Weekly Economic Update 07-18-25: Consumer Price Index; Producer Price Index; Retail Sales; Home Builder Confidence; and Building Permits & Starts

Retail inflation picks up, but wholesale inflation is flat as consumers resume spending after taking a two-month breather.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Earlier this week, while driving back from a much-needed vacation, I was listening to the news on the radio and couldn’t help but laugh. On Tuesday, the U.S. Senate, “narrowly passed” a “rescissions bill” that cut $9 billion in “wasteful spending” that was identified by DOGE. To hear the politicians crow about it, you would think they just discovered the cure for cancer. It would have been $9.4 billion, but eliminating the AIDS funding for Africa (clearly something that our tax dollars should be paying for) was a deal killer, so that got put back in. The Wall Street Journal ran the following headline:

Those brave and courageous Senators. They just saved us $9 billion. We should be ever so thankful.

To put this in perspective, we run a $2 TRILLION deficit each year. That means that these bold, audacious spending cuts reduced that deficit by 0.45%. I feel better already.

In terms of total spending, this hotly contested rescissions bill slashed federal expenditures by 0.11%. The march toward fiscal responsibility has begun in earnest!

What a bunch of clowns. We will get the Epstein client list before we get any serious spending cuts.

Last week, I pointed out that there is no constituency for debt reduction. While having breakfast this week with a friend, they asked me how to connect the massive federal debt to the everyday lives of Americans.

That is a good question. I think there are several ways to do it, but here is one of the easiest. According to the National Association of Realtors, the median age of a first-time home buyer last year was 38 - an all-time high. That is the MEDIAN, meaning that half of first-time home buyers were older! The median age of all home buyers was 56, also an all-time high. Only 24% of all home purchases were by first-time home buyers - an all-time low. Finally, 26% of all home buyers paid cash - also an all-time high.

