Weekly Economic Update 11-14-25 Shutdown Edition #7: Consumer Credit; and Small Business Optimism

Our long national nightmare (aka “shutdown”) is over!

The views and opinions expressed in this post are solely those of the author and do not necessarily reflect the views of the Georgia Institute of Technology or the Georgia Board of Regents.

Before I get started, I need to correct an oversight. Last week, I was thanking my gold and silver-level subscribers, and I left the newest silver-level subscriber, Manfred Graeder, off the list! I apologize for the oversight, Manfred, and I very much appreciate your support!

It would appear that this may be the last Shutdown Edition of the Weekly Economic Update. Of course, that depends on how fast the Federal workers can get back to their desks and process the data, so perhaps we have a week or two more until normality returns.

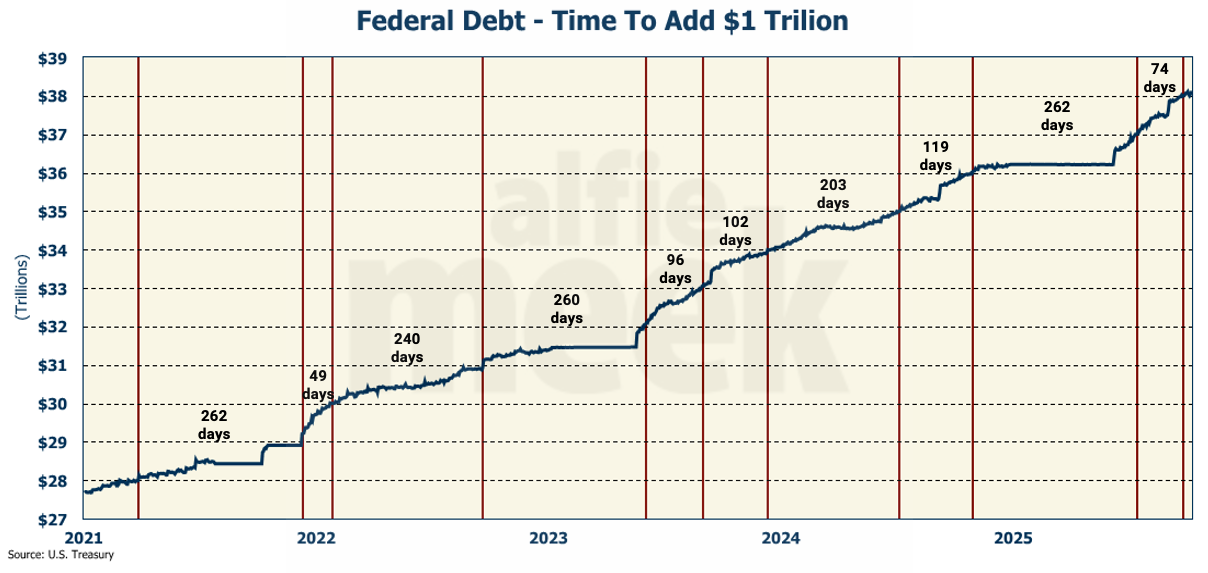

As I was preparing for a speaking engagement this week, I updated my Federal Debt Timing chart (below) because on October 21st, we officially surpassed the $38 trillion mark. Only 74 days after we passed the $37 trillion mark. That was really fast. In fact, only the move from $29 trillion to $30 trillion was faster. Since 2021, on average, we add $1 trillion to the Federal debt every 167 days.

But that’s OK, because the Senate just bravely voted Sunday to continue to fund the government at previous levels, which include $2+ trillion annual deficits, and will vote in the next few weeks on whether or not to extend the ACA healthcare subsidies. Nary a mention of cutting spending. There was a great quote this week from a media commentator…

“If we cannot as a nation decide not to continue a subsidy that was imposed, or was enacted, during a national health emergency and was designed to be temporary and that [Congress] voted to have be temporary, if we can’t let that expire, what hope do we ever have of getting government spending under control?”

