Weekly Economic Update 12-26-25: An Update on Bitcoin Performance in 2025

Gold is up 70% while Bitcoin is down 10%...one is real money, one is not.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

As a reminder, starting next Friday, in order to receive the full Weekly Economic Update, you will need to have a paid subscription. In addition to U.S. dollars, you can also purchase an annual subscription using a new, innovative, gold-backed currency - Goldbacks. Using the current exchange rate, the price for an annual subscription would be 9 goldbacks. However, to encourage their use, I am offering an annual subscription for only 8 goldbacks. If you are interested, please reach out to me at blog@alfie.com and I will let you know where to send your goldbacks. If you are looking for a place to purchase goldbacks, you can find a list here. (I use Alpine Gold but I am sure that any of those listed will work equally well.)

Last year, around this same time, I authored a brief article to spell the esteemed Dr. Meek. The piece was on crypto-currencies, specifically Bitcoin (BTC), and why I do not think it is actually “money” and detailed some aspects of BTC about which I had concerns. (I guess no one agreed as I did not even get one coffee bought for me!) I am back this year to follow up on that article and see where we currently stand with Bitcoin.

First, before we start, nothing written here is intended to be investment advice and is my opinion, and my opinion only. Please do your own due diligence before investing an anything.

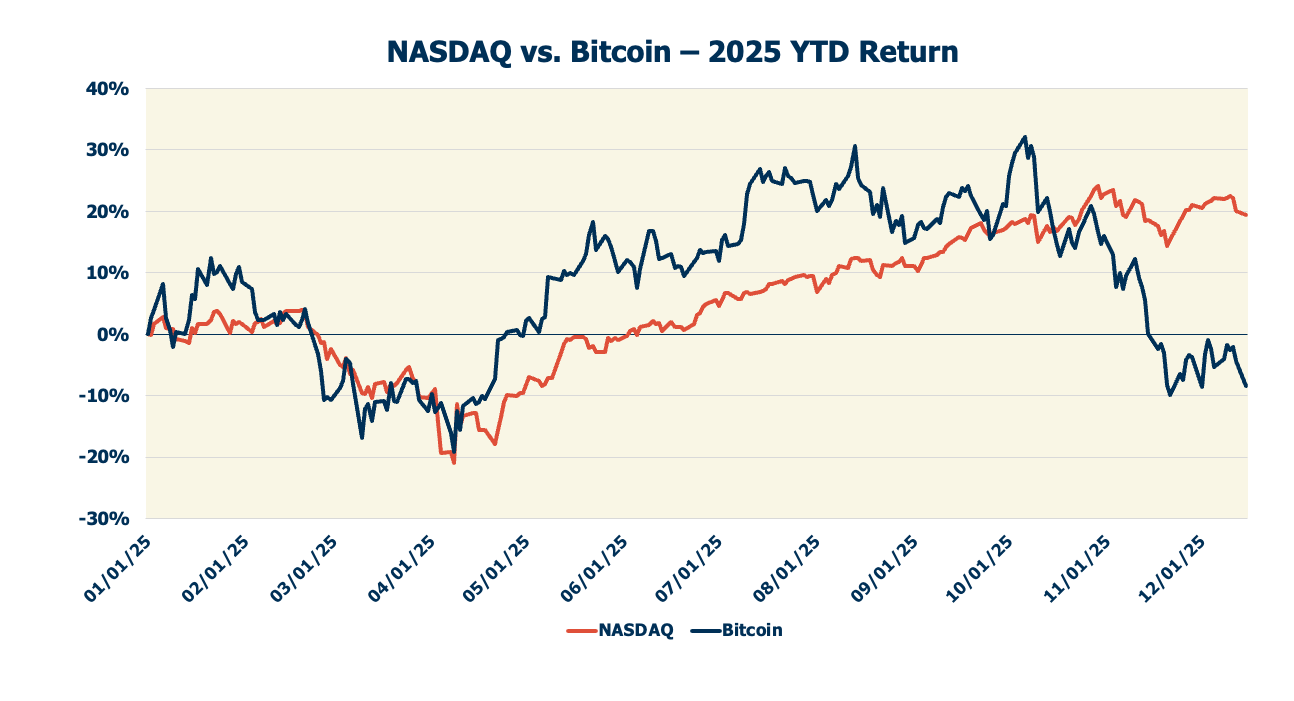

Bitcoin did not do very well over the past 12 months, unless you were lucky enough to get out mid-year to early Fall.

