Weekly Economic Update 01-31-25: Fed Interest Rate Decision; New Home Sales; Durable Goods; Personal Income & Spending; PCE Inflation; Consumer Confidence; and 4th Quarter GDP

The Fed holds rates steady as inflation remains elevated; consumers sour on the outlook for the economy

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

After a couple of slow weeks with respect to data releases, the government made up for it this week, releasing data from housing to income & spending to inflation to GDP. There is a lot to cover, but first, I need to discuss the Fed’s decision not to cut rates this week. Let me start by saying that, for once, they made the right decision. But after last week, the decision was a foregone conclusion. You will recall that last week, the new President “demanded” that the Federal Reserve cut interest rates. That effectively guaranteed that they wouldn’t. (Not that you have any way of knowing this, but I wrote this introduction on Monday…two days before the Fed meeting…that’s how much of a lock it was.)

The irony is that they have walked directly into the President’s trap. President Trump knows full well that the economy is slowing, that inflation is still a problem, and that, despite his valiant efforts, prices are unlikely to come down. Further, he knows that a rate cut would make inflation worse. And lastly, he also knows that about 99% of voters do not understand the relationship between rate cuts and inflation. (That isn’t a knock against Trump voters…it is a reflection of the economic illiteracy of the nation as a whole.). So, when prices don’t come down, and the economy slows (as it is likely to do), the President will point to the Fed and say, “See, if they had only done what I told them to do, we would be winning biggly. It is all their fault.” The man is playing 3D chess while the Fed plays checkers. It isn’t a fair fight.

New Home Sales

Last week we saw that existing home sales for 2024 were the lowest in 30 years. This week, we found out that NEW home sales rose for the second year in a row coming in at 683K units, 2.5% over 2023 (full release here). In December, despite rising mortgage rates, the number of sales rose much more than expected as buyers took advantage of builder incentives. In fact, more than 60% of builders said they used sales incentives in December, and 30% said they cut prices. Even so, the median price of a new home rose to $430,850.

However, going forward, incentives may not be enough. First, builders are sitting on a lot of inventory, with completed new homes for sale rising again to 124K units - the third-highest level ever. In addition, there are more listings for existing homes as re-sale inventory is up 16.2% from a year ago.

With mortgage rates at 7%, and few if any rate cuts on the horizon (not that rate cuts did much in 2024), there will be no recovery for the housing market in 2025.

Durable Goods

Despite the optimism expressed by manufacturers in recent months, orders for durable goods dropped sharply for the second month in a row, falling 2.2% in December (full release here). Expectations. were for an increase of 0.7%. To make matters worse, the November number was revised down to -2.0%.

However, if you take out orders for transportation equipment, new orders rose 0.3%…the fourth increase in the last five months. This is most likely Boeing-related, as non-defense aircraft and parts orders tumbled 45.7% in December. Orders for “core capital goods” (a proxy for investment in equipment excluding aircraft and military hardware) increased 0.5% last month after a revised 0.9% jump in November.

PCE Inflation

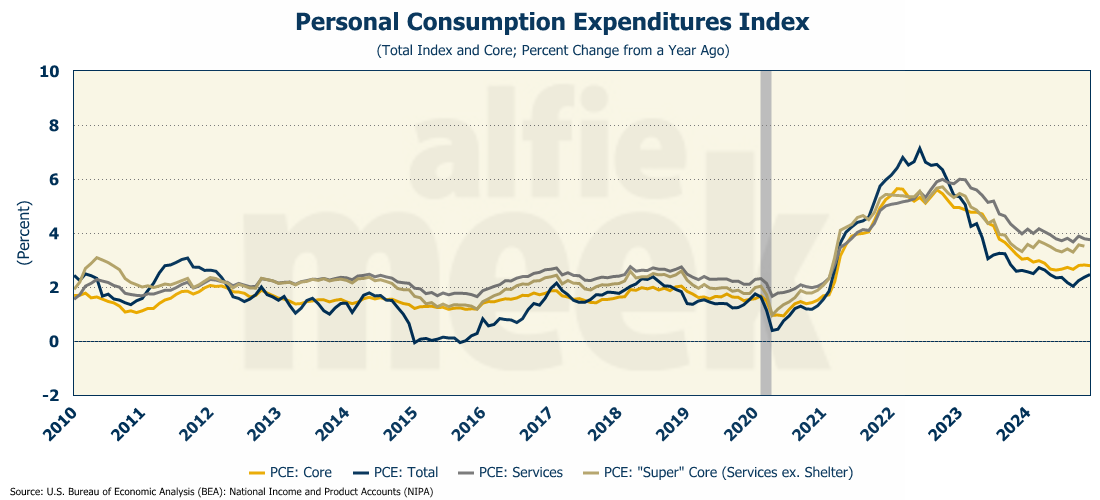

PCE inflation rose for the third month in a row in December, coming in at 2.5% year-over-year (full release here). While that may not seem high, if you annualize the monthly increase, it grew at a rate of 3.2%. In other words, it is accelerating.

Core PCE (PCE less food and energy) remained flat at 2.8%. Core PCE used to be the Fed’s “favorite” measure of inflation, but they haven’t talked about it much recently. Maybe because it remains stubbornly high. Services inflation also remained flat at 3.8%. “Super” core inflation (services less shelter) came in at 3.5%.

To make matters worse, the Employment Cost Index rose to 3.4% in the fourth quarter, after falling during most of 2024. To the extent possible, employers will pass those costs on to consumers, resulting in future inflation pressure.

What does this all tell us? Inflation is sticky and getting it down is difficult. Maybe the Fed shouldn’t have been cutting rates last year. And given these numbers, it is no surprise that they took a “pause” at their meeting this week.