It is a great question, and it gets to the heart of the problem. Ronald Regan famously said, “Nothing lasts longer than a temporary government program.”

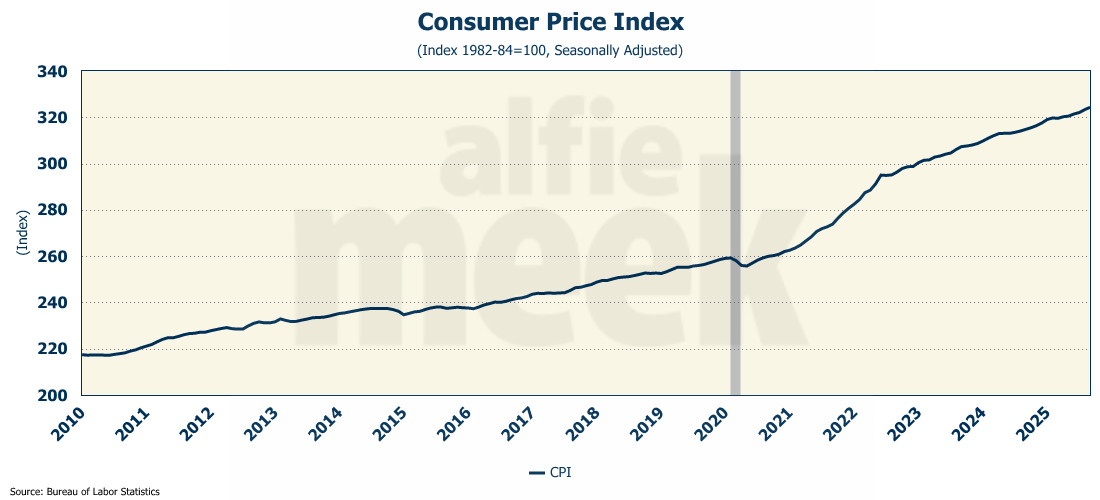

The current administration was elected on a promise to “bring prices down.” Never mind that such a promise was ludicrous on its face; you simply can’t do it when you are injecting an additional $2 trillion in Keynesian stimulus into the economy on an annual basis.

