Weekly Economic Update 09-19-25: Retail Sales; Building Permits & Housing Starts; Home Builder Confidence; and Industrial Production

Rich consumers keep spending while the Fed cuts rates, but builders aren't pulling permits or starting houses.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

First, let me thank you all for your response to last week’s post. I received e-mails, texts, a few dozen “coffees,”and had several personal conversations in Savannah with people who agreed with what I wrote. Your support is appreciated more than you know.

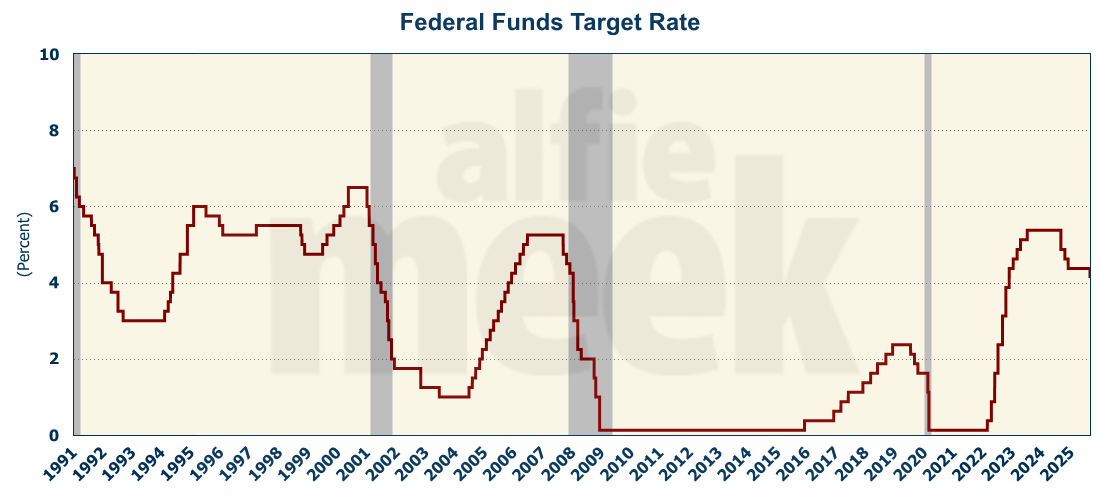

Second, to no one’s surprise, on Wednesday, the Federal Reserve cut the federal funds rate by 25 basis points. It has been nine months since the last rate cut. Only once since 1970 has the Fed waited longer during a period of rates cuts, and that was in 2001 when the economy was coming out of recession, consumers weren’t spending, the stock market was stagnant, and most important, inflation was BELOW target. Now…none of that is true. As we also learned this week, consumers are spending (at least the rich ones are), the economy is growing at 3%, the stock market is exploding, and inflation is well above target and rising. What are they doing?

They are trying to fix a mess of their own making dating back to COVID, if not before. They printed a LOT of money ($7 trillion worth) and they have been unable to reign in the resulting inflation. But, at the same time, the labor market is weakening and they are obligated to try to do something to fix it…even if it means inflation will accelerate again. Then they will need to raise rates…by a lot. What a mess.

