Weekly Economic Update 3-22-24: What Constitutes "Fair Share?"; Home Builder Confidence; Housing Starts; Building Permits; Existing Home Sales; and Leading Economic Indicators

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

For nearly all my adult life, I have listened to politicians say that "rich" people don't pay their "fair share" in taxes. As part of his irate national scolding two weeks ago, the President repeated this well-worn mantra over and over again.

However, also over my entire adult life, not once has anyone clarified to me what constitutes a "fair share." How much should "rich" people pay? And, while you are at it, can someone please define who exactly is "rich?"

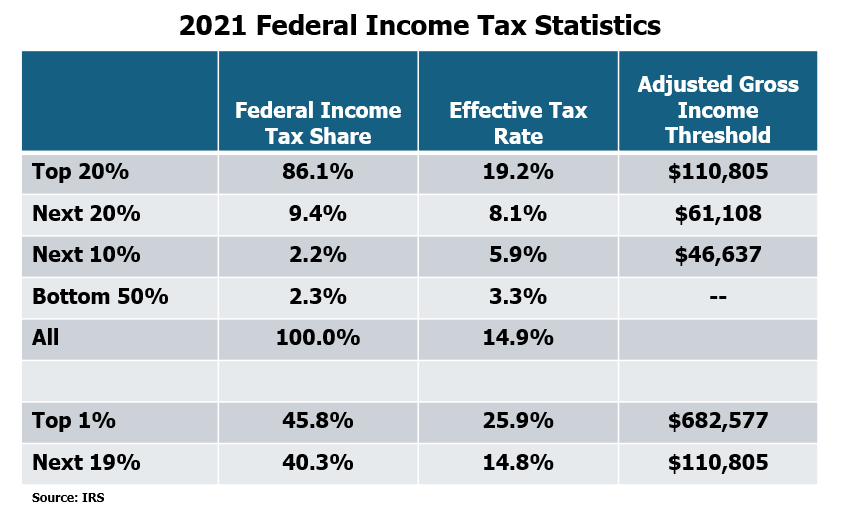

In 2021, (the last year for which I could get the raw data from the IRS) 36.6% of all tax paying units had zero or negative federal income tax liability. The bottom half of the country contributed only 2.3% of federal income tax revenue. Conversely, the top 20% of earners (those with an Adjusted Gross Income - or AGI - of at least $110,805...is that "rich"?) had an effective federal tax rate of 19.2% and paid 86.1% of all federal income tax. Again, the top 20% of the people are paying 86% of the federal taxes, while the bottom 37% pay nothing.

The very top 1% of income earners (minimum AGI of $682,577) had an effective federal tax rate of 25.9% and paid 45.8% of all income tax. Again, 1% are paying nearly HALF of all income tax. Not enough? OK. Then tell me what is enough. Put a number on it. Tell me, at what point the "rich" will have paid their "fair share."

They can't do it. Because it will never be enough. When 1% of the population pays nearly half the tax, while more than a third pay nothing, we have gone well beyond "fair."

But not only have we gone well beyond "fair"...we have created a situation with serious policy consequences.

Is it really the case that nearly 40% of all Americans have incomes so low that they can not afford to contribute anything to the general services provided by the federal government?

Is it good for sound democratic decision making for the payment of public services to be so concentrated and for so many to have no "skin in the game?"

Are voters likely to be fully responsible when they realize that extra federal spending is likely to have no tax cost for them?

A hard and honest consideration of these questions might explain why our country is running a $1.5 trillion annual deficit and is $35 trillion in debt. But "hard and honest consideration" is not what our government is known for. Again, as I've said for three weeks now...we are governed by very unserious people.

