Weekly Economic Update 2-23-24: Leading Economic Indicators; Existing Home Sales; Personal Interest Payments; Generational Debt & Wealth; and Consumerism

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

First, let me welcome all our new subscribers! Since the beginning of 2024, just a few weeks ago, we have nearly doubled the number of subscribers to this little update. I want to say “thank you” to each of you. I appreciate all of you and I hope you find it useful, and that you will share it with others who may find it useful as well. Would love to double again in the next two months!

Very little economic data coming out this week, so the update will be short. But next week, we get a lot of data on personal income, spending, new home sales, PCE inflation, and the first revision to fourth quarter GDP…we will have a lot to discuss!

Recently, the update has "been too long for e-mail" (which is the warning I get when I post it.) Hopefully if your e-mail client is not downloading the entire update, you are clicking on the link at the end and going to the Substack site and reading it there. I will try to keep it short enough to fit in an e-mail, but some weeks there is just too much data. (A problem we may have next week.)

Leading Economic Indicators

For the 22nd consecutive month, the Conference Board's Index of Leading Economic Indicators declined in January. This equals the longest streak of declines since the index was started in 1959. Of the individual indicators, the biggest positive contributor was stock prices, which frankly are being driven by the "Super 6" combo of Nvidia (NVDA), Meta Platforms (META), Amazon (AMZN), Alphabet (GOOGL), Microsoft (MSFT), and Apple (APPLE). The biggest negative contributor was the average work week, which continues to decline and by doing so, is "raising" average hourly wages.

But you have to love the commentary that the Conference Board released with the data. "While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its ten components were positive contributors over the past six-month period (ending in January 2024). As a result, the leading index currently does not signal recession ahead."

WHAT?!?! So, let me get this straight...your index - which HAS ONLY ONE PURPOSE...IT EXISTS TO ONLY DO ONE SINGLE THING...to tell us which way the economy is headed - has been moving down for 22 consecutive months, but because some of the indicators were positive in January, there will be no recession? Have I got that right? If so, perhaps you should re-work your index because it doesn't seem to be able to do the ONE THING IT IS SUPPOSED TO DO!!!

In fact, as you can see from the graph below, the index has completely decoupled from GDP. So if the LEADING index no longer tells us where the economy is headed, why should we bother to track it and report on it each month? Something to consider.....

Existing Home Sales

Sales of existing homes in January came in much lower than expected at 3.1% over December. (Experts were expecting 4.9% growth.) On a year-over-year basis, existing home sales were down 1.7% from January 2023. That represents 4M homes on an annual rate. With the average 30-year mortgage rate above 7.2% this week, housing sales may not continue this upward trend in February.

Even so, the median sales price of an existing home finally broke through the $400K level at $400,511 in January (on a seasonally adjusted basis).

Institutional investors continue to be a major buyer of homes as first-time home buyers continue to gradually get priced out of the market. All-cash sales represented 32% of January transactions, up from the December rate of 29%. First-time home buyers represented only 28% of sales, down from 31% a year ago.

Some Final Thoughts

Since I have the space this week, there are a few other things I want to comment on. In the past, I have spent a lot of time here discussing the exploding federal debt, and the skyrocketing level of interest our government has to pay on that debt. Just a few weeks ago I discussed how annual interest on the federal debt has now past $1 TRILLION and is expected to hit $3 TRILLION over the next 6 years.

I have also focused on the rising level of personal debt and just two weeks ago I discussed how U.S. consumers, excluding mortgage debt, now have more than $5 TRILLION in revolving debt including auto loans, student loans, credit cards, etc.

