Weekly Economic Update 12-22-23: Home Builder Confidence; Housing Starts and Permits; New and Existing Home Sales; Personal Income and Consumption; and Leading Economic Indicators

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Big week for data releases and with everyone focused on Christmas, not everyone is paying attention. But the actions of the Fed last week certainly shook up markets and while some Fed officials are trying to dial back the exuberance, various market segments seem to be off to the races.

Home Builder Confidence

First on the list is the housing market. Mortgage rates have been heading down in recent weeks and as they drop, the confidence of home builders rises. As you can see below, for the first time in five months, home builder confidence ticked up in December right along with the drop in mortgage rates (mortgage rates are inverted in the graph). Last December, the index was at 31...the lowest level since COVID. We were getting ready to test that low, but the turn in rates has lifted builder confidence, although builders are keeping up sales incentives with just over 1/3 saying that they cut prices an average of 6%.

Not only is builder confidence on the rise with the drop in mortgage rates, but so to are mortgage applications. Last week (ending 12/15/23) was the first time since August 10 that the 30-year rate finished the week below 7.0%. If the trend continues, that could certainly loosen the "Golden Handcuff" that has current home owners sticking with their existing mortgage and free up some of inventory. If the Fed does lower interest rates in 2024 (as the market seems to expect) that would further lower rates and loosen the housing market.

Housing Starts

"Experts" were expecting housing starts to decline in November, but instead, they exploded 14.8% over October and have now risen for three months in a row! On an year-over-year basis they are up 9.3% to a rate of 1.56 million units on an annualized basis. That is nearly back to where they were in May of this year.

While total housing starts are up, the real story is in single-family homes. They were up 18% in November and as you can see below, are the real driver in total housing starts as multi-family starts have been trending down for a year, and have fallen off sharply since May. At the same time, single-family starts have been slowly trending up and are sharply up in November.

The story is similar with respect to permits. New residential building permit were down 2.5% in November. However, single-family permits were up slightly (0.7%) while multi-family permits were down sharply. But, as you can see below, multi-family permits tend to swing wildly from month-to-month and that can impact the overall permit numbers. Given that building permits are a leading indicator of housing starts, it isn't too surprising to learn that, like starts, single-family permits have grown consistently for the past 11 months. With interest rates starting to move lower, and home builder confidence on the rise, I would expect that trend to continue, if not accelerate.

New and Existing Home Sales

Existing home sales ticked up slightly in November, from 3.79 million units to 3.82 million units on a annualized basis. Economists had been expecting a slight decline, but again, the lowering trend of mortgage rates probably moved some people to pull the trigger. This the first time home sales have risen since May 2023. Even so, we are still down more than 7% from where we were a year ago. It is interesting to note that "all-cash" buyers made up 27% of sales; individual investors or second-home buyers made up 18%; and first-time home buyers made up about 31%. The median price of an existing home rose $920 to $395,269. Prices continue to be resilient as there is simply no supply. Rates are going to need to fall much farther to get people to release their existing mortgage rate and move to a new home. As such, inventory will need to come from new homes.

Speaking of new homes, despite the dropping mortgage rates, new home sales plunged 12.2% in November to an annual rate of 590K. (Expectations were that sales would increase to 688K.) However, like existing home sales, the median sales price continues to rise as the law of supply and demand dictates home prices. The median sales price for new homes rose nearly $20K in November to $434,700.

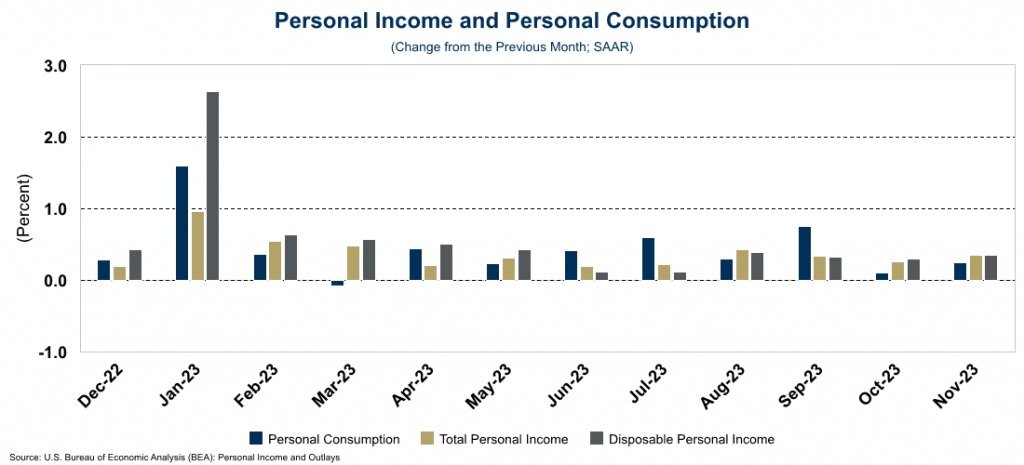

Personal Income and Consumption

Despite the holiday season, consumer spending only rose 0.2% in November, suggesting that the consumer is slowing down, which in turn, points to slower growth in the U.S. economy in the 4th quarter. Overall, we spent more on housing, utilities, and dining out, and less on gasoline because of declining oil prices. Personal income rose 0.4% in November as wages are finally growing a little faster than inflation which is giving the consumer a little breathing room.

