Weekly Economic Update 11-15-24: $2 Trillion Cut?; Consumer Price Index; Producer Price Index; and Retail Sales

Inflation is back! And Mr. Musk has his work cut out for him.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

As we come to the end of the year, both work and personal schedules are getting hectic and time for the Weekly Economic Update is getting tight. I apologize in advance if the update is a little shorter over the next few weeks.

Last week, in my opening comments I stated that “many of the problems with the economy are structural and improving them will be like trying to turn a battleship.” I want to start this week by expounding on that statement. In my mind, there are three major challenges facing the incoming administration:

Inflation

Government Spending

Labor Market/Consumer

For purposes of my comment last week, I was primarily referring to #1 and #2 above.

First, let’s look at inflation. You will see below in the CPI number this week, inflation it is beginning to come back and by the summer of 2025, we could easily be experiencing another wave. As I have said many times, it is all about the growth in the money supply. Period. To my friends on the left, it isn’t corporate price gouging. To my friends on the right, it isn’t about the price of oil and over regulation. Do these things impact prices? Certainly. But oil, for example, is relatively low and yet inflation is still an issue. The underlying reason for inflation is that we grew the money supply by 40% between 2020 and 2022. And despite an actual contraction of the money supply between mid-2022 and late 2023, (which has led to the recent slowdown in the rate of inflation) it is now growing once again and is more than $4 trillion above trend.

The problem, of course, is that there isn’t an easy solution. Sure, lowering energy prices may help, but at some point they get so low it is no longer profitable for the producers to pull it out of the ground. And yes, lower regulation can help. But these “solutions” are just band-aids on gaping wound.

In this blog, I have talked a lot about inflation (including my most read post) and have often presented Milton Friedman’s famous quote “Inflation is always and everywhere a monetary phenomenon...it is made or stopped by the central bank.” Long term, the new administration could try to fix the problem by legislatively ending the Fed’s open-market operations and debt support…permanently. While that would be a fantastic solution, it doesn’t help the current problem….one that may haunt the new President sooner rather than later.

Second, with respect to federal spending, a few weeks ago Elon Musk was asked how much he thought his “Department of Government Efficiency” (DOGE) could cut from the federal budget. He tossed out $2 trillion. That would be wonderful! I hope he can pull it off. Where will it come from? Homeland security? Transportation? HUD? The President-elect has often suggested cutting out the Department of Education entirely and sending that function back to the states. Ok. Interesting idea. That gets you just under $200 billion. Only $1.8 trillion to go.

Below is a chart that shows FY24 spending by department. If you eliminated the departments of Agriculture, Education, Homeland Security, Transportation, Energy, Labor, Justice, Commerce, Interior, and State you would have only cut $1.75 trillion. That is because eighty percent of the spending is Health & Human Services, the Treasury, Defense, and the Social Security Administration.

Instead of looking at departments, let’s look at spending by budget function. Of the $8.7 trillion budget, the top four categories are Medicare, Social Security, national defense, and net interest. Can’t realistically do anything with Medicare, Social Security, and net interest, and those three alone are $4 trillion. (To put that in perspective, the entire spending for FY18 was $4.1 trillion….we have more than doubled the size of the federal government in 7 years!) Add in national defense and you are at $5.4T leaving only $3.3T to play with. (And yes, I realize that there are probably cuts that can be made in defense….but it isn’t easy.) Then, with the “affordable care act” we have massive national health care expense, not to mention income security programs. Now we are at $7.1 trillion leaving only $1.6 trillion available for cuts. (Why does D.C. love antonymic names? “Affordable” Care Act; Inflation “Reduction” Act….)

You see the problem. I’m not saying it can’t be done, but it won’t be easy. And it will hurt. It will absolutely require cuts to entitlements. The federal government has made promise, after promise, after promise and people (who vote) expect those promises to be kept. And congressmen who renege on those promises tend not to get re-elected. Some people in congress are going to have to make some very hard decisions, and that isn’t exactly something congressmen are known for. In fact, the reality is quite the opposite as nearly every one of them are spineless cowards.

So, like I said, these problems are structural. Changing them will take more political capital than even the newly elected President has to spend. But someone has to do it. As a nation, we are broke. The Fed cuts rates, but the bond market says, “not so fast” and rates actually rise making our debt even more difficult to service. The incoming administration has some major challenges ahead.

Consumer Price Index

As I referred to above, on Wednesday we got the October CPI and it kicked up to 2.6% (full release here). That was the first time the headline number has moved up since March. Core CPI (CPI less the more volatile food and energy components) has now risen on a month-over-month basis for 53 consecutive months and came in at 3.3%. “Super Core” (CPI for services less shelter) is still running much hotter and came in at 4.6% in October.