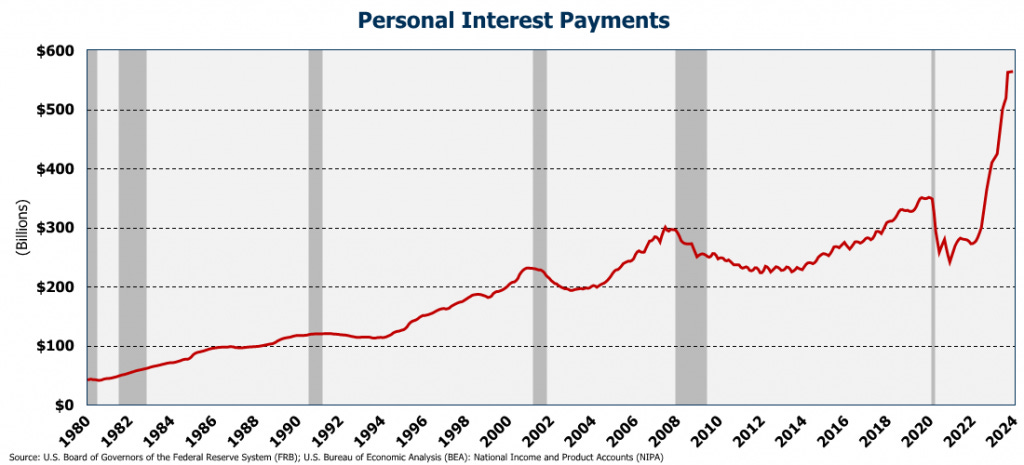

But until now, I haven't discussed personal interest payments. Obviously if government debt is exploding and Treasury rates are rising, the interest payments on that debt will skyrocket. But is the same thing happening to consumers? The answer is "yes."

Since 2020, the interest payments on the federal debt have doubled, rising 102%. However, personal interest payments are up 134% over the same period. Consumers now spend $564 billion per year in interest payments!

But those payments are not distributed equally. If we look at consumer credit by generation, we see that 41.7% of that outstanding consumer credit belongs to Millennials.

It seems like a disproportionate share of the debt is owed by the younger generations. But perhaps, that explains headlines like this recent one from Bloomberg...

In the above story, a young lady "drained her savings" to purchase a $2,500 "vintage Chanel bag." Why? Because, while "she knew her money could be better spent, saved or invested," she felt that "homeownership and a life with kids" were simply out of reach. "It’s just easier to spend money on things that will bring you immediate fulfillment.”

I get it. With $1.6T in student debt and the average price of a home up 44% since 2020 and now sitting above $400K, it isn't too surprising that the younger generation doesn't feel like wealth creation is attainable. But frankly, I'm not sure that EVERY generation didn't feel this way when they were younger. When we are young, we tend to see what our parents have spent a lifetime building and expect it to happen quickly. It doesn't. The Baby Boom Generation has more than 50% of the wealth in this country. And they earned it. The next generation, my own, has another 25%. And believe me, as to my share, I earned it. I hear so much about Boomers "hoarding" their wealth. What are they supposed to do with it? Just give it away?!? They earned it, they can enjoy it any way they see fit, including using it to pay medical/housing expenses in their old age!

Millennials have less than 10% of the wealth...but they have also only been working for a few years! It takes time, and discipline, to build your net worth...and you don't do it by throwing your hands up in hopelessness and splurging on luxury goods. When I was young, I wanted cool, new, nice stuff. But I also wanted to one day afford a very nice home, and be able to later enjoy a comfortable retirement. And now I have both. And I did it by saving and living within my means. By driving old cars; by foregoing vacations; by eating in; and by working hard and giving my best. Not by giving up on that future, and instead living in the moment by buying $2,500 vintage Chanel hand bags!!

Yes, I know, housing in expensive. Everything is expensive! When the government prints money and creates price inflation, it's a brutal tax on everyone, especially those at the lower end of the income spectrum, or those starting out in life. Even our food is expensive! Just this week, the Agriculture Department released data that showed food accounts for 11.3% of our disposable income. That is the highest it has been in 30 years.

I would consider food to be a "basic spending need." When people are asked about how they met their basic spending needs over the past week, nearly 35% say they used a credit card. This is why credit usage is up, personal interest payments are up, and Millennials feels they will never catch up.

But even with prices rising faster than wages, there is another major reason we have a personal debt problem in this country. Consumerism. Consumerism is "a social and economic order in which the goals of many individuals include the acquisition of goods and services beyond those that are necessary." Why do you need a new $1,000 cell phone every 12 months? Why do you need a new car every three years? Do you need to spend $120 on blue jeans? How many $7 non-fat Chai lattes do you need in a week? Does your dog really need a sweater? Do your kids need a PlayStation, an Xbox, AND a Nintendo Switch? Bottled water? You do know you can get water out of the tap, right? Do you really need to subscribe to six streaming services? And, does ANYONE really need a $3,500 Apple Vision Pro? No, they don't. I got a chance to play with a Vision Pro this week, and yes, it was really, really cool. And it is really, really unnecessary.

There is an old saying..."the only difference between men and boys is the price of their toys." I'm not sure it only applies to men anymore. Most of us succumb to consumerism, to some extent. And the younger generation may succumb more than others. And until we can beat our addiction to "stuff," our consumer debt problem won't go away.

And I admit, I am probably as guilty as anyone else. Except I pay cash for my toys.