Weekly Economic Update 01-24-25: A New President; Industrial Production & Capacity Utilization; Existing Home Sales; and Consumer Sentiment

New President....same economy.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

As of Monday, we have a new administration in Washington, one that promises a new “golden age” of American prosperity. That is easier said than done.

Regardless of your political leanings, we should all want America to prosper. But in many ways, the last TWO administrations did more harm than good. When faced with the threat of a global pandemic, the first Trump Administration did what Washington politicians always do…they threw money at the problem...a LOT of money. My father used to say, “When you have a hammer, every problem looks like a nail.” Money is the hammer of Washington, and they think everything can be solved by spending more of it. So, we had the COVID Preparedness & Response Act ($8 billion); the Families First Coronavirus Response Act ($104 billion); the CARES Act ($2.1 trillion); the Paycheck Protection Program ($438 billion); the Paycheck Protection Program Round 2 ($10 billion); and the 2020 Stimulus Act ($932 billion); for a total of $3.6 trillion in extra spending.

Not to be outdone, the Biden Administration came in and did more of the same…same problem, same hammer. We had the American Rescue Plan ($1.9 trillion); the Inflation Reduction Act ($891 billion); the Infrastructure Investment & Jobs Act ($1.9 trillion); and the CHIPS Act ($230 billion); for a total $4.2 trillion in extra spending.

So, here we are, $7.8 trillion later with much higher prices and a decline in real wages. In 2021, the average wage in America was $55,261. Adjusted for inflation, in those same 2021 dollars, the current average wage is just $53,968…a decline of 2.3%.

And now the new second Trump administration wants to solve the problem that the first Trump administration started. And to make it more complicated, the President has promised to bring down prices.

Possible? Yes. Easy? No. Painful? Most certainly.

First, the money printing has to stop. Period. This means that the unprecedented government spending and subsequent debt accumulation has to stop. As I wrote back in November, that is highly unlikely to happen because it will require cuts to entitlements. Cuts that would be painful. Cuts that will cost people their seats in Congress.

The Congressional Budget Office (CBO) predicts that the current fiscal year deficit will come in at $1.9 trillion and grow to $2.7 trillion by 2035…or 6.1% of GDP, “significantly more than the 3.8% that deficits have averaged over the past 50 years.” This can’t continue.

So, IF the government drastically cuts spending, (and that is a big IF) and if the Fed stops printing money, (another big IF) then you have a chance to slow the rate of inflation. But without significant cuts to government spending, we are stuck in a feedback loop. High inflation leads to higher interest, (despite the efforts of the Fed to bring them down) which leads to higher debt costs. Without spending cuts, those higher debt costs require more government borrowing, which means the Fed creates more money, which leads to high inflation.

But even if you can do all that, inflation only slows….prices don’t come down. The new administration has promised to LOWER prices. For that, you will need more. Much more. The most significant factor would be productivity growth. For the past 10 years, productivity growth has averaged about 1.6%. We need to double or triple that. At the very least.

A second important factor would be lowering the cost of energy. Energy is in EVERYTHING. Lower the cost of energy, and you could lower prices. This is one area in which the new administration could actually make headway, and has already taken executive action to start down that path.

The formula is simple - cut government spending, stop printing money, lower energy costs, and increase productivity. But like I said, it is easier said than done. Perhaps artificial intelligence will be part of the solution. Fewer regulations would certainly help. Whatever the new administration can do to unleash the U.S. economy is where they need to focus. Declassifying the JFK files, pausing the ban on TikTok, and renaming the Gulf of America are needless distractions.

Industrial Production & Capacity Utilization

Most of the manufacturing indices have been down over the past two years as manufacturing has clearly been in a recession. However, many of the indicators in the manufacturing sector are starting to show signs of life. Most recently, industrial production rose for the second straight month rising 0.9% in December (full release here). Production for manufacturing industries rose 0.6%, also for the second consecutive month.