Retail Sales

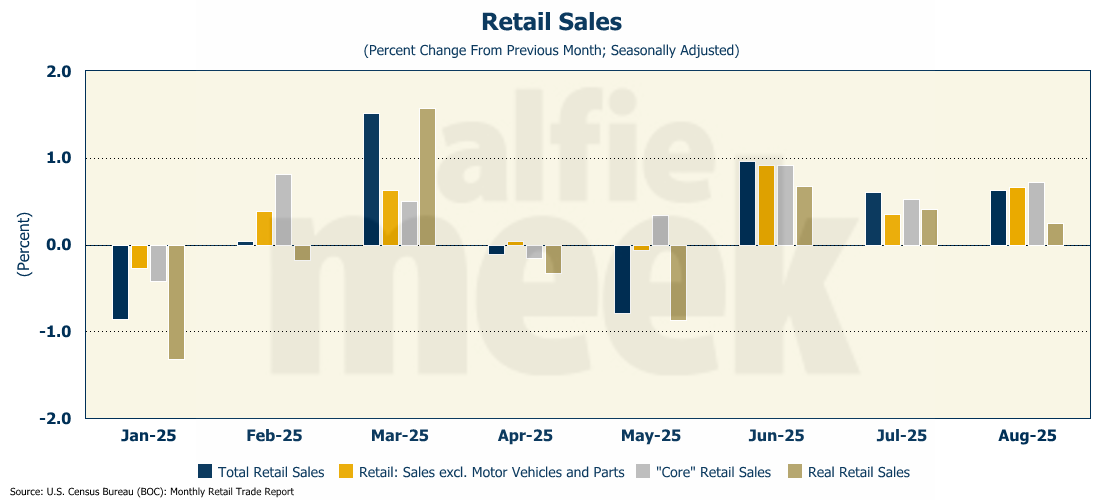

On the surface, it appears that the U.S. consumer is doing well and has plenty of money to spend, as retail sales were up another 0.6% in August, and were up 5% from one year ago (full release here). Of course, retail sales are reported in nominal terms, but even adjusted for inflation, retail sales were up 2% from a year ago, and have been positive for 11 consecutive months.

Here is the problem that you won’t hear in the typical business media. These sales are being driven entirely by high-end consumers. The top 10% of consumers represent almost 50% of the retail sales. That is the highest share since in more than 25 years. Everyone else - roughly all those households making less than $190K per year - are spending the exact same amount (adjusted for inflation) that they spent in 2020. And, since incomes haven’t kept up, they are doing it by using debt. They are watching necessities rise in price; are helpless to do anything about it; and certainly can’t expand their consumption profile. The top 10%, on the other hand, are spending far more (adjusted for inflation) than they did in 2020.

Why does this matter? Because the moment that the top 10% get a little nervous, retail sales will collapse and better reflect the realities of the economy that most of us live every day. But until then, the media will continue to report that “the consumer is strong” because overall retail sales are growing. We’ll see if that continues.

