Weekly Economic Update 09-26-25: New & Existing Home Sales; 2nd Quarter GDP; Personal Income & Spending; and PCE Inflation

Second quarter GDP revised up on strong net exports and new home sales surprise to the upside.

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

The week after the Fed meets to set the federal funds rate, the Fed governors and Federal Reserve Bank Presidents, all go on speaking tours and give their two-cents about the economy and monetary policy. Those comments often provide fodder for ridicule, as I have done here on more than one occasion.

However, this week, I want to applaud Atlanta Federal Reserve Bank President Raphael Bostic. In an interview with the Wall Street Journal, Bostic said:

"But for me, the risk to the price-stability mandate is still the most significant. We are not at target. We're still a ways from it. We get signs from our contacts and from our surveys that prices are likely to still go up some more from here. So we're going to see upward movement in inflation. I worry about that."

Yes!! More of this, please! Despite Chair Powell’s claims to the contrary, inflation is not under control, and at least one Federal Reserve President is saying the quiet part out loud. Unfortunately, Mr. Bostic is not currently a voting member of the board.

Oh, and in other news, the Federal government is likely to shut down at the end of the month. Personally, I think it would be a great thing if the Federal government shut down for several months, but that only happens in my dreams. There will be much artificial angst and dramatic hand-wringing over the threat of closure, but in reality, it is all meaningless. Even if it “shuts down,” everyone will get back pay when it re-opens; all Federal grants will be funded; “critical” services will continue, and nothing of importance will have been accomplished. (This, of course, begs the question, what services are not “critical” and if they aren’t, why is the government doing them?). Congress will cave, fail to do its job, and pass yet another continuing resolution that maintains the post-COVID absurd level of spending that is going to eventually bankrupt the country. The entire bunch is utterly worthless.

There is a rumor that the administration will use this as an opportunity to actually trim the federal workforce. We can dream, but I am not holding my breath.