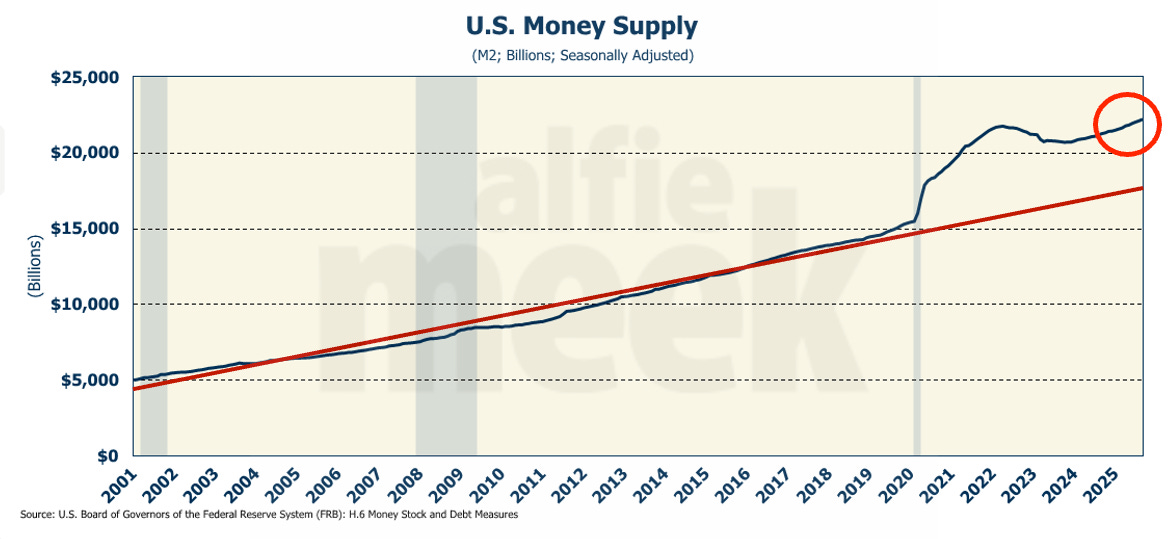

In his book How Countries Go Broke, Ray Dalio lays it out quite simply. History is clear. When a country has too much debt during an economic downturn, it is no longer able to borrow money to repay its debts, and the financial bubble bursts, which, to put it mildly, creates domestic hardship. At this point, the government can choose to default or print new money. At first, they almost always choose to print more money. Initially, this money is printed gradually, but eventually it accelerates considerably.

This, of course, devalues the currency and raises inflation.

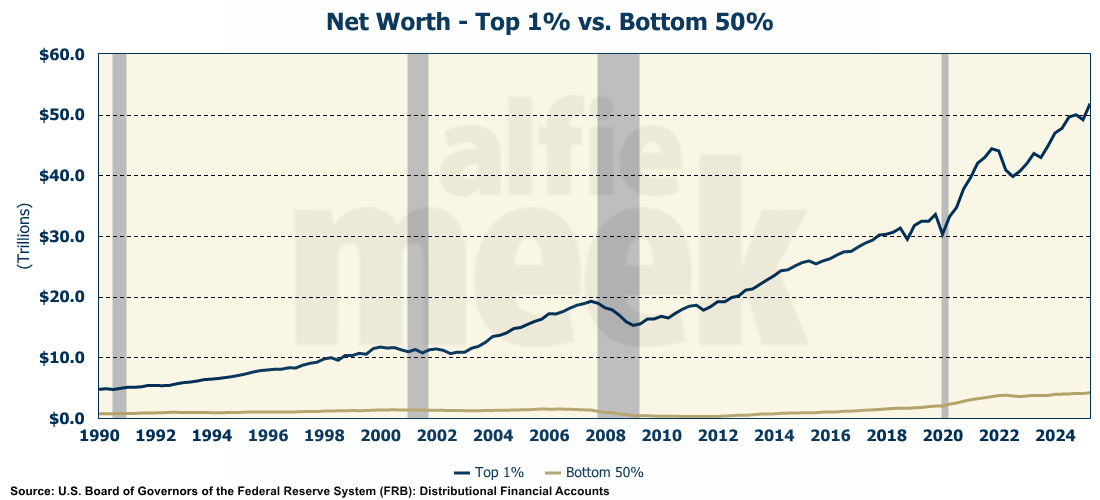

Living standards decline, and this leads to the rise of political extremism, as there is conflict about how to divide the shrinking resources, and the gap between those with resources and those without widens.