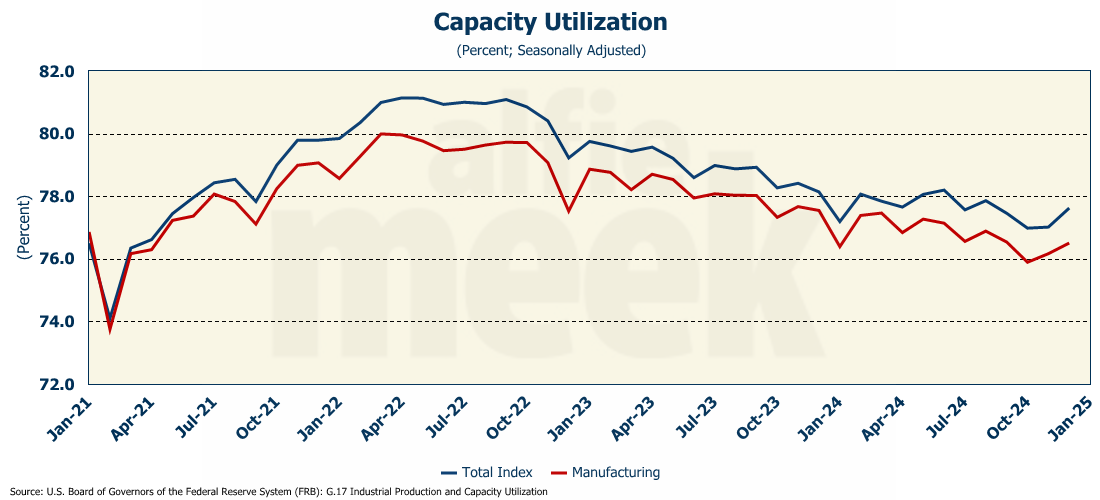

Further, capacity utilization (a measure of how much potential output that is actually being realized in the economy) also posted an increase for the second consecutive month after falling steadily since 2022.

These are just two measures of industrial output, and two months doesn’t necessarily make a trend. But the sector appears to be moving in the right direction. In addition, the most recent Philadelphia Fed survey on the outlook for manufacturing absolutely exploded in January to its highest level since 2021.

Digging into the details, we see the optimism is widespread with the 6-month outlook for shipments, capital expenditures, and new orders all rising sharply.

From a forward-looking perspective, this is all very positive. But the reality is that currently, manufacturing is still in recession, as evidenced by the fact that the volume of freight shipments were negative on a year-over-year basis for every month in 2024, with December running 6.5% below a year ago. But if the outlook above is any indication, 2025 may be the year that manufacturing finally recovers.

Existing Home Sales

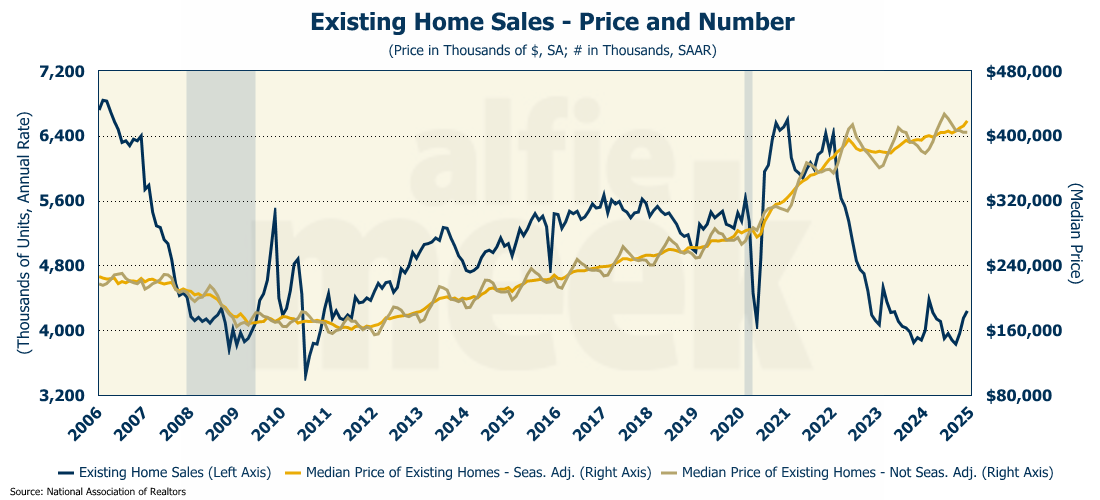

Existing home sales for December were a mix of good news, not-so-good news, and bad news. The good news first…existing home sales rose for the third consecutive month, which is the longest streak since late 2021 (full release here). On a month-over-month basis they rose 2.2%, and were up 9.3% year-over-year.

Now, for the not-so-good news: prices rose again, increasing significantly in December to $418,600 (seasonally adjusted).

Now the bad news. Despite the positive movement of the past three months, for the entire year, existing home sales were 4.06 million which is the lowest they have been in 30 years! The last time we had existing home sales this low was 1995 and at that time, we had 70 million fewer people! And mortgage rates continue to climb and are likely to increase throughout the year. 2025 is going to be an interesting year it the residential real estate market.

Consumer Sentiment

Finally, late this morning we got the final read on consumer sentiment from the University of Michigan (full release here). Overall, sentiment was down in January as both the “present conditions” index and the “expectations” index fell.

Driving that drop was a sharp increase in consumers’ inflation expectations. The one-year expectation rose from 2.8% to 3.3%, and the five-year rose from 3.0% to 3.2%.

As we have mentioned before, the University of Michigan breaks its data down by party affiliation. And that data is quite interesting. Democrats have a one-year inflation expectation of 4.2%. It was less than 2% before the election. By contrast, Republicans have a one-year inflation expectation of only 0.1% - virtually zero inflation. Before the election, they were sitting at 3.5%. It would seem that your politics, rather than your realized experience, drives your expectations about inflation. As such, it isn’t surprising that the Independents probably have it right. They have a one-year inflation expectation of 3.2%…roughly unchanged from before the election. New President…same economy.

One More Thing…

I want to thank SCM Group North America for having me speak this week to their national sales team. It was a good group and I hope they found something useful in my comments.

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.