Weekly Economic Update 04-11-25: Consumer Credit; Small Business Optimism; Consumer Price Index; and Producer Price Index

Inflation is falling? Wait, what? But they told us tariffs were supposed to be inflationary.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

The weekly update is coming to you today from beautiful Bermuda! Clear blue water, pink beaches, and perfect temperatures. What a great way to spend Spring Break. Unfortunately, the 2-day boat ride here was a complete roller coaster ride as the north Atlantic was in rare form. Personally, I don’t get motion sick, but the same can not be said for many of my fellow passengers. Hopefully, the ride back today and tomorrow will be a little smoother.

My original plan was to take the week off from the update, but I just couldn’t do that with both CPI and PPI coming out this week. Plus, with weather conditions being what they were on the way here, I found myself with more time on my hands than I originally expected. But given the cost of internet time in the middle of the ocean, the update will be short. (Plus, I am on vacation!)

Consumer Credit

For quite some time, I have been waiting for the consumer to finally stop spending. My forecasts for this have been shockingly wrong, and the consumer has been stunningly resilient. I showed a few weeks ago that it was, in fact, the high-end consumer that was doing all the spending while everyone else was putting in on the card. And their capacity to put it on the card continued to amaze.

It looks like the party may finally be over.

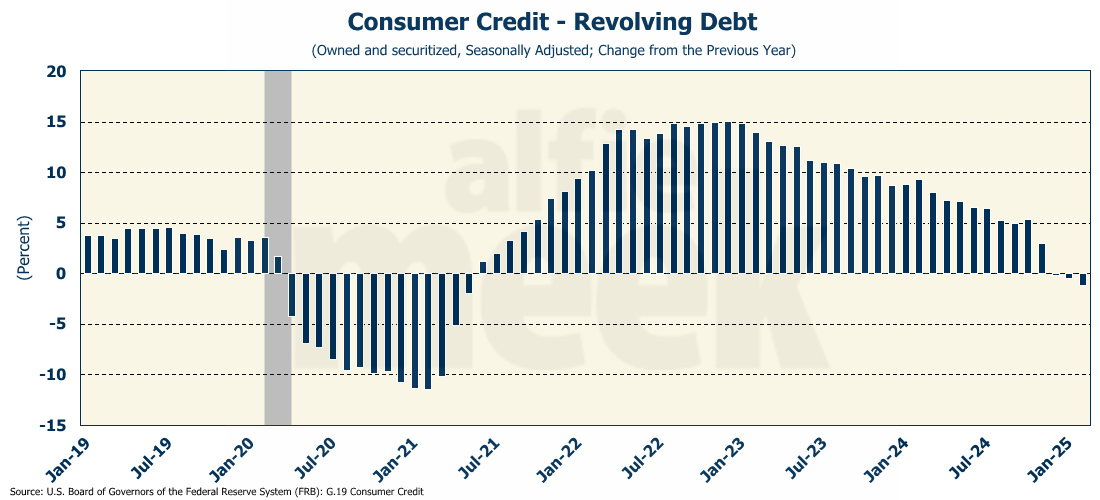

Consumer credit in February was shockingly bad (full release here). Expectations were for outstanding consumer credit to grow by $15 billion. Instead, it fell by $1 billion, and the revolving credit portion of that (which is mostly credit cards) was virtually flat. On a year-over-year basis, revolving credit fell 1.2% - the third consecutive annual decline.

Consumers owe $1.2 trillion in credit card debt, and more than 11.3%, or $135 billion, is more than 90 days past due, and that share is rising.

Small Business Optimism Index

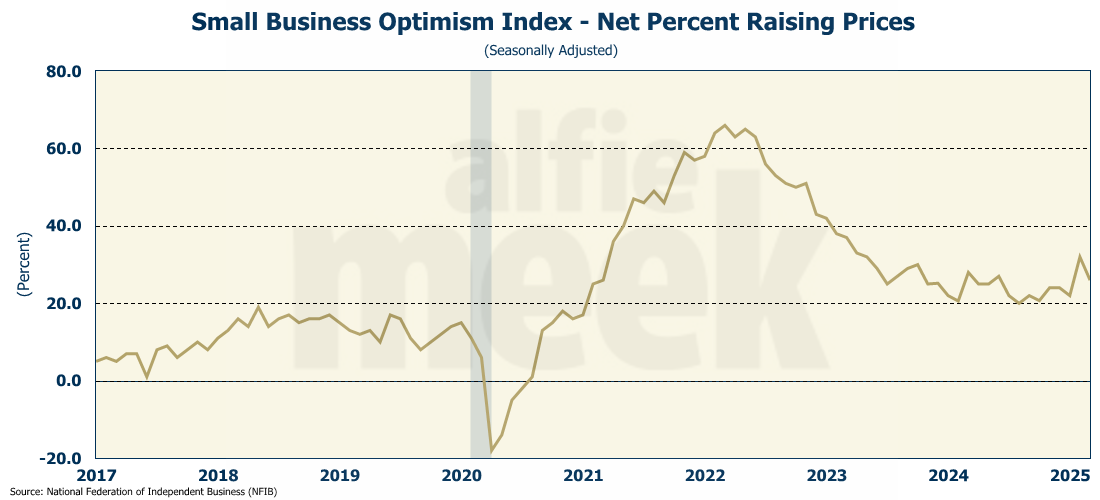

The brief sense of euphoria that small businesses reported after the November election has vanished as the NFIB Small Business Optimisim Index fell back below 100 for the first time since the election (full release here).