Building Permits & Starts

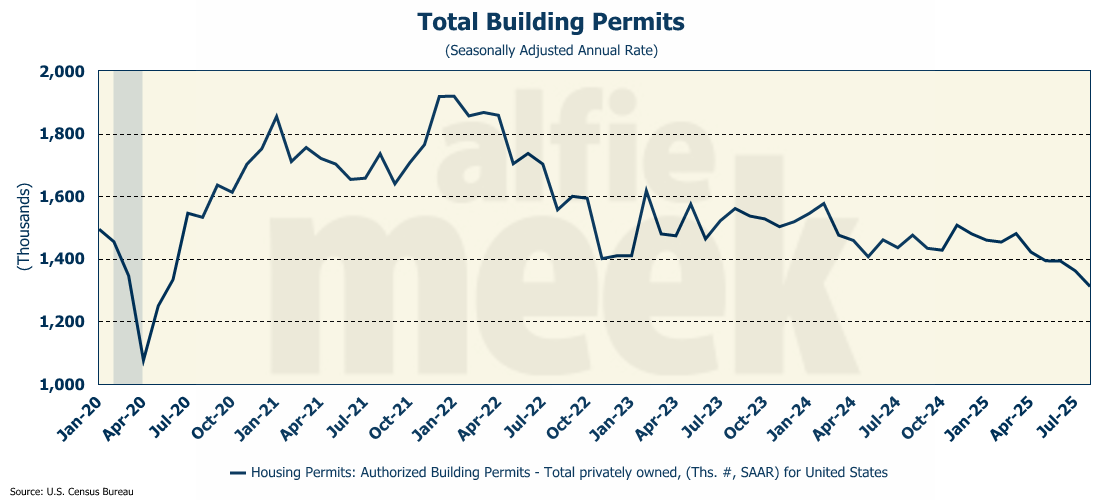

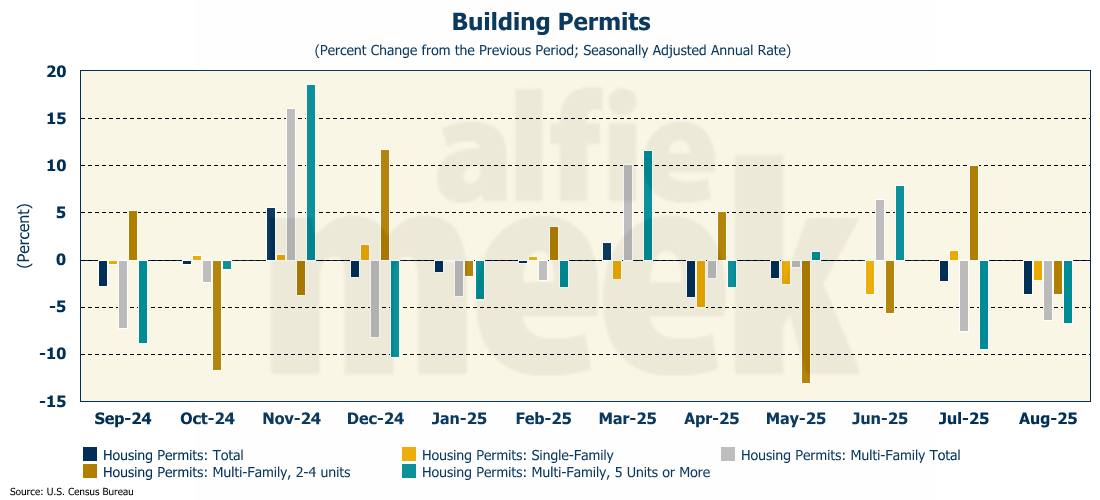

Building permits fell again in August, falling 3.7% for the month - far more than the 0.6% drop that was expected (full release here). Permits have been falling since March and are now at a level we haven’t seen since June 2020 when we were in the middle of a global pandemic.

To make matters worse, unlike previous months, permits declined across the board in every category - single-family, multi-family with 2-4 units, and multi-family with 5 units or more. Single-family permits were down 2.2% in August to the lowest level since March 2023. Total multi-family permits were down 6.7% to the lowest level since May 2024. Simply put, builders are not applying for housing permits.