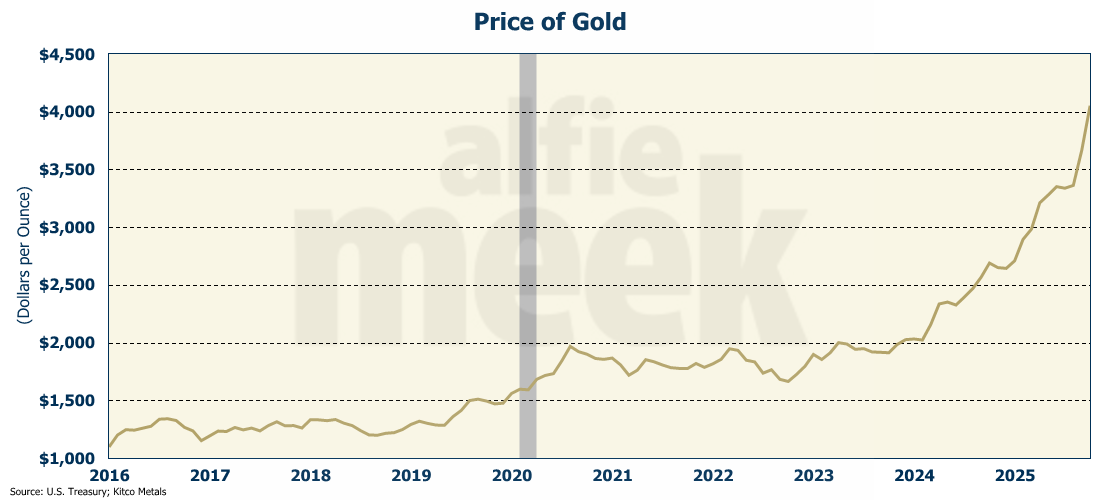

At some point, the wealthy feel like their wealth is threatened by confiscation or heavy taxation, and they move it into assets (or locations) that are safer and less able for the government to tax.

This leads to even less government revenue, fewer resources, further decline in the standard of living, and the downward spiral continues. This results in the rise of populist movements (on both the right and the left) that promise to bring about “order” if they are given control.

This is why I spend so much time harping on the level of debt taken on by the Federal government. Throughout history, it has single-handedly toppled empires and ruined nations. As I have written before, since 1800, 51 of the 52 countries with a debt-to-GDP ratio above 130% have defaulted. There is no reason to expect that in the long run, the U.S. will be any different. I can assure you, it won’t.

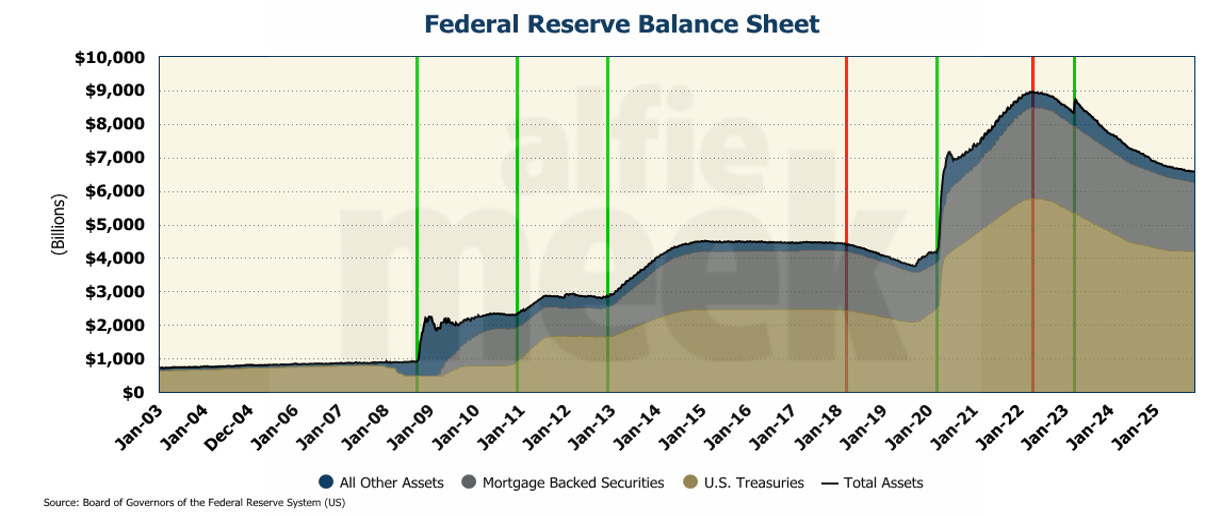

Of course, the U.S.has been able to delay this result for longer than I would have imagined because each time the financial bubble bursts, the Federal Reserve steps in and saves the day. First, there was the debt-financed dot-com bubble of the early 2000s. Then, the subprime mortgage crisis of 2007 led to QE1, QE2, and QE3 (represented by the first three green lines on the chart below). Then the pandemic-driven spending explosion took the Fed’s balance sheet to $9 trillion. Each time there is a crisis, the Federal Reserve steps in with stronger and stronger measures.

