Weekly Economic Update 02-21-25: DOGE; Home Builder Confidence; Building Permits & Housing Starts; Existing Home Sales; Consumer Credit; Initial Claims; and Consumer Sentiment

Home building slows as rates remain high and builders sour on the outlook

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

“The definition of insanity is doing the same thing over and over again and expecting different results."

I have been thinking a lot about this quote over the past few weeks as I have watched, with awe, wonder, and sometimes stunned amazement, as the new administration attempts to “trim” (or completely dismantle depending on your perspective) the Federal Government.

On one hand, there are those who are cheering on the President and his proxy, Mr. Musk, as they attack each and every department with ruthless (and perhaps reckless) abandon. Then, there are those who support the idea in principle but think that a more balanced and possibly less chaotic approach would be more judicious. And then, there are those who despise the whole effort entirely and prefer things just as they were.

Regardless in which camp you find yourself, there is one thing that is not in dispute. The nation is broke. Our debt-to-GDP ratio is over 120% and rising. We simply can not continue with annual budget deficits that are running 5%-6% of GDP.

Further, it would be the very definition of insanity to expect the system that got us in this mess to get us out. As I pointed out last March, the Congressional Budget Act of 1974, lays out a very clear budget process. The last time Congress followed that process was in 1996 for the fiscal year (FY) 1997 budget…29 years ago. For the last 29 years, Congress has never passed more than 5 of the 12 appropriation bills established by the Act on time. And when there is no budget, you get federal spending that has grown at an annual rate of 8.7% over the past 6 years. The system is broken and is unable to fix itself.

So, love it or hate it, at least the Trump Administration is trying something new. Although, it isn’t that new. We’ve done this same thing before.

Some of you may be old enough to remember Al Gore’s “Reinventing Government.” That was the 1992 version of DOGE. Within the first few weeks of the Clinton Administration, the administration cut 100,000 federal jobs. Over 8 years, they cut 380K jobs, which at the time represented more than 12% of the federal workforce.

That was more than 30 years ago, and by 1992, the federal workforce had grown to 3.1 million. When President Trump took over, the federal workforce was 3 million. Think about that…more than 30 years after the Clinton Administration’s “reinvention” of government, with all the growth in the federal government, it is still smaller today than it was in 1992 (in terms of total employment).

So in fairness, DOGE isn’t all that new. Certainly, the techniques are new, with computer networks being the primary tool of the modern bureaucracy, but we’ve been here before.

Despite cries emanating from bureaucrats, DOGE’s efforts won’t bring about the end of the world as we know it. Shortly after the Clinton Administration’s efforts, the U.S. ran a budget surplus - the first one since 1969. (Not coincidentally, that surplus corresponds to the last time Congress followed the Congressional Budget Act of 1974.) And we ran a budget surplus for four consecutive years…until 9/11 when we decided that U.S. foreign policy should be to wage unending war with every country in the Middle East. While it is unlikely that DOGE, despite their best efforts, can get us to a budget surplus, perhaps they will move us in the right direction.

We have to try something different because doing what we have been doing and expecting things to improve is insanity.