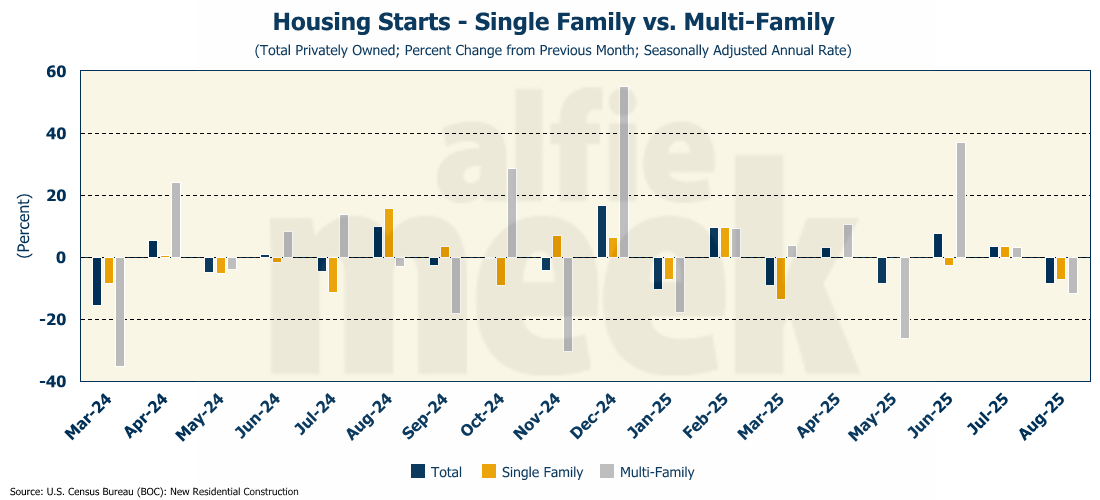

Obviously, fewer permits means that there will be fewer housing starts in the coming months, and, as a result, less new inventory coming online. The weak permits of the past five months are starting show up in starts, which were also down across the board in August. Housing starts were down 8.5% in August, much more than the 4.4% decline that was expected. Single-family starts fell 7.0% to the lowest level since July 2024, and multi-family permits fell 11% to the lowest level since May. In short, housing construction is slowing rapidly.

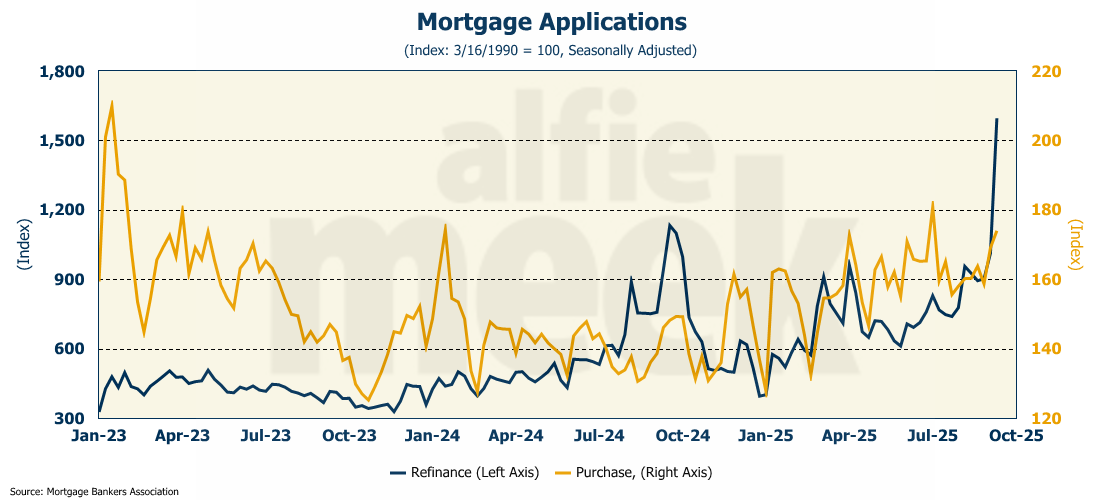

If there is good news, it is that mortgage rates are falling (for now). The 10-year bond seems to be responding to both the anticipation, and now the reality, of a Fed rate cut by pulling back to the low 4’s. In response, mortgage rates fell sharply in recent weeks, and are the lowest they have been in a year - although they rebounded somewhat late in the week. As a result, mortgage activity jumped to the highest level since July, and the second highest level since January 2024. The bulk of that activity was in refinancing which jumped sharply as people who got stuck with high rates over the last few years look to lower their payment. If the rate continues to drop, that activity will only increase from here.