PCE Inflation

One of the Fed's preferred measures of inflation, core PCE, continued to decline in November and is now running at 2.3% on a year-over-year basis. Total PCE actually DECLINED in November from October for only the second time since early 2020 and is now running 2.6% over last year. This continued lowering of the rate of inflation is why the Fed has recently kept the policy rate unchanged, and why some believe that the next move will be to cut rates in early 2024. But, as I have been saying, that may be a bit premature as cutting too soon could unleash another wave of inflation similar to what happened in the 1970s.

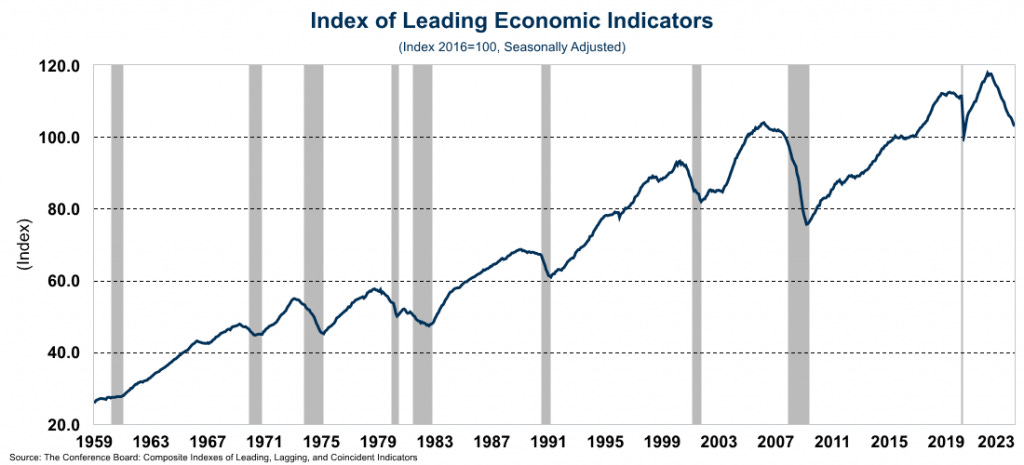

Leading Economic Indicators

The Index of Leading Economic Indicators is a gauge of 10 economic variables that are designed to forecast the direction of the economy. As can be seen below, the index has now fallen for 20 straight months including a 0.5% drop in November. In November, 9 of the 10 variables were flat or negative, with stocks being the only variable to post positive performance. Clearly the index is signaling a recession ahead. The last time the index fell this many consecutive months was during the Great Recession from 2007-2009. Somehow, the economy has defied the constant recession predictions due to the strong labor market and the ever-resilient consumer. However, despite November's strong retail sales (which we reported on last week), as noted above from the November personal consumption numbers, the consumer may be tapped out.

Merry Christmas!!

Given that today is the Friday before Christmas, many of you may already be heading out to see family, preparing for guests, finishing shopping...anything other than focusing on housing starts, personal income, or inflation.

Even so, let me take this opportunity to wish you all a Merry Christmas, and to encourage each one of you to remember the true meaning of Christmas - the day we celebrate the one Son of God, Jesus Christ, who became flesh; dwelt among us; and gave His life as a sacrifice to provide us salvation and reconciliation with God. He is the Light of the World, and the only hope for mankind. For those of us who know Him, this is certainly the most wonderful time of the year. And to those who don't, I invite you to investigate Him; research His claims; and learn more about the best Christmas gift ever given.

"And there were in the same country shepherds abiding in the field, keeping watch over their flock by night. And, lo, the angel of the Lord came upon them, and the glory of the Lord shone round about them: and they were sore afraid. And the angel said unto them, 'Fear not: for, behold, I bring you good tidings of great joy, which shall be to all people. For unto you is born this day in the city of David a Savior, which is Christ the Lord. And this shall be a sign unto you; Ye shall find the babe wrapped in swaddling clothes, lying in a manger.' And suddenly there was with the angel a multitude of the heavenly host praising God, and saying, Glory to God in the highest, and on earth peace, good will toward men." - Luke 2:8-14