Weekly Economic Update 03-03-25: Atlanta Fed GDPNow; ISM Manufacturing; Factory Orders; ISM Services; and the February Jobs Report

The Atlanta Fed's GDPNow model predicts recession despite positive news on the service economy and strong growth in manufacturing jobs

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

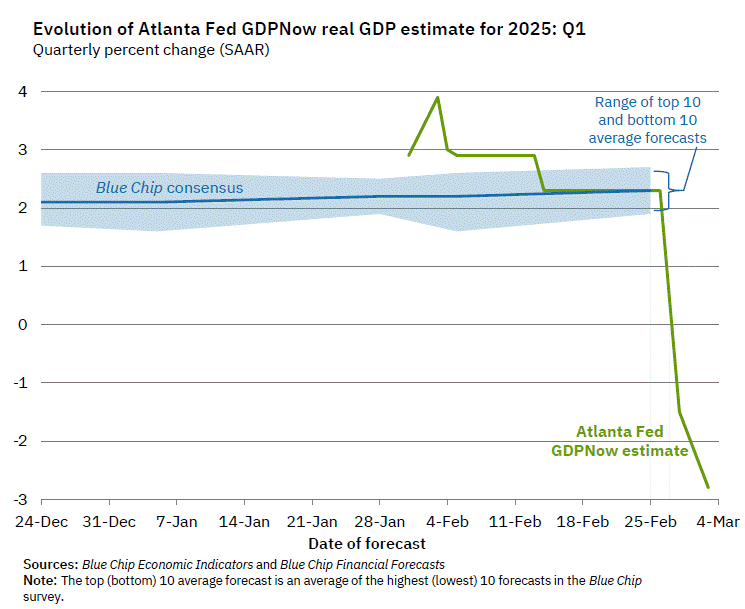

Late last week, the Atlanta Federal Reserve released its latest GDPNow estimate for first quarter GDP. For those who may not be aware, the Atlanta FED GDPNow model is designed to provide a current estimate of what the official GDP reading will be using a methodology similar to the one used by the U.S. Bureau of Economic Analysis. Their track record is fairly good, and the model is generally well respected.

Surprisingly, the model took a major downturn last Friday, dropping 380 basis points in a single day, moving from showing first-quarter growth of 2.3% to a decline of 1.5%. Then, on Monday, it was revised again dropping another 130 basis points to -2.8%. In the matter of two days, the model dropped 510 basis points to show a significant economic downturn in the first quarter.

Now, I can appreciate changing your forecast as new data becomes available. But what data came out last week that would move a model that was showing steady economic growth to a significant economic contraction?!? I really can’t think of any.

I have been predicting a recession for several years, and for several years, I have been wrong. Under “normal” conditions, we would have had one by now. However, what I didn’t account for was the government spending $2 trillion in deficit each year. With that level of government spending, GDP will remain positive even if investment, inventories, and exports are all negative. Further, I didn’t expect consumer spending to continue to be as strong as it has been, with real incomes declining while inflation continues to rise. But the consumer proved me wrong over and over again.

This is why, in my more recent public talks, I have finally given up predicting a recession. Until both the government and the consumer get their spending under control, the economy will keep on chugging away. So, of course, now that I have given up on the recession outlook, the Atlanta Fed is essentially predicting a recession in the first quarter.

Again, I ask, what could have caused this change? According to the Atlanta Fed last Friday:

“After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcast of the contribution of net exports to first-quarter real GDP growth fell from -0.41 percentage points to -3.70 percentage points while the nowcast of first-quarter real personal consumption expenditures growth fell from 2.3 percent to 1.3 percent.”

And, then again Monday morning:

“After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of first-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 1.3 percent and 3.5 percent, respectively, to 0.0 percent and 0.1 percent.”

So it is mostly a shift in exports, a drop in consumer spending, and a decline in manufacturing? Net exports have fallen because U.S. businesses stocked up in January just in case tariff’s kicked in. That isn’t structural. Last week, we did get a surprising drop in consumer spending in January. But will that continue? That has been a losing bet for quite some time. And I will discuss the ISM Manufacturing data below.

Certainly, government spending may slow in the first quarter, but let’s be honest…despite all the hoopla, what has DOGE really cut? By their own admission, as of this writing, only $65 billion. Even if we assume that number is correct, that is a drop in the vast ocean of government spending and certainly not enough to have a significant impact on GDP.

As to the DOGE job cuts? As I pointed out last week, the number of initial claims for unemployment insurance in D.C. are up 4x…but that is only 1,500 jobs. I looked at the number for Virginia, and there isn’t even a blip. Frankly, I question if the number of potential Federal job losses will be big enough to have any real impact on the economy or labor market. As I have pointed out many times, government spending has been obscene for several years, and the kind of cuts required at this point to make a significant impact are far too large for Washington to stomach.

Both residential and non-residential fixed investment have been slow for several quarters, so that can’t be the source of the change in the forecast. So I am at a loss. It will be interesting to watch the Atlanta Fed’s model over the next month as more data comes in. It will also be interesting to see if we actually get a “recession.” Don’t forget, when GDP dropped for two consecutive quarters in early 2022, it was decided that it was NOT a recession. Interestingly, second quarter 2022 GDP has now been revised to be positive…what are the odds? I guess the National Bureau of Economic Research (NBER) was right. Will the NBER be just as slow to hold off on judging this downturn? I wouldn’t bet on it.

