Weekly Economic Update 3-29-24: $1.2 Trillion in New Spending; New Home Sales; Case-Shiller; Durable Goods; Consumer Confidence & Sentiment; Personal Income & Spending; and PCE Inflation

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

They did it again! The spineless, feckless cockroaches that we call Congress passed a $1.2 TRILLION spending package last week. And, like the cockroaches they are, they did it in the dead of night. They dropped the 1,000+ page bill at 2:30am on Thursday; waived the rule giving members 72 hours to consider the bill before voting on it (because we wouldn't want anyone to actually have time to read all 1,000 pages and see on what worthless programs they are spending our money); and then the final votes were done at around 2:00am Saturday morning. Isn't is interesting that these types of shenanigans all happen in the dead of night when no one is watching.

Three weeks ago, I pointed out that we are currently adding $1 TRILLION to our national debt every 100 or so days. And we are on pace to hit the $35 trillion mark in June. Last week, when giving the keynote at an economic luncheon, I was trying to give some point of reference for how much $1 trillion actually is and I suggested this....if you spent $1 million per day, every day, since Jesus Christ was born, you would not yet have spent $1 trillion. And we add that much to our debt every 3-4 months. It is unfathomable.

This led Fed Chair Powell last week to say "the U.S. is on an unsustainable fiscal path." Talk about the understatement of the week! The U.S. debt-to-GDP ratio now stands at 124%. The CBO projects it will hit 130% in the near future. Since 1800, 51 out of 52 countries with a ratio above 130% have defaulted. And a sovereign debt default would have catastrophic consequences. Pension funds and banks holding U.S. debt would fail; the dollar's value would collapse; the dollar would lose it unique place as the primary unit of account in global finance; the American standard of living would plunge; millions of Americans would suffer as a depreciating dollar triggered surging inflation and economic collapse. I do not believe it is hyperbole to say that we are on the verge of losing the Republic. But like Nero fiddling while Rome burned, most Americans have no idea what is coming, and our incompetent leaders seem unwilling to face the harsh reality.

I don't win a lot of friends or readers talking like this. But at this point in my career, I don't really care. The emperor has no clothes and I'm going to call it out. Further, my two sons are about to graduate college and are going to have to live with, and eventually deal with, this mess we've made and that is not a legacy of which any of us should be proud.

New Home Sales

Last week we got a bunch of good data about the housing market including home builder confidence, housing starts, building permits, and existing home sales. Then, Monday, we started the week with a big disappointment in new home sales which dropped 0.3% in February vs. an expected 2.3% increase. However, even with the drop, new home sales are up 5.9% over last year.

The median price of a new home dropped another $3K in February, continuing the downward trend from a peak of $481K. Prices of new homes are trending down, while the prices of existing homes have been sliding up. After two years of a significant gap between the two, the price difference between the two is almost zero.

Keep in mind, this is MEDIAN home price....not AVERAGE home price. One of the reasons that the MEDIAN price of new homes is dropping is that builders are building more smaller and cheaper homes! That is not the same thing as seeing the price of a consistently-sized home decline. That is why the median price of NEW homes is going down, while the price of EXISTING homes is rising.

Case-Shiller Home Price Index

Speaking of rising home prices, prices in the 20 biggest U.S. metro areas rose to yet another all-time high back in January, up 6.6% from a year ago. In fact, for the second consecutive month, all 20 cities in the index posted annual increases. The broader national index also rose more than 6% on an annual basis. The question is...how can the Fed justify any easing of monetary policy when home prices are rising 6% per year?

Durable Goods

After declines for the past two months, new orders for durable goods rose 1.4% in February, much better than the 1.0% growth that was anticipated. The growth was driven by new orders for transportation-related goods. Surprisingly, non-defense aircraft orders jumped 25% in the month. (Apparently, the concern about Boeing aircraft falling out the sky due to poor quality control is abating.) New orders for defense goods plunged - as Ukraine is running out of money and waiting for the next infusion of cash from an increasingly broke U.S. government. Excluding defense orders, durable goods grew 2.2% in the month and were up 3.3% from a year ago. Given that this is LESS than the rate of inflation, real growth in durable goods is down for the year. In addition, core capital goods shipments (non-defense capital goods excluding aircraft) fell 0.4% in the month. This number is used to calculate equipment investment in the GDP report. However, despite these declines, there is little doubt that, somehow, first quarter GDP will be wildly positive beyond anyone's expectations.

Consumer Confidence

Economists were expecting a small rebound for consumer confidence in March after the plunge in February. However, consumer's confidence in the economy actually declined slightly, driven by their concern for the future which fell for the third straight month and is well below the 80 level. This is important, because if consumer confidence falls below 80 for any period of time, it is USUALLY a good leading indicator of a recession. Interestingly, that number has only risen ABOVE 80 for 5 of the last 24 months! And yet, the economy is booming. It is truly amazing how well the economy can perform when you pump trillions in fiscal stimulus into the mix.

Once again, as seems to be the trend with most economic data these days, for the 5th consecutive month, the headline confidence number was revised down. Amazing how that continues to happen month, after month, after month. Publish a number...get your headline...and then revise it down in the future when no one is looking. Well, I for one am looking.