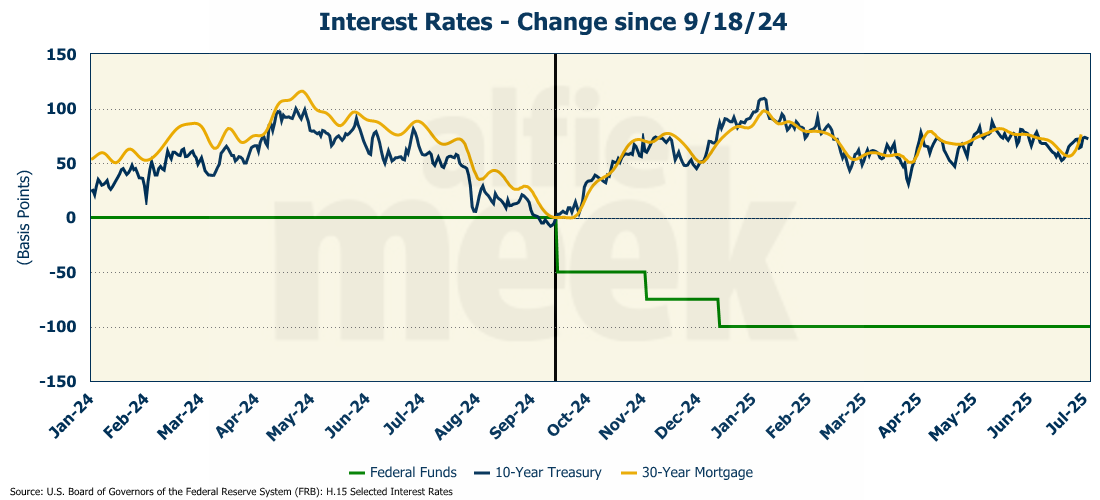

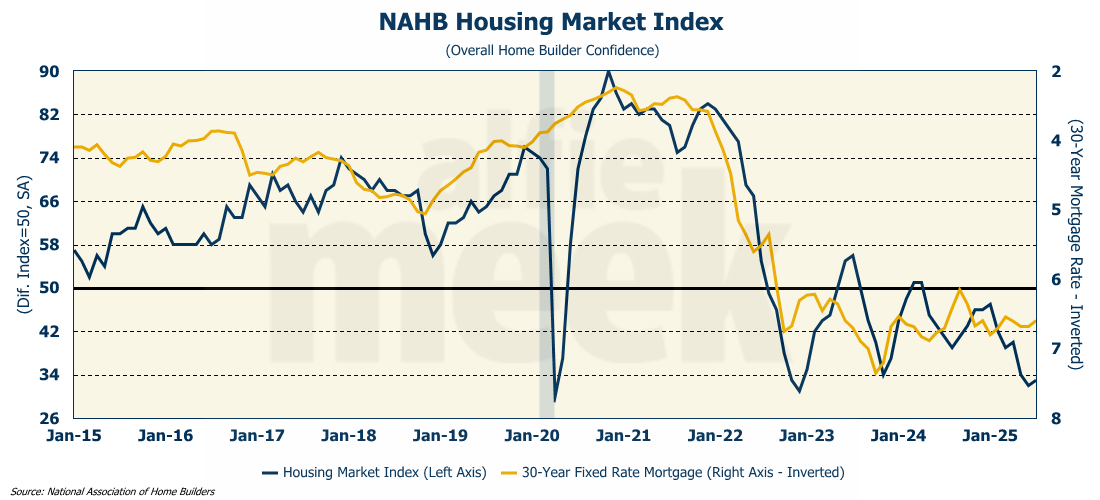

One reason that people are finding it harder and harder to get into the housing market is that mortgage rates remain stubbornly high. The President (incorrectly) blames Fed Chair Powell for this. He argues that if only the Fed would lower rates, the economy would explode to new, unimaginable highs and all would be well.

However, setting aside for the moment that cutting rates would ignite a new round of inflation (which is already creeping up as discussed below), the last time the Fed cut rates by 100 basis points, the 10-year treasury yield ROSE 100 basis points!

Clearly, the 10-year rate has completely decoupled from the federal funds rate. Why? Because the bond market sees that we are $36 trillion in debt; that we are growing that debt at about $2 trillion per year; and that we have no realistic plan to reduce it. So, the bond market is going to demand higher and higher rates to finance our debt. And what is tied to the 10-year treasury rate? The 30-year mortgage rate, which won’t be coming down anytime soon.

So there you go. You 20- and 30-somethings who can’t buy a house? One reason (among others) is that high mortgage rates are directly related to the excessive federal debt. Maybe if that story got some traction, people might be a little more concerned about how their elected representatives spend money.

Consumer Price Index

Again, driving home on Tuesday, all I heard on the radio was that “inflation came in hot” and “now we see the inflationary results of tariffs.” So, you can imagine my surprise when I got a chance to read the CPI release later that night, and it wasn’t nearly as dire as it was made out to be (full release here).

Consumer prices were up 0.3% in June, and came in at 2.7% above last year. That is a considerable increase from the 2.4% posted in May. So yes, to the extent that it was a jump, and that inflation is moving in the opposite direction away from the Fed target of 2%, it was “hot.” But, as I have been pointing out, it had little to do with tariffs, and everything to do with the Fed’s abominable monetary policy.

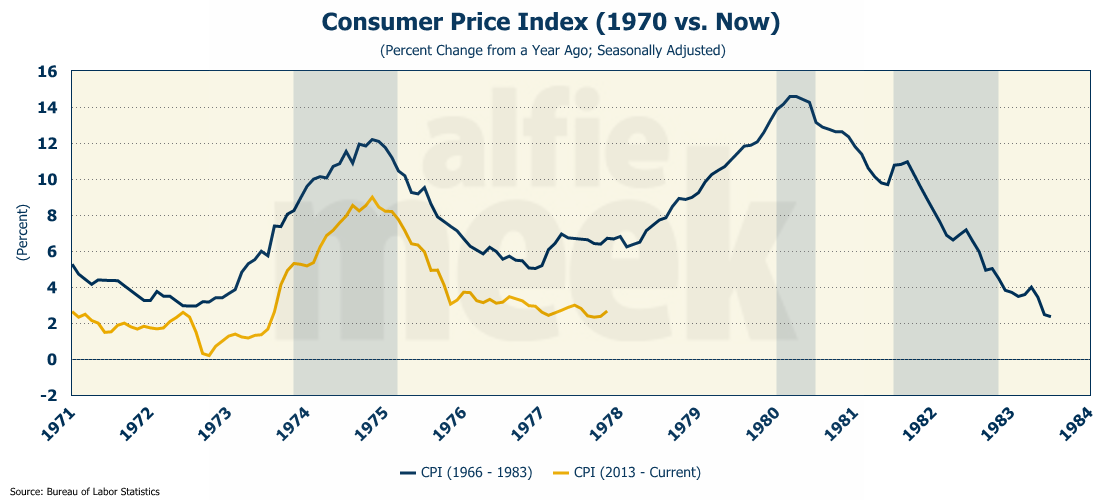

Last month, Fed Chair Powell said that “every forecaster you can name who is a professional forecaster with adequate resources and forecasts for a living - everyone I know is forecasting a meaningful increase in inflation in coming months from tariffs."

