Weekly Economic Update - 02-28-25: Consumer Confidence; Case-Shiller Index; New Home Sales; Durable Goods; Personal Income & Spending; and PCE Inflation

Despite home sales slowing to a crawl, home prices continue to rise as the consumer pulls back in January.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Last week I suggested that love him or hate him, you had to at least give the President credit for trying something new with respect to cutting the cost of the federal government. With more than $35 trillion in total debt, and a deficit running $2+ trillion annually for as far as the eye can see, something has to be done. He may be going at it in an unorthodox and chaotic way, but at least he is doing something.

So, admist these efforts, earlier this week, the House of Representatives passed a reconciliation bill that, among other things, increases the debt ceiling by $4 trillion. Are you kidding me?

First, let me congratulate the new Congress for again failing to follow the Congressional Budget Act of 1974. Thirty consecutive years now. Quite an impressive streak.

Second, regardless of your thoughts on the appropriate level of federal taxation, cutting revenue by $4.5 trillion while reducing spending by only $1.5 trillion, and raising the debt ceiling by $4 trillion isn’t exactly the recipe for fiscal responsibility.

As I have said many times before…these are not serious people.

When I was on the debate team in high school, there was a principle known as “fiat” power, which, as the name implies, meant that the affirmative team had the absolute power to implement whatever policy they chose to address the topic being debated. I was asked during a talk this week what I would do to solve the federal budget problem. If I had “fiat” power today, my answer is simple…Congressional term limits. Our founders were brilliant men, and our founding documents are phenomenally wise, bordering on inspiration. But if they left one thing out, it was Congressional term limits. Of course, I don’t think the founders ever contemplated a permanent political class that would ensconce themselves in the nation’s capital and never leave. But that is what we have. And it is devastating our economic future.

Just a few years ago (i.e., pre-COVID) our federal government spent about $4.5 trillion annually with roughly a $500 billion deficit. We are getting close to doubling spending with 4x the deficit. And they have the audacity to look us in the face and say that they can only find $1.5 trillion to cut? (Actually, that is their “floor target”…they haven’t actually found it yet. One month ago, the GOP House conference went on a Miami retreat to identify $2 trillion in cuts. After two days of talks, they could only agree on a paltry $300 billion.)

