Weekly Economic Update 01-17-25: Small Business Optimism; Producer Price Index; Consumer Price Index; Retail Sales; Home Builder Confidence; Building Permits and Housing Starts

Inflation was up at wholesale and consumer levels, yet somehow, it is "cooling?"

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

I admit, I have been VERY slow to adopt AI. Over my lifetime, I have been a relatively early adopter of new technologies, but as I have gotten older, I find that I am more set in my ways and use those things that are comfortable to me. The adage “It is hard to teach an old dog new tricks” is very applicable.

Also, I grew up in the age of the original Terminator movies and have a healthy suspicion about where this could lead….

For those who read this on SubStack, you know that each post has a picture that goes along with it and it usually ties into the theme of the post. This week I used X’s AI tool Grok to generate an image of “two small business owners, wearing aprons, and standing in front of their business, leaning on the door and an ‘open’ sign on the window.” If you are on SubStack you can see the results. I admit…I am impressed. Perhaps this will keep me from engaging in any copyright infringement.

In addition, I installed the free version of Grammarly on my laptop. Two observations. First, it is a great tool, taking spell and grammar checking to an entirely different level. Automatically running in every app from a web browser (where I write this) to e-mail to texting apps…it is everywhere trying to improve my writing. This leads to my second observation…it would appear that improving my writing is a Herculean challenge. Grammarly wants to make several changes to my prose. But please don’t judge the product by the quality of this post - I have the free version and most of the changes the app wants to make require a paid subscription…which is somewhat frustrating. Now I know the writing is bad, but I don’t know why or how to fix it!

Anyway, the point of all this is that despite my own hesitancy, AI will have a significant impact on the global economy. It will improve everything from industrial production to medical research all the way down to helping us write better texts. (And if working with a great team of Millennials and Gen Z'ers has taught me anything, it is that people need help writing texts. SMH WBU AFAIK TTYL are not words. And punctuation exists for a reason!)

NFIB Small Business Index

I don’t think I have ever reported on the Small Business Optimism Index, published monthly by the National Federation of Independent Business (NFIB). However, in the last two months, this index has made some monumental moves worth discussing. In December, the NFIB Small Business Optimism index rose to 105.14…the highest reading since October 2018 (full release here). That is stunning given that just three months prior, it was sitting at 91.46, not far from its post-COVID low set in March.

For the past two months, the index has risen above its 51-year average of 98. What could have caused this rapid turn around? According to the NFIB Chief Economist, Bill Dunkelberg…

“Optimism on Main Street continues to grow with the improved economic outlook following the election. Small business owners feel more certain and hopeful about the economic agenda of the new administration. Expectations for economic growth, lower inflation, and positive business conditions have increased in anticipation of pro-business policies and legislation in the new year.”

I appreciate their optimism, and I hope it is well founded. We’ll have to see if their expectations of lower inflation come true.

Interestingly, of the 10 components of the index, only two were negative - “plans to make capital outlays” and “current job openings.” So, to be clear, small businesses are optimistic, but they aren’t going to hire anyone now, and they aren’t going to invest in any capital equipment. In other words, they aren’t putting their money where their mouth is. Maybe we should call that “cautiously” optimistic.

Producer Price Index

Speaking of inflation, on Tuesday, we got the latest read on producer prices (PPI) from the Bureau of Labor Statistics (full release here). The numbers came in “not as hot as expected” and the market rallied on the news. For example, final demand PPI came in at 3.3% vs. the expectation of 3.4%. Similarly, core final demand PPI came in at 3.5% vs. the expectation of 3.8%. And so, the market rallied on this “good” news.

Here is the issue. While those results were “better than expected,” they were all increases over the last month! That’s right….PPI inflation ROSE across the board in December, showing that inflation at the producer level is still an issue and is rising. But because the results were “better than expected,” the numbers were widely reported as positive.

Services PPI also rose and finished above the 4% level for the first time since February 2023. Several outlets I saw reported this report by saying that inflation is “cooling.” Cooling? How do rising prices indicate inflation is “cooling?” One wonders if these people even read the data releases.

Consumer Price Index

Just like PPI, the December consumer price index (CPI) also increased rising to 2.9% year-over-year, which means that CPI has increased for the third month in a row (full release here). And again, like PPI, all the reporting is about how CPI “came in lower than expected.” Lower than expected? So what? And lower than who expected? It certainly didn’t come in lower than I expected. Simply put, prices are rising at an increasing rate and have been for three consecutive months.

This move is consistent with the comparison to the 1970s which I have been sharing for months.

On the positive side, we did see a slight decline in core CPI falling to 3.2% from 3.3%. That is certainly good news. But the better news was the drop in the Fed’s favorite indicator, “Super Core” (services CPI less shelter) which fell sharply for the second month in a row but is still running 4.2%…more than two times the Fed target.