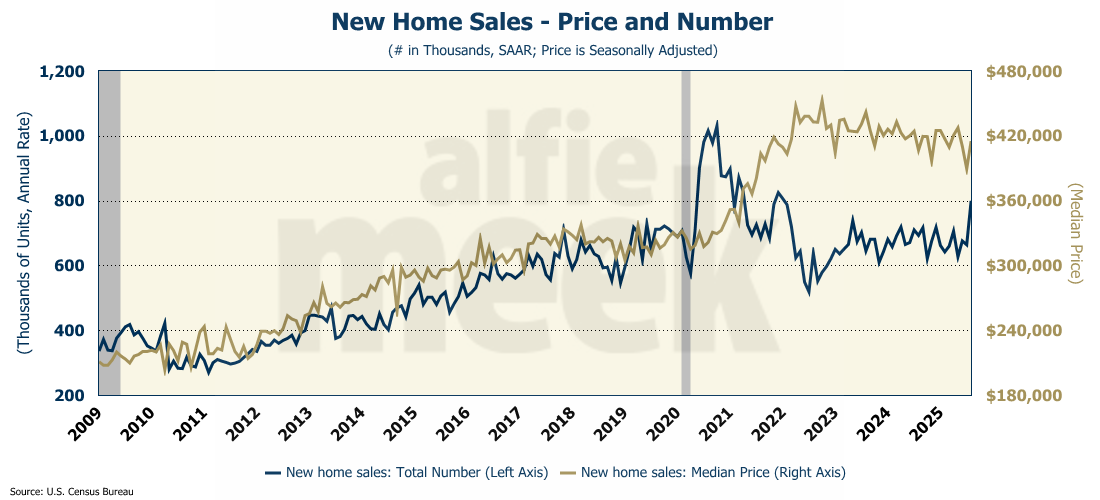

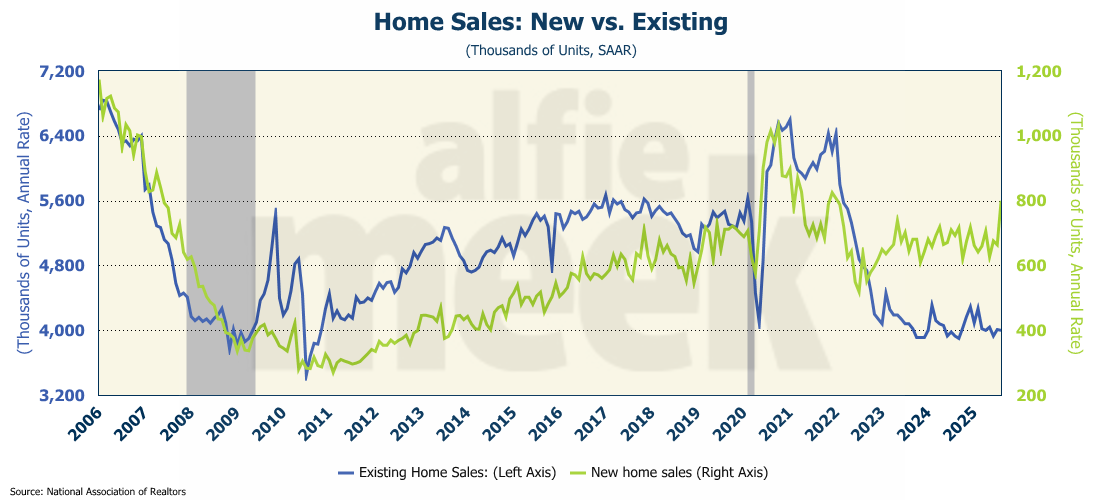

New Home Sales

The number of new homes sold absolutely exploded in August, rising 20% over the July number to an annual rate of 800K units (full release here). We haven’t seen a rate that high since January 2022! That jump brings the year-over-year growth to more than 15%!

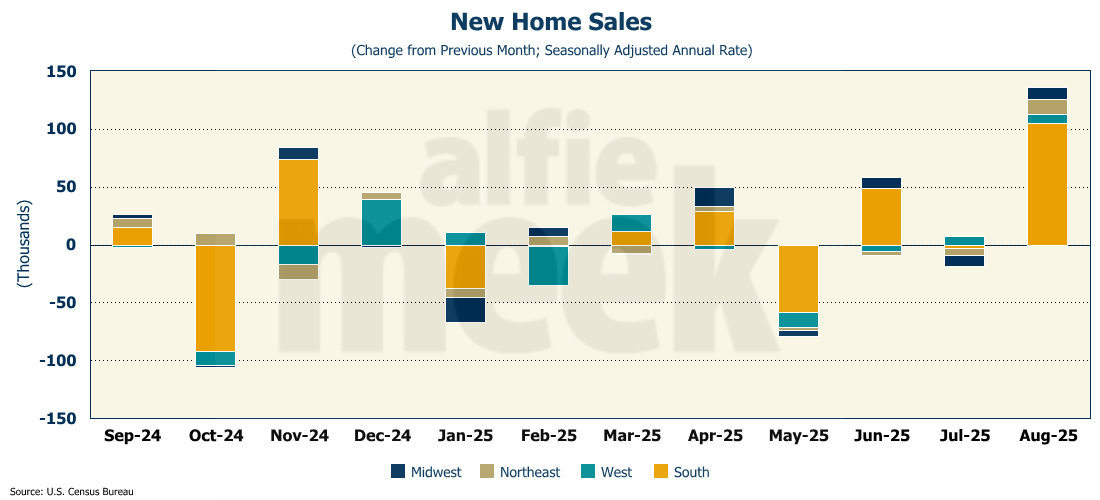

Looking at the data by region, the sales jump was driven almost entirely by sales in the South.