Consumer Sentiment

Consumer CONFIDENCE is put out by the Conference Board. Consumer SENTIMENT is put out by the Univ. of Michigan. Earlier in the month they released the "preliminary" reading, and this week they dropped the "final" reading for March. I don't normally comment on both, but it was interesting that sentiment rose sharply from the preliminary reading to the final, and now sits at a 32-month high. According to the survey director, the main driver of this improvement is that "consumers exhibited confidence that inflation will continue to soften." As you can see below, inflation expectations for both 1-year out and 5-years out are declining. But as I have been reporting, inflation has actually been rising in recent months, and the PCE reported this morning shows that is still the case.

PCE Inflation

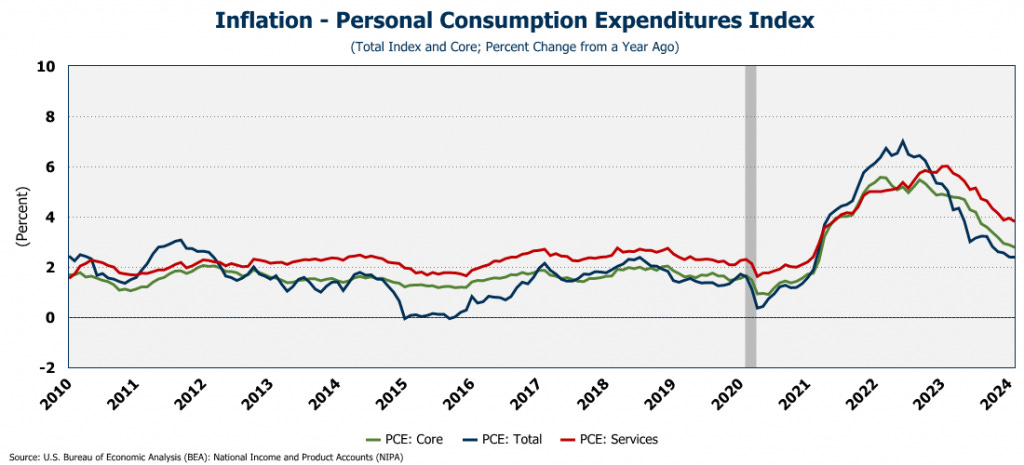

Speaking of PCE inflation, for the month of February, prices jumped 0.3% at an annualized rate of 4.0%! Core PCE inflation for February came in at an annualized rate of 3.2% and services PCE came in at 3.1%. These are lower than they were in January, but still far higher than the Fed's target rate of 2.0%. With PCE running two times the Fed target, how can they even consider a rate cut?

Even if you look at it on a year-over-year basis, it is clear that inflation is leveling out at a rate much higher than what the Fed would like. And year-over-year, services inflation is running 3.8%! Services represent a significant amount of what consumers purchase. It is hard to understand why consumers feel that inflation will continue to soften when that is clearly not what they are experiencing.

Personal Income and Spending

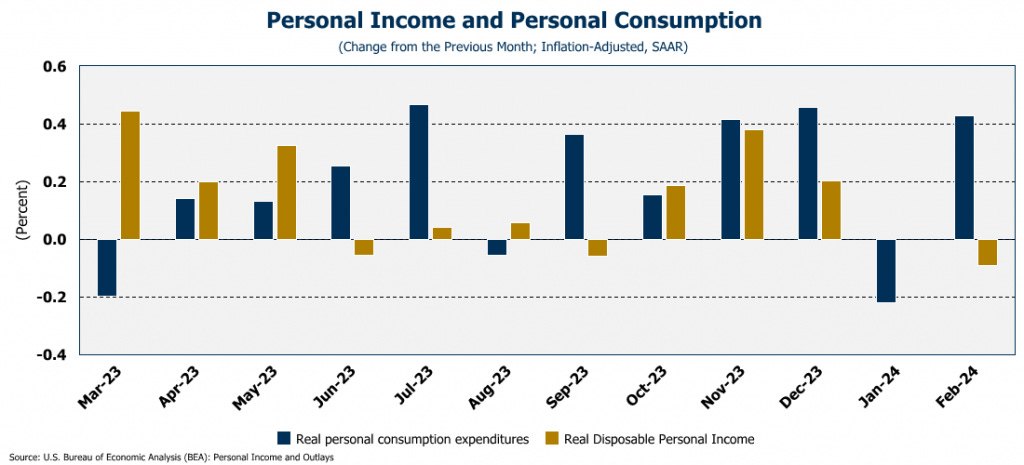

Finally this week, we got data on personal income and consumption for February. Economists were expecting income to grow 0.4%, but it came in at only 0.3%. Disposable income grew at only 0.2%. As for consumption, economists were expecting growth of 0.5%, but the number was actually 0.8%. So, in summary, in February, we spent more, and made less.

Remember, these numbers are nominal (i.e., not adjusted for inflation). If you adjust for inflation, REAL disposable income fell in February, after being flat in January. But real spending was still positive. How did that happen with less income? More personal debt.

Final Thoughts

Next week is spring break and I will be taking some time off with my wife. I seriously doubt that I will publish an update next Friday. The only big economic data coming out next week is March employment, but, if the past year has taught us anything, it will be a total fabrication and revised down significantly in the coming months, so I see no reason to interrupt an otherwise relaxing vacation to report on it.