Here is the simple fact of the matter…inflation is purely a monetary phenomenon, and it lags the movement in the money supply by about 16-18 months. If we take a look at CPI along with the growth in M2, we can see clearly that the former follows the latter. And M2 is growing at better than 3.7% on an annual basis, and that rate is increasing every month. And where money goes, inflation will follow.

Retail Sales

Well, isn’t this interesting. Expectations were for a great December retail sales number as the calendar surrounding the Christmas season was favorable to the month relative to last year. A late Thanksgiving pushed Cyber Monday into December compressing the holiday shopping season. But last week, we were told that consumer debt on credit cards plunged in November which may have given us a signal that the consumer was tapped out.

Well, they weren’t “tapped out” but they certainly performed below expectations with retail sales rising 0.4% in the month vs. the expectations of 0.6% (full release here). That brought year-over-year sales to 3.9%. Adjusted for inflation, retail sales were up 1.0% which is the third consecutive month of positive growth after nearly a year of being negative.

So, even though they didn’t buy as much as was expected, the consumer still appears strong and is willing to spend…and spend more than last year in real terms. We will find out later this month if they paid cash, or just put it on the plastic.

Home Builder Confidence

Home builder confidence rose slightly in January to 47, up just one point from December (full release here). This is a little surprising given that the average 30-year mortgage rate is up 20 basis points from December with little to suggest it will improve in the near future. As a reminder, this is a diffusion index so a reading over 50 is an indication that the majority of builders feel confident about the current and near-term outlook for housing. Obviously, a reading below 50 signifies the opposite.

Looking at the components of the index, we see that the 6-month outlook dropped significantly, but is still well above 50. Again, that drop is probably due to the outlook for mortgage rates, and frankly, it is a bit surprising that the outlook index is still in “optimistic” territory.

The “present sales” sub-index moved above 50 for the first time since May. Perhaps home buyers are realizing that rates in the 6% range aren’t all that bad…especially if the outlook is for rates to move even higher in 2025. (They hit 7% this week.) Even so, the “traffic of prospective buyers” still isn’t what builders want to see as that index improved slightly but has been below 50 for more than two and a half years.

Housing Starts & Building Permits

First, with respect to housing starts, the data for November was revised down but from that adjusted level, they jumped 15.8% in December - the first increase since August (full release here). That was the largest monthly increase since March 2021, and brought total starts to the highest level since February.

As you can see below, the increase was largely driven by multi-family units which exploded 58.9% in December. That is the biggest monthly jump in multi-family starts since 2016.

With the 30-year mortgage rate rising above 7% this week, perhaps many people see renting as the future of housing. It looks like the builders certainly think so.

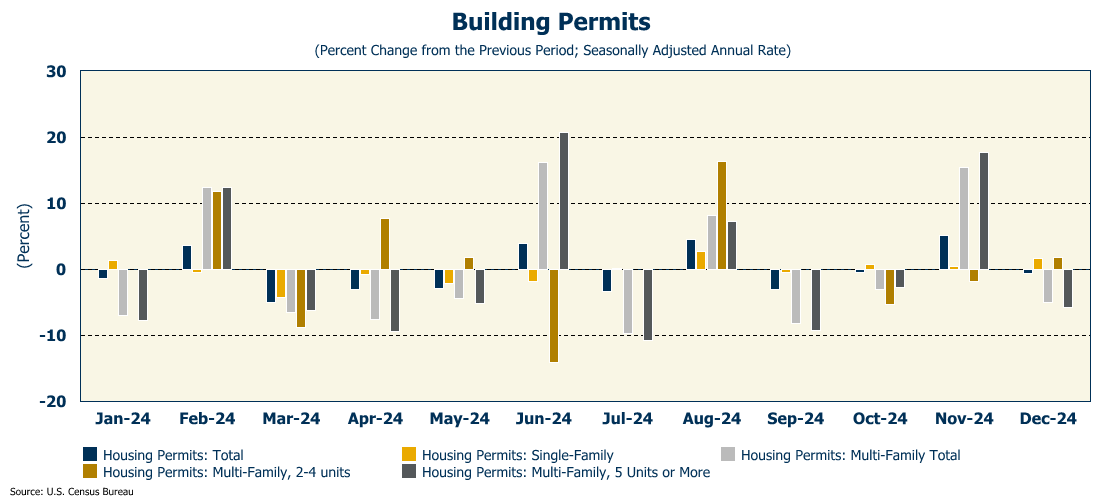

But even the rise in starts, the building permit data (which is obviously more of a leading indicator of the housing market), declined in December….and the decline was led by multi-family permits. After last month’s big jump in permits and with all those projects getting started, I guess the builders are just taking a breather. The movement in mortgage rates, which continue to rise, will likely also be a factor in the coming months.

One More Thing…

Next week I will begin my series of economic update/outlook presentations to various groups and I am looking forward to getting out and talking with several of my readers. Please come up and introduce yourself if you attend one of these events.

Also next week, there is very little economic data being released so the update will be short. Perhaps I’ll find some time to talk about another topic to fill the space.

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.