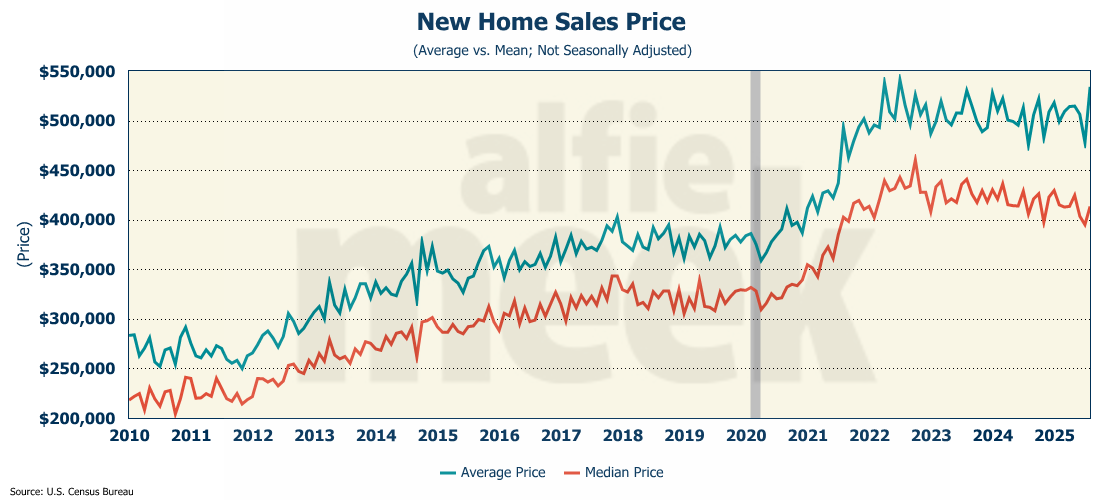

Unfortunately, prices also rose, with the median price rising to $413,500. However, the AVERAGE price of a new home shot up to $534,100 - the third highest level ever.

So what drove the jump in new home sales? Mortgage rates were down slightly in August, but that certainly wasn’t enough to drive this many people into the market. There was a decline in the number of new homes for sale, 490,000, which is the lowest level of available inventory this year. Another factor may have been sales incentives, which have accelerated. As I reported a few weeks ago, according to the National Association of Home Builders, two-thirds of builders are using sales incentives, which is the highest level since early 2020 during COVID. As an example, home builder Lennar Corp. recently said they were offering sales incentives equal to 14.3% of its average sale price, which is more than double the usual 5%-6%.

Even so, many buyers can’t afford these prices (even with incentives), given the level of interest rates and lagging wages. With renewed concerns about the labor market, the August data may be an anomaly rather than a turning of the tide.

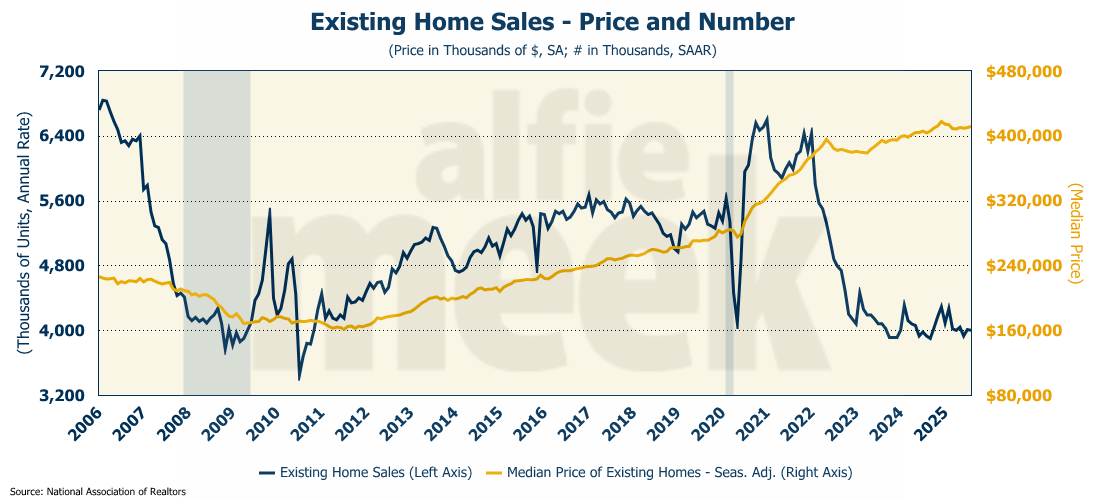

Existing Home Sales

If August brought an explosion of new home sales, existing homes didn’t reap any benefit. In fact, for the month of August, existing home sales FELL 0.2% (full release here). Obviously, those sales incentives that builders can use to sell new homes don’t work on existing homes. Sellers just have to lower prices. But they really don’t like to do that. In fact, the median price for an existing home rose in August by another $1,700 to $411,887.