Home Builder Confidence

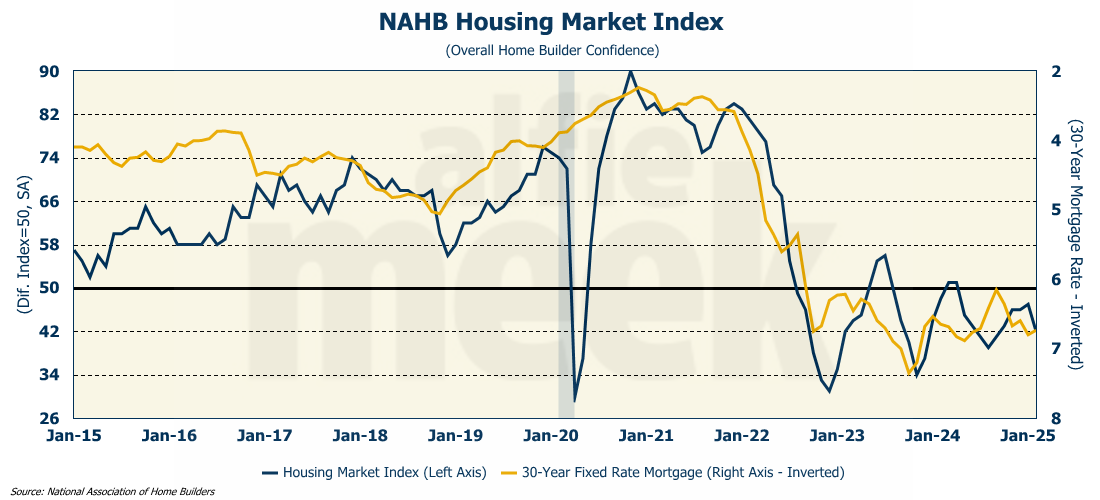

Home builder confidence plunged in February to 42, far below expectations and 6 points lower than it was in February 2024 (full release here). In January, the 30-year mortgage rate averaged right at 7%, and the rate is virtually unchanged so far in February. For obvious reasons, home builder confidence tends to have an inverse relationship with mortgage rates.

Looking at the index components, the drop was driven in large part by falling sentiment among builders about sales over the next six months, which fell back below 50. The other two components - traffic of prospective buyers and current single-family sales also declined in February. (The way the index is constructed, a reading below 50 means that more builders rated that component as “poor” than “good”.)

Builders are right to be concerned. Mortgage applications for home purchases have fallen off sharply for the first two weeks of February, and despite the wishes of the Trump Administration, there is no reason to believe rates will be falling anytime in the near future. Further, proposed tariffs on imported goods from Canada and Mexico may increase the cost of building materials. While some of those have been paused, the uncertainty of future cost pressure is weighing on the builder’s outlook for the housing market.

Building Permits and Housing Starts

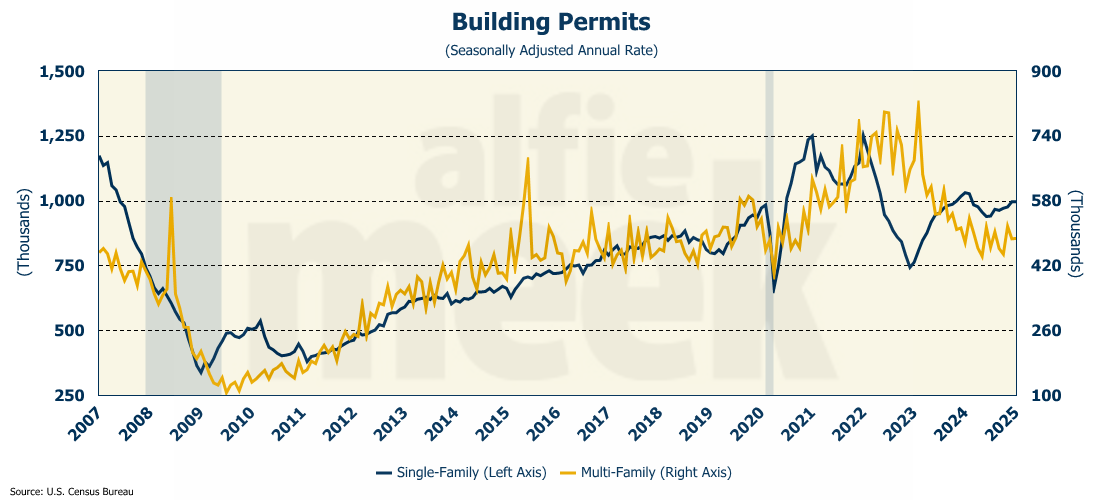

As confirmation of builders’ pessimism, after falling in December, single-family permits were flat in January, and multi-family permits were up only 0.2% (full release here). In total, residential building permits were 1.7% lower than one year ago.

Further, after a big jump in December, housing starts fell 9.8% in January, which was more than was expected. That was the largest monthly decline in housing starts since March 2024.

Homebuilders’ dreams of a better housing market in 2025 are fading as the reality of the interest rate environment begins to sink in. In fact, prediction markets now have a 23% chance of rate HIKES in 2025 (and frankly, I think that is low). I guess things aren’t turning out quite like homebuilders were expecting.

Existing Home Sales

The final piece of housing data this week was for existing home sales, which fell 4.9% in January to a seasonally adjusted rate of 4.08 million (full release here). However, on a year-over-year basis, sales were up 2% from January 2024.

On a seasonally adjusted basis, the median price rose slightly to $418,230, which is 4.8% higher than one year ago. With prices rising and rates refusing to come down, 2025 looks to be another slow year for existing home sales, which are coming off their worst year since 1995.