If you look at the money supply chart above, this move up in October CPI shouldn’t be a surprise. In fact, long-time readers of this update know that I have been predicting a second wave of inflation much like we had in the late 70s and early 80s. The two periods look eerily similar. With money supply currently growing at an annualized rate of 4.6%, inflation isn’t going anywhere. In fact, it wouldn’t surprise me at all if this CPI reading causes the Fed to pause in December and re-evaluate their interest rate policy….something they certainly need to do.

Producer Price Index

Another indicator of future inflation is the Producer Price Index which measures the prices at the producer level. Like the CPI, PPI rose in October to 2.4% (full release here). Prices at the producer level have been trending up for nearly the entire year, and to the extent possible, those producers will pass on those costs to consumers.

Core goods inflation rose to 2.2% - the highest rate since May 2023! Service inflation at the producer level came in at 3.5% which is the highest it has been since June.

By any reasonable measure, inflation is coming back. If the Fed cuts rates in December, it will be proof positive that they don’t care, and that their focus has shifted from stable prices to the labor market. Of course, given that we have lost 1 million full-time jobs in the past 12 months and replaced them with 1.2 million part-time jobs might indicate that the labor market has issues too. But that is a topic for another week.

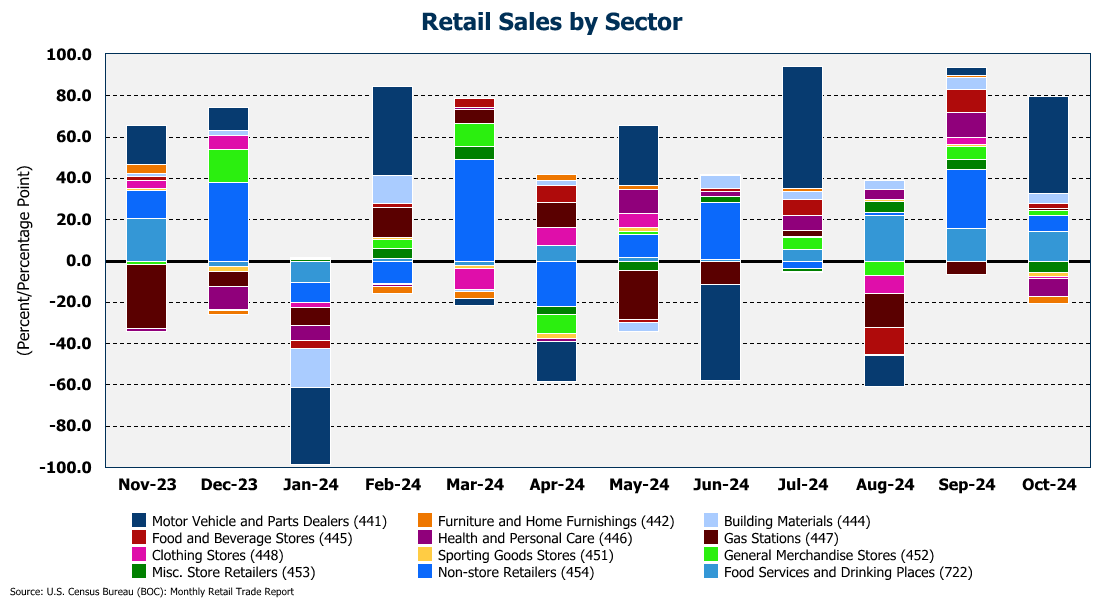

Retail Sales

Finally this week, we got data on October retail sales which came in slightly stronger than expected at 0.4% month-over-month, and 2.8% year-over-year (full release here). As I always remind my readers, that number is nominal, meaning it is NOT adjusted for inflation. However, with CPI at 2.6%, inflation-adjusted retail sales came in very slightly positive at 0.2% year-over-year. That is only the third time that has happened in 2024…and the other two times were 0.15% and 0.003% respectively making October’s anemic 0.2% the strongest of the year.

October sales were totally driven by autos. Excluding autos, nominal retail sales were up only 0.1% for the month, which was weaker than expected.

The consumer continues to spend, despite the fact that over 11% of current credit card balances are more than 90 days delinquent, which is the highest rate since 2012. Auto loans over 90 days are also slipping up and are now at 4.6%. And, with the new administration coming into office, sweeping student loan forgiveness is highly unlikely….with $1.6 trillion in outstanding student loan debt, can you imagine what that will do to the consumer? Last year I predicted a weak Christmas season. I was wrong. But with a very short time between Thanksgiving and Christmas, and the weakening financial position of the consumer, I’m going with that prediction again this year.

One More Thing…

Here on Substack, there are a few dozen readers who have “pledged” to support this update with a “paid subscriptions” if I turn them on. However, in order to continue to build my readership, I am leaving them off so the Weekly Update doesn’t fall behind the paywall. However, if you have pledged, I ask you to click/scan the QR code below and fulfill your pledge on the “Buy me a coffee” site. That way you can support this effort and I can continue to attract new readers.

Finally, we haven’t added any new subscribers in a while. Please share this with your network and if they find it interesting or useful, ask them to subscribe!

Thanks again for all the support!