Sales of existing homes decoupled from new homes back in 2022, and with the jump in new home sales in August, that gap has widened to its largest point ever.

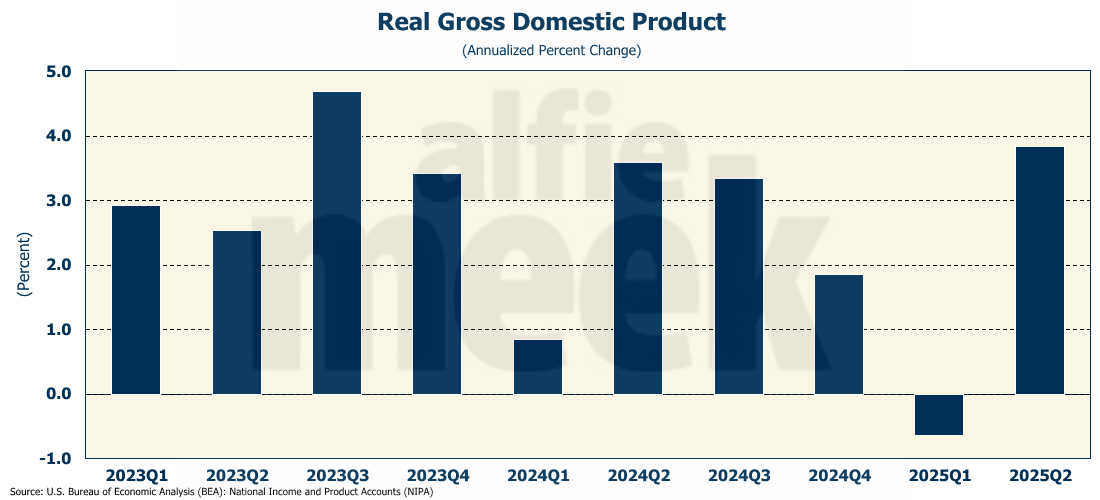

2nd Quarter GDP (Final)

Back in July, they told us that the 2nd quarter GDP rose at an annual rate of 2.96%. Then, in August, they revised that up to 3.29%. Lo and behold, it turns out that both of those estimates were WAY off and the economy actually grew at a blistering 3.83% in the second quarter - the highest rate since late 2023 (full release here).

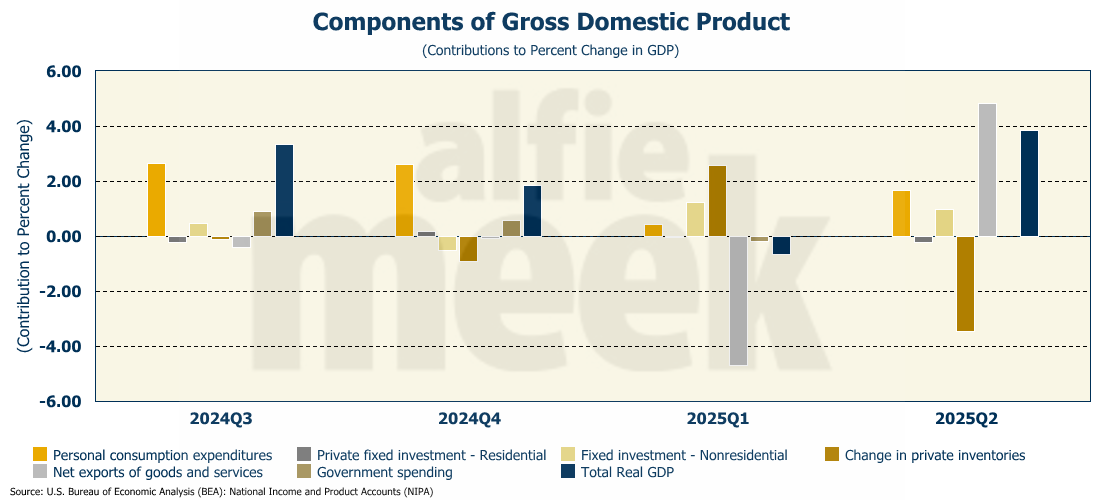

And what drove this astonishing growth? Two things. First, consumer spending, which I discussed at length last week. Personal consumption accounted for nearly half of the growth in GDP.