Personal Income & Spending

As inflation rises, so too does spending. And, per usual, spending grew faster than income. Personal consumption grew 0.7% in December, while personal income grew only 0.4% (full release here). This of course means that the savings rate fell once again and now sits at 3.8%.

Consumer Confidence

Overall consumer confidence fell for the second consecutive month in January as consumers’ attitudes soured on both their present situation and their expectations about the future (full release here).

Last week, we saw in the University of Michigan consumer sentiment data that Democrats’ outlook was much worse than that of Republicans. While the Conference Board doesn’t break down their data by party affiliation, if we look at states as a proxy for party, we see similar trends in the consumer confidence data. Since the election, consumer confidence in Texas and Florida have risen substantially, while confidence in California and New York has fallen. However, despite the state color (red or blue), confidence across the board was lower in January than it was in December.

Finally, across the board, consumers reported a decrease in plans to buy a car, buy a home, buy a major appliance, or go on vacation (both foreign and domestic) in the next six months. What is strange about that is that the percentage of people who expect their income to stay the same or increase over the same period rose, and expectations for overall family finances reached a new series high. There is a disconnect here between where people think their finances are headed and what they intend to spend. Maybe they have decided to take a break and pay down some debt. We’ll see what transpires over the next few months.

Fourth Quarter GDP

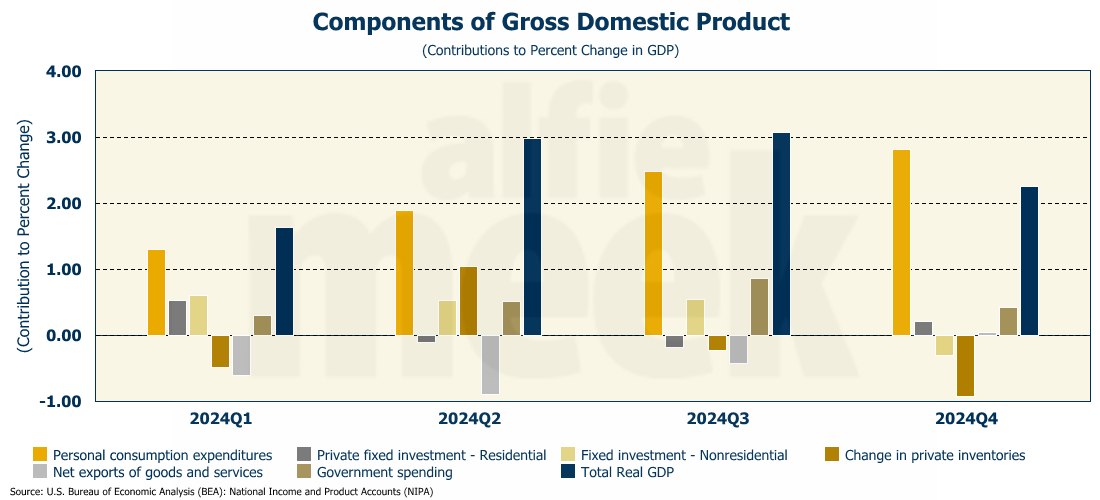

Finally this week, we got our first look at how the economy performed in the fourth quarter of 2024….it wasn’t too bad, but it wasn’t great either. According to the advanced estimate from the Bureau of Economic Analysis, the economy slowed to a 2.25% pace in the fourth quarter (full release here). That is significantly slower than the 3.0%, and 3.1% posted in the second and third quarters, respectively. For the year, the economy grew 2.8%, slightly slower than it did in 2023.

However, the more interesting parts of the release are the components of the growth in the fourth quarter. Personal consumption represented a larger share of the growth in GDP than in any of the previous six quarters. Throughout 2024, the contribution of personal consumption to GDP growth steadily grew, and by the fourth quarter, it represented more than 100% of the total growth. Understand what that means….the combined net contribution of investment, inventories, government spending, and net exports was negative in the fourth quarter.

I am always fascinated by the media reporting on economic data. It is clear they only look at the headline number and then crank out some quick drivel without doing any real analysis. For example, MarketWatch, a Dow Jones company, reported that “the report showed an economy on strong footing as the Biden administration handed off to the Trump White House.” Part of the article headline was “economy looks good under the hood.”

Really? A “strong footing?” “Looks good under the hood?” Did you even look under the hood? Even IF 2.25% could be considered “strong,” I think the data and the graph are pretty easy to read. The consumer is spending like a drunken sailor, with personal consumption growing at a 4.2% annualized rate in the fourth quarter - the fastest rate in 2 years. Of course, this is all being driven by an increase in household debt. The second biggest positive influence was government spending, which is also being driven by record levels of public debt. Virtually everything else was negative.

Further, under the new administration, government spending is likely to slow significantly, leaving everything on the shoulders of the consumer, who is starting to hit a wall as inflation continues to eat away at incomes that are not keeping up.

The bottom line…the economy is slowing, and is completely dependent on record borrowing - at both the consumer level or the government level. That isn’t a “strong economy.” That is an economy teetering on the edge.

One More Thing…

Once again, I want to thank you for subscribing and reading this weekly update…especially those of you who are members and support this on an ongoing basis.

Over the next few weeks, I will be making some decisions about the future of this update and the best way to move forward. I am leaning toward moving to the paid subscription option. The “buy me a coffee” system has dropped off significantly, with only one contribution over the past month. While I am still trying to build my subscriber base, at some point, I have to decide if the weekly effort is worth it. So, if you find this worthwhile and aren’t already a member, please click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.

As always, I am also open to sponsorship. Please reach out if you are interested. Next week, since it will be the first week of the month, I will be highlighting my gold and silver-level sponsors. Would love to have you on the list!