I am not technically a “professional forecaster,” and I clearly don’t have “adequate resources,” nor do I do this “for a living.” As such, I guess it doesn’t count that I, for one, have been saying for MONTHS (long before tariffs or even the current administration was in office) that inflation was going to increase. It wasn’t a difficult forecast. As sure as day follows night, money printing causes inflation. And when inflation spikes, more than 80% of the time, a second wave emerges. And you are starting to see it in the data. And it would have been there with or without any of this tariff nonsense. This is the very definition of groupthink, and it permeates society, even “professional forecasters with adequate resources who do this for a living.”

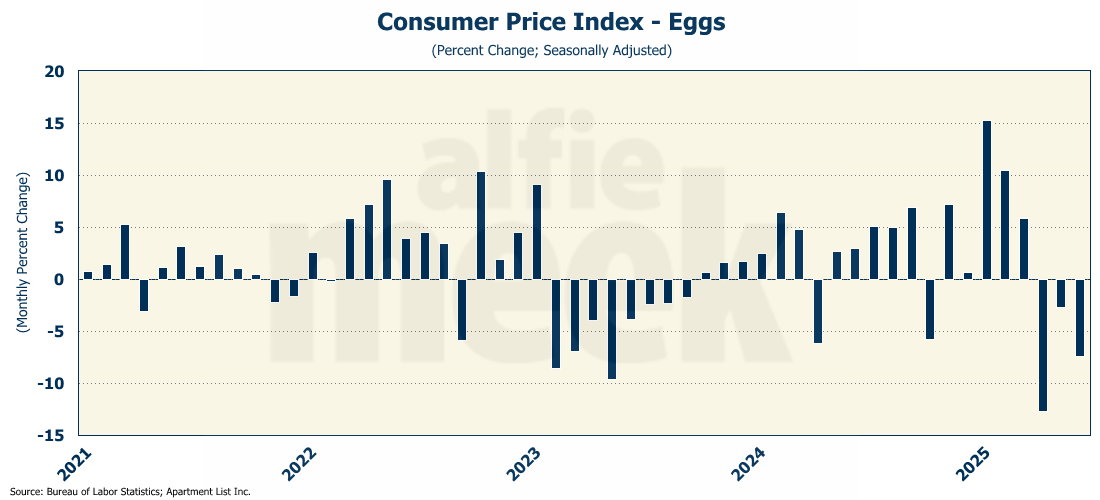

Oh, and by the way, the price of eggs is still dropping. Don’t know why anyone still cares about this, but it came up again this week, so I thought I would toss it in.