Consumer Credit

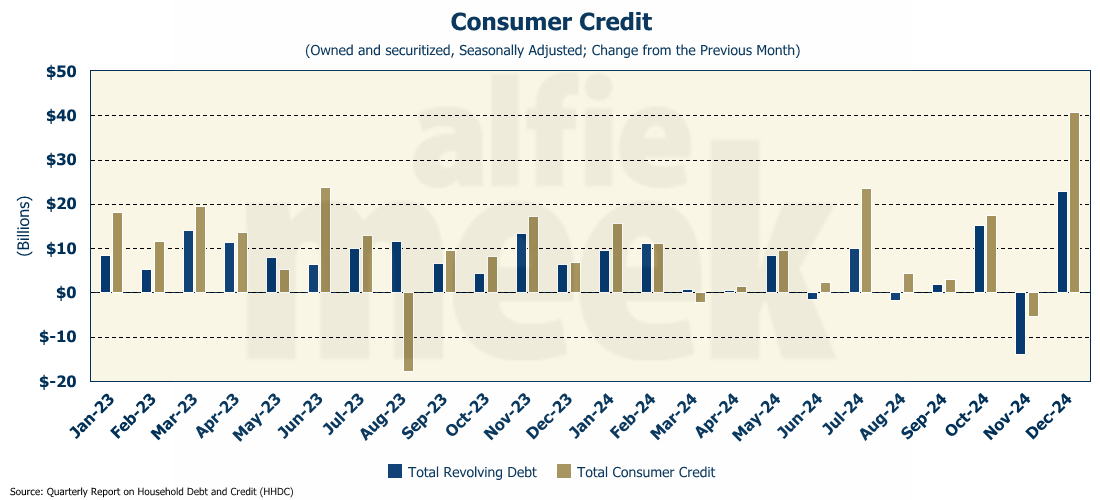

This is the number I have been waiting for. And it was worse than I feared. In December, consumers added $22.9 billion to their outstanding revolving credit (e.g., credit cards) and another $18 billion in other forms of credit (full release here).

Last month, I suggested that either the consumer hit a wall in November or that they were taking a breather before going crazy in December. It appears it was the latter…they went crazy in December. A friend of mine, who is a local government official, told me his sales tax receipts for December were the highest ever. I have said many times, you can’t overestimate the U.S. consumer’s ability to spend. And oh boy, it appears they spent in December. December saw the largest one-month increase in revolving credit since June 2021.

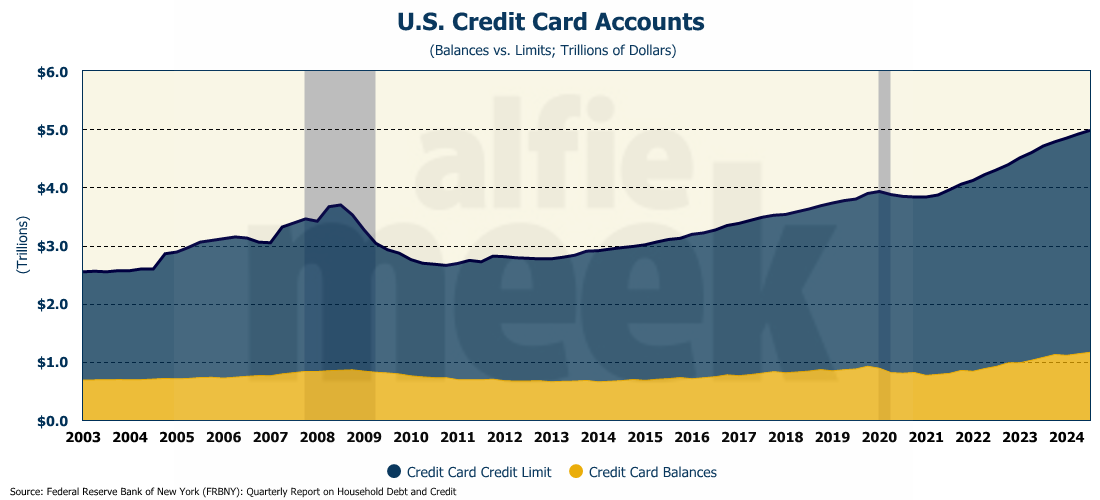

According to the NY Fed, total household debt rose $93 billion in the fourth quarter, and is now just over $18 trillion. Not surprisingly, the biggest increase was in credit card debt which now stands at an all-time high of $1.21 trillion. Mortgage debt and auto debt also set records coming in at $12.61 trillion and $1.66 trillion, respectively. And student loans are also at an all-time high coming in at $1.62 trillion.