ISM Manufacturing

Let’s talk about the ISM Manufacturing index which sent the Atlanta Fed into a complete tizzy on Monday. In February, it dropped, ever so slightly, to 50.3 (full release here). Understand what that means. Any reading above 50, and the sector is EXPANDING. The index was below 50 for nearly two solid years and the Atlanta Fed didn’t really seem to care. Suddenly, a slight pull back after two strong months, is cause for complete economic catastrophe and a plunge in the estimate of first quarter GDP.

Seems like a little bit of an over-reaction. Either they are lying now, or they were lying then. My bet is the latter since a reading above 50 shouldn’t have that sort of negative impact.

Looking at the components of the index, the story becomes even stranger. The indices for employment, new orders, and new order backlog are all below 50, but are much closer to 50 than they were nearly all of last year. And the backlog index actually improved! What does stand out is the prices paid index. It exploded in February and was the highest it has been since mid-2022 when inflation was at its recent peak. Shocker…inflation is still a problem. Pretty sure I have said that in nearly every post since I started writing this in 2023. The Fed is just now figuring it out?

Of course not. The Fed knows that inflation is about to come back with a vengeance and they are looking for a scapegoat. And what better scapegoat than the new administration’s policies. They never should have cut rates in the first place. Now, as the economy slows they will be forced to cut rates further, which will spur even more inflation. But now, they can blame it on “tariffs,” or “DOGE,” or whatever other boogeyman they can conjure up rather than on their own money printing and senseless monetary policy. We have a name for low economic growth combined with inflation - stagflation. And it looks to be headed our way.

Factory Orders

On Wednesday, the Census Bureau released the final data on factory orders for January, and they were up 1.7% (full release here). Expectations were for an increase of only 1.6%. Surprisingly, the Atlanta Fed didn’t update its GDPNow model after this positive data. That seems curious. After two months of declines in November and December, you would think a positive number that beat expectations would have an impact on a model that seems to be very sensitive to manufacturing data. Something seems a little fishy to me.

ISM Services

Despite what the Atlanta Fed is predicting, the ISM Services Index for February rose to 53.5 (full release here). Services are a huge part of the economy and the service sector employs nearly 8 out of every 10 employees. Remember, like the ISM Manufacturing Index, this is a diffusion index which means that any reading above 50 represents expansion.

A look at the sub-indices shows that new orders and employment both rose in February. The employment index is at its highest level since August 2023! This was the third consecutive month that all four subindexes - Business Activity, New Orders, Employment, and Supplier Deliveries - were all in expansion territory. Shockingly, this incredibly positive report on the service economy did not result in any movement in the GDPNow model. I wonder why? Maybe the guy that runs the model went on vacation.

One more note…like the ISM Manufacturing Index, the prices-paid index, a measure of inflation, rose again and is now at 62.6%. This sub-index has been above 60% for three months in a row. This is the first time this has happened since 2022, when inflation was running hot. Yet more evidence that inflation is still with us and is starting to come back with a vengeance.

February Employment

Finally, this morning, we got the February jobs report, and the number came in slightly below expectations at 151K new jobs versus the 160K that were expected (full release here). On a three-month moving average basis, employment dipped slightly from the upward trend of the past few months.

As indicated by recent ISM Manufacturing reports, employment in manufacturing was up and actually came in twice what was expected in February, adding 10K new jobs. (But wait….didn’t the slight decline in the ISM Manufacturing Index cause the Atlanta Fed to predict a major downturn this quarter? But the sector is adding jobs…I am so confused.)

Overall, government employment grew by 11K, but federal government employment fell by 10K. That is the biggest drop in federal employment since June 2022. The survey week was prior to the larger DOGE announced cuts, so next month should see a much larger decline.

The unemployment rate rose to 4.1% as the number of employed workers dropped by 588K and the number of unemployed workers rose by 203K. I addition, part-time employment rose while full-time employment fell. Once again, the household numbers tell a very different story from the establishment survey. Overall, the labor force participation rate fell to 62.4% - still far below pre-COVID levels.

One More Thing…

I want to thank the Barrow County Chamber of Commerce for having me at their monthly luncheon this week. Their president, Tommy Jennings, is a huge supporter and promoter of this weekly update.

My next event is the biggest one I do each year and one that I really enjoy - the Partnership Gwinnett Economic Outlook on March 27th. I am told that registrations have already exceeded last year’s attendance. I hope you can join us in Duluth for this great event.

THANK YOU!

Once again it is time to publicly thank my gold and silver members. Special thanks to my “gold” level member Andrew Hajduk and my two “silver” level members Dan McRae and C. Fitch. I also want to add to this list Greg Whitlock who became a monthly supporter at the “silver” level. (I am not sure why the “Buy Me A Coffee” site has “memberships” and “supporters” but they do and whichever you choose is fine with me!)

This support helps cover the cost of putting this together. To put this in perspective, the data service I use costs about $20K per year. Currently, my total regular support is $2,388 per year. By the end of the year, I am looking to have enough support to cover the data cost. Please consider a regular contribution. I only have about 600 subscribers, but the update gets read by about twice that number each week. If another 185 of you contributed $8 per month, that would cover the cost. Please consider clicking the link below and becoming a regular member or supporter.

Next week, I’ll send out a “thanks” to all my “bronze” level members. Until then, thanks to all of you for your support!