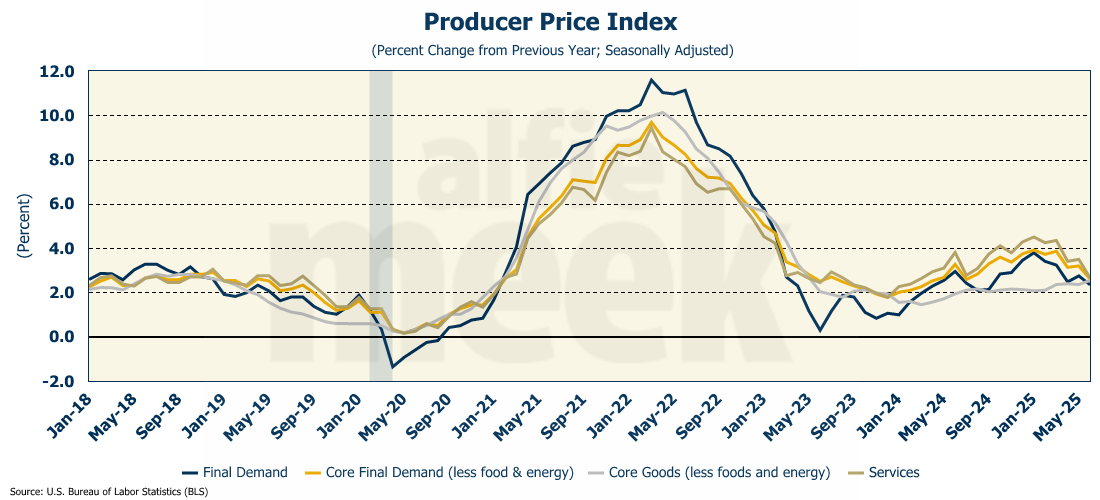

Producer Price Index

CPI came in hotter than expected, but PPI, which reflects prices at the wholesale level, certainly did not. Producer prices were flat in June, dropping the year-over-year rate to 2.4%, down from the 2.8% rate posted in May (full release here). That is the slowest rate since September 2024. Core PPI (PPI less food and energy) also fell to 2.6% from the 3.2% rate the previous month. The PPI for services fell to 2.7% from the 3.5% rate posted in May. That is the lowest rate for service costs at the producer level since March 2024.

So again, all this begs the question…when are we going to see the dreaded “tariff-inflation” that everyone keeps fretting about? The answer….we’re not.