Home Builder Confidence

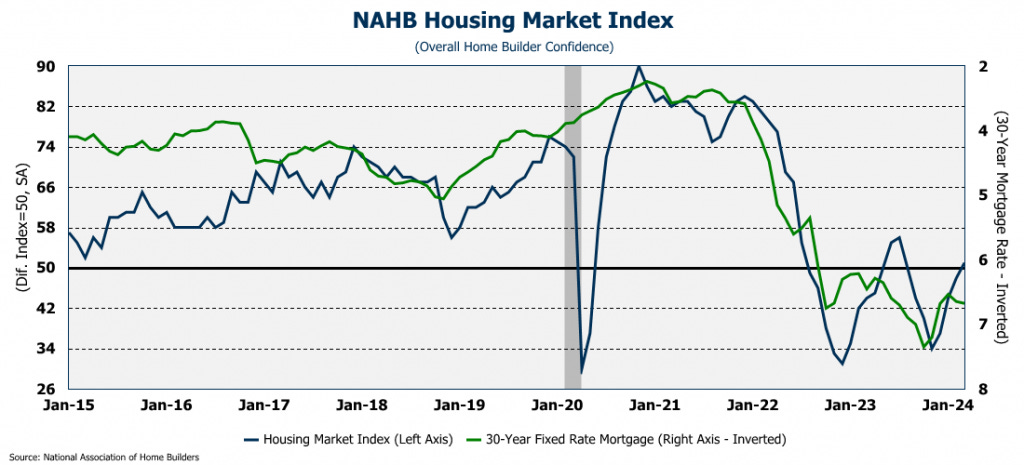

We got a lot of housing data this week. Clearly, spring has arrived, and with it the annual home-buying season, raising the confidence of home builders. Even though rates have moved slightly higher in the month, home builder confidence rose in March, with the index rising above 50 for the first time since July. (Since it is a diffusion index, a reading above 50 means that more builders were positive on the single-family housing market than were negative.)

The overall index, is actually a weighted average of three separate component indices: Present Single-Family Sales, Single-Family Sales for the Next Six Months, and Traffic of Prospective Buyers. All three component indices moved higher in March. However, Traffic of Prospective Buyers was will well below 50, but not enough to keep the overall index below that level.

Housing Starts

Not only are builders reporting higher confidence, they are showing it with a big jump in housing starts for both single and multi-family units. Overall, housing starts were up 10.7% month-over-month in February - well above expectations. That was the largest monthly jump in starts since last May. Single-family starts were up 11.6% for the month, and multi-family starts were up 8.3%.

This is great news for the housing market, which is still struggling with meager supply. However, with prospects of a rate cut diminishing more every day as inflation continues to be sticky, will homebuilders remain confident and keep building, or have they gotten too far ahead of themselves?

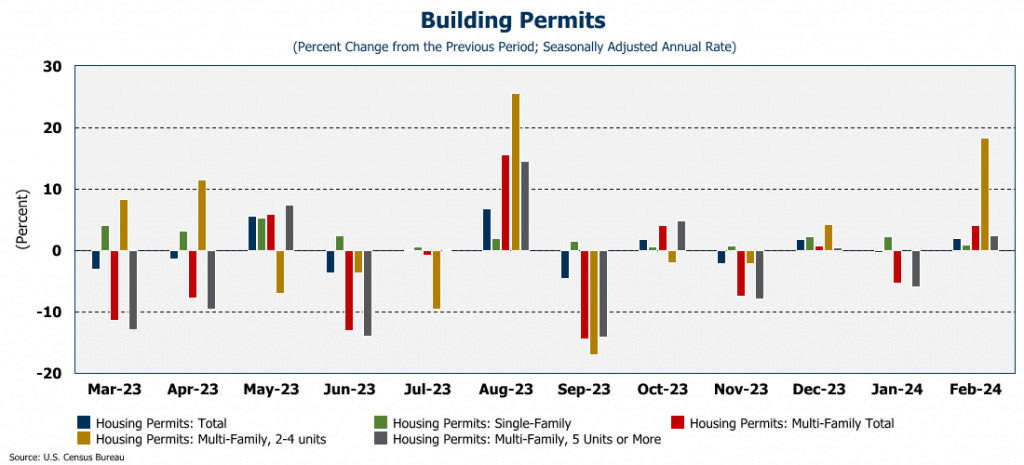

Building Permits

Not only were both single and multi-family starts up, but the same was true with building permits. Multi-family permits bounced up slightly off of a four-year low, rising 4% in February. Single-family permits rose 1% in the month to an annual rate of 1.03 million units.

Looking under the hood, permits for buildings with 2-4 units drove the gain in the multi-family category jumping 18.4% in February. Again, this bodes well for the housing market outlook, as permits obviously lead starts. Again, however, as expectations of a pending rate cut diminish, will permits fall off as well? Only time will tell.