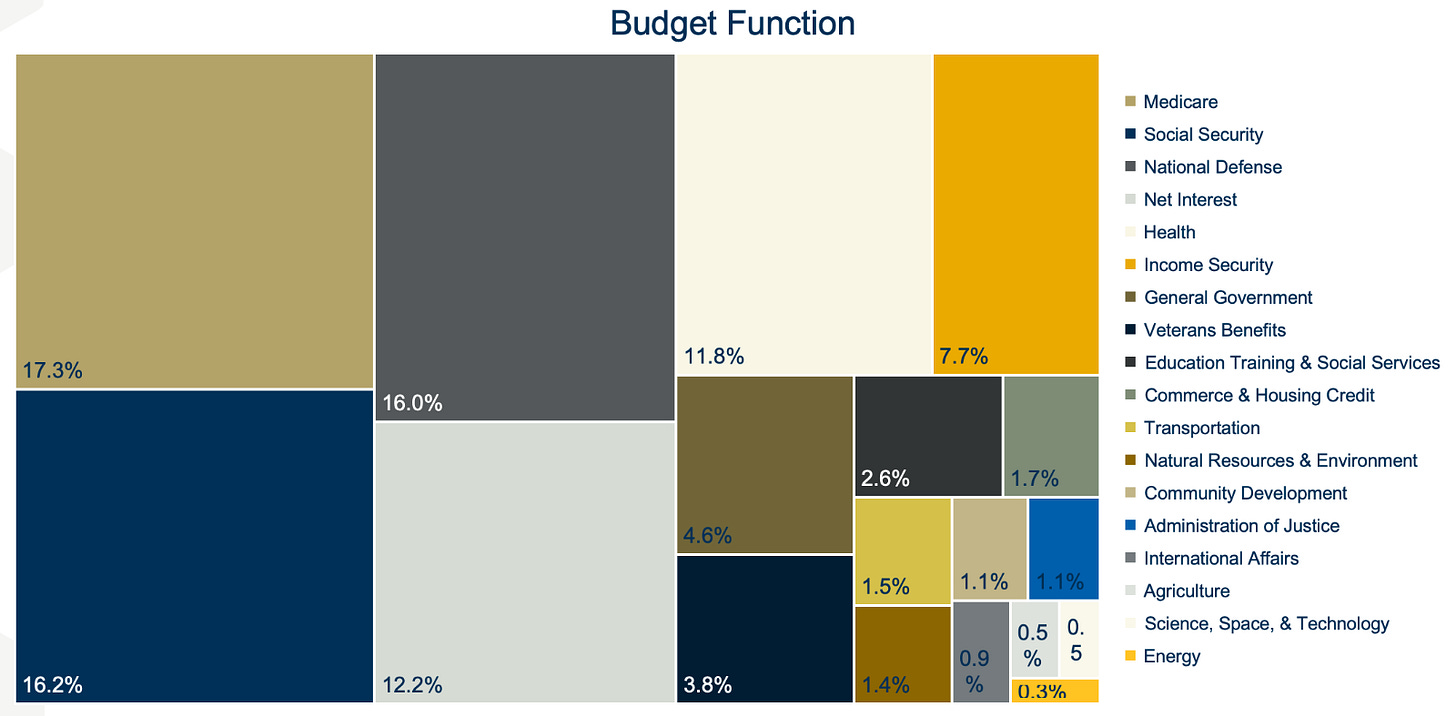

If you look at the details, the federal government is little more than a military with an insurance company attached. If you don’t address those two items - the military and healthcare/social services - you aren’t serious about the problem. Cutting $800 billion from the insurance side while adding $300 billion to the military side is prima facia evidence of their lack of seriousness. From where are the remaining cuts going to come? The rest of the federal government is less than $2 trillion in total!

Tuesday night produced an unserious proposal from an unserious group of politicians. We should demand better.

Consumer Confidence

Last week we saw consumer sentiment for February plunge, and this week, we got similar results from the Conference Board. The 7-point monthly drop in overall consumer confidence was the largest since August 2021 (full release here).

With respect to level, overall confidence fell to 98.3. Of more interest, however, is the fact that confidence about the future fell 9 points and came in below 80 - a critical level for predicting a future economic downturn. It had been below 80 for most of 2022, 2023, and the first half of 2024.

The drop in confidence was across the board….all age groups, nearly all income brackets, and even in both red and blue states. According to the Conference Board:

“Consumers became pessimistic about future business conditions and less optimistic about future income. Pessimism about future employment prospects worsened and reached a ten-month high.”

It would appear any election euphoria has worn off and uncertainty about the future is dampening consumer confidence. It remains to be seen if this will be reflected in consumer spending going forward.