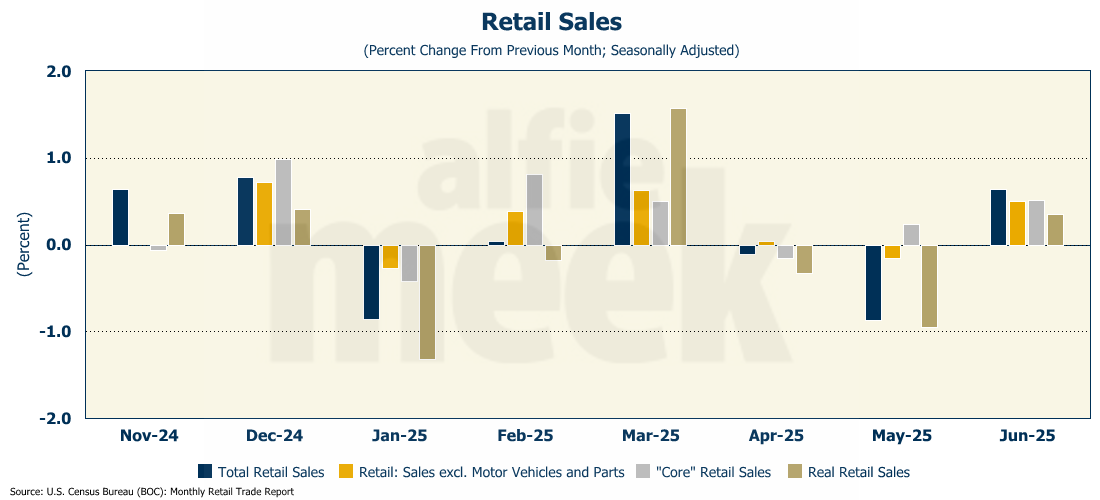

Retail Sales

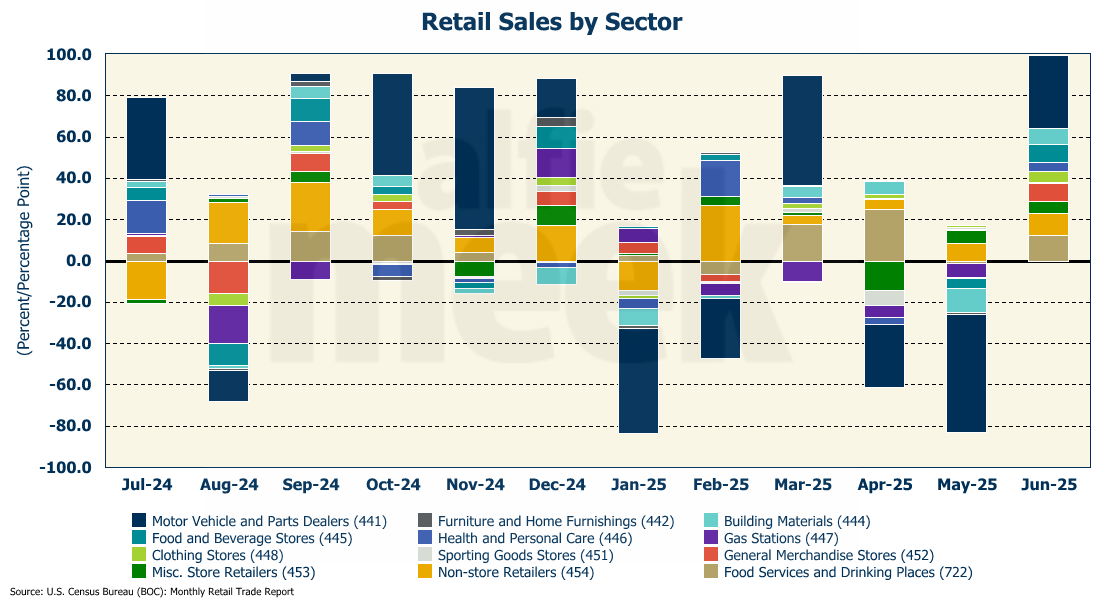

After a couple of months of taking a breather, the U.S. consumer is back! Retail sales grew 0.6% in June, the first increase in three months (full release here). On a year-over-year basis, retail sales are up 3.9% on a nominal basis. Since that is faster than the current pace of 2.7% for the CPI, in real terms, retail sales are more than 1% above last year.

The increase was driven in large part by motor vehicles and parts, which also rebounded after two dismal months. But the growth wasn’t only in motor vehicles. In fact, every single retail sector increased in June. That is something that doesn’t happen very often. Further, since this was AFTER the tariffs were put in place, the growth wasn’t the result of any “front loading.” Guess those pesky tariffs aren’t yet having a big impact on consumers.

Home Builder Confidence

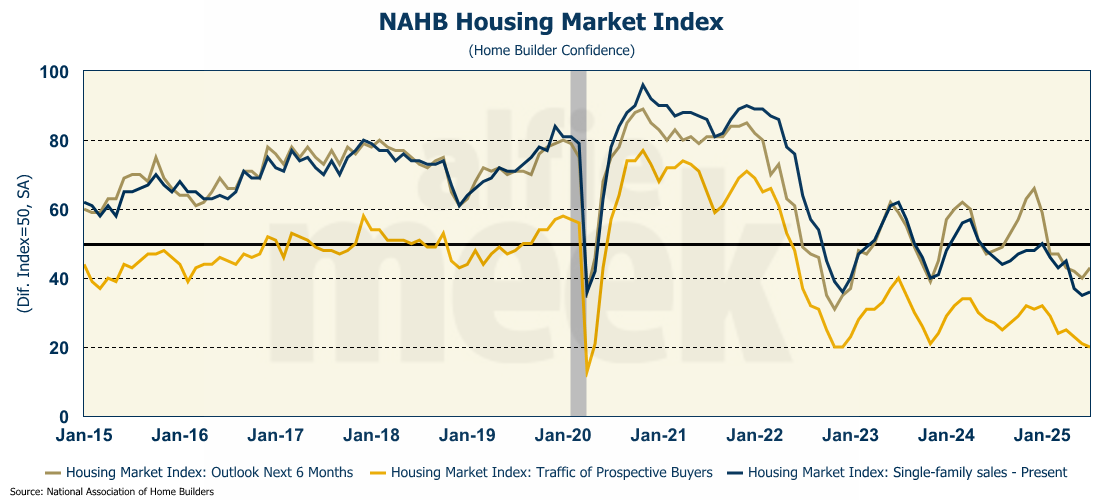

Home builder confidence ticked up one point in July, but is still at the very low level of 33 (full release here). The small increase was in line with a small decline in the 30-year mortgage rate. (Home builder confidence tends to move inversely with the mortgage rate.)

Looking at the components, the traffic of perspective buyers fell again. It has been trending down steadily since January. Regardless, the ever-hopeful builders’ outlook for the next 6 months ticked up slightly.

Not sure what they are seeing to support that view. Perhaps they see prices coming down? About 38% of builders cut prices in July, which was the highest share since the National Association of Home Builders began tracking this data in 2022. The average price reduction was 5%. That would be some welcome news for buyers.