Remember, this downward spiral starts with too much debt and an economic downturn. By all accounts, the U.S. economy appears to be in great shape with no recession in sight. To believe that, you have to also believe that the consumer is going to keep on spending. Let’s see how they are doing…

Consumer Credit

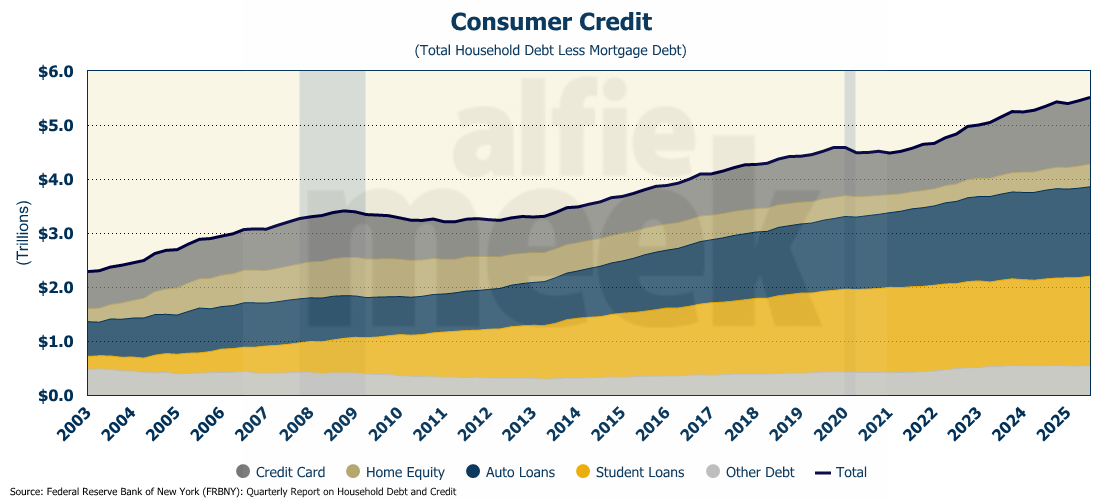

As of the third quarter, U.S. consumers held $5.5 trillion of non-mortgage-related debt - $1.65 trillion in auto loans, another $1.65 trillion in student loans, $1.2 trillion on credit cards, $420 billion in home equity loans, and another $550 billion in “other debt” (full report here).

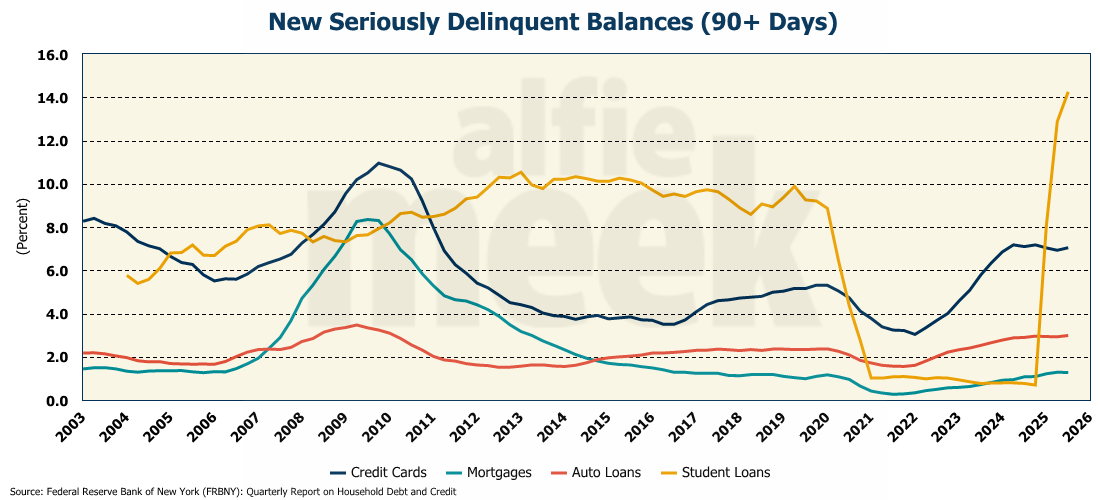

Digging a little deeper, 7.1% of credit card debt moved into the “seriously delinquent” category (defined as being more than 90 days past due), close to the highest level in 14 years. Three percent of auto loans moved into “seriously delinquent,” and that was the highest level since early 2010. Just under 1.3% of mortgages became 90+ days past due, the highest level since 2016. But the big move was in student loans, where 14.3% became “seriously delinquent” in the third quarter. That is the highest rate ever. So, 14.3% of $1.65 trillion is $236 billion. That’s bigger than the entire economy of the State of Kansas.