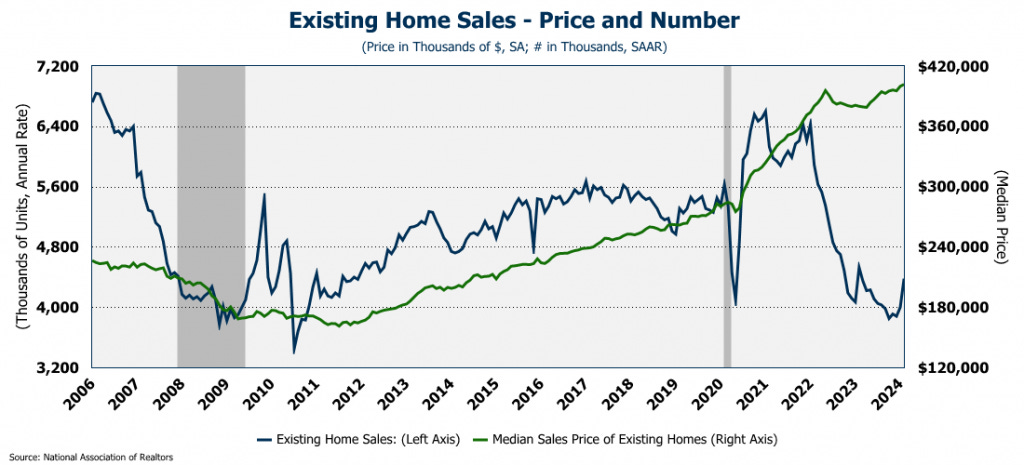

Existing Home Sales

Finally this week, we got existing home sales, and the data provided even more evidence that the home buying season has begun! Even though the 30-year mortgage rate was trending up in February, and the median price rose to an all-time high of $401,860, sales of existing homes rose 9.5% in the month to an annual rate of 4.38 million units, the highest monthly increase in a year. However, even with that increase, overall, existing home sales are down 3.3% from last February as people are still unwilling to put their house on the market and part with their low mortgage rate. Even so, brokers did report a slight increase in listings.

One of the drivers of the February sales increase was the number of "all-cash" buyers, which made up one-third of existing home sales. That is the highest share of "all-cash" buyers since 2011. (Obviously, an "all-cash" buyer is not sensitive to the rising mortgage rate environment.) Individual investors and/or second-home buyers made up 21% of February sales, while first-time home buyers comprised 26% of the market, matching the lowest rate on record. It is just becoming harder and harder for those first-time home buyers to get into a home at these rates and prices.

Even with the uptick in activity, existing home sales are likely to remain dampened, again, due to the lack of inventory. However, on the buyer side of the equation, it seems that perhaps borrowers are starting to realize that mortgage rates are going to remain high for some time (at least relative to recent history) and that this is the new normal.

Of course, the big question is will the National Association of Realtors proposed settlement regarding their commissions in home sales affect sales activity in any meaningful way. That will be interesting to watch over the next several months.

Leading Economic Indicators

For the first time in 23 months, the Index of Leading Economic Indicators rose in February....from 102.7 to 102.8. Hardly enough to even register on the graph. But it did snap the negative streak that had tied for the longest decline since the index was started in 1959. Of course, the previous two times it was down this long (1973-75 and 2007-09) the economy fell into recession. Which shouldn't be surprising as the whole purpose of the index is to forecast when the economy is going into recession!

But apparently, "the post-pandemic period has broken from normal economic patterns." Really? No kidding? You don't say? Maybe, the fact that the federal government is deficit spending to the tune of more than $1.5 TRILLION every year is having some impact on "normal economic patterns." I could be wrong, but I think that really might have something to do with it.

Final Thoughts....

First, for those looking for my comments on the Fed decision this week to hold rates steady...obviously I am not surprised as I have been saying for some time that they aren't going to cut rates, at least for a while. That said, the update is already fairly long so I will reserve my comments on the Fed statement until next week.

And finally this week, I want to thank Partnership Gwinnett and the Gateway 85 Community Improvement District for having me as the keynote speaker for their Annual Economic Outlook on Thursday. It was a great group and I hope I was able to provide some insight on the macro economic situation that they found useful. Also, thank you for the invite to present again next year! I am looking forward to it!