Building Permits & Starts

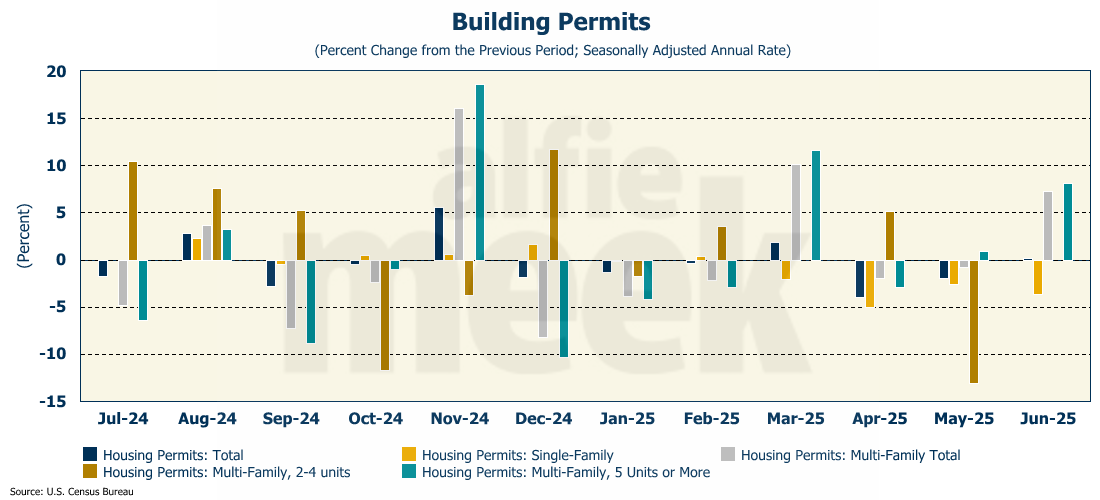

Finally, this morning, the data for June building permits and starts was released, and they were surprisingly strong given recent readings on builder sentiment (full release here). After falling for two months, building permits inched up slightly, rising 0.2% in the month. However, the increase was completely due to multi-family permits as single-family permits fell for the fourth month in a row. Why pull a permit for a new single-family home when the inventory of new homes is already at historic highs, and sellers outnumber buyers by 500K?

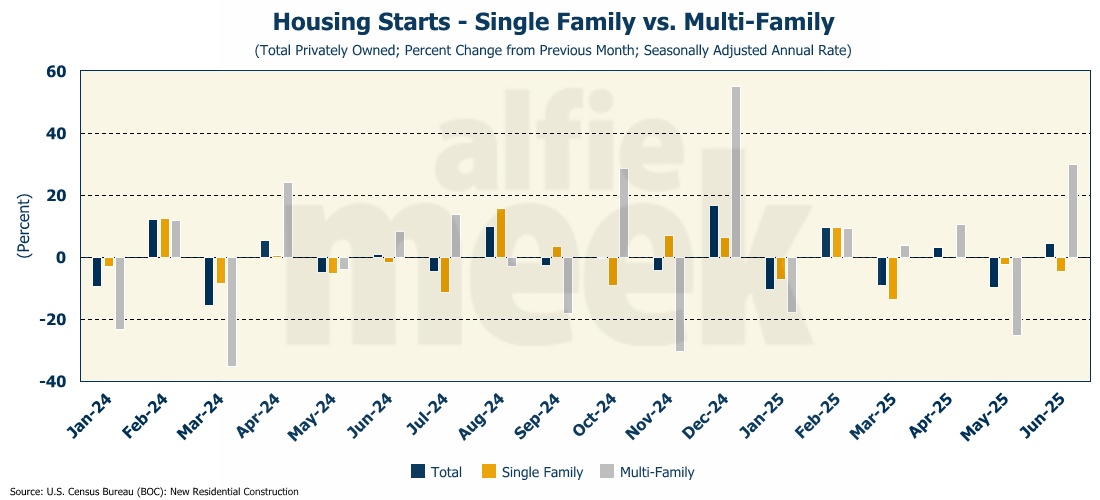

Housing starts jumped 4.6% in June, but that was because they fell off the table in May when they dropped to the lowest level since the COVID crash. But again, it was all due to multi-family housing. Single-family starts were down for the fourth straight month, falling another 4.6%. No one can afford to purchase a home, so builders are building multi-family housing. We are becoming a renter nation.

One More Thing…

As always, thank you for subscribing and reading this weekly update. It continues to grow, and subscribers are added almost every week. And we continue to get paid members. As a reminder, by the end of the year, I will need to transition to a pay-only model in order to be able to fund the resources necessary to keep this up and running. If you find it informative, I urge you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.