So what does this tell us? Consumers are drowning in debt, and the consumer may not be able to keep GDP in positive territory in the coming quarters. I am a little worried about the upcoming Christmas season, and as of now, I think that the chances of a recession in 2026 are better than even.

Small Business Optimism

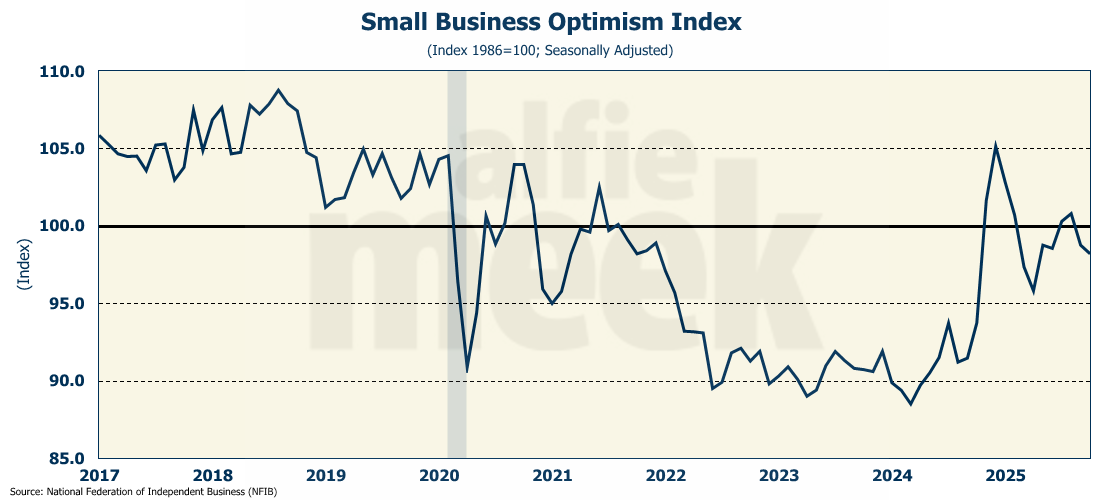

And, it appears that small business owners may agree with me. On Tuesday, we got the latest read on small business optimism for October from the National Federation of Independent Businesses (full release here). Sentiment among US small businesses fell to a six-month low as they saw earnings deteriorate and generally felt less optimistic about the economy.

