Weekly Economic Update 12-8-23: Factory Orders; ISM Services Index; Job Openings; Consumer Credit; and Employment

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Christmas is just about two weeks away and things are starting to wind down for the year. People are attending office parties, wrapping gifts, planning travel, and debating whether or not FSU should have made the College Football Playoff. (I will refrain from adding my opinion on that matter to the mix, other than to say that if the Playoff Committee would like to add an analytical economist to their ranks, I am more than happy to join....I am used to people being unhappy with what I have to say.....)

Not a lot of data this week, and I spent the week traveling around the state meeting with clients, so this is getting out late on Friday, with less commentary that normal. (As I mentioned before, the Christmas season is going to make it tough to get this out each week, but I will do my best!)

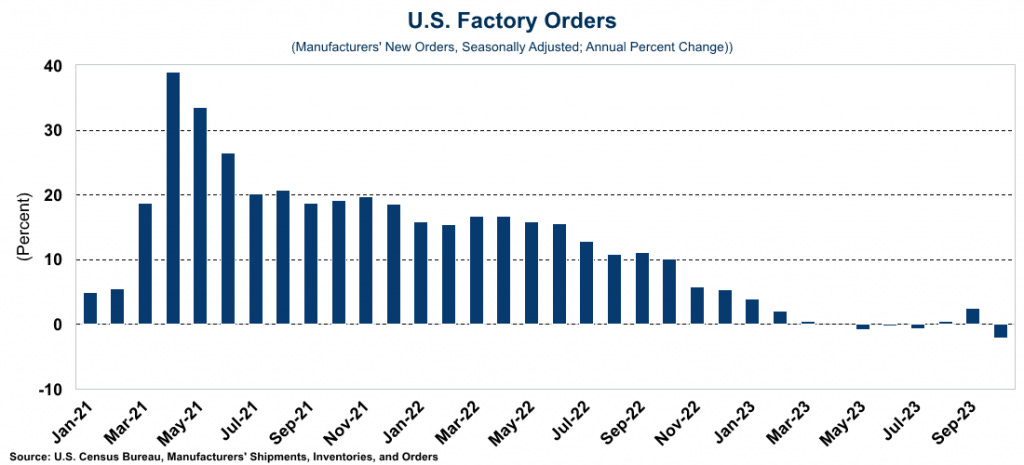

Factory Orders

New orders for manufactured goods fell 3.6% in October...more than the 3.5% drop economists were expecting. Although this was the largest monthly decline since COVID, it is only the second monthly decline in the last 8 months. However, as can be seen below, on a year-over-year basis, new orders have been steadily declining and 4 of the last 6 months have posted year-over-year declines with October's decline being the largest by far. New orders excluding transportation, ("core" orders) were also down 1.2% in October.

ISM Services Index

The ISM Services Index, a measure of business conditions at restaurants, hotels, and other service industries, moved up slightly to 52.7% in November from a five-month low of 51.8% in the prior month. Any reading above 50 indicates the sector is expanding which is confirmed by the fact that 15 sectors reported growth in November while only 3 reported a decline in activity. It is interesting to note that according to ISM, "the buildup for the holiday season is not as robust as sometimes in the past." Of course, time will tell, but that doesn't bode well for the holiday season.