Second, there were net exports, which are usually a negative contributor to GDP, as the U.S. typically imports far more than it exports. Remarkably, it turns out that if you impose tariffs on foreign goods, you will import less. Who knew? Plus, we imported a ton in the first quarter to avoid tariffs, so that is also having an impact on the second quarter reading.

It is also interesting to note that government spending was a NEGATIVE contributor to the 2nd quarter GDP. That almost never happens.

So, if the Bureau of Economic Analysis can be believed, the economy is on fire. Further, the Atlanta GDPNow forecast for the third quarter (as of this writing) is 3.3%. (Not that they have a great record of forecasting GDP…). It would appear that there are no signs of stagflation anywhere on the horizon…as long as wealthy consumers keep on spending. We’ll see if they can hold the rest of us up.

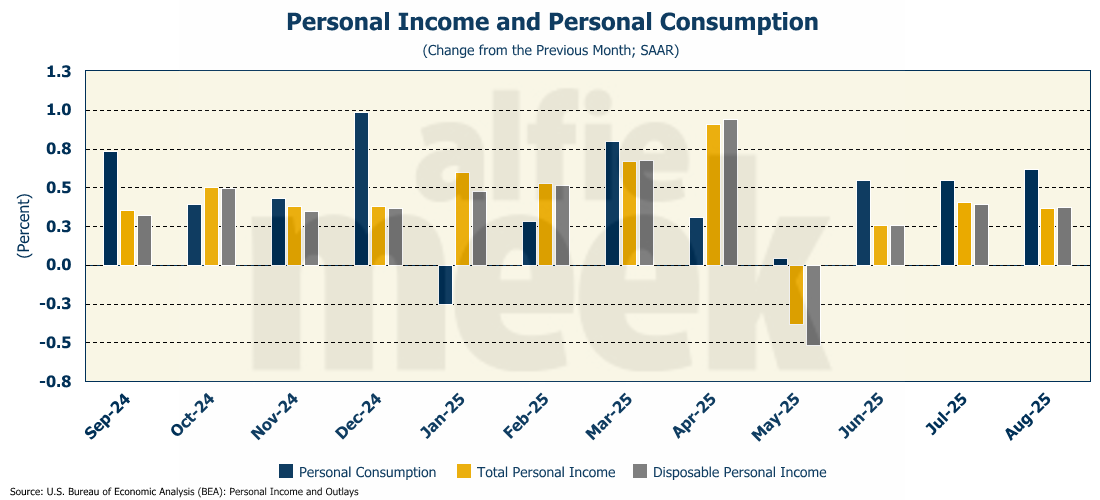

Personal Income & Spending

This morning, we got data on August's personal income and spending (full release here). Personal income was up 0.4%, slightly better than expected. On a year-over-year basis, nominal personal income is up 5.1%. However, adjusted for inflation and taxes, disposable personal income is up only 1.9% over last year.

Personal consumption was also up more than expected, coming in at 0.6%. On an annual basis, nominal spending is up 5.5%. Adjusted for inflation, spending is up 2.7% on an annual basis.