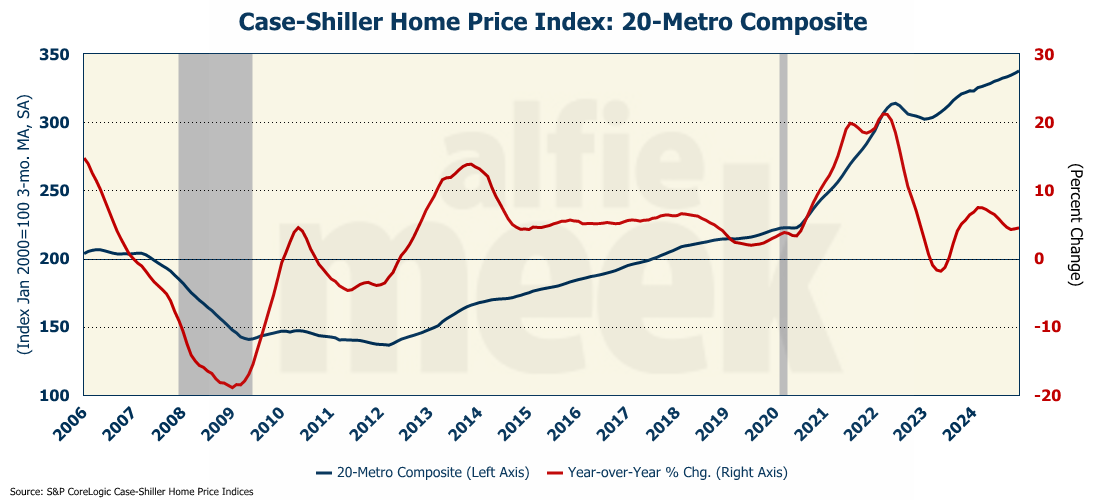

Case-Shiller Home Price Index

As I have pointed out previously, the Case-Shiller Home Price Index lags by a couple of months, but it does provide 1) confirmation of price movement and 2) insight into different areas of the country. In December, home prices accelerated for the second straight month (full release here). Prices have been increasing, but since February of last year, they have been growing at a decreasing rate. But for the last two months, the growth has been accelerating.

On a regional basis, 19 or the 20 metro that are tracked showed price growth. Only the Tampa region showed a decline and it declined for the second month in a row.

New Home Sales

And the hits just keep on coming. After rising for the last two months, new home sales in January plunged to 657,000 units on an annual rate - far lower than what was expected (full release here). On a year-over-year basis, new home sales were down 1.1%.

While sales were down, you wouldn’t know it from looking at the median price, which shot up more than $30K to $446,000. The average sales price was over $510,000. The number of completed new homes for sale stayed steady at 118K units which represents about 9 months’ worth of inventory.

Of larger concern, however, is that according to the National Association of Realtors, pending home sales fell to an all-time low in January. Year-over-year, contract signings fell in all four U.S. regions, with the South experiencing the largest drop - 9.2%. Of course, contract signings occur a month or two before a home is sold, which doesn’t bode well for new and existing home sales in the coming months.

Durable Goods

Over the last couple of months, we have seen indications that the manufacturing sector is on the rise - increasing capacity utilization, purchasing managers’ optimism, etc. The advanced data on durable goods for January would appear to confirm this move. For the month, durable goods orders were up 3.1%, and if defense orders are excluded, they were up 3.5% (full release here). Defense orders fell for the 4th consecutive month.

Personal Income and Spending

Personal income grew much faster than expected in January, rising 0.9% in January. Consumption was expected to rise slightly in January but actually fell 0.2% (full release here).

Of course, typically you might expect that consumption would fall in January after the Christmas season. However, these numbers are seasonally adjusted so the decline does represent a slowdown in consumer spending.

With incomes rising and spending falling, the monthly savings rate did climb to 4.6%, the highest it has been since June.

PCE Inflation

Inflation, as measured by the Personal Consumption Expenditures (PCE) index, rose in January by 0.3%. That was the largest monthly increase since last April. Even so, it did bring the annual rate down to 2.4%. Core PCE (PCE less food and energy) also rose 0.3% in January, resulting in an annual rate of 2.6%. The services index also fell sharply from 3.9% in December to 3.4% in January, and “super core” fell from 3.6% to 3.1%.

While still far above the Fed’s target rate, these are significant drops in inflation, and they fly in the face of what was reported earlier by both CPI and PPI. Going forward, it will be interesting to see if this trend continues or if PCE begins to reflect what is being seen in the other inflation indicators.

Initial Claims (aka DOGE update)

This week’s data on initial claims was interesting. Overall, initial claims for unemployment insurance were up 22K for the week to a level of 242K… which is the highest level of claims since October. However, initial claims in D.C. rose to over 2,000, which is 4x the average level for the district. I fully anticipate both numbers to move higher in the coming weeks as the new administration moves forward with its cost-cutting efforts.

One More Thing…

I want to thank the LaGrange-Troup County Chamber for having me speak this week at their State of the Community: Economic Outlook luncheon. It was a great group in a more “cozy” environment and I enjoyed the questions and the interaction. Several people there were already subscribers and we added about 20 new subscribers after the talk! Welcome, and I hope you find this weekly update useful.

Next week, I will be speaking at the Barrow County Chamber Membership Luncheon. I know the Chamber President is a subscriber and I hope to see many of you there!

As always, thank you for subscribing and reading this weekly update. Please share it with those who you think may find it interesting. I am adding new subscribers almost daily. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.