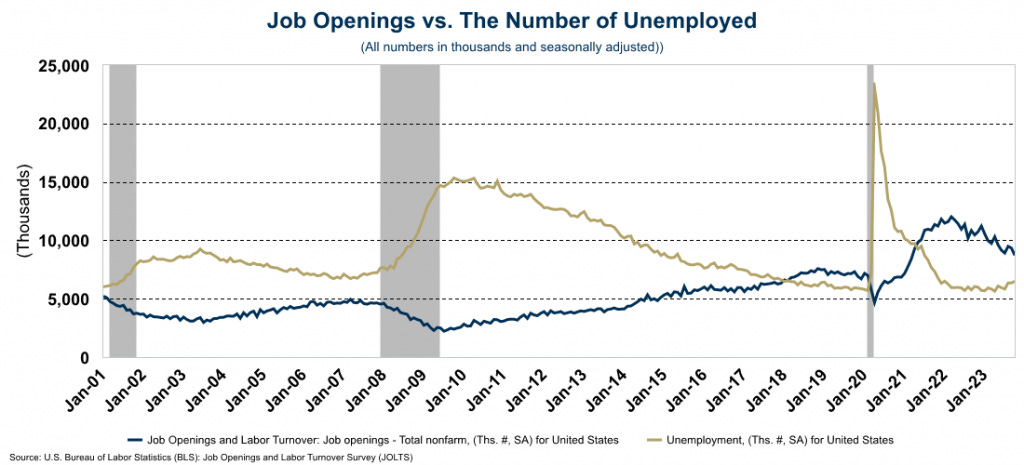

Job Openings (JOLTS)

The number of job openings in the U.S. fell to the lowest level since March 2021, evidence that the labor market may be cooling off. The ratio of job openings to unemployed people dropped to 1.3, and is almost back to the pre-pandemic normal level of around 1.2. (The number got as high as 2 jobs for each unemployed worker in 2022.) The Federal Reserve watches this ratio closely as a gauge of labor market strength. Further evidence that the labor market might be cooling is that the "quit rate" (number of people quitting their jobs as a share of employment) was unchanged in October at 2.3%. Obviously, people tend to stay in their current job as the labor market tightens and jobs are more difficult to find.

Employment

On Wednesday, ADP released their estimate of November employment. The expectation was that the report would show 128,000 private-sector jobs added to the economy. However, the number came in weaker than expected at only 103,000 private-sector jobs which, like the JOLTS report, suggests a cooling labor market. In November, manufacturing posted the biggest job losses (confirming what the ISM Manufacturing Index reported last week) but the "Leisure and Hospitality" sector lost jobs for the first time since Feb 2021 (confirming the ISM Services Index above). In short, all these different barometers of the labor market are showing the same thing...that the labor market is cooling, which is one of the goals of recent Federal Reserve policy.

However, Friday, the November employment report was released, and it was slightly better than expected at 199,000 jobs added to the economy. However, it is important to note that the 199,000 number included 47,000 workers returning from strikes - 30,000 UAW members and 17,000 SAG-AFTRA members. If you remove those one-offs, the gain would have only been 152,000 - roughly the same as October. And, if you do that, the three-month moving average would have dropped to 188,000, instead of the 204,000 shown in the graph below. That would have continued the downward trend that began in mid-2021. Overall, employment growth, especially in cyclical sectors, continues to weaken.

Interestingly, the number of employed workers as reported in the household survey exploded by 747,000 rising to the highest level on record. The job growth was equally split between part-time and full-time jobs. The "official" unemployment rate dropped to 3.7%. The broader measure of unemployment, U-6, dropped to 7.0% which is finally back to where it was in February 2020 before COVID.

Consumer Credit

Total consumer credit grew $5.1 billion in October as both revolving and non-revolving debt increased. However, as you can see below, credit growth is slowing dramatically.

Total revolving debt is just below $1.3 trillion, and credit card debt is about $1.1 trillion of that. While slowing on a month-to-moth basis, total revolving debt is still running 9.3% above last year.

And wages are not keeping up. Adjusted for inflation, wages were down on an annual basis for the second month in a row. In fact, in recent history, only June, July, and August showed annual real wage increases. Of the past 31 months, only those three posted real wage increases. The other 28 months have posted declines in real wages. So, revolving debt is increasing, and wages are not keeping up. The consumer is tapped out and the slow down in credit growth is clear evidence of that.

Further, personal bankruptcies are have been growing at double-digit annual rates for the past 5 quarters, not to mention the growth in business bankruptcies as companies come to grips with higher financing costs. The data for the 4th quarter will be released in early January and I expect the trend to continue.