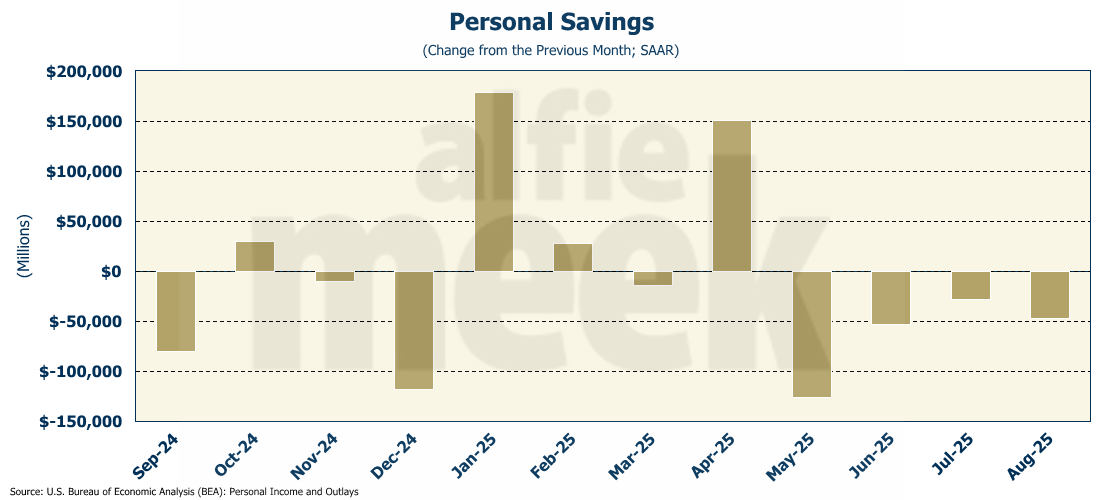

Once again, spending grew faster than income. As such, for the fourth consecutive month, personal savings declined, falling nearly $47 billion in August, and bringing the savings rate down to 4.6%.

PCE Inflation

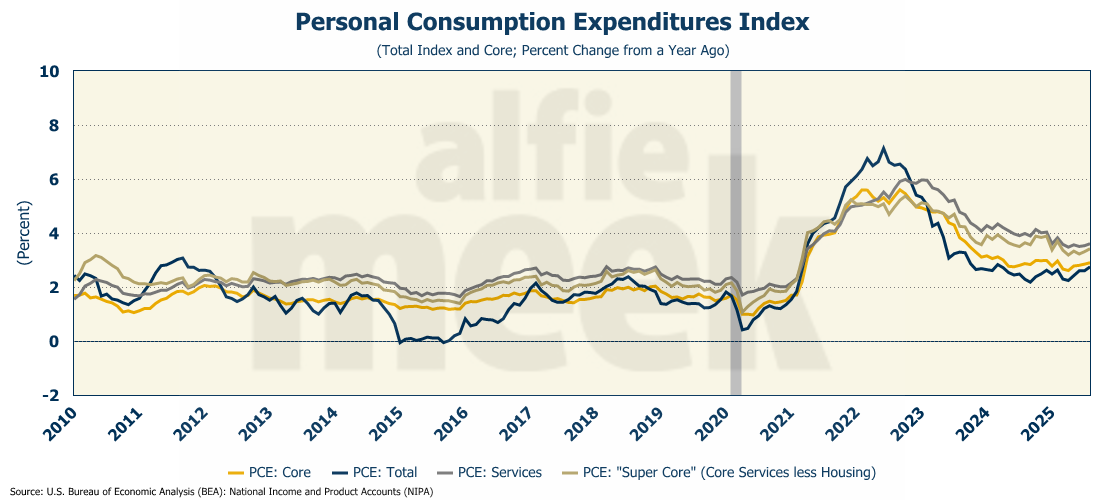

Finally, this week we got the Fed’s favorite measure of inflation, the Personal Consumption Expenditures Index (PCE), and, not surprisingly, it increased in August, rising 0.3% for the month, and climbing to 2.7% year-over-year (full release here). Last month it was 2.6%.

Core PCE (less food and energy) rose 0.2% in August, bringing the annual rate up to 2.9%. Super core (core services less housing) rose to 3.6%. Readings rose across the board. Inflation continues to increase despite Chair Powell’s claim that the Fed has conquered it. There is no way to deny that the trend for inflation is moving in the wrong direction. Mr. Bostic’s concerns are real, and the Fed needs to be taking them more seriously.

One More Thing…

My life has gotten extremely busy and hectic of late, and each week I find that I have less and less time to write this update. I can’t tell you how many times recently I have considered calling it quits. However, I am going to try to soldier on, especially for those of you who are paid subscribers. However, I apologize in advance if the post is a little shorter with less opening commentary in the coming weeks.

As always, thank you for subscribing and reading. If you find it informative, I invite you to click/scan the QR code below to join as a “member” or to buy a coffee or two (or five) and support this effort.