Home Builder Confidence

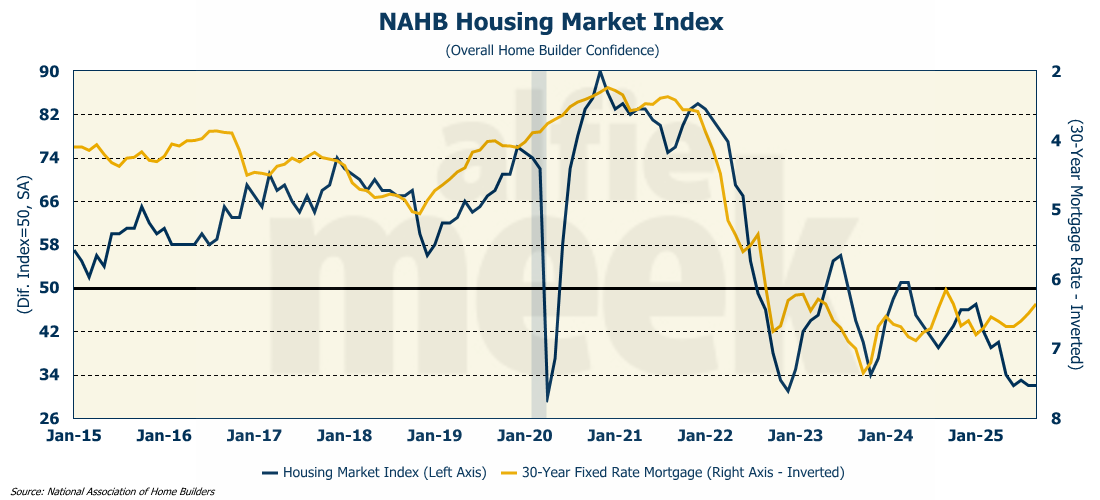

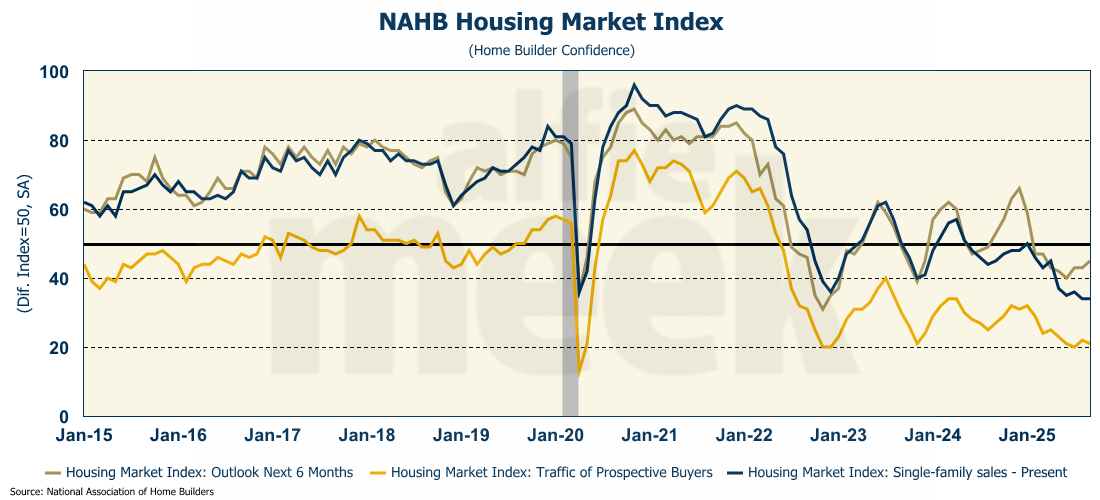

And those lower rates have lifted the hopes of home builders about their sales prospects over the next 6 months - although not enough get them pull any new permits. Probably because they have so much unsold inventory all ready. Overall, home builder confidence was unchanged in September, and is very close to a 12-year low (full release here).

However, looking at the details, we see that the current traffic of perspective buyers dropped slightly, while single-family sales were flat. However, their outlook for the next 6 months jumped to the highest level since March, again, driven by the fact that mortgage rates have improved noticeably. The question is, have they dropped enough to get people to let go of their existing mortgage and make a move. Probably not. And I don’t expect them to any time soon.

