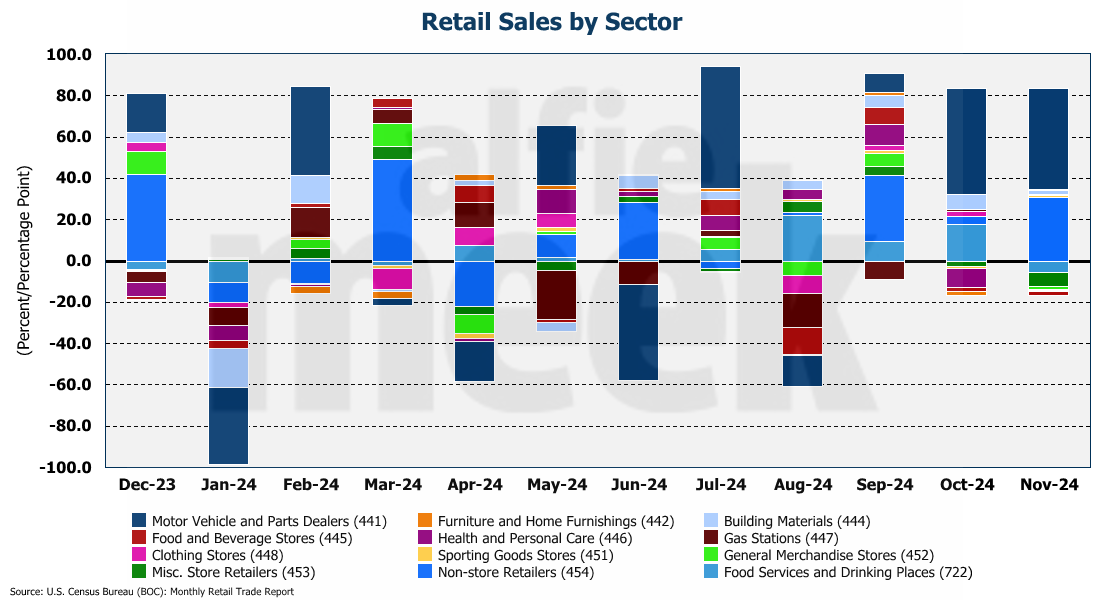

Retail Sales

The week started with the report of retail sales in November…and it was a doozy. Retail sales were up 0.7% for the month, which was much better than expected (full release here.) On an annual basis, retail sales were up 3.8%, the fastest rate this year. Excluding motor vehicles, the annual rate was 3.2%.

Because of the odd calendar this year, with Thanksgiving so late, the data includes “Black Friday” but not “Cyber Monday.” Even so, all indications are that online spending was strong all through “Cyber Monday” week. And, in fact, it looks as if online sales where already running hot even before “Cyber Monday” as “non-store retailers” (i.e., online stores/vendors) were the second largest contributor to the growth. For the second month in a row, “motor vehicle and parts dealers” dominated the numbers and lead retail sales growth for the month.

As I pointed out last week, consumer credit exploded in October. These retail sales numbers suggest further expansion in consumer credit is on deck for November. For whatever reason - election results; a surging stock market; Christmas spirit - the consumer is feeling good and spending money…money I don’t think they have. The data is hard to capture, but indications are that “buy now pay later” options set records in November as well.

So, again we have to ask….why in the world did the Fed cut rates? It makes absolutely no sense. I think at this point has become clear that Fed interest rate policy has little to nothing to do with the overall macro economic situation, and everything to do with trying to manipulate the yield curve. The U.S. government is sitting on $35+ trillion debt and has interest payments in excess of $1 trillion per year. For every single basis point interest rates go up, it costs $3.5 billion! (For reference, a “basis point” is equal to 1/100th of 1%, or 0.01%.). The new administration has quite a challenge going forward as they work to issue new debt and refinance short-term debt purchased by the current administration.

Speaking of the current administration, I found it humorous that outgoing Treasury Secretary Yellen, when meeting with her successor Scott Bessent last week, “expressed regret over failing to make more progress in narrowing the fiscal deficit during her tenure.” Really?!? Well, during her tenure as Fed vice-chair and chair (October 2010 through February 2018) she kept rates at virtually zero and the debt rose $6.8 trillion. Then, as Treasury Secretary from January 2021 to current, the debt has risen another $8.4 trillion. So, in short, under her oversight, the debt has increased $15.2 trillion, or about 44% of total debt outstanding. Doesn’t seem like “narrowing the fiscal deficit” was really something on which she was very focused.