If there was any good news in the report, it was that the net percent of owners raising average selling prices fell 6 points from February to 26%. That was the largest monthly decrease since December 2022.

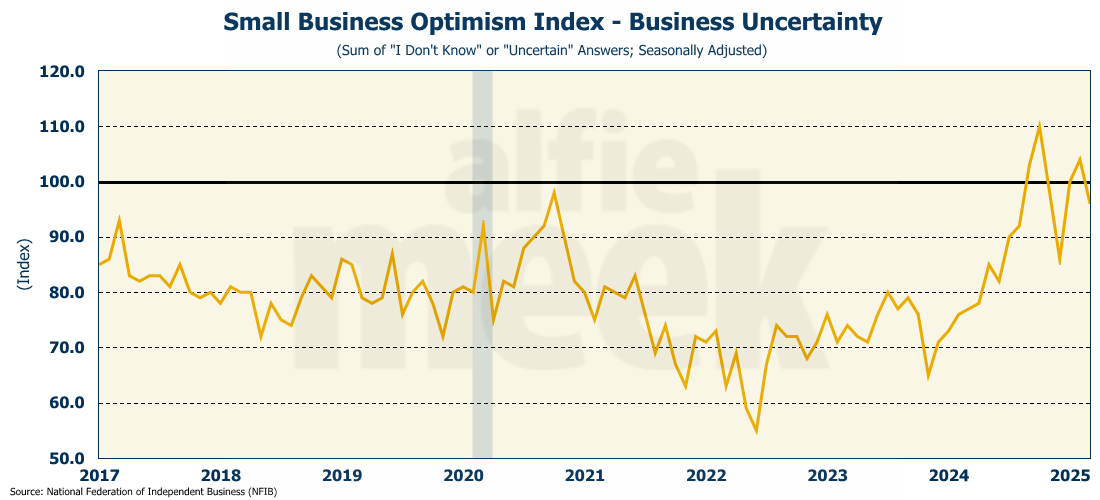

Surprisingly, the reading for business uncertainty also fell 8 points. Given the world right now, that seems counterintuitive. But the way the survey works, this only counts those who respond “I don’t know” or “Uncertain” to the questions posed. If they are reporting all good or all bad responses, then uncertainty will fall. My guess is that as their optimism declines, they are becoming more “certain” in that outlook, and therefore, their level of “uncertainty” is falling.

Consumer Price Index

Well, well, well. I thought tariffs, and even the threat of tariffs, were supposed to be highly inflationary! (Of course, I have been pointing out for weeks that this was not necessarily true.) The March CPI fell 0.1% - the largest drop in 5 years - since the second month of COVID (full release here). Understand what this means. Prices actually FELL in March. That decline brought the year-over-year growth rate all the way down to 2.4%. Core CPI (CPI less food and energy) also came in much cooler than expected at only 0.1% (vs. expectations of 0.3%). That brought the core CPI down to 2.8% on an annual basis - the lowest it has been since March 2021.

Super core CPI (services less shelter) also FELL 0.1% in March, bringing it down to an annual rate of 3.2%. That is still high, but it is the lowest readying since December 2021.

Do I think this deflation will continue? No. But I sure don’t think that these tariffs (which are already starting to be “canceled” or “delayed” or otherwise not put into place) will have an inflationary impact. And clearly, the inflation expectations that the Uninversity of Michigan has been putting out are way off the mark. The question is, how will the Fed respond? Despite these declines, I still don’t think we are out of the woods, and a rate cut would be a big mistake.

Producer Price Index

And then, to wrap up the week, this morning, we got the Producer Price Index (PPI). Expectations were for the PPI to accelerate in March. However, as was the case with CPI, the “experts” were wrong, and PPI tumbled 0.4% (full release here). This brought the annual number down to 2.7%. The drop was driven by a sharp decline in energy prices. Given what is currently happening in energy markets, PPI is likely to decline further in the coming months.

So what if we remove energy? Core PPI (PPI less food and energy) also fell by 0.1% in March. That brought core PPI down to 3.3% on an annual basis. Again, the highly anticipated tariff inflation certainly did not materialize in March. And don’t expect it to show up in April, either.

One More Thing…

Again, sorry for the abbreviated version of the update this week. I’ll try to have more commentary next week.

Finally, in the second week of each month, I try to thank all my “bronze” level members who subscribe for just $8/month. Dave Gmeiner, Steve Goins, Colin Martin, Brad Wood, Tommy Jennings, Carlos Alvarez, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, and someone with a “GTwreck” e-mail! Thanks for all your support!

I also have a few supporters who have chosen the monthly coffee-support option - Rope Roberts, and Sarah Jacobs. Thank you both for your monthly support!

As I do each week, I want to invite you to join this group and click/scan the QR code below to join or just “buy some coffee” in support of this weekly update.