How much longer can the consumer fight inflation by increasing their debt? If you can answer that question, you can predict when the next significant economic downturn will finally arrive. I’ve just about given up trying to guess how much longer the consumer can hang on. What is scary is that consumers’ credit card balances are only about 23% of their available credit, so they have plenty of room to keep on running.

Consumer Sentiment

This morning, the University of Michigan released the final numbers for February consumer sentiment, and they fell significantly across the board (full release here). Total consumer sentiment fell 7 points to 64.7. Sentiment about the present fell even further dropping 9.4 points to 65.7.

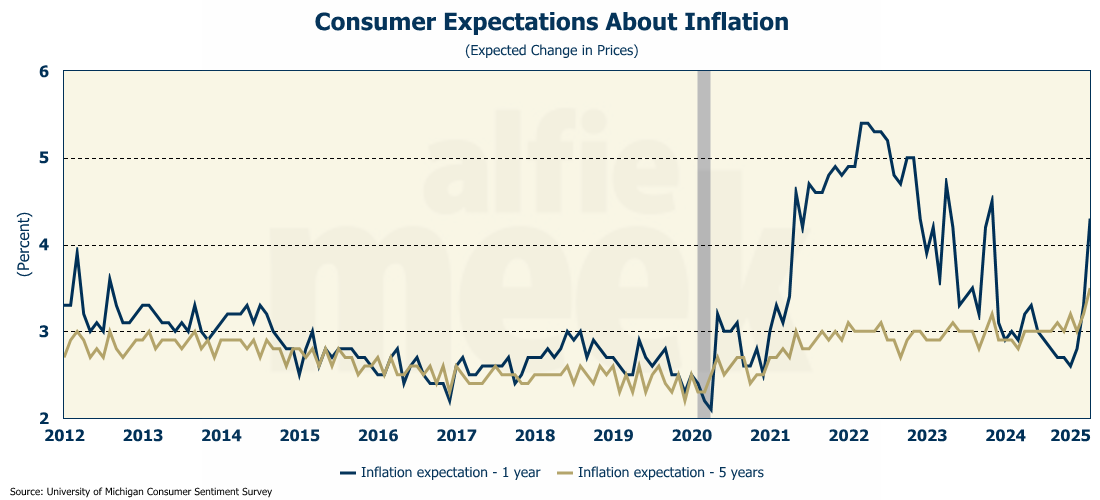

So why the decline? Perhaps those December credit card bills have shown up. But more likely, the decline has to do with the fact that consumers’ expectations of inflation have skyrocketed over the past two months, and they are now expecting inflation to be much higher one year from now. (Maybe more people are reading this weekly update because I have been saying this for a while.). But the real story is that consumers’ expectations of inflation 5 years out rose to 3.5% which was a 30-year high!

The report noted that inflation expectations were vastly different based on respondent’s politics with Democrats expecting inflation one year out to be over 5% and Republicans expecting it to be flat (0.0%). That is the largest partisan divide on record. As usual, the truth is likely to be found somewhere in the middle.

Initial Claims for Unemployment Insurance

Data on initial claims for unemployment insurance are released every Thursday and I don’t regularly comment on them as they move up and down and are usually only interesting at the beginning or end of a business cycle. Currently, the labor market is tight, and so it isn’t surprising that the number of workers filing for jobless benefits for the first time rose only slightly last week to 219K and is hovering around a multi-decade low (full release here). However, what is interesting is the movement in the claims from the Washington D.C. area…they are up 200% since the beginning of the year. This will be an interesting number to watch as DOGE continues it cost-cutting efforts over the next several months.

One More Thing…

On Monday, I will be speaking at the LaGrange-Troup County State of the Community Luncheon. If you are in the area, I invite you come and hear my economic update and outlook for the U.S., Georgia, and Atlanta. And please come up and say “hello” afterward. I enjoy meeting my subscribers and readers. The following week, I’ll be doing a similar talk in Barrow County. I’ll post a link to that event next Friday.

As always, thank you for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.