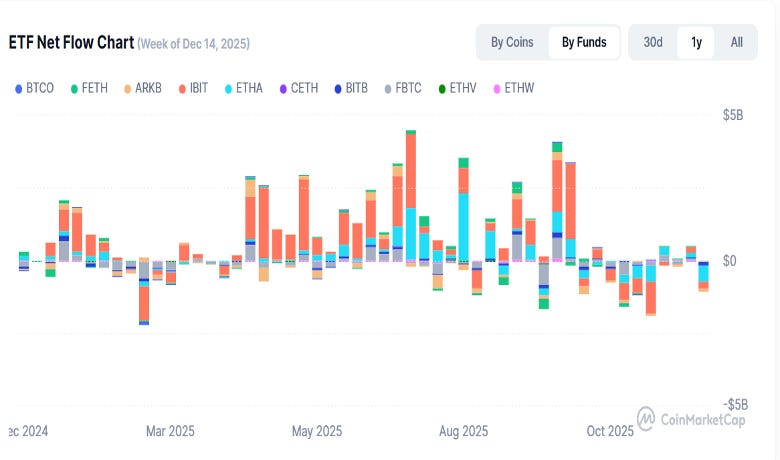

If you held it over the entire year, it has performed poorly, even after a wave of new ways to invest (ETFs mainly) have swelled into the market, giving retail investors an easy way to enter a position. It has been, and in my opinion will always be, a speculative investment and until just recently has been fairly correlated with the NASDAQ.

Do ETFs Give Bitcoin Credibility?

No. What ETFs do is give the Wall Street firms a way to get in on the crypto game. The action being skimming off fees and charges as they execute the retail investor’s trades.

Wall Street, and the Federal Government, do not like being left out of the action. The former in the way of fees and commissions; the latter in the way of taxes. Having multi-trillion-dollar crypto-currencies (sic) trading around the global internet was too much to bear. They had to set up a structure so they could make money or know when YOU made money and tax your capital gains. Those wolves of Wall Street do not care what is trading as long as they can set the rules and obtain margin from it.

The Government cannot stand to have something not taxed, and formalizing a way for reporting to occur is something it fully supports. And so suddenly all types of in-the-financial-system ways to buy and trade BTC blossomed.

Bitcoin vs. Gold

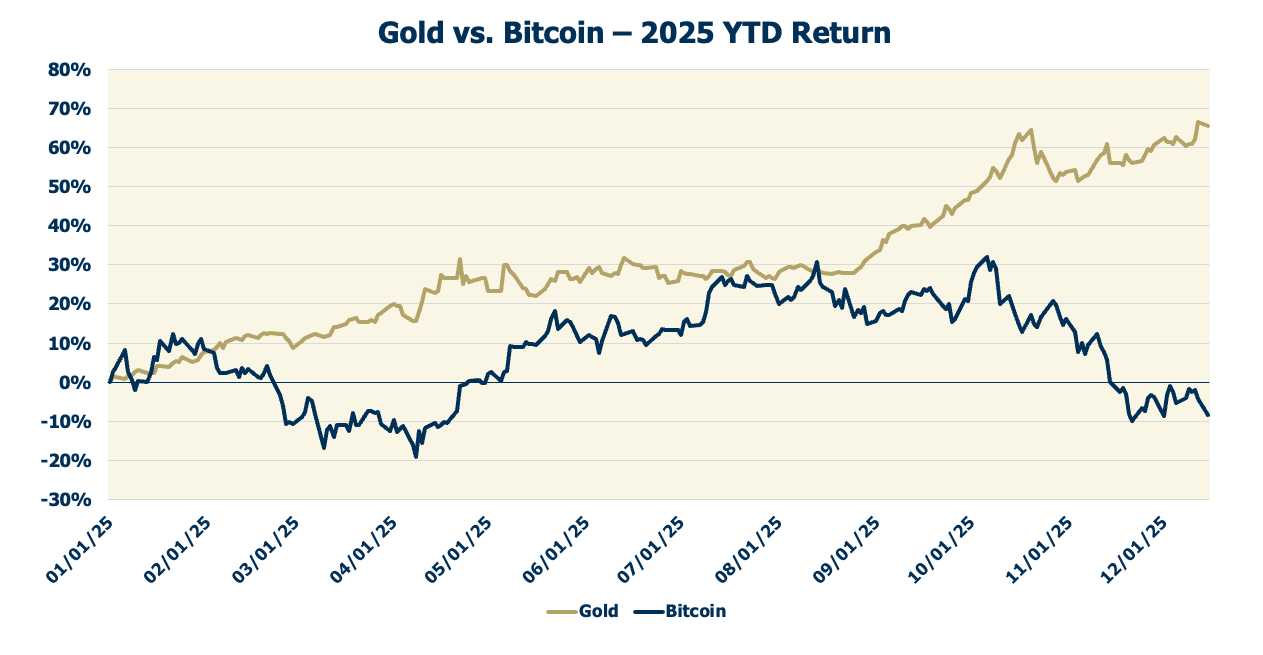

The article last year highlighted some key differences between BTC and Gold. I argued BTC is speculative and does not have the traits of a true currency, whereas Gold does, as it has for 1,000s of years. Let’s see how they did compared to one another.