Industrial Production

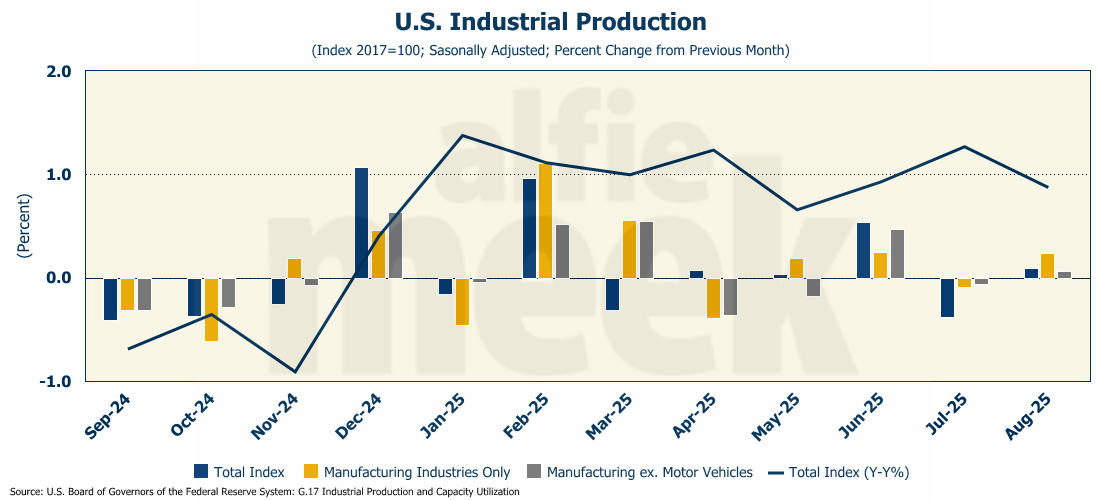

Finally this week, Industrial production rose 0.1% in August, posting a modest rebound from July. Industrial activity is up 0.9% since August 2024, a slight drop from July. Manufacturing production was up 0.2%, also bouncing back from a decline in July.

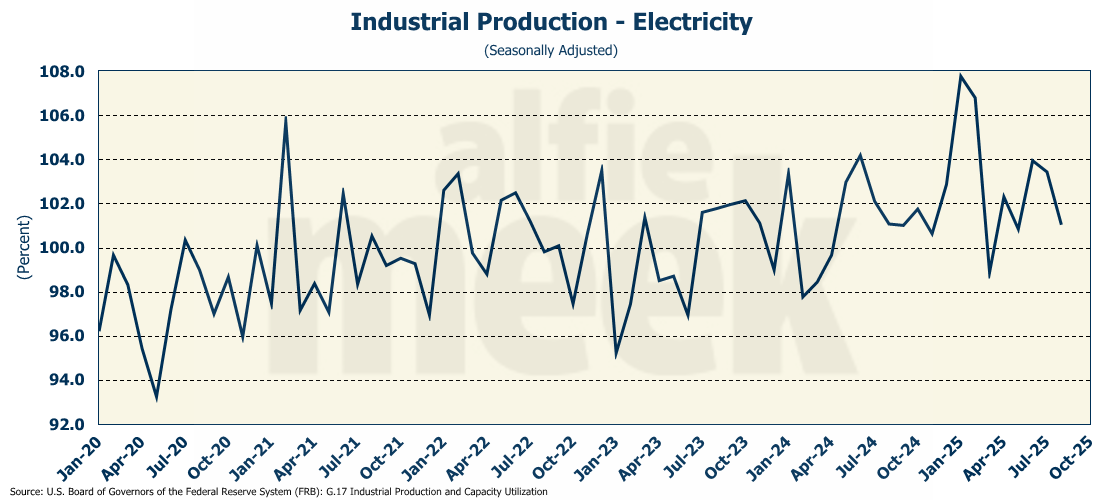

There is one interesting statistic in the industrial production data. Electric power generation dropped sharply in August (seasonally adjusted), and frankly, hasn’t really moved very much since COVID. If artificial intelligence is so hot, and if the data centers to run them are all the rage, why isn’t electricity production soaring?

One More Thing…

I enjoyed seeing many of you at the Georgia Economic Developers Association (GEDA) annual conference in Savannah this week! I had some great conversations and some of you may have signed up and are getting this update for the first time. Welcome! I appreciate all the kind words and insightful suggestions. I hope to incorporate some of those in the coming weeks.

As always, thank you so much for subscribing and reading this weekly update. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.