Industrial Production

For the third consecutive month - and the fourth month out of the last five - industrial production in the U.S. fell in November to 0.9% year-over-year…the biggest decline since January (full release here).

Capacity utilization (a measure of how much potential output that is actually being realized in the economy) fell to its lowest level since April 2021. But yet, we are consistently told that “the economy is strong” and that “we are NOT in a recession.” Someone tell the manufacturing sector. It has unquestionably been in recession now for two full years.

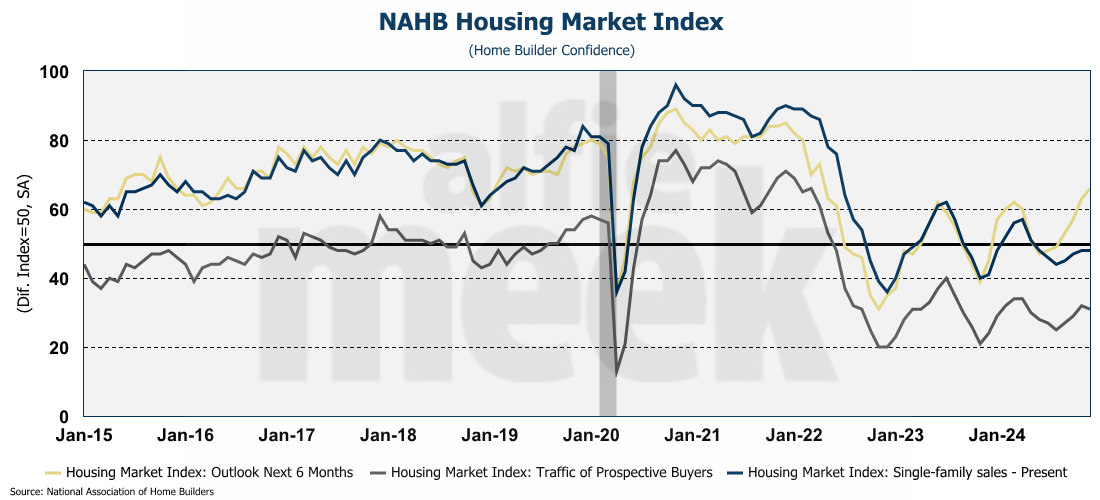

Home Builder Confidence

Home builder confidence was unchanged in December coming in at 46 as mortgage rates have shown very little movement of late (full release here). As a reminder, this is a diffusion index so a reading less than 50 indicates that the majority of builders are not confident about the current and near-term outlook for the housing market.

Digging into the sub-components of the index, we see that the sales component was unchanged at 48; traffic of perspective buyers dropped slightly to 31; but the outlook for the next six months rose to 66…the highest it has been since early 2022. Those builders are always confident about the future. Tomorrow is going to be better than today. Let’s hope they are right.

Existing Home Sales

And maybe they will be. For the second month in a row, sales of existing homes posted a year-over-year increase, rising to 6.1% - the largest year-over-year increase since June 2021 (full release here).

It looks like people may finally be getting used to the idea that 6%-7% mortgage rates are here to stay. The days of the 2%-3% mortgage rate are gone and won’t be returning. That means that now, affordability is the biggest hurdle and, on a seasonally adjusted basis, the median sales price hit an all-time high of $414K. Unadjusted, the November median price was $406.1K which was an all-time high for November, and 4.7% higher than November 2023.