Gold marched steadily higher with a great annual performance of almost 70%, far beyond what I expected. This move was mainly on the back of Central Banks around the world shoring up their gold holdings. Meanwhile, BTC had a lot of volatility and is currently about 10% lower than a year ago. If BTC is such a great “store of value” (because only 21 million will ever be created), why aren’t the world’s Central Bankers stocking up on it?

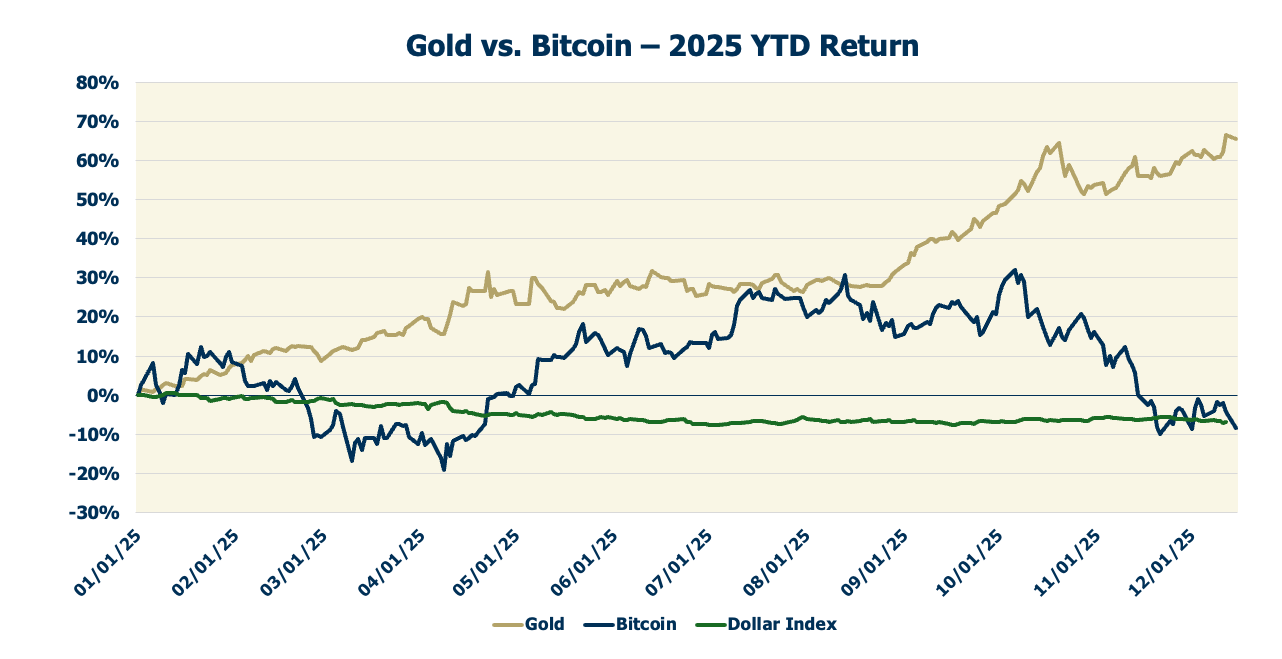

Dollar Continues to Fall

The dollar had a poor year, falling by about 10%, which helps gold. BTC, after its year of dramatic price swings, settles in at about the same annual loss as the dollar. This is not too surprising since we now have more dollars in the world than ever. With the temporary closure of the Federal government, activity slowed down a bit, but the Fed just announced they have flipped from monetary tightening to monetary easing. Or, as they are now claiming - “to maintain market liquidity.”

Gold, as mentioned, performed tremendously in 2025. I believe it will continue to do well as long as the world’s Central Banks keep adding it to their stockpiles. Once they stop their reallocation, gold will likely settle down at its new equilibrium to the dollar and then track more closely to the dollar, back to gold’s role as a store of value.

The dollar will continue to be under pressure as these same Central Banks diversify out of the dollar. BTC will likely whipsaw around again; some will profit, many will lose money, and the Wall Street firms will take their cut and NOT buy additional BTC for their own balance sheets.

Closing Thoughts

It is a great time to be alive! But it is also a very scary time with so much change happening. We have great new technologies being created, space travel is on the horizon, flying taxis are being prototyped, productivity improvements spawned from AI will revolutionize how we work and live.

Yet, Warren Buffet is sitting on more cash than ever. Geopolitical tensions are rising. The Dollar’s hegemony is being undermined by China, Iran, and Russia. Gold’s rise could be a signal of something sinister on the horizon. Stock Index valuations are at very high P/E ratios.

A lot can go right. A lot can go wrong. Echoing Alfie’s commentary last week, take this time of the year and celebrate what you have. Cherish your relationships and be thankful for the opportunities and freedoms you enjoy. Enter the new year with gratitude and optimism, appreciating the positive aspects of your life and community. Best of luck in the New Year!

Thanks to Chad for filling in this week! If you enjoyed this article, click here to buy Chad a coffee! (All proceeds this week will go to Chad.)