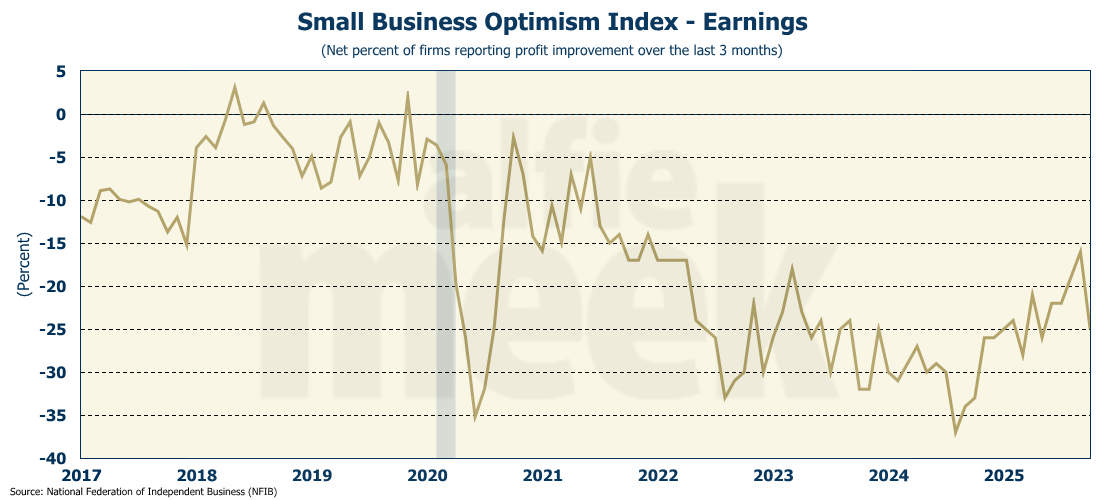

The net share of small business owners reporting stronger earnings in the last three months fell 9 percentage points to -25%, the largest one-month decline since the pandemic. The drop was driven by both weak sales and higher costs.

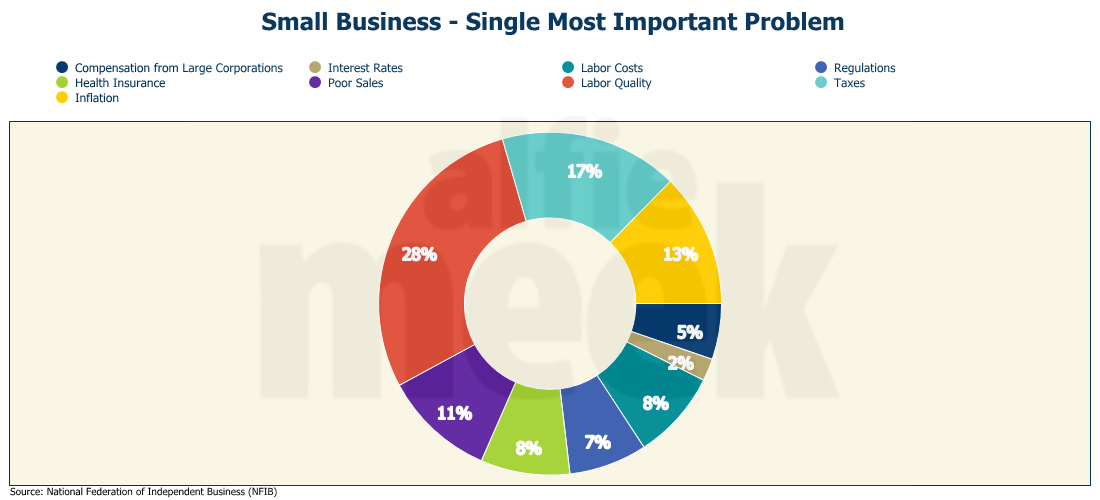

While sales were weak, they weren’t the most important problem reported by small businesses. By a large margin, the single most important problem reported by small businesses was “labor quality,” followed by “taxes.” “Poor sales” came in a distant third.

One More Thing…

Finally, this week, I want to thank all my “bronze” level members who do subscribe for just $8/month. Dave Gmeiner, Colin Martin, Brad Wood, Carlos Alvarez, Steve Goins, Tommy Jennings, Chad Teague, Andrew Imig, Adam Hayes, Kimble Carter, John Mooney, Charles Frazier, Barry Puckett, Matt Murphy, Penn McClatchey, Thomas Smith, Pat Graham, Sean McMillan, Kevin Langston, and someone with a “GTwreck” e-mail! (I still don’t know who you are, “GTwreck,” but thanks for your support!)

I also have a couple of supporters who have chosen the monthly “supporter” option - Rope Roberts and Sarah Jacobs. I thank ALL of you for your monthly support.

Remember, I will be halting all bronze- and silver-level payments on the Buy Me A Coffee site in early December. If you want to keep getting the update in 2026, remember to make a pledge on the SubStack site. I’ll turn those on in January.

If you want to offer one-time support, you can still click/scan the QR code below.