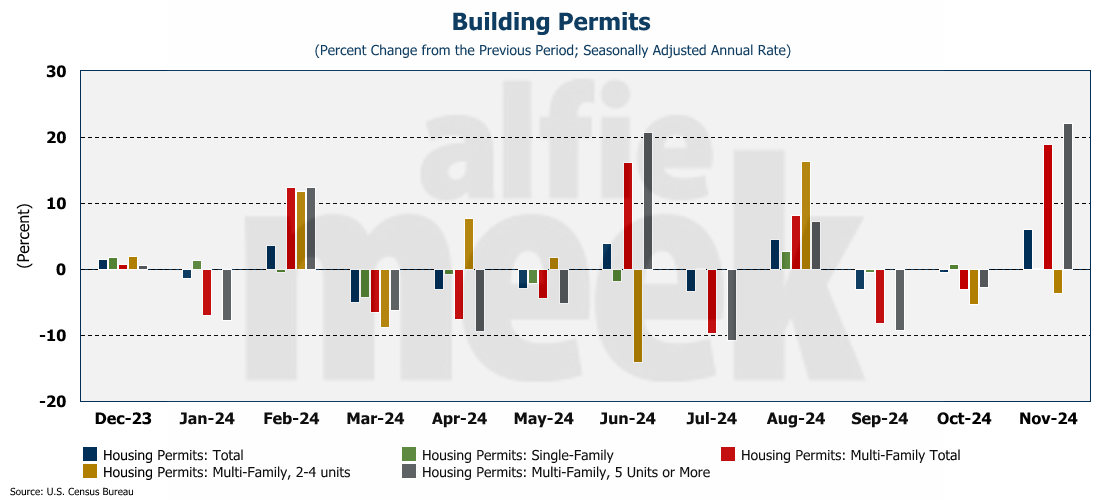

Building Permits and Housing Starts

While existing home sales were strong, on Wednesday, we got a very mixed view of the future housing market as building permits posted strong growth while housing starts fell for the third consecutive month (full release here).

Building permits grew 6.1% in November, the fastest monthly rate since February 2023. The number was driven entirely by multifamily permits which were up 19% in November. Multifamily permits with 5 units or more grew 22.1%. Again, both of those rates are the highest since early 2023.

This comes at a time when the delinquency rates on multifamily housing are creeping up and are now significantly higher than they were even during COVID and are moving back into the territory they found after the financial crisis.

While permits were up, housing starts were down for the third consecutive month, and are now running at 1.289 million units on an annual basis. Single-family permits were actually up 6.4% in November, but multifamily starts fell more than 20%. But with the permit activity described above, multifamily starts should be pick up again in the coming months.

Third Quarter Gross Domestic Product (GDP) - Final

Thursday, the Bureau of Economic Analysis released the third and final reading for third quarter GDP and it was revised up significantly to an annualized rate of 3.1% from a previous estimate of 2.8% (full release here). With this revision, it means that the U.S. economy accelerated throughout the first nine months of 2024….no slowdown, much less a recession, anywhere to be found.

Of that 3.1%, personal consumption represented 2.5% of the growth. Not surprising is that government spending represented another 0.9%. On the downside, residential fixed investment, inventories, and net exports were all negative for the quarter. This is the first time in more than two years that three of the six major categories of GDP were negative. But if the consumer and the government keep spending significantly more than they take in, the economy will just keep growing…until it comes to a tragic stop.

Personal Income

This morning, the Bureau of Economic Analysis (BEA) released data on November personal income and consumption (full release here). For the month, consumption rose 0.4% while disposable personal income was up only 0.3%.

This reverses last month’s surprising increase in personal savings, as once again, consumers are using savings to cover their spending. Given what we are seeing in other data, I expect they will be dipping farther into savings in December.

PCE Inflation

Finally this week we got the latest read on Personal Consumption Expenditure (PCE) inflation, and not surprisingly, it rose to 2.4% in November, from 2.3% in October. The Fed’s “preferred” measure of core PCI (PCE less food and energy) held steady at 2.8% (full release here). If there was a bright spot in the report it was that both PCE for services and “Super Core” PCE (services less shelter) both dropped 0.1%, but are both still quite high at 3.8% and 3.5% respectively.

So again, this week the Fed cut rates in the face of rising inflation as reported in their own preferred measure. I’ve written plenty above about how clueless the Fed seems to be. And this morning, I woke up to the Wall Street Journal asking “Does the Fed Even Know What It’s Trying To Do?” It appears that what I have been saying for months is now hitting the main stream. That’s why you subscribe to this Weekly Economic Update…to get the best economic news and commentary before anyone else!

One More Thing…

As I did last year, given that today is the Friday before Christmas, I want to take this opportunity to wish you all a Merry Christmas, and to encourage each one of you to remember the true meaning of Christmas - the day we celebrate the one Son of God, Jesus Christ, who became flesh; dwelt among us; and gave His life as a sacrifice to provide us salvation and reconciliation with God. He is the Light of the World, and the only hope for mankind. For those of us who know Him as our Savior, this is the most wonderful time of the year. And to those who don't, I invite you to investigate Him; research His claims; and learn more about the best Christmas gift ever given.

"And there were in the same country shepherds abiding in the field, keeping watch over their flock by night. And, lo, the angel of the Lord came upon them, and the glory of the Lord shone round about them: and they were sore afraid. And the angel said unto them, 'Fear not: for, behold, I bring you good tidings of great joy, which shall be to all people. For unto you is born this day in the city of David a Savior, which is Christ the Lord. And this shall be a sign unto you; Ye shall find the babe wrapped in swaddling clothes, lying in a manger.' And suddenly there was with the angel a multitude of the heavenly host praising God, and saying, Glory to God in the highest, and on earth peace, good